The onset of a recession is not a random event, but rather the result of various macroeconomic factors coming into play.

As reported by the World Bank Group, the global economy has experienced four major recessions in the past seven decades, between 1975-2009. As an investor, it is crucial to have a thorough understanding of these factors to make informed decisions and protect your investments from potential downturns.

Inflation or Recession?

Inflation, a persistent rise in the prices of goods and services, is caused by a combination of economic factors. Two of the most influential factors that contribute to inflation are fiscal and monetary policies. However, it’s not just these policies that can lead to inflation; supply-side factors, such as a rise in the cost of raw materials, can also play a role.

Recession is a complex phenomenon that a variety of factors can cause. One of the main drivers of recession is a decline in aggregate demand or the total demand for goods and services in an economy. The Covid-19 pandemic has severely impacted the global economy, leading to widespread unemployment and a significant reduction in GDP. According to Forbes, during the height of the pandemic in 2020, unemployment reached 14.7%, and GDP decreased to 3.4%.

Signals Identifying Recession

Recession is crucial to investors as it presents opportunities to buy assets at lower prices. As the economy slows and companies struggle, their stock prices decrease, providing a buying opportunity for investors. However, recessions also come with increased risk, and it is crucial to do proper research and analysis before making investment decisions. Below are signals that indicate a recession is coming.

1. People Are Losing Their Jobs

Individuals play a crucial role in driving economic growth. The circular flow of income model illustrates how households generate income through their consumption, leading to job creation. However, when consumer spending decreases, it can indicate a lack of disposable income. This trend has been observed in the U.S., according to Pew Research.

The economic downturn of 2020, which lasted from February to April, resulted in widespread job loss across the United States. According to recent research, 25% of surveyed individuals reported being laid off or losing their jobs, with an additional 15% stating they knew someone who had been affected.

It’s a common practice for companies to trim expenses during a recession, as was seen during the 2007-2009 global recession, which resulted in over 22 million job losses. Take note of these signs, and be proactive in securing your financial future during difficult economic times.

Amanda Augustine suggests that during layoffs, companies follow the “last in, first out” approach, where the most recent hires are the first to be let go. This can lead to an uptick in unemployment rates, often a sign of an impending recession.

2. Stagflation Is the Order of the Day

Stagflation, a term used to describe the unfortunate convergence of inflation and recession, poses a significant challenge for businesses, investors, and job seekers. The Phillips Curve illustrates the inverse relationship between inflation and unemployment, highlighting that stagflation can only occur when both rates are uncharacteristically high. This unfortunate reality is a bitter pill for all those affected by it.

The 1970s recession in the United States brought about a challenging period of stagflation, as reported by GoCardless. Inflation soared to a staggering 6.22% in 1973 and continued to climb, reaching 11.04% in 1974. At the same time, unemployment rates also rose, with a peak of 9% in 1975. These high inflation and unemployment rates defied the predictions of the Phillips Curve theory.

3. Money in Circulation Is Decreasing

One sign of an impending recession is a decrease in the money supply. Inflation can also be a warning sign, as the government may respond by raising interest rates. This can cause economic contraction, leading to a decrease in demand for goods and services. As a result, businesses may be forced to reduce worker salaries or layoffs.

Shawn Plummer explains that there are two types of recessions: inflationary and deflationary. Deflationary recessions occur when there is a decrease in money circulation, leading to a drop in prices for goods and services. As a result, there is less demand for goods and services, causing a decline in the economy. This was the case during the Great Depression of the 1930s and Japan’s Lost Decade.

4. GDP is Shrinking

Gross Domestic Product (GDP) is a measure of the total economic activity of a country, calculated as the value of all goods and services produced within a given year. The GDP measurement is a crucial indicator of an economy’s growth or decline.

A decrease in GDP reflects a reduction in the production of goods and services, which can signify an economic recession. According to the International Monetary Fund (IMF), a recession is typically defined as two consecutive quarters of decline in GDP.

GDP is a key indicator of the overall health and stability of an economy. Typically, during a recession, the economy contracts by 2 percent, and in severe cases, the output may decrease by as much as 5 percent. When the economy contracts, people tend to produce, purchase, and sell less, which can severely impact an economy that is not showing improvement.

5. Interest Rates Are Rising

Interest rates are a powerful tool that governments use to manage the economy. When the economy is struggling, such as during a recession, policymakers often lower interest rates to encourage spending and boost employment. This can help to put more money in people’s pockets as borrowing becomes more affordable.

Low-interest rates make it easy for businesses to borrow money, which can lead to increased investments in their future and the hiring of new employees. However, if interest rates rise, the economy becomes too heated and needs to cool down. This can lead to decreased spending, and companies may need to lay off workers in preparation for a potential recession.

