In an economy, the money people don’t spend is said to be saved. Moreover, an economy comprises, majorly, the rich elites and the poor masses. While the masses save for an emergency, or say for a rainy day, the wealthy people mostly save for investment opportunities.

There are different ways to save money. You can either create a savings account or keep it yourself (KIY) or any other method you see as the best. However, you should know in the emergence of inflation, the value of your total savings can quickly be flooded away, depending on the percentage increase.

In this report, we’ll cover all important statistics and facts on the UK savings landscape. Going forward, we will look at the individuals’ savings habits, and factors affecting their ability to save. Let’s explore the findings in this report.

UK Savings: Key Statistics and Facts

- Around one in seven (13%) UK adults don’t have any savings

- 14% of UK adults use cash or a money box to save money

- London residents have the highest monthly savings in the UK, with an average of almost £270 per month, and £3,240 per year

- The average yearly savings in the North East of England are £1,400 per person, which is 6% of annual income

- Savers in the South West and East of England set aside 9% of their yearly income

- The average household in the UK has £76,301 in savings

- The average person in the UK has £17,365 in savings

- Women in the UK have an average of £11,698 in savings, showing a significant gender gap to men’s £23,951

- The savings ratio for households in the United Kingdom averaged 8.7% over the past ten years

- 21% of Brits are not saving for retirement, compared to 12% in 2019

- The savings rate in the United Kingdom will remain between seven and eight per cent in the coming years

- The average amount people have in savings in the UK increases as they get older

- The average savings for British adults in 2020 was around £6,757

- The average savings for individuals under 25 in the UK is £2,533

- The average savings for individuals aged 25-34 in the UK is £4,775

Average Savings in the UK

Average savings vary depending on age, income, education level, and geographic location. In the UK, the average savings per person is £17,3651.

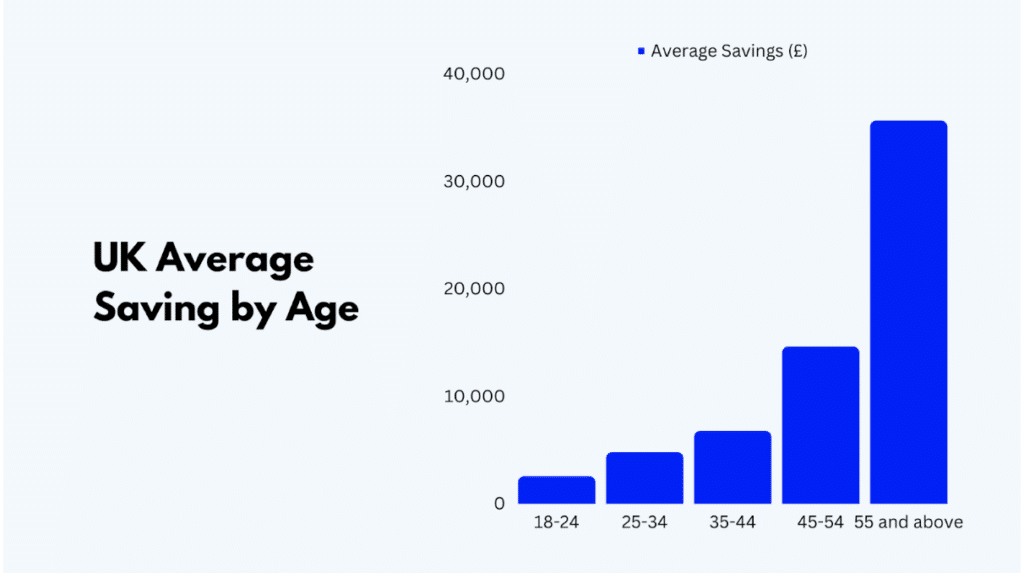

Average Savings by Age

In the UK, different age groups have different average savings. The table below presents the average savings specific to different age groups.

