A host of lithium explorers and titans are setting up shop. Here’s what you need to know.

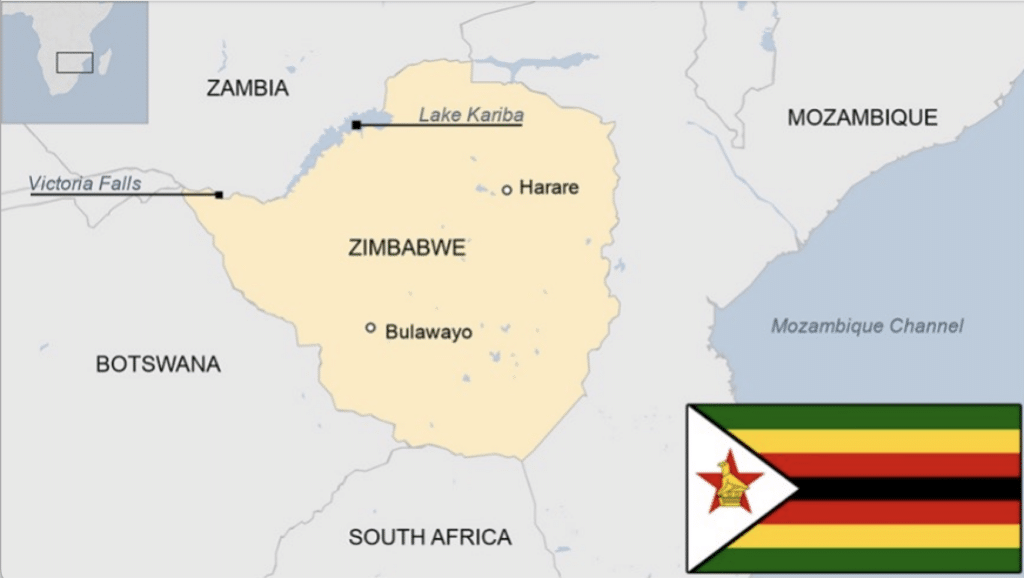

As a long-time investor in lithium shares in Africa, Zimbabwe remains my favoured destination.

To start with, the country is littered with the silvery-alkali metal, with the sixth largest reserves globally, and the largest reserves in Africa. For perspective, the Bikita mine houses circa 11 million tons and Arcadia 26 million tons alone.

Second, there’s the new law banning the export of raw lithium for new sources; a government bid designed to grow the domestic downstream sector and force new investment into the country. Zimbabwe would only do this if it felt there were further sources off untapped lithium potential.

Third, there’s a long history of lithium investment — going back at least six decades. The African country continues to enjoy significant international investment, a skilled domestic workforce, and a slew of explorers who are confident in spending money on exploring, with little worry that the government will turn on them.

Fourth, there’s the economic predictions. While Zimbabwe suffers from dangerously high inflation, SP Global analysts consider that it could meet 20% of global lithium demand when all current resources come online.

Fifth, there’s the huge Chinese investment into the country, well in excess of $1 billion. I’ll get into this below, but the Chinese always get their money back — and this financial vote of confidence is a key point.

Sixth, there’s the relative political stability. The mining industry accounts for circa 12% of GDP, and the government is keenly aware that it is a key source of external investment and jobs — with a plan to turn it into a $12 billion market this year.

Attached to this — and this is not a political comment — is the relative safety of current President Emmerson Mnangagwa, who was installed in late 2017 after predecessor Robert Mugabe resigned during the aftermath of a 2017 coup d’état. Mugabe is now dead and August elections are irrelevant — there is no effective opposition.

Legislative encouragement

Zimbabwe offers a solid legal framework for miners. In addition to the Base Mineral Export Control Act ban on raw exports — which the country estimates has cost $1.8 billion — the state runs the Zimbabwean Investment and Development Agency, the Reserve Bank of Zimbabwe, the Ministry of Industry and Commerce, the Competition and Tariff Commission, the Environmental Management Agency, and the Zimbabwe Revenue Authority.

