Andrada’s foray into lithium has piqued my interest. A speculative investment may be in order.

Long-time readers will know that I have a soft spot for London-listed companies exploring for lithium in Africa. The financial rewards on offer, combined with the regulatory protections — stop laughing at the back — make the plays attractive, if very high risk, high reward.

And there are risks. Exploratory mining is risky, penny shares are risky, lithium mining is risky, and some African nations are politically volatile to say the least. There are then the wild swings in share prices to consider; PREM, KOD, MARU, ALL et al might have delivered strong returns over the longer term, but wild spikes and cavernous dips are hallmarks of these shares.

And investor sentiment is a fickle thing.

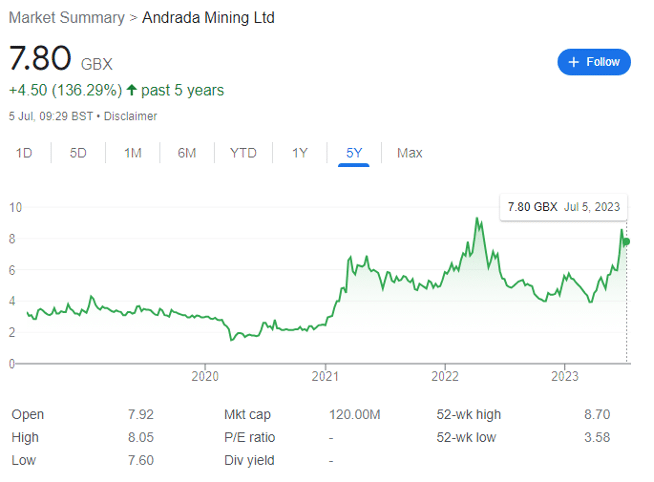

Andrada (LON: ATM) is no different; shares in the FTSE AIM stock were worth 3.94p in mid-March, a record 9.35p in early April 2022, and currently change hands for 7.80p. Over the past five years, ATM is up by 136%, but an investor who bought in at the start of 2019 could have instead put that money to better use elsewhere and bought the recent April 2023 dip for the same price.

Of course, that’s volatility for you — it’s a similar story many lithium explorers. A cursory glance at any social media site or share chat board can show you just how quickly sentiment can flip, even if the fundamentals remain the same.

Understanding the tin market

Andrada rebranded from AfriTin Mining in January to better reflect its multi-metal focus. However, the company’s primary operations in Namibia still focus on tin despite the new lithium operations — which is the key reason why I haven’t covered the company until now.

Allow me to explain.

I am not a tin market expert, but can provide a brief overview of why analysts remain wary of trading the metal.

During the 2008 financial crisis, tin stood at around $10,000 per tonne — but subsequently tripled to over $30,000 by 2011 as the global economy recovered. However, by 2015 oversupply and weak demand pushed the price briefly below $14,000.

Three years later, the market rebounded to around $22,000 due to supply shortages and a weak US dollar, but by 2019 tin demand was again declining due to reduced semiconductor demand resulting from ongoing Sino-US trade wars.

The covid-19 pandemic further impacted global trade, causing tin prices to drop to approximately $13,400 per tonne during the March 2020 mini-crash. Nevertheless, the market began recovering as automotive, electronics, and solar industries swiftly rebounded and entered new growth phases. Supply chain disruptions and soaring freight costs further limited tin availability, leading to a price rebound.

In 2021, tin prices surged by nearly 90% to $39,100 per tonne on the London Metal Exchange, marking the largest annual increase since the relaunch of tin trading in 1989.

For context, tin had been suspended for four years, starting from 1985, after the collapse of the International Tin Council, which had attempted to stabilise prices through buying low and selling high using a tin reserve. This led to a market crash when the council ran out of funds.

By November 2021, tin stocks in LME-registered warehouses had hit their lowest levels since 1989 due to strong demand outpacing supply from major producers. Chinese producers faced electricity supply restrictions, Myanmar experienced ore export disruptions due to Covid-19 restrictions and political unrest, and production shutdowns were rife in major producers Malaysia and Indonesia.

The rally in tin prices continued into 2022, with record highs of $50,000 per tonne breached in March as commodity markets reacted to Russia’s invasion of Ukraine and its potential impact on global supply chains. However, prices have since sharply declined to circa $28,000 per tonne due to high inflation and rapidly rising interest rates that are expected to cause a global slowdown.

Of course, this is a very brief overview, but the key point to understand is that while tin plays a vital role in multiple technologies, its market is much smaller and less liquid than other metals like copper or aluminium. This means that very small changes in supply and demand can massively affect tin prices — which goes some way to explaining Andrada’s volatility.

