Stock screeners are handy tools investors and traders use to sift through countless publicly traded stocks, focusing on specific criteria. They apply specific criteria like financial ratios, market capitalization, dividend yield, and price-to-earnings ratio.

What stock screeners do is that they help you find investment or trading opportunities that suit your preferences, risk tolerance, and strategy. You can find them on financial websites, platforms, and software applications. Popular options include Yahoo Finance and Google Finance.

Notably, online brokers often give clients access to these tools, and there are many free versions. Stock screeners are a starting point for investors building reasonable and profitable investment portfolios. This post explains everything you need to know about them.

Key Takeaways:

- Stock screeners are valuable tools to help investors and traders find investment opportunities that match their preferences, risk tolerance, and strategy.

- These tools use specific criteria, such as financial ratios, market capitalization, dividend yield, and price-to-earnings ratio, to sift through countless publicly traded stocks.

- Some popular stock screeners are TC2000, Zacks (NASDAQ), Trade Ideas, Finviz, Stock Rover, and TradingView.

What Are the Best Stock Screeners?

- Best Overall Stock Screener: TC2000

- Best Free Stock Screener: ZACKS (NASDAQ)

- Best Stock Screener for Day Trading: Trade Ideas

- Best Stock Screener for Swing Traders: Finviz

- Best Stock Screeners for Buy and Hold Investors: Stock Rover

- Best For Global Investing: TradingView

Best Overall Stock Screener

TC2000

TC2000 is an exceptional stock screener that combines advanced functionality with a user-friendly design. It offers a comprehensive array of fundamental and technical screening tools to help you find the perfect stocks, ETFs, and options to trade. The platform’s intuitive trading interface simplifies the trading process, allowing you to focus on making informed decisions.

Featuring vibrant and engaging visuals, TC2000 makes it a breeze to interpret complex market information and visualise your trades. Its easy-to-use platform empowers beginners and experienced traders to navigate the financial markets confidently. It’s no wonder that TC2000 has been named the best overall stock screener by many experts in the field.

Pricing and Subscription Options

- Free Version: Available

- Silver Plan: $9.99 per month

- Gold Plan: $29.99 per month

- Platinum Plan: $89.98 per month

- Each option has its different offers.

Pros

- The platform supports trading stocks, ETFs, and options, making it suitable for various trading strategies.

- It boasts an intuitive and easy-to-use platform, making it accessible to traders of all skill levels.

- It offers multiple technical and fundamental screening tools, allowing users to make informed trading decisions.

- It provides interactive charting with chart drawing tools for detailed market data analysis.

- It uses an integrated paper trading account to test the strategy before trading.

Cons

- It works only for the U.S and Canadian exchanges

- It has a free trial but only available to students

Best Free Stock Screener

Zacks (NASDAQ)

Zacks Investment Research is a company that provides financial data, research, analysis, and insights to investors and financial professionals. Founded in 1978, Zacks is primarily known for its proprietary rating system for stocks, which ranks them based on their expected outperformance or underperformance compared to the market.

The company also provides research reports on individual stocks and industries, as well as commentary on market trends and events. In addition to its research services, Zacks offers several investment tools and services, including a portfolio tracker, stock screener, and quantitative models for stock selection. Zacks serves individual investors, financial advisors, and institutional investors, making it widely respected in the financial industry.

Pricing and Subscription Options

- Free Version: Available, and its free trial is especially the best as it allows investors to trial all the features in the premium package within a duration.

- Premium Plan: $249 per year with free 30-day try-it membership

- Ultimate Membership Plan: $299 per month: $2,995 per year with a 30-day trial for $1

Pros

- The stock screener is well-equipped and free of charge.

- There are hundreds of fundamental metrics available for analysis.

- The stock database is extensive.

- A wide range of EPS metrics is included.

- There is also an affordable paid plan option.