Together, these institutions control and implement several laws:

- Zimbabwe Investment and Development Agency Act (Chapter 14:37): Reduces bureaucracy for foreign investors, and promotes and facilitates foreign direct investment through ZIDA and the One-Stop-Shop-Investment Services Centre.

- Mines and Minerals Act (Chapter 21:05): Consolidates laws related to mines and minerals, including acquisition of mineral rights and related matters.

- Exchange Control Act (Chapter 22:05): Confers powers and imposes duties and restrictions on gold, currency, securities, exchange transactions, and property import/export.

- Indigenisation and Economic Empowerment Act (Chapter 14:33): Provides for indigenisation of businesses, reserves specific economic sectors, and requires approval for merger, demerger, acquisition, and relinquishment transactions.

- Companies and Other Business Entities Act (Chapter 24:31): Governs constitution, incorporation, registration, management, and internal administration of companies, aligning Zimbabwean company law with international best practices.

- Competition Act (Chapter 14:28): Promotes and maintains competition, regulates mergers, prevents restrictive practices, controls monopoly situations, and prohibits unfair trade practices.

- Environmental Management Act (Chapter 20:27): Focuses on sustainable natural resource management, environmental protection, pollution prevention, and degradation prevention.

Incentives and restrictions

- National Project Status — a five year duty free window to import equipment for companies with a large capex plan and job creation strategy.

- Special Economic Zone Status — five years of no corporation tax, 100% rebate on imports, cost allowances, and flat 15% tax rate on specialised foreign staff.

- Future beneficiation — government wants producers to produce battery-grade carbonate in-country, with potential carrots and sticks involved. Likely delayed given stockpiles mounting as result of raw export ban.

- Minimum investment — future law could see investors forced to invest at least $1 million and form a local company with a state stake.

- Responsible Mining Audits — May 2023 saw an ESG compliance audit where Bikita was forced to suspend operations. Roughly one miner dies every week in the country — rising to 139 between Q2-Q4 2022 — with recent deaths at Bindura, Esigodini, Chegutu, Battlefields, and most recently Arcadia. More audits are inevitable and very necessary, and in combination with crackdowns on ‘artisanal’ mining shows the country is ready to ‘grow up.’

- Local procurement — Zimbabwe will likely set thresholds for local procurement in the future, though not for some time as the country doesn’t yet have the infrastructure or suppliers in place.

Chinese investment into Zimbabwe

Of course, my key Zimbabwean lithium investment is Premier African Minerals — whose 100% ownership of the Zulu producing mine is very promising. But rather than discuss the impending new deal, I’m highlighting the company for a different reason.

Back in early 2022 when Canmax (formerly Suzhou) was selected as a strategic partner to the tune of $35 million, CEO George Roach noted that ‘at one point, I was involved with 11 separate negotiations with people all wanting Zulu. It was a very intense period.’

China is investing heavily — including in a massive battery metals park — and wants a piece of every likely mine.

Major investments include:

Sinomine Resource Group

- Acquired Bikita Minerals for US$180 million in 2022.

- Investing US$200 million in mine development and two plants for spodumene and petalite.

- Plant construction is expected to be completed in July 2023.

- The capacity of the plants will be 480,000 tonnes of petalite and 250,000 tonnes of spodumene concentrate per year.

Zhejiang Huayou Cobalt

- Bought the Arcadia Mine from Prospect Resources in 2021 for US$422 million.

- Investing US$300 million in mine development and a processing plant.

- Plant construction was completed in April 2023.

- The Arcadia Mine has a capacity to produce 400,000 tonnes of concentrate per year.

- The company made its first shipment of lithium concentrate on 21 April.

Chengxin Lithium

- Bought 51% of MaxMind for $76.5 million, which owns the Sabi Star Mine.

- Construction of a new plant is ongoing, with an investment of US$130 million.

- Completion of the plant is expected in 2023.

- The plant will have a capacity of 300,000 tonnes of lithium concentrate per annum.

China Natural Resources

- Acquired the Williams Minerals lithium mine from Feishang Group and Top Pacific for $1.75 billion.

