Sentiment in the lithium sector is improving and this microcap is being ignored by the market.

The small cap space is a weird and wonderful world, especially in the junior resource sector. Small caps seem to cover everything from £190 million profitable producers like Jubilee Metals through to £1 million nanocaps like Kendrick Resources.

An interesting component of this variation in valuation is that investors spend just as much time focusing on the sardines as they do the tuna — but this can make sense when you consider that the smallest companies mean investors have a larger proportion of the shares in issue for the same money, and therefore more of a potential profit.

One of the microcaps on my radar, which could have a promising future, is Mila Resources.

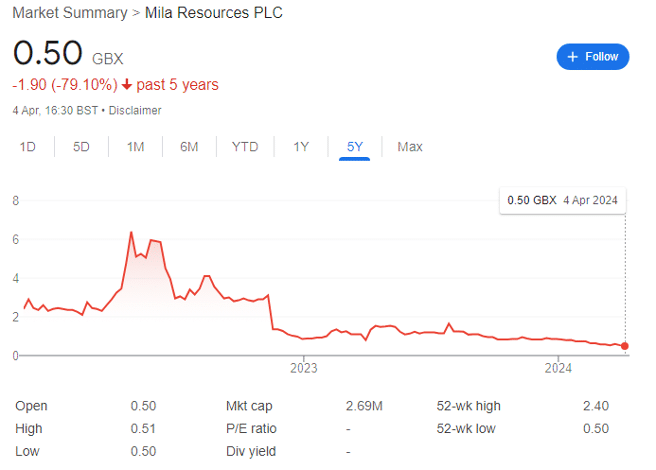

Just look at that share chart. Squint a bit, and you could probably assign that chart to any number of junior resource companies, with the classic pandemic era spike, a few sharp drops, and a gradual erosion of value over the past few months.

But when sentiment is dreadful and the stock unpopular, is often the time to strike.

Let’s dive in.

Mila Resources: Liontown Option Agreement

On 27 July 2023, the company entered into an option agreement with Liontown Resources — this piece is not specifically about Liontown, but anyone interested in Mila should read up on the failed Albemarle bid, Gina Rinehart’s involvement, the subsequent share price slide and the recently announced $364 million loan to get Kathleen Valley into production this year.

But the basics are this: Liontown is backed by a wildly successful mining magnate, is finally going to get cracking on production within a few short months (making Mila far more interesting than when Liontown had a funding problem), is enjoying the cautious recovery of spodumene pricing, and is still worth $3 billion.

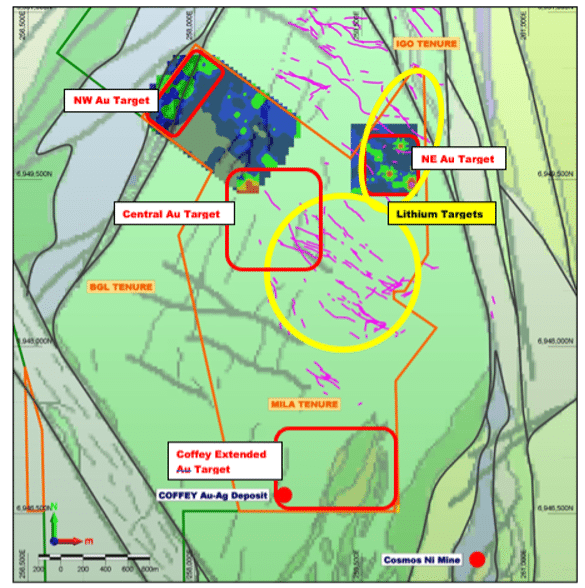

As I was saying, Mila entered into an option agreement with LBM, a subsidiary of Liontown in summer last year, to explore for lithium in its Kathleen Valley licence area, within Western Australia and adjacent to Liontown’s own world-class asset which has a Mineral Resource Estimate of 156Mt at 1.4% Li2O and 130ppm Ta2O5 — with over 80% classified as Measured or Indicated.

The key terms are as follows:

- Liontown will fund all lithium exploration activities, mining costs and associated Heritage Surveys.

- Mila (and other co-owners including TPE and NGM) will maintain ownership over any gold or other non-lithium minerals found.

- Liontown will have the option to acquire the right to extract lithium from the Licence Area

- Liontown has the option to acquire up to 80% of the lithium rights from Mila and TPE for a total consideration of up to AU$2,200,000 through a phased investment programme.

- By agreement with TPE and NGM, Mila currently has a 50% interest, in the Lithium Rights, which would convert to 10% of the Lithium Rights following full exercise by Liontown of its option.

As a general rule, though this is not stated anywhere, Mila would have the option for its 10% lithium rights to be converted down to a 1% royalty.