Table One: UK Average Saving by Age

| Age | Average Savings (£) |

|---|---|

| 18-242 | 2,533 |

| 25-342 | 4,775 |

| 35-442 | 6,751 |

| 45-542 | 14,591 |

| 55 and above2 | 35,607 |

The age group illustrates that as people get closer to their retirement age, the average amount they save increases. Student loans, low salaries, and high expenses are the reasons why younger people have lower savings than older people.

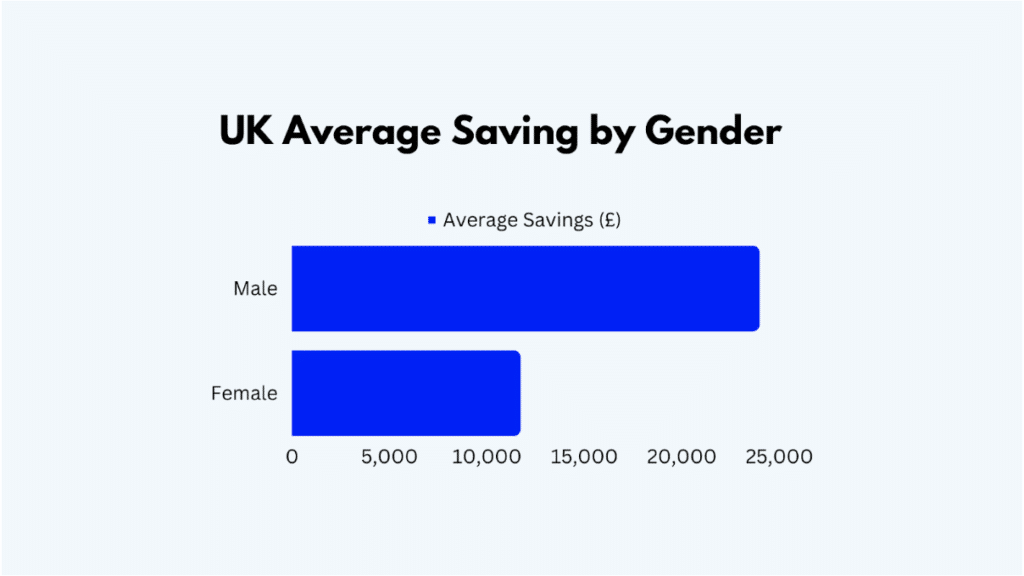

Average Savings by Gender

According to a source3, the proportion of women’s savings is 35% less than the amount men have in savings. The table below shows the most recent value of men’s average savings to women’s.

Table Two: UK Average Saving by Gender

| Gender | Average Savings (£) |

|---|---|

| Male2 | 23,951 |

| Female2 | 11,698 |

Lower earnings and career interruptions, such as nursing babies, account for why women don’t save as much as men. The latter, however, is the architect of the former.

Average Savings by Region

Some regions are more developed than others, and the expenses in regions differ based on their level of development. The East of England ranks higher than the rest of the UK in terms of development. On the other hand, the West Midlands had the lowest average savings.

Table Three: UK Average Saving by Region

| Region | Average Savings (£) |

|---|---|

| East of England2 | 27,561 |

| North West2 | 24,485 |

| South West2 | 22,301 |

| South East2 | 22,192 |

| Scotland2 | 21,641 |

| Yorkshire and the Humber2 | 17,451 |

| Northern Ireland2 | 14,155 |

| Wales2 | 13,913 |

| East Midlands2 | 13,306 |

| North East2 | 10,486 |

| Greater London2 | 8,901 |

| West Midlands2 | 8,688 |

Attributes such as employment rate, cost of living, transport expenses, electricity and water bills are the major reasons why some individuals in certain regions will see significantly higher savings than others living in another region.

Average Savings by Household Income

The UK household comprises low-income and high-income families. The average savings for a UK household is £76,301.

The table below shows the average savings by household income.