- Aiming to strengthen its lithium market position.

| BROKER | PROS | FEATURES |

|---|---|---|

| + Founded in 1974 + First-class web trading platform + Superb educational tools + Great deposit and withdrawal options | Fees: Spread cost; Overnight financing costs; Inactivity fees Min. Deposit: $£250 Tradeable Symbols: 19537 |

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. |

||

| – Fast withdrawal – 0% commission on US stocks – Real Cryptos, Stocks – 2000+ assets – Copytrading – Social Trading – PayPal deposits possible – One Stop Shop | Fees: $5 withdrawal fee. Inactivity fee. Min. Deposit: $50 Pairs Offered: 47 Leverage: 1:30 |

74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

||

| – Fast order execution – Tight spreads – Zero commissions – Big variety of deposit methods – Risk-management for beginners “AvaProtect” – Negative Balance Protection – Innovative mobile apps (AvaTradeGo, AvaOptions, AvaSocial) – Wide range of educational materials | Fees: High inactivity fees Min. Deposit: $100 Pairs Offered: Over 1,000 (all instruments) Leverage: EU – Up to 30:1, Professional Client/ROW up to 400:1 Withdrawal Process Time: 1-2 business days. |

76% of retail investor accounts lose money when trading CFDs with this provider. |

||

| – Advanced risk management tools – 24/7 online support. – 30+ languages. – All devices. – 0 commissions. – Tight spreads. – CFD Service. | Fees: Inactivity fee, but only if you don’t login to account. Min. Deposit: $100 Pairs Offered: 70+ Leverage: 1:30 Withdrawal Process Time: 1-3 business days. |

81% of retail investor accounts lose money when trading CFDs with this provider. |

||

| – Beginner Friendly – Well established – Well regulated – Negative Balance Protection – Over 3000 instruments to trade | Fees: High Forex Fees. Inactivity Fee. Min. Deposit: $100 Pairs Offered: 2000+ assets, including forex, indices, commodities, shares Leverage: UK/AU/EU – Up to 1:30 Withdrawal Process Time: 24 hours |

81,3% of retail investor accounts lose money when trading CFDs with this provider. |

||

| – ASIC, FCA, DFSA, FSA Regulated. – Trade with more than 80 currency pairs. | Fees: Inactivity Fee. Min. Deposit: $0 Leverage: 1:400 Withdrawal Process Time: Varies |

82,7% of retail investor accounts lose money when trading CFDs with this provider. |

||

Zimbabwe lithium explorers

This isn’t exhaustive but constitutes every lithium company in the country on my current watchlist.

- Premier African Minerals — 100% ownership of Zulu, new lithium hydroxide revenue sharing agreement being negotiated with Canmax.

- Marula — exploring for claims at present, has established a local subsidiary.

- Meeka Metals — acquired Mbeta Lithium’s claims and is currently exploring.

- Prospect Resources — after selling Arcadia for a $352 million profit, is prospecting Step Aside just 8km away.

- Galileo resources — expending $1.5 million on exploratory drilling near Kamativi.

- Li3 Lithium — in equal partnership with PREM to explore the 1,500ha Mutare project nearby Sabi.

- Pulserate — exploring 84 claims covering 10,000ha, private company in partnership with Canmax.

- Zimplats — gigantic subsidiary company looking to invest into proven projects.

- Red Rock Resources — recently received an environmental certificate to start producing and selling, but light on details.

- Arkle Resources — microcap with three licences covering 163ha.

- Cat Strategic — developing Kamativi tailings, but in long-term legal wrangles.

- Mutoko — Canmax’s Pei Zhenhua plans to invest in a project in Mutoko, details unknown.

- Kuvimba — plans to develop the old Sandawana emerald mine, believing it holds an untapped lithium resource.

- Sichuan Yahua — JV with China Nerin to reach a 350,000 tonne output from Kamativi

The bottom line

Zimbabwean lithium explorers are benefitting from an increasingly strong regulatory environment and huge interest from Chinese companies which have already spent hundreds of millions of dollars on infrastructure.

Investors in PREM may wish to dive into the tangled web — there’s more than one opportunity out there and those looking ahead are already considering the next acquisition target.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.