The deal is signed, and all cards are on the table. Here’s the good, the bad, and the intriguing.

Here we go again.

When the original deal between Premier African Minerals and Canmax ‘collapsed’ on 28 June 2023, it was clear to me that the two companies would eventually come to a new agreement — one where Canmax gets some sort of advantage over the previous agreement, but which nevertheless would be a net positive to both companies.

I characterised this possible advantage as ‘the sting in the tail’ — though the Chinese idiom may perhaps have been a better metaphor. In Asia, during negotiations where protracted disagreements might advantage one party, that party often chooses to ‘let the bullets fly for a while.’ As well as a being a business phrase, it also describes the act of waiting for the full truth to out — and now both sides have it.

This is a reference to the popular satirical comedy, ‘Let the Bullets Fly,’ a 2010 film where new information is constantly revealed to the audience which changes their perspective of what’s happening.

Let’s dive in.

SGM & accoutrements

Starters before mains — let’s set the scene. Before the SGM, CEO George Roach had promised to sell £2 million in PREM shares when required to fund general working costs, to be repaid in shares in the future, interest free. This was an upgrade on a previous announcement.

Also before the SGM — on 31 July — the company announced that ‘the Board’s expectation is that there is a common understanding between the parties, and they are close to a satisfactory resolution.’

On Saturday, the key vote to grant Roach the ability to issue 5 billion more shares at his whim (a dilution of circa 20%) was passed with an overwhelming majority. This majority crucially included Canmax, which fresh from attempting to eject the CEO and vote down his proposals, is now back to being best friends.

On Monday, PREM released a short statement with two additional salient points:

- ‘The Company has also agreed the terms of an amended Offtake and Prepayment Agreement with Canmax, and a further announcement will be made shortly.’

- ‘The Company has also now elected to draw down on the entire £2 million Amended Facility entered into with George Roach (as previously announced on 9 August 2023) immediately on announcement of the full terms of the amended Offtake and Prepayment Agreement with Canmax.’

The second point is perhaps the more important, as it implies but does not definitively state, that the CEO will sell shares and then make the cash available immediately after the deal announcement. If this is the case, then the share price response is not a fair market of market reaction. Of course, if Roach had already forward sold his shares, then this interpretation does not apply.

What I also find interesting is that Roach had previously proposed that a comprehensive RNS would be out on Monday — but it took two days for investors to get it. This suggests an element of back-and-forth with the NOMAD, and you can interpret this as you will.

But the new deal was announced at 13.30 on Wednesday 15th August — and once Roach’s selling ceases, investors will know what the markets make of it.

The New Deal

The first thing that’s noteworthy is that at a first glance, it’s relatively hard to know whether this deal is a good one. This makes the initial market reaction relatively irrelevant — even if you exclude the effect of the CEO selling shares. But by Thursday close, there will be a much better understanding of where the share price will settle, as analysts and retail investors dissect the RNS line by line.

As per usual, this is only my opinion, and not financial advice. If you can’t tolerate wild swings in the share price, this might not be the stock for you — indeed, I cover plenty of excellent blue chip opportunities elsewhere.

For context, PREM shares are currently down 10% today — and that’s not a problem. It’s a Tuesday on AIM.

Once again, this is high risk investing.

To start with, it’s worth pointing out that the original agreement was signed a year ago in August 2022. While it’s not required, it is common for Chinese companies to give each other a small gift as a token of good faith, and I would be intrigued to know whether Canmax’s representative offered this to PREM. Acknowledging milestones is an important part of Chinese business culture, so this may also be reserved for first sales.

Also relevant — because Canmax holds more than 10% of PREM shares, the deal was agreed without the voice of Dr Luo Wei, who serves on PREM’s board as Canmax’s appointee.

So what’s in the deal? To start with, the agreement ‘restores the working arrangements between Premier and Canmax, and therefore, the Force Majeure (FM) and default notices have been withdrawn by the respective parties.’

Canmax for its part released an RNS equivalent, which reads as follows (very abridged):

‘The company conducted friendly negotiations with Premier…for all parties to work together to resolve. The Zulu pilot plant issues and the achievement of production goals for all parties provided the basis. The signing of the revised agreement between the company and Premier is conducive to the company’s protection and consolidation of upstream high-quality lithium concentrate raw materials stable supply, forming a stable and high-quality raw material supply system, which meets the needs of the company’s daily business activities. It is necessary that there is no behaviour that damages the interests of the company and all shareholders.’

