Uncosted tax cuts and a plunging pound offer potential investing opportunities for the quick-witted trader with an appetite for risk.

On Friday, the new Downing Street duo, Chancellor Kwasi Kwarteng and PM Liz Truss, will announce a mini-budget. Dubbed a ‘fiscal event,’ this is the initial response to the cost-of-living crisis that the Bank of England has previously warned could cause a recession that will last for five quarters, matching that of the 2008 financial crisis.

The immediate political advantage of calling a fiscal event rather than a full budget is that it avoids the need to publish an Office for Budgetary Responsibility economic forecast simultaneously.

With tax cuts worth £30 billion pencilled in on top of the £150 billion energy bills intervention, Commons Treasury Committee Chair Mel Stride has warned the forecast is ‘vital.’ Concurring, Institute for Fiscal Studies Director Paul Johnson has called the lack of an OBR report ‘not the best start.’

The inevitable outcome will be increased pressure on Bank of England Governor Andrew Bailey to increase the base rate, already at 1.75%, to as much as 3.75% by year-end. Worse, the markets are pricing in further rises through 2023.

What could be in the mini-budget?

Kwarteng has promised to focus ‘entirely on growth,’ with a relaxed emphasis on fiscal discipline.

Accordingly, near-certainties include a corporation tax freeze at the current 19%, scrapping the previously planned increase to 25% in the next financial year. In addition, it now seems beyond doubt that the National Insurance rise — dubbed the Health and Social Care levy— will be immediately ended, with similar plans for the dividend tax increase.

The rest requires a little more crystal ball gazing.

For individuals, the most important potential rumour is about changes to income tax thresholds, which are currently been frozen until 2026 despite the inflationary crisis. The new government could bring in the 1p cut in the basic 20p rate earlier, and even increase the higher 40% bracket level to £80,000pa from its current £50,270pa, a move the PM’s predecessor had committed to in 2019.

There’s also a possibility that the marriage tax allowance will be increased, increasing the £1,260 transfer allowance for basic rate taxpayers to the entire personal allowance of £12,570, saving some couples as much as £2,500 a year.

Inheritance tax, which generated £6.1 billion for government coffers in the 2021/22 tax year, could be abolished completely, to be replaced with a wealth tax. However, a task of this scale would most likely become an election pledge for January 2025.

The most significant consideration for business could be the plan to develop ‘investment zones,’ with lower personal taxes and regulations across some areas in the UK. This could see increased investment from certain sectors, though difficult to implement given the rise of remote working.

In addition, the PM is considering the ‘nuclear option;’ cutting VAT from 20% to 15% for all VAT-able items, benefitting businesses and individuals alike.

Other potentials include scrapping the sugar tax, as well as the banker bonus cap to attract more investment into London.

Of course, every tax cut represents an inflationary increase, and further pressure to increase interest rates, which in turn could cause a housing market crash, or even a second credit crunch for squeezed consumers and businesses. And Truss has indicated this could just be the start.

For fairness, OBR figures show the UK’s tax burden is currently at its heaviest since the post-war years.

Investing Strategies to consider

While many of these possible policy points are yet to be cemented, there are a few points to consider in advance of Friday:

First, Sterling has fallen to just $1.14 from a high of $1.42 in May 2021. UK companies, already cheap by international standards, are becoming significantly cheaper for dollar-rich investors. Apple, for example, is more valuable than the entire FTSE 100 combined. Private-equity buyouts could soon rise.

Second, government movements and the falling value of Sterling mean interest rates are almost certain to rise. Highly indebted companies, especially those who rely on cheap money for growth, could soon be in trouble. Likewise, high cash reserves are now a significant plus.

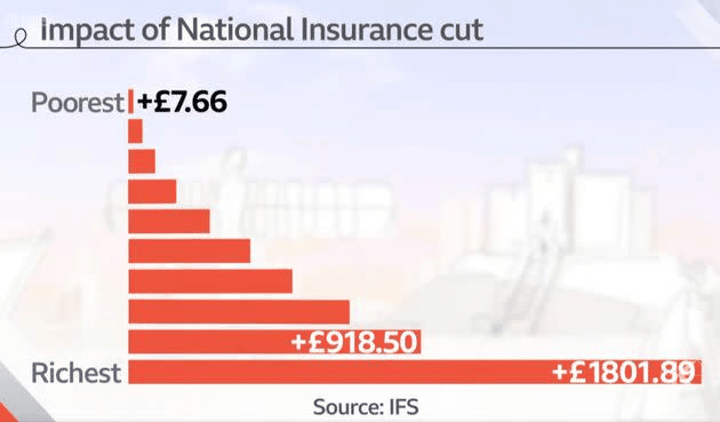

Third, the vast majority of the proposed tax cuts will benefit wealthier taxpayers at the expense of the poor. This isn’t a political point, simply a feature of a progressive tax system- higher earners are also penalised more when taxes rise. Luxury good stocks like Burberry, beaten down by the wider recessionary environment, could well become decent picks.

Fourth, some of these tax cuts are extremely specific. Scrapping banker bonus limits could benefit the big four, while binning the sugar tax could benefit companies like Unilever and Coca-Cola. Meanwhile, local investment zones could help smaller start-ups with the freedom to rapidly relocate. On announcement day, these companies could see a rapid share price boost, allowing only a small window of opportunity.

As always, it is wise to proceed with caution. These tax cuts are not costed and could backfire on a country already entering recession. Investing for the long term, and staying away from quickfire trading, could be key to reaping the rewards.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Leave a comment