Obviously, Liontown is the king of the valley — and all drill and assay analyses from Liontown’s work at the KV Project will be shared with Mila’s exploration team. Importantly, the larger partner is paying for all costs associated with the Heritage Surveys over the relevant areas of the KV Licence and will apply its significant expertise in Heritage Survey management enabling Mila to leverage off the development of these studies for the purposes of its own gold exploration and development activities.

Specifically, Liontown will fund exploration and mining costs, may acquire a 50% interest in the lithium rights for AU$200,000 and then acquire a further 30% for AU$2 million.

Executive Director Mark Stephenson noted ‘This is a highly exciting development which adds a new and potentially valuable dimension… the benefits and synergies of this work comes at no incremental cost to Mila and allows us to leverage the deep local experience from the Liontown team.’

Hooray — essentially Liontown will do some initial work and if all goes well, take it from there.

On 13 February 2024, Mila announced that Liontown had completed an aerial image survey using drones over its flagship asset. The survey occurred between 30 January and 4 February covering both Liontown and Mila assets — in order for the baseline studies to comply with heritage and environmental regulations, ahead of commencing sampling and drilling works on the project.

Soil sampling is up next, with assays to be used to determine Liontown’s lithium drilling targets. It’s worth noting that all this data can also be used to further understand any base or precious metal geology, including new potential targets.

Where next for Mila Resources?

Here’s the good news. The company conducted a placing in October 2023, at 1p per share — and 200 million warrants with an exercise price of 2p per share and expiry in late 2025. The placing raised £2 million — and at 31 December 2023, the company had cash and equivalents of £1,684,073.

To colour this in, the business made a loss of £321,436 in the six months to 31 December, so has a monthly cash burn of just over £50,000. With Liontown funding the exploration and costs low, the likelihood of corporate financial issues or further placings anytime soon is low.

Mila does still market itself as a post-discovery project generator, and recently hired well-known geologist Alastair Goodwin to do some exploration — so the cash burn may now be a little higher than previously. Indeed, in recent results, the business noted that it is looking to ‘broaden our horizons to potential new projects.’

As an FYI, by post-discovery project generator, Mila means identifying and developing projects already proven projects along the value curve — rather than doing first curve work a la First Class Metals.

Goodwin is now ‘working on various potential new opportunities, assessing their relative merits in order to generate a shortlist of potential assets.’ The company justifies the strategy by arguing that ‘the biggest single risk facing most junior mining companies is that they are reliant on the success of a sole project, something that the Board of Mila are keen to avoid.’

I appreciate the sentiment, but if anyone at Mila reads this — please know that if Liontown don’t find any lithium, then no matter what asset you take on, it’s game over anyway.

Well, sort of. While Liontown is hunting for lithium, there’s already some fairly decent gold grades at the asset — there was an initial drilling campaign in 2019, Mila acquired it in 2021, and then conducted two more drilling campaigns in 2022 and 2023, which both intercepted gold, silver and zinc mineralisation.

There are some handy highlights:

- 6.6 metres@ 14.86 g/t Au & 21.79 g/t Ag.

- 8 metres @ 2.8 g/t Au & 6.6 g/t Ag

- 5 metres @ 4.26 g/t Au & 13.35 g/t Ag.

- 10 metres @ 8.38 g/t Au & 13.96 g/t Ag

That’s not bad at all. In fact, those are excellent, if early stage.

For context, the theory is that Mila’s asset enjoys geology in places analogous with Bellevue Gold, located 7 kilometres south, and Bellevue Golds Government Well project, located on the neighbouring tenement along strike to the north-west of Coffey.

The wider area is literally called ‘The Goldfields.’ Bellevue owns one of the highest grade and largest assets in Australia, with a JORC Mineral Resource of 9.8Mt @ 9.9 g/t gold for 3.1 Moz. And it’s got an AU $2.3 billion market capitalisation, up over 240% in the past five years.

Kathleen Valley is surrounded by gold mines, infrastructure, and majors. And while there is an intersection between the central gold target and the lithium targets, the NW, NE and promising Coffey target appear to be separate.

Clearly, Mila has only allowed Liontown access to lithium rights because it wants to JV the gold rights to another partner — and the obvious one is just next door.

Now to finish with the caveats. This is a beaten down junior resource microcap with some decent initial assays and a dream. It is very much still at the mercy of the drill bit and is by no means a central portfolio stock. If Liontown finds nothing of interest, then what is left of investor sentiment could collapse.

But placees got in for double the current share price only months ago and were confident enough to accept warrants at

2p. Today, you get a 0.5p buy-in, no need to worry about warrants being exercised until a 4x return, the Liontown deal funding exploration, excellent gold grades, and perhaps further good news on additional assets in the pipeline.

The name Mila comes from the Spanish ‘milagros.’

Sometimes, they happen.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.