This is a huge development — even though most investors were aware this was the case since the SGM — because there will no longer be the spectre of imminent legal proceedings breathing down PREM’s neck. While I believed that the practical effect of the FM would last long enough to get the mine working, it was always legally unsound.

Another element is that the amended agreement terms ‘remain the same as the original agreement entered into in August 2022’ save for specific changes. These agreement terms, in my view, refer to the legal underpinnings of the contract — for example, any further spats would be heard in Singapore.

The actual agreement is much changed, however.

PREM has agreed:

- A revised product supply schedule (and alternative arrangements) in respect of the prepayment of US$34.6 million plus accrued interest.

- A revised hybrid pricing agreement with the payment for SC6 supplied by Premier based on the SC6 price, and a profit share whereby Premier and Canmax will share in the profit from production by Canmax of Lithium Hydroxide from SC6 supplied by Premier.

In the words of the board, this ‘resolves the dispute between Canmax and Premier, and provides a basis for the parties to work together to resolve the plant issues at Zulu and achieve all parties’ production objectives.’

This working basis is a modified ‘hybrid pricing structure’ — but first I need to cover the pre-payment agreement.

Canmax purchased $34,644,385 worth of product in advance to be sold by PREM once production started — and there’s bad news to start with. Annual interest on this amount has increased from 3.5% to 8% from 31 May 2023. However, this is not too onerous when you consider the high interest rate environment, and seems a fair compromise — because in reality, it’s just a promise of more Spodumene. It also incentivises PREM to produce as much as possible, in the same way as overpaying a mortgage.

Into the specifics of how much product will be sold to Canmax — from 1 November 2023 to 30 May 2024 (that’s seven months for the mathematically challenged) — Canmax will receive 25% of all gross proceeds due to PREM from the sale of product.

And then from 1 June 2024 and until the Advance Purchase Amount plus accrued interest has been settled, Canmax will receive 50% of all gross proceeds. I think there is a typo in the RNS here, as the date cited is 1 June 2023.

Specifically, settlement (i.e. delivery of product) should commence no later than 1 November 2023 at a minimum rate of 1,000 tons per month on a rolling average basis. Interestingly, this is calculated on a plus or minus 10% basis, which is likely to account for the variation in the quality of the ore being fed into the plant.

So far, this seems eminently achievable as long as nothing goes wrong. Here we come into the sting in the tail:

‘If the Minimum Delivered Product does not occur, then Premier will be required to make a cash payment to Canmax for that month.’

Between 1 November 2023 to 28 February 2024, this is set at $1.5 million per month. This rises to $3 million per month between 1 March 2024 and 30 May 2024, and then rises again to $4 million per month from June until the prepayment plus interest has been settled. Further to this, if PREM fails to make a second Minimum Delivery Product, the interest rate will rise to 10% from the next month.

And if production is not achieved in ANY month, and cash settlement can’t be made, Canmax can choose to select from:

- carry forward the balance to the following month, and the interest rate applicable to the outstanding balance of the entire amount increases to 12% per annum from the first day of the next month.

- accept new ordinary shares in PREM in lieu, at a conversion price that will be a twenty daily volume-weighted average trading prices of ordinary shares during the last twenty trading days of the month where the Minimum Delivered Product was not delivered. This cannot be lower than 0.32p per share.

What this means is that there are real consequences to further delays unless anyone fancies pulling out the FM card again. However, this is a legal trick that can really only be played once.

Now to the good news.

Settlement of the pre-payment agreement is now subject to a new long stop date of 1 April 2025, and as a last resort, Canmax would be entitled to receive the outstanding amount as a direct interest in Zulu Lithium based on a project valuation of $200 million.

There are a couple of things to unpack here. The first is that this is the first valuation for Zulu that investors have had in some time — $200 million, or circa £160 million. PREM currently sports a £120 million market cap at 0.52p per share, so there is now a floor of sorts to the company’s value on a fundamental basis. And that’s without a producing plant, RUS, EPO, or accounting for any other interests.

