Celadon Pharma’s share price has been a clear winner of the FTSE AIM market in 2023. Is this rise sustainable?

Cannabis shares in the UK have always had something a complex relationship with the law — use of the recreational drug was upgraded to a class B in 2009, and Suella Braverman even recently hinted that it should be upgraded to class A.

For context, possession already comes with a prison term of up to five years, an unlimited fine, or both. And yet, ONS data shows that 7.8% of adults between the ages of 16 and 59 — or 2.6 million people — use cannabis every year, making it by far the most-used illicit drug in the country.

Across Europe, a third of citizens have tried the psychoactive at least once — and police in the UK have been accused of ‘decriminalising’ possession, with only 16% of people found in possession of cannabis actually charged with a crime, and even fewer prosecuted.

Meanwhile, the UK remains one of the biggest cultivators and exporters of medicinal cannabis in the world.

In November 2018, the Theresa May government changed the law to allow the NHS and private providers to prescribe cannabis-based medical products after lengthy campaigns waged by epilepsy sufferers. However, thousands still rely on getting CBD oils illicitly, as it’s still virtually impossible to get an NHS prescription.

For context, 89,239 prescriptions for unlicensed cannabis medicines were issued between November 2018 and July 2022 in England, and only five of these were issued by the NHS. The problem is that while the NHS has licensed 11,000 products, patients can only get access to the actually useful unlicensed products through private doctors on the GMC’s specialist register.

While an NHS doctor can prescribe an unlicensed treatment in theory, they must apply for specialist funding or request their NHS trust to fund them directly — and only after they have proven that every other alternative licensed medication has been tried. And further — patients can’t even get a prescription for any cannabis medication from their NHS GP, but only from a hospital doctor from a heavily overburdened health system.

But if you have the cash to go private, it’s pay-to-win.

Celadon may have the solution — or at least form part of one.

Celadon Pharmaceuticals (LON: CEL)

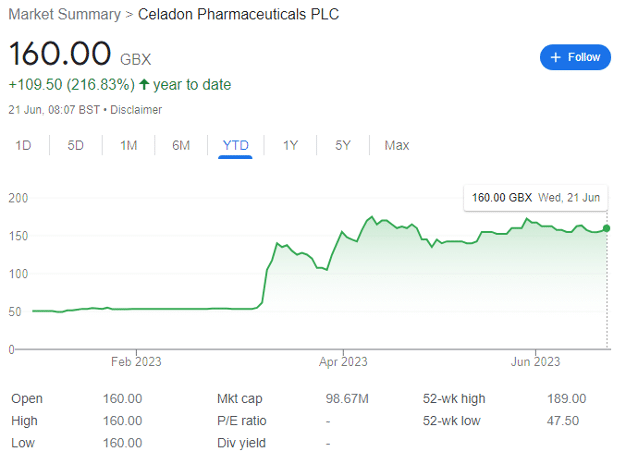

To start with, it’s worth noting that CEL shares are up 217% year-to-date.

On 14 March, CEL announced that its ‘current Home Office licence has been successfully updated to allow the commercial sale of its high 9-tetrahydrocannabinol product, following the Company’s recent registration as a Good Manufacturing Practices manufacturer by the UK MHRA.’

Consequentially, the licence allows Celadon to commence commercially supplying its cannabis-based medical product to third parties, the first registration of a UK pharmaceutical facility for high THC cannabis active pharmaceutical ingredient since May’s legislation in 2018. Celadon has therefore joined a small, select group of producers which can make EU-GMP grade high-THC cannabinoid API.

CEO James Short enthuses that ‘our updated Home Office licence now gives Celadon the opportunity to pursue revenue through the sale of our medicines, and to becoming a partner of choice in the pharmaceutical cannabis sector.’

It didn’t take long for the first contract win — on 24 May entering into an agreement whereby CEL will sell a minimum of £3 million worth of product over the next three years to ‘a leading UK medicinal cannabis company.’ The first shipment is expected in Q4 2023, with the contract providing for a two-year extension if both parties agree. The company also has a letter of intent from the same company for an annual £7 million of product on an ongoing basis.

The company also notes that it has ‘multiple expressions of interest in the sale of its pharmaceutical-grade product. The Company is currently in discussions to convert these into commercial contracts, and whilst there is no guarantee around if or when these will convert, if successful they would be expected to move the Company to a cash generative position.’

Celadon believes that UK-based production, combined with its indoor, fully controlled hydroponic cannabis cultivation, has a significant advantage over imported product, due to the associated frustrations for patients of supply delays and increased cost.

This could be the first step towards greater NHS adoption — and CEL could be the prime beneficiary.

However, CEL’s finances are something to keep an eye on.

On 30 May, the company entered into a £7 million, two year unsecured committed credit facility with a UK-based high net worth investor and current shareholder. However, any drawn balances will attract a ‘a fixed interest rate of 10 per cent per annum and payable quarterly’ — this is not charitable financing.

For context, full-year results from 5 June show that when company was readmitted to AIM it raised £8.5 million but was left with a cash balance of just £1.8 million at the end of May 2023, plus £1 million due from HMRC.

Further, it made revenue of just £24,000 in the entire year, with an operating loss of a whopping £5.38 million, and a loss before tax of £18.12 million. This financial situation isn’t compelling for a £99 million company whose share price has risen 217% year-to-date.

Of course, setting up is expensive. It’s completed seven harvests from the Phase 1 grow facility, with independent third-party testing of test batches confirming high quality, consistent pharmaceutical grade cannabis.

CEL also submitted the results of its Feasibility Study for the company’s chronic pain study to the Research Ethics Committee in December 2022, anticipating that REC will formally approve commencement of its clinical trial in H2 FY23. Of course, it also constructed its Phase II facility through 2022, and expects to ramp up production in line with demand during 2023.

These accomplishments aren’t cheap. But given the cash burn, the company will likely need to either issue new shares or get more loans on better terms as it scales up.

And institutions by and large stay clear from cannabis stocks.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.