Table Four: UK Average Saving by Family Income

| Household Income | Average Savings (£) |

|---|---|

| Low Income Families4 | 95 |

| High Income Families4 | 62,885 |

The reason for the wide disparity in household income between low-income and high-income families is that low-income households spend more of their earnings on basic needs. On the other hand, high-income households save more than they consume due to larger earnings, especially those from returns on investment.

Sources: Money1, Finder2, Open Access Government3, Money Farm4, Moneyzine5

Factors Affecting UK Savings

Factors affecting UK savings are numerous. Some of these factors include the following:

- Interest rates

Interest rates can have a significant impact on savings. When interest rates are high, savers can earn more on their deposits. This encourages people to save more. On the other hand, when interest rates are low, savers become less motivated to save.

In the UK, the Bank of England’s official ‘Bank Rate’ is one factor that affects savings rates. When the Bank of England raises its interest rate, banks usually raise the interest rates for both savers and borrowers.

However, banks normally pay less to savers than they charge to borrowers, so there’s usually a gap between rates on savings and loans. According to a report, the average interest rate on savings accounts in the UK is 5.25% in 20231.

- Inflation

Inflation is another factor that affects savings. When inflation is high, the value of money decreases over time. This, therefore, means that savers need to earn a higher rate of return on their savings to maintain their purchasing power.

According to recent statistics, inflation in the UK was 7.9% in June 20232. This is above the Bank of England target rate of 2%. This outcome prompted the Bank of England to raise interest rates in an attempt to bring down inflation. While higher interest rates can help combat inflation, their impact on savings are minimal.

- Income

Personal income also affects savings. People with higher incomes may be able to save more than those with lower incomes. According to a report, the average savings in non-interest accounts grew from £257 billion in January 2023 to almost £268 billion in August 20233.

However, savings can be challenging to execute when income is low. Unexpected expenses can make things even worse. On the other hand, higher income generally allows for a greater capacity to save. For instance, the average savings for high-income families in the UK is £62,885 compared to £95 for low-income families.

- Personal Circumstances

Personal circumstances can significantly impact an individual’s ability to save money in the UK. While the average savings in the UK may be relatively high, many people have little to no savings. Factors such as age, income, and location can affect an individual’s savings.

According to savings statistics3, up to a third (34%) of UK adults have either no savings or less than £1,000 in a savings account. Additionally, the average person in the UK has £17,3653 in their savings, which varies widely by age group. Lastly, the East of England has the highest average savings, and the difference varies widely compared to the West Midlands4.

Sources: Bank of England1, Trading Economics2, Money3, Finder4, Bank of England5, Money Farm6

Savings Market Size in the UK

The UK savings market is a significant component of the country’s financial landscape. It encompasses various banking institutions and non-bank financial institutions, all of which are crucial in managing and facilitating savings for individuals and businesses.

Overview of the Savings Market

The UK savings market is substantial. The market approximately has £1.5 trillion2 held in savings accounts.

Also, more than half of all adults in the UK, 66%, have a cash savings account or above £1,0001. This indicates the widespread participation and importance of savings in the country’s financial system.

The savings rate in the United Kingdom keeps growing and is expected to remain between seven and eight percent in the coming years.

The resilience of the banking sector and the widespread participation in cash savings highlight the importance of savings in the UK financial system.

Banking Institutions

In the UK, the banking sector is considered resilient. This sector is capable of supporting lending, even in adverse economic conditions. For instance, major UK banks have built up significant financial buffers since the 20084 global financial crisis. This positions them well to absorb shocks and continue operating effectively.

The Bank of England publishes regular statistics on financial markets and banking institutions’ balance sheets. This does not only provide insights into the sector’s performance but gives a perception to the sector’s stability across the country. By 20505, the UK banking sector is predicted to double its current market size, reaching more than 950% GDP.

Currently, the top banks in the UK include HSBC Holdings Plc, Lloyds Banking Group Plc, Barclays Plc, Standard Chartered Plc, and NatWest Group Plc. These banks are not expected to fold in years to come, emphasising their strongholds in the UK financial system.