The second is this: in an absolute worst case scenario where PREM has delivered no product by April 2025, the prepayment amount + interest would amount to less than $50 million, or less than 25% of Zulu. Alternatively, if production delays occur, Canmax could start to take more shares in PREM, gaining more control of Zulu in a different way. Because without production, there’s no revenue, and no cash to pay back the pre-payment.

While no production by April 2025 would of course be a disaster, this continues to highlight one fact: Zulu is valuable and Canmax will happily take more of it.

Now here’s where it gets a little lairy, and it’s all about the hybrid pricing structure. Under the amended agreement:

‘Payment for 50% of SC6 supplied by Premier will be based on the SC6 price, and the balance as a profit share whereby Premier and Canmax will share equally in the profit from production by Canmax of Lithium Hydroxide from SC6 supplied by Premier.’

Beyond this:

- In respect of the SC6 delivered by Premier, a price based on the average middle price of all contract prices for 6.0% Spodumene concentrate (CIF) quoted by Fastmarkets less an agreed discount.

- In respect of the profit share, the net profit after deducting Premier and Canmax’s agreed costs of production and based on average prices of Lithium Hydroxide and Lithium Hydroxide Monohydrate.

I interpret this — and am happy to hear other thoughts — thusly:

Canmax will take delivery of all SC6 (an assumption still, remember), generated by PREM. The company must deliver a minimum of 1,000 tonnes of product per month, all of which will be based on market prices, less an agreed discount.

Investors don’t know how much this discount is — SC6 is trading for around $3,500/t — though pricing remains highly volatile, and this is only one of several benchmark measures. But if you assume that $3 million would be being paid off per month if the entire amount were used to pay back the pre-payment amount, then it would be paid off in just over a year — obviously a deeper discount would mean a longer payback time.

But the middling monthly ‘penalty’ would be $3 million, so in the absence of further information I think this is a reasonable assumption.

However, Canmax is only taking 25% of the proceeds of the 1,000tpm initially, leaving PREM with the cash needed to fund OPEX — and I suspect this was the sticking point at which negotiations broke down a few weeks ago. This increases to 50% next year, by which point production will in theory have increased.

All production beyond that initial 1,000 tonnes is then on a profit share basis. If you presume — yes, another presumption — that the plant can generate 2,000tpm from Q1 2024, then that additional 1,000 tonnes of revenue flowing to PREM can be calculated like this:

It takes 7.5 tonnes of SC6 grade spodumene to generate 1 tonne of Lithium Hydroxide.

Ergo, 1,000 tonnes of SC6 grade spodumene generates 133 tonnes of Lithium Hydroxide.

1 tonne of Lithium Hydroxide sells for $36,500/tonne.

133 tonnes x $36,500/tonne = $4,854,500

After production costs etc, this will likely fall to $4 million, of which PREM receives half, or $2 million. This covers OPEX for the ramp-up to 4,000tpm and beyond — more production costs more diesel etc.

Of course, there are various assumptions here, and it would be helpful for PREM to clarify how this all works. Positively, it’s possible that Canmax has already secured long-term higher prices from when Lithium Hydroxide was selling for more. It’s also possible that the grade will be slightly lower than SC6 quality at times as the company delves into the orebody, or that it will take more time to get up to 2,000tpm of production.

But I think this makes sense as a basic premise.

There is one further addendum: Canmax continues to have the right to acquire the first three years of production of SC6, years which only start when PREM gets up to 4,000tpm. This term can be extended by a further three years subject to mutual agreement between the parties. This marriage is planned to last.

Is production going to happen in November?

