F3 Uranium has seen two recent strong drill results and has signed a promising letter of understanding with SKRR. There may be further rises ahead.

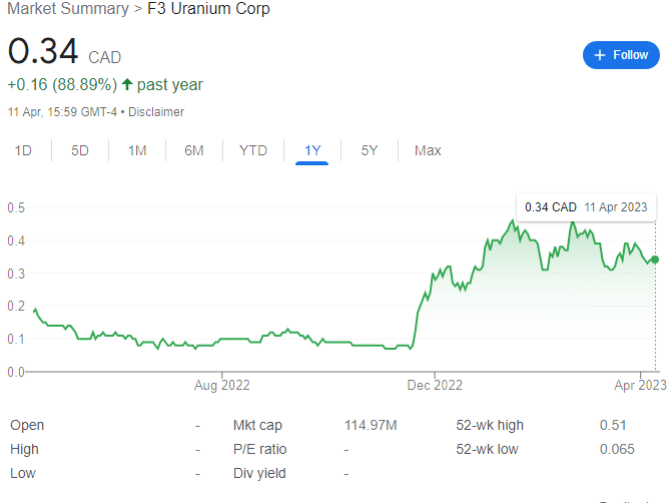

F3 Uranium (TSX: FUU) shares are my cup of tea. A strong management team, huge volatility, and a massive rise over the past few months to CAD$0.34.

The company’s uranium portfolio is situated in the Athabasca Basin, where several other companies have had huge success. I’ll be covering one of their smaller neighbours — Power Metal Resources — shortly, as the risk-reward trade-off seems exceptionally attractive for those getting in on the ground floor.

Of course, like all speculative uranium miners, this is not a risk-free investment. However, as I’ve covered before, the fundamentals behind uranium could see the metal spike in price as geopolitics continue to fray amid a search for energy independence.

F3 Uranium in brief

F3 is a uranium project generator and exploration company, focused entirely on projects in the Athabasca Basin in Canada, home to some of world’s largest high grade uranium discoveries.

F3 owns 16 projects in the Athabasca Basin, with several close to large uranium discoveries, including the Arrow, Triple R, and Hurricane deposits.

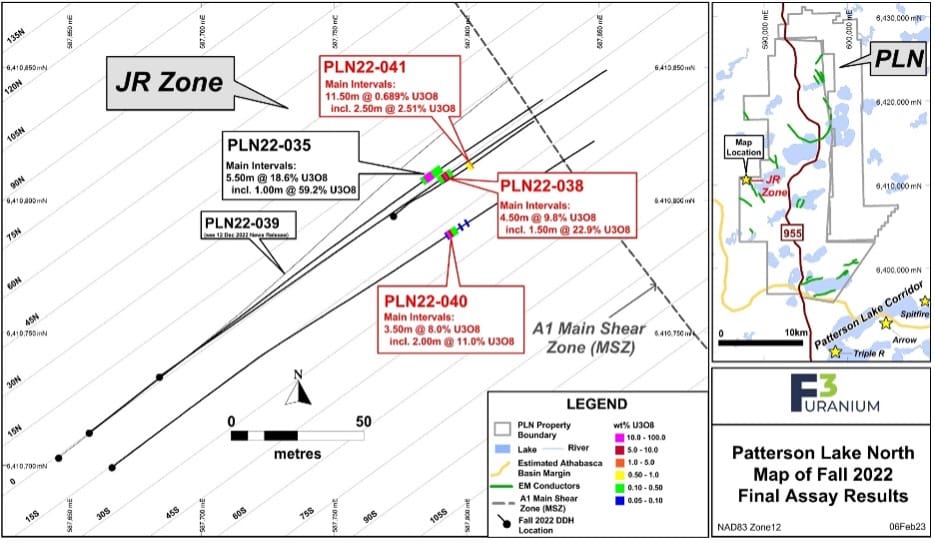

F3 is currently in the middle of its ongoing exploration and drill program, expanding its JR zone discovery on the PLN (Patterson Lake North) Project. A larger drill program is planned in 2023, with new discoveries just 25km from the highly prospective Patterson Lake area.