Non-Banking Institutions

Non-banking institutions in the UK play a significant role in the financial sector. These institutions are a diverse range of investment and funding markets, and are not covered by the prudential regulatory frameworks applicable to banks. In 2021, the UK non-banking sector’s market reached £1.33 trillion6.

Pension funds are one of the dominant non-banking institutions in the UK. They’re financial institutions that manage retirement savings on behalf of individuals and organisations. According to the UK Parliament, there are 5,100 pension schemes in the UK, with total assets around £1.4 trillion7.

Insurers are another dominant non-banking institution in the UK. They provide insurance coverage for individuals and businesses, protecting them from financial losses due to unforeseen events. According to the UK Government, the UK insurance industry is the largest in Europe and the fourth-largest in the world, with total investment of over £1.7 trillion8.

Other non-banking institutions include hedge funds and non-depository financial intermediaries. These institutions provide a range of financial services, including lending, leasing, and investment management.

Sources: Money1, Financial Conduct Authority2, Statista3, Bank of England4, The Treasurer5, Global Data, Statista6, UK Parliament7, UK Government8

UK Savings Accounts and Products

Savings are an important part of money management, and it’s essential to compare savings accounts to select the one that suits you best. In the UK, various savings accounts and products are available to help individuals achieve their savings goals. Let’s explore some of them.

ISA Holdings and Savings

Individual Savings Accounts (ISAs) are tax-efficient savings and investment accounts that allow you to save a set amount each year. This savings grows tax-free for as long as it remains in the account. The amount you can save in an ISA is called your ISA allowance, and it currently stands at £20,000 a year for 2023/241.

The significant difference between an ISA and a savings account is the tax you pay on your returns. When you earn interest on your savings, you’re responsible for income tax. However, ISAs are completely tax-free regardless of how much interest you earn. While it’s reported that 34% of Brits have less than £1,000 in savings2, 60% of UK households have varying savings accounts3.

Regular Savings Accounts and Rates

Regular savings accounts are designed for putting away specific amounts each month for a fixed period. Each account will have slightly different requirements, and some offer top rates of up to 7.00% for depositing money every month.

Regular savers come with a few more restrictions than easy access or fixed-term savings accounts, such as how much you can deposit each month and access to withdrawals. So, it’s best to choose one that suits your needs.

Table Five: UK Regular Saving Accounts and Rates

| Service Provider | Account Name | Interest Rates/AER | Min/Max Deposit |

| First Direct4 | Regular Saver Account | 7.00% | £25 / £3,600 |

| Lloyds Bank4 | Club Lloyds Monthly Saver | 6.25% | £1 / £4,800 |

| NatWest4 | Digital Regular Saver | 6.17% | £1 / £5,000 |

| Nationwide4 | Start to Save (Issue 2) | 5.50% | £1 / £2,400 |

| Halifax4 | Regular Saver | 5.50% | £1 / £3,000 |

To find more information about regular savings accounts offered by these banks, you can visit their websites. These banks operate online, so you can set up an account and start saving using mobile banking. Additionally, you can visit their branches to inquire about their product offers. You can also reach them by calling their mobile telephone numbers.

Pension Schemes and Retirement Savings

If you live and work in the UK, there are three main ways to build up a pension that can help provide you with an income when you retire. These are the State Pension, workplace pensions, and pensions you set up yourself.

The State Pension is a regular payment from the government, and the amount you get depends on your National Insurance record. If you’re over 22 and under the State Pension age and earn more than £10,0006 a year, your employer must automatically enroll you in a workplace pension scheme.

Personal and stakeholder pensions are a way to ensure you have additional money on top of your State Pension. Pensions help you save money for later in life. You may be able to get a pension from the government (‘State Pension’) or money from pension schemes you or your employer pay into.