In 1976, then-Federal Reserve Chairman Paul Volcker implemented a bold strategy to combat inflation by raising interest rates to a staggering 13.7 percent. Unfortunately, this approach ultimately proved unsuccessful as inflation continued to soar, reaching a peak of 20 percent by 1982. This ultimately led to a recession in the United States. As a result, it’s important to keep in mind that rising interest rates can be a cautionary sign of a potential economic downturn.

6. Consumers Are Spending Less

A decline in consumer spending is often a sign of a slowing economy. When consumers feel uncertain about the future, their confidence in making purchases decreases, leading to a drop in consumption.

The onset of the COVID-19 pandemic in February 2020 resulted in widespread business closures and job layoffs. According to a study by the Pew Research Center, American consumers’ financial confidence dropped significantly as many had to rely on borrowing or assistance from loved ones to pay their bills. Only a small percentage of respondents reported feeling optimistic about their financial situation despite earning more.

A recession can occur when consumers cannot maintain their spending levels due to events such as layoffs or pay cuts. This creates a downward spiral that can further exacerbate economic hardship.

7. A Decline in the Stock Market

The stock market serves as a barometer of the economy’s health. As individuals feel financially secure, they tend to invest in stocks and other investments, increasing asset prices due to increased demand.

Conversely, when confidence wanes, investors tend to sell off their assets, causing prices to decrease and creating a sense of unease among those who own shares or have invested in mutual funds.

A downturn in the stock market often signals an impending recession, leading investors to lose faith in the economy and causing a panic selling of company shares. This decrease in demand drives stock prices down, prompting even more investors to sell off their stocks to avoid further losses.

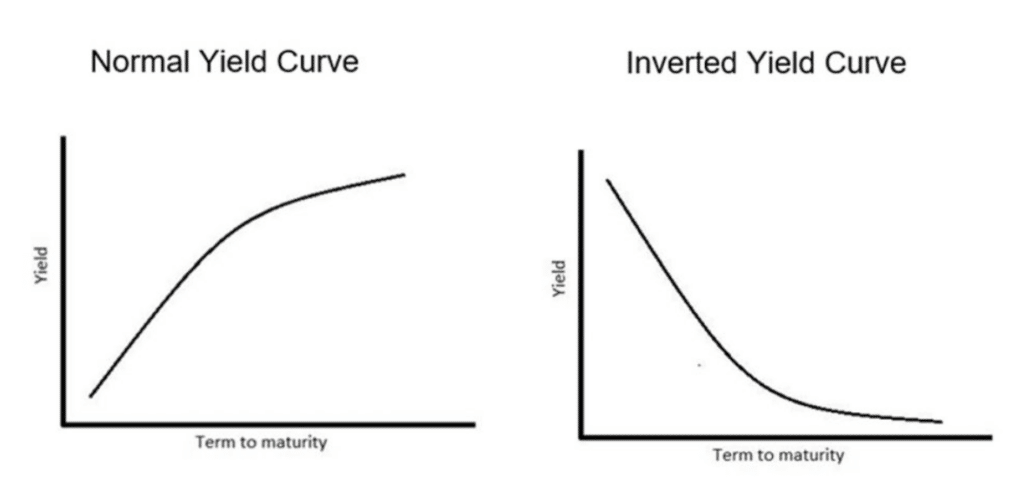

8. Inverted Yield Curve

An inverted yield curve is often considered one of the most reliable indicators of a looming recession. Historically, an inverted yield curve has influenced every recession in the US since 1950, with the average lead time being some months. For example, in 2000, the yield curve inverted, and the US officially entered a recession in 2001. Similarly, in 2006, the yield curve inverted, and the US officially entered a recession in 2007.

The inverted yield curve is often seen as a signal of investor concerns about the economy’s future. When short-term interest rates are higher than long-term rates, it suggests that investors are less optimistic about long-term growth prospects and are more willing to accept lower returns on long-term investments.

Expert opinions on the inverted yield curve vary. Some experts argue that this signal should not be overlooked. For example, in a 2019 article, economist Julius Probst wrote that “the ‘yield curve is one of the most accurate predictors of a future recession” and that investors should take it seriously. Others argue that the inverted yield curve alone is unreliable and should be considered alongside other economic indicators.

Are the Recession Signals Reliable?

While recession signals can provide valuable insights, it’s important to remember that the economy is a complex and ever-changing landscape. There’s no such thing as certainty when predicting economic downturns.

Furthermore, different signals may be interpreted differently, and some indicators may lose relevance or evolve over time. So, always take these signals with a grain of salt and use them as just one piece of the puzzle when evaluating the economy.

While these indicators may not be foolproof predictions of an economic downturn, they serve as valuable warning signs. By keeping a close eye on the number and severity of these signals and comparing them to past trends, savvy investors and business owners can gain insight into the potential direction of the economy and make more informed decisions about their investments. So, stay alert to these signals and use them to your advantage.