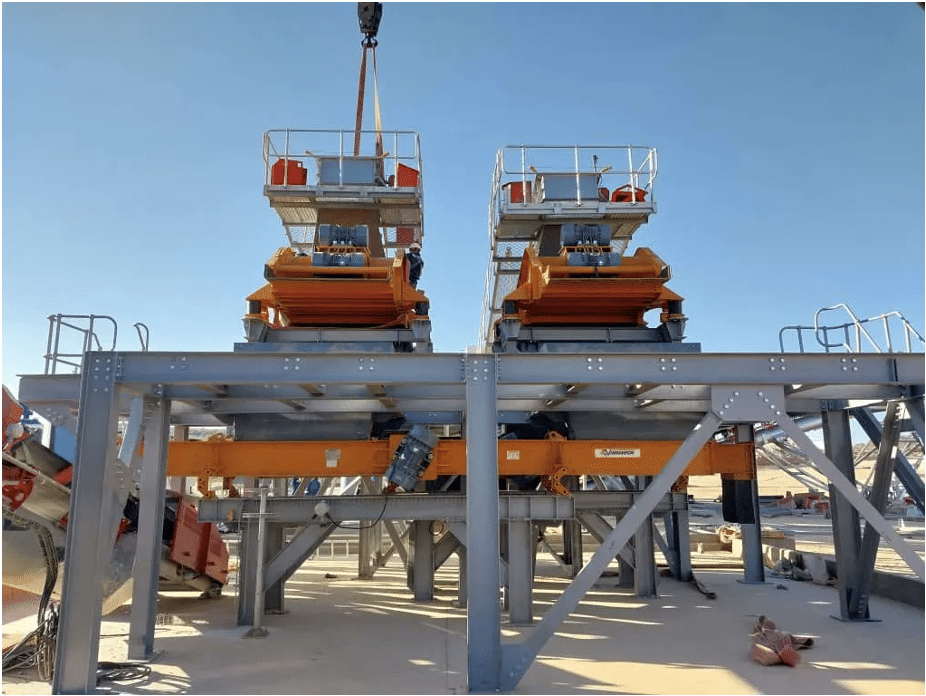

PREM has already had the hydro sizer and UV sorters installed, and so the last problem to be solved — to my knowledge — is the mill. The RNS notes that ‘operations at Zulu have been temporarily suspended to allow for the installation and commissioning of the mill from RHA Tungsten. This is expected to be completed during the early Autumn and within sufficient time to meet the revised Product delivery schedule.’

I contacted the team at STARK for the technical detail and this was the response:

‘The Mill is in Zimbabwe and should be commissioned mid to end September. While the Mill is in Zimbabwe, additional supporting equipment is being transported from South Africa — which accounts for the timeline. Once the Mill is installed and commissioned, STARK will be able to confirm whether the planned feed of around 50% capacity to flotation is achieved. This means the team will be able to establish whether there has been the hoped-for impact on Mica floatation, which is the key factor holding back the spodumene grade.’

It is worth noting that without the world-first UV laser ore sorting technology STARK has put in place, it would not be possible to get SC6 out of the Zulu deposit. And I suspect that if the answer was lack of manpower, there would be several hundred shareholders at the site bright and early tomorrow morning in hi-vis jackets, orange hard hats, and with pickaxes in hand.

On this note, and in the interests of transparency, I am now in the early stages of a conversation with STARK to help develop its business, as an independent strategic consultant. No contract has been signed to date, and any freelance work will be centred solely on new opportunities.

Fair or not — this is STARK’s party now, and notice of 1,000tpm of production will hugely de-risk the company. With the offtake partner back in place but with a strict schedule, PREM has simply swapped one risk for another — and I suspect that the share price will reflect this uncertainty. But the SGM has shown that most shares are in engaged retail hands.

On the other hand, between OPEX costs, any debt built up (unlike previous RNS’s I did not see any mention that PREM is debt-free, though will happily amend if this can be corrected), and just general working capital, it’s likely that a share placing will be needed over the next few weeks.

If you consider diesel costs — alongside Roach’s SGM remarks about the costs of developing the mine — I’m assuming circa £1.5 million per month, much higher than my previous assumptions. Of course, this falls drastically at times when the mine isn’t producing. This isn’t too onerous when compared to the market cap, but it seems clear that Canmax will not stump up more cash until the plant is delivering at least 2,000tpm.

However, when you analyse the new deal — it seems very much like Canmax is doing its level best to set achievable targets on realistic timeframes — while the profit share could become highly lucrative as production increases. As I have said before, Canmax needs this Spodumene, and every caveat to the new deal simply involves them getting more of it in one way or another.

And if PREM does manage to start producing soon, I still speculate that Canmax will pay for expansion, including potentially more plants. The company simply needs to show its own investors that a return is being made.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.