Sources: Nerdwallet1, Money2, Money Farm3, The Times4, Money Helper5, UK Government6,

Facts about UK Savings

The UK savings market is diverse, with various savings accounts available to suit different needs and preferences. While some people have significant savings, others have little or none, highlighting the importance of financial education and planning for the future.

UK Savings Habits and Popular Goals

According to recent studies, the average UK household saves 7.6%1 of their income. The typical UK household saves £2,160 per year, representing the median amount saved annually. The average person in the UK has £17,365 in savings, while 34% of adults have either no savings or less than £1,000 in a savings account1. On average, UK savings amount to approximately 8.21% of monthly income3.

The most popular savings goals in the UK include creating a financial safety net, going on holiday, saving for a house, and Christmas. Other popular goals include debt repayment, car fund, bills, wedding, birthdays, tattoos, car insurance, driving lessons, kitchen and bathroom renovation funds, and baby funds.

Proportion of Population Saving Regularly and Influence of Age and Gender

Approximately 61%1 of UK adults save money either every or most months. However, research3 suggests that around 15% of people in the UK have no savings at all, while one in three people have less than £1,500 put away. The gender savings gap is a significant issue in the UK, with women saving 35%4 less than men.

Women across the UK save a third less than their male counterparts due to a gender savings gap. This leaves a disparity of 40% between men and women at the retirement age. The impact of the gender pay gap has led to a savings gap4 too, lessening women’s savings compared to men’s.

Age is also a significant determinant of average savings in the UK. The average savings of people in the East of England is £27,561, compared to the average savings of £8,688 in the West Midlands5. The highest proportion of those affected are women aged 18-24 (53%) and women aged 25-34 (48%)6. For both men and women, the amount of investable assets increases with age, but the level increases at a faster rate for men (£13,140) compared with women (£6,869)7.

Tips for Getting into the Savings Habit

Developing a savings habit can be challenging, but several tips and strategies can help you get started. Here are some suggestions from various sources:

- Use the 50-30-20 rule: This rule suggests that you allocate 50% of your income to necessities, 30% to discretionary spending, and 20% to savings and debt payments. This can be a helpful guideline for budgeting and prioritizing savings.

- Pay yourself first: Strive to automate your savings by setting up automatic transfers from your checking account to your savings account. This can help you prioritize saving and make it a regular habit.

- Start small: Even if you can’t save 20% of your income, set aside something – even if it’s just 1% – to start building a habit and developing positive feelings about your money. Saving for the future is just as important as any other expense you have.

- Build an emergency fund: Having an emergency fund can help you cover unexpected expenses and avoid going into debt. Financial advisors generally recommend having at least three to six months’ worth of expenses saved up.

- Cut back on expenses: Look for ways to reduce your expenses and free up more money for savings. This could include decluttering and selling unneeded items, cutting back on dining out or entertainment, or finding ways to save on utilities or other bills.

- Take advantage of bank technology: Many banks offer tools and resources to help you save, such as automatic savings plans, round-up features, and budgeting apps. Take advantage of these resources to make saving easier and more convenient.

Sources: Money1, Nimblefins2, Money Farm3, Daily Record, Open Access Government4, Finder5, FCA Insight6, APTAP7

FAQs

According to a report, the average person in the UK has £17,365 in their savings as of 2023.

Research shows that 34% of adults in the UK have either no savings or less than £1,000 in a savings account.

Most UK adults have a personal savings allowance allowing them to earn up to £1,000 interest on their savings without paying tax if they’re a basic rate taxpayer. However, interest earned on savings above this amount is subject to income tax.

The amount you can save in a UK savings account varies depending on the account type you have. Some accounts have a maximum deposit limit, while others do not. It’s best to check with your bank or building society to find out the specific details of your savings account.

The highest regular savings account and rate in the UK can vary over time. Presently in 2023, the highest rate is 7.00% AER, offered by First Direct Bank.

Savings accounts generally do not require credit checks since they do not involve borrowing money. However, some banks or building societies may perform a soft credit check when you apply for a savings account to verify your identity and address.