It also makes it hard to predict how valuable the tin it will mine in the future will be worth. While not advice, most analysts confidently predict that lithium, copper, and graphite will all see prices increase sharply over the next five years — but tin’s illiquidity makes it hard to make similarly sound predictions.

Andrada Mining: investment case in brief

Andrada’s flagship asset is the Uis mine in Namibia — formerly the world’s largest hard-rock open cast tin mine. In 2022, laboratory tests were conducted on lithium, resulting in the production of a high-grade, lithium petalite concentrate with extremely low iron content.

The process of converting the lithium petalite concentrate into battery-grade lithium hydroxide has been initiated in collaboration with Nagrom, a renowned Australian processing company. The company is currently engaged in commercial discussions with potential buyers of the lithium petalite concentrate — site visits have been completed and a partner should be selected by the end of September.

An exploration drilling program is currently in progress to expand the tin resource across fourteen additional pegmatites that have been historically mined. These pegmatites are all located within a 5 km radius of the existing processing plant. The company has set a target of delineating a mineral resource of 200 Mt within the next five years.

In addition, ATM has started trading on the US-based OTCQB market, in addition to listing in London and Namibia — three markets could help improve the share’s liquidity.

Q1 results

Operational Highlights

- 50% year-on-year (YoY) increase in tin concentrate production to 359 tonnes.

- 42% YoY increase in contained tin metal to 216 tonnes.

Lithium Testing Program

- Production of first saleable bulk lithium concentrate through dense medium separation.

- Testing of petalite concentrate by potential industrial offtakers.

- Construction of on-site bulk-sampling pilot plant on schedule and budget.

Lithium Exploration Program

- Ongoing confirmatory drilling to upgrade historic resources on pegmatites.

- Completion of drilling on the promising Spodumene Hill license area, assay results pending.

- Infill mapping and channel sampling on the Lithium Ridge license area completed, assay results expected in July.

Financial Highlights

- Average C1 operating cash costs below management guidance at USD 15,741 per tonne of contained tin.

- Average C2 operating costs below management guidance at USD 18,235 per tonne of contained tin.

- All-in sustaining cost (AISC) below management guidance at USD 21,377 per tonne of contained tin.

- Execution of $5.5 million finance facility with the Development Bank of Namibia.

- Progress in negotiations for a $25 million financing facility with Orion Resource Partners.

- Cash balance of $3.1 million as of 31 May 2023 — perhaps a key worry.

Construction and Metallurgy Updates

- Progress in the construction of the on-site bulk-sampling pilot plant.

- Testing and analysis of lithium concentrate through flotation, sensor-based ore sorting, and metallurgical processes.

- Expectations of generating early revenues from the pilot plant and planned lithium expansion.

CEO Anthony Viljoen enthuses that ATM has ‘demonstrated the ability to produce saleable lithium concentrate. The completion of our on-site bulk-sampling plant remains on track for completion this month and will expedite the metallurgical testwork required to bring lithium revenues onstream…the combination of the DBN funding, operational cashflows and the outcome of the strategic process will enable us to expedite the development of the lithium revenue stream.’

Final comments

ATM boasts fully permitted and established mining and processing facilities in Namibia, just 230km from the nearest port. It has a globally significant and JORC-compliant mineral resource estimate of 138 million tonnes. The resource contains high purity lithium constituting of 0.73% at 1,45 million tonnes of lithium carbonate equivalent, 0.15% tin at 120,000 tonnes, and 86ppm tantalum at 6,960 tonnes.

Lithium concentrate production has already begun at the Nai-Nais mine in Uis — as part of an off-site pilot test programme to investigate the metallurgical potential of the mine’s pegmatites. The petalite concentrate is believed to be 85% pure with a 4.16% assayed percentage of lithium oxide.

Viljoen enthuses that this ‘moves us one step closer to full-scale lithium production. With the completion of the on-site pilot plant imminent, we intend to expedite bulk pilot test work on all our mineral licences. Simultaneously, we plan to increase pilot-scale production of lithium concentrate for testing with potential off-takers to achieve initial lithium sales.’

The CEO is also building an on-site lithium bulk sampling pilot plant — the minimum annual targeted production of the pilot plant is 2,400 tonnes, with a maximum target of 10,000 tonnes.

Andrada is starting to look promising — hence a speculative buy — but only if you’re happy to weather the almost guaranteed long-term volatility associated with tin production.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.