Cons

- The metrics for technical are limited

Best Stock Screener for Day Trading

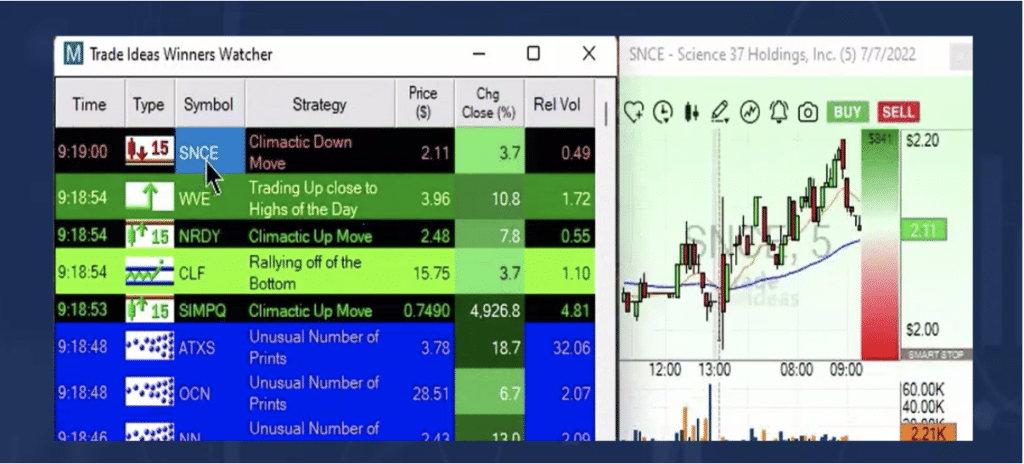

Trade Ideas

Trade Ideas is a powerful and intuitive stock screening tool designed to help day and passive traders find profitable trades quickly and efficiently. With its advanced algorithms and cutting-edge technology, Trade Ideas can help you identify trading opportunities in real time, giving you an edge in the market.

One of the standout features of Trade Ideas is its ability to scan thousands of stocks and other financial instruments in seconds, using various criteria. You can set your custom filters and search for specific patterns or signals that match your trading strategy, or you can choose from a range of pre-configured scans designed by expert traders.

With Trade Ideas, you can also set up alerts and notifications that will keep you informed of any significant market movements or changes in the stocks you are interested in. This means you can stay on top of the market and make informed trading decisions, even if you can’t be at your computer all day.

Pricing and Subscription Options

- Free Version: Available

- Swing Picks: $17 per week

- Standard Package: $118 per month

- Premium Package: $228 per month

Pros

- The stock screener has AI functionalities

- Availability of live trading room

- Offers integration with an online broker

- The screens are customizable

Cons

- Exchanges are limited to U.S. and Canadian stock

- It’s not available for Mac

Best Stock Screener for Swing Traders

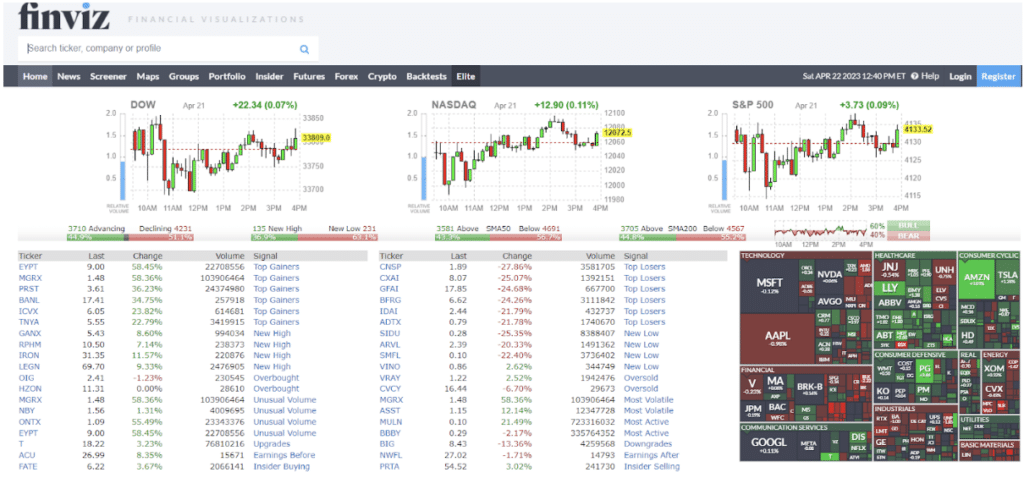

Finviz

Finviz is a powerful stock screener that’s a favourite among swing traders. It’s a user-friendly interface, and robust features allow traders to quickly and easily sort through thousands of stocks to find the ones that fit their trading strategies.

