TGR shares could now be trading at a discount to their fair value given the company’s high-quality graphite reserves and strong half-year results.

Tirupati Graphite (LON: TGR) investors haven’t been a particularly pleasant experience over the past year. The London-listed company’s shares have fallen by 75% from 140p in July 2021 to just 35p today and stands 10p below their IPO price of 45p.

But with catalysts round the corner, TGR shares could meet my requisites for a small-cap mining entry point: underloved, underappreciated, and undervalued. The case for investing in graphite stocks is already obvious, and TGR appears well-positioned to capitalise on the increased demand as green tech and the EV revolution takes off.

Tirupati shares: graphite stock for 2023?

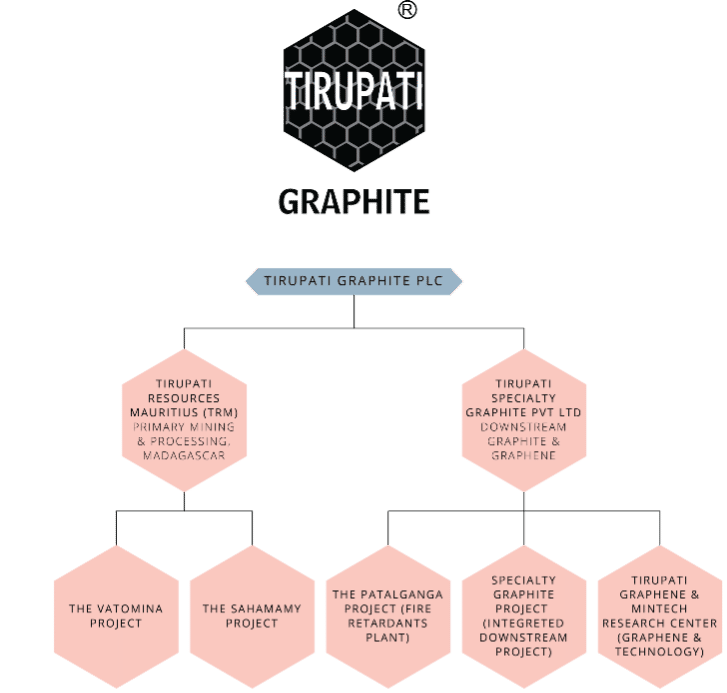

TGR intends to become a fully integrated graphite and graphene producer (see here for the distinction), with operations in both Madagascar and India, and ambitions to become a world-leading benchmark flake graphite company. For context, TGR at present remains a £35 million minnow.

The company aims to operate across the supply chain, all the way from mining graphite at source to shipping graphene to customers worldwide. This includes primary mining and processing in Madagascar, and hi-tech graphite processing in India to produce valuable speciality graphite, in addition to plans to construct a start-of-the-art graphene and tech centre.

Tirupati is placing an emphasis on ‘green’ graphene applications that is likely to appeal to ESG investors, such as renewable energy generation and storage. And encouragingly, the company’s board and management cover more than 150 years of collective experience in the sector.

TGR operates two key projects at present, both in Madagascar- Sahamamy and Vatomina. Mining permits have been issued across a 33 square kilometre area lasting for 40 years. The projects are connected by highways to both capital city Antananarivo and the nearby Tamatave port.

Its first plant is now producing 3,000 tonnes per annum (TPA), and the company expects to develop to 81,000TPA production from the twin projects in stages over the next four years, of high-quality flakes of up to 96% purity, of which 60% will be jumbo sized.

At Vatomina, the current defined mineral estimate under JORC implies a total graphite reserve of 852,000 tons with a mine life of 14 years based on planned 60,000TPA production capacity. At Sahamamy, the same dataset shows total graphite of 296,800 tons, also with 14 years of mine life assuming a ramp up to 21,000TPA production capacity.

Key infrastructure is already in place, including an admin and residential area for the on-site team, an engineering centre and lab facilities for quality control, and full road surface improvements.

The company is also developing speciality graphite processing facilities to generate expandable, high purity, micronized and spherical graphite and graphene through its India-based projects — Patalganga, the Specialty Graphite Project, and the Tirupati Graphene and Mintech Research Centre.

Recent developments

On 5 December, TGR reported a successful £5 million fundraise through a share placement at 35p per share (a 18.57% discount at the time). £3.5 million is to be used to fund the acquisition of Suni Resources SA from Battery Mineral Ltd, a deal originally announced in mid-2021, with the remainder to be used to ‘progress its activities and developments.’

The deal includes the rights to The Balama Central and Montepeuz projects based in Mozambique, both of which are fully licensed for construction to 150,000TPA flake graphite production capacity, and which have already benefitted from significant infrastructure investment on site. With 152 million tons of JORC 2012 reserves and resources established across the two sites, there is more than 13 million tons of high-quality flake graphite to be mined, making the acquisition ‘transformational for the company.’

Then on 29 December, the company released unaudited half-year results to 30 September. Despite ‘exceptionally adverse weather conditions’ in the period, it achieved 63% growth in production and 78% growth in sales compared to the same half in the prior financial year.

Revenue from sales increased by 108% to £1.17 million, while gross profit increased by 24% to circa £378,000. And as a result of ‘increased operating profits and reduced administrative costs the negative EBIDTA reduced by 24% from £836,522 to £632,891.’

Executive Chairman and Managing Director Shishir Kumar Poddar claims that the company is positioned to be a ‘globally significant ex China source for mineral flake graphite’ in 2023. The mineral is expected to see a widening supply gap through 2023 and beyond, amid a determined western political focus to diversify supply chains away from the political and pandemic troubles of China.

Of course, there’s plenty that can go wrong as production accelerates. But as a speculative investment in the graphite sector, TGR shares look promising for 2023.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.