CEO and Chairman Dev Randhawa is the former CEO of Fission Uranium Corp, who together with President and COO Raymond Ashley has made multiple discoveries in the area, leading to Fission eventually being sold off at a premium to Denison Mines.

The same idea may be in place — gain the rights to highly prospective licences and then sell them to the highest bidder. In exploratory mining, it’s not a bad plan. As Randhawa notes after a recent award win, ‘we are very proud to have earned a spot in the 2023 TSX Venture 50 ranking. Last year was a transforming year for F3.’

Ashley recently enthused that there is ‘tremendous potential for F3’ with immediate priorities being the ‘that F3 meets its short-term operational goal of expanding the JR Zone and its mid-term goal of advancing it toward a maiden resource estimate.’

Meanwhile, newly onboarded Vice President of Exploration Sam Hartmann has been ‘drawn to the PLN property and in particular the A1 area ever since managing the 2014 and 2019 drill programs there, and seeing our persistence finally payoff is incredible.’

Recent updates

Two geological updates have helped catalyse the upwards share price movement.

The first — on 21 February — saw excellent results at PLN, with Ashely enthusing over ‘scintillometer results of step out hole PLN23-050 on line 045S where mineralization was encountered over a 21.0m interval within the A1 main shear zone, including the high grade core.’

Further, F3 is ‘growing the JR Zone further along strike to the south, which has now been defined over a total length of 75 meters to section line 060S where PLS23-052 intersected high grade mineralization with up to 53,600 cps.’

The second — on 27 March — saw F3 hit its ‘strongest hole to date…with infill hole PLN23-060 on line 060S, making it the best hole to date.

In technical terms, ‘drill hole PLN23-060 collared on line 060S has intersected the strongest radioactivity to date at the JR Zone. It intersected radioactivity over 17.5m, including 3.82m of continuous off-scale radioactivity >65,535 cps between 244.0m and 247.82m.’

Moreover, the two holes which have expanded the JR Zone to a current length of 105m both intersected off-scale radioactivity >65,535 cps.’ These promising results came with the final nine holes of the initial drill program — proving that exploratory mining requires an element of luck in addition to skill.

SKRR Option Agreement

On 10 April F3 signed a non-binding ‘letter of intent’ with nearby gold explorer SKRR Exploration, whereby ‘SKRR and F3 will negotiate and settle the terms of a definitive option agreement that will provide SKRR with an option to acquire up to a 70% interest in F3’s Clearwater West Project.’

This deposit is just 13km from Fission Uranium’s Triple R deposit, only 7km outside the basin edge on its PLS Property, and 17km south of NexGen’s Arrow uranium deposit. It’s also immediately adjacent to Fission Uranium’s PLS property, with Clearwater West itself is comprised of 3 contiguous mineral claims totalling 11,786 hectares.

While there are no guarantees that the project will be profitable, it’s worth mentioning again that management were previously in charge of Fission Uranium’s nearby deposits.

Randhawa notes that ‘working with groups like SKRR will allow F3 to advance exploration and unlock potential value for our company and shareholders. F3 will be the operator during the earn-in period, having assembled the team responsible for three major uranium discoveries in the Athabasca Basin, the J Zone at Waterbury Lake (which was sold to Denison Mines), Fission Uranium’s Triple R deposit and most recently F3’s JR Zone at PLN.’

F3 is to receive up to $700,000 in cash and operator fees, 7% ownership in partner pre-financing, and up to $5.4M in work expenditures to advance exploration at the project. While full details can be found on the investor site, this represents an excellent opportunity, and could be the first of many JVs that will be needed to explore the further 15 projects.

The next F3 Uranium catalyst may be just around the corner.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.