Finviz can filter stocks based on various criteria, such as price, volume, market capitalization, etc. This makes it easy for traders to narrow their search to the stocks that meet their specific requirements.

In addition, Finviz provides various helpful tools that traders can use to analyze stocks and make informed trading decisions. These tools include customizable charts, news alerts, and even a portfolio tracker that lets traders keep track of all their investments in one place.

Pricing and Subscription Options

- Free Version: Available but not in real-time

- Finviz Elite: $39.50 per month with $299.50 per year

Pros

- The interface is easy to use

- Available in a free version for swing traders

- Availability of global stock exchanges

- Good selection of fundamental and technical screening filters

Cons

- It has a lower count of fundamental metrics compared to other screeners

Best Stock Screeners for Buy and Hold Investors

Stock Rover

Stock Rover is a powerful tool for investors looking to buy and hold stocks for the long term. This software helps users screen stocks based on various criteria, such as financial performance, valuation, and dividend yield. With Stock Rover, investors can quickly and easily identify stocks that meet their specific investment goals and preferences.

One key feature of Stock Rover is its comprehensive database of financial data, which includes information on nearly 500 stocks, ETFs, and mutual funds. This data is updated in real-time, so investors can be sure they are always working with the most current information. Stock Rover also offers a range of tools for analyzing this data, including charts, graphs, and customizable dashboards.

Stock Rover also provides investors with access to a wealth of educational resources. These resources include tutorials, webinars, and a community forum where users can ask questions and share information with other investors.

Pricing and Subscription Options

- Free Version: Available

- Startup Plan: $7.99 per month

- Premium Plan: $17.99 per month

- Premium Plus Plan: $27.99 per month

Pros

- Provides excellent fundamental screening tools

- Includes a stock scoring program

- Offers multiple preset screens to choose from

- It contains ten years of fundamental data for analysis

- Integrates with most brokerage platforms for seamless use

Cons

- Day trading functions are limited

- Only compatible with exchanges in the U.S. and Canada

Best For Global Investing

TradingView

If you’re looking to invest globally, check out TradingView. This platform is known for being helpful to investors worldwide, offering features that can help you with your investments regardless of your location.

One of the things that make TradingView stand out is its user-friendly interface. The platform is easy to navigate, even for beginners. It offers various tools and indicators to help you make informed investment decisions, including real-time data and chart analysis.

Another advantage of TradingView is its community of investors. You can connect with other investors worldwide, sharing insights and tips on the best investments. This can be a great way to learn from others and stay up-to-date on the latest trends.

Pricing and Subscription Options

- Free Version: Available

- Pro Plan: $14.95 per month

- Pro+ Plan: $29.95 per month

- Premium Plan: $59.95 per month

Each paid plan offers comparable functionalities. However, the number of datasets, timeframes, alerts, and algorithms vary across plans.

Pros

- Comprehensive fundamental screening

- Wide-ranging selection of worldwide stocks

- Social media platform for sharing trading insights

- Exceptional graphical representation

- Free basic edition available

Cons

- Insufficient historical data

Conclusion

Stock screeners are tools that investors and traders use to find investment opportunities that fit their preferences and strategy. They are available on financial websites, platforms, and software applications, and some online brokers also offer access to these tools. The best stock screeners include TC2000, Zacks (NASDAQ), Trade Ideas, Finviz, Stock Rover, and TradingView.

Each one has its unique features and pricing options. By using these tools, investors can identify potential stocks that meet their specific criteria, reduce risks, and increase profits. Choosing the right stock screener that suits your investment goals and trading style is essential to get the most out of it.