A year ago, growth stocks in general, and tech stocks in particular, were cold on the stock market. Rising interest rates and yield requirements were not optimal.

Now it’s a different story. So far this year, the technology-heavy Nasdaq in the US has risen by over 25 percent, which is double the broad index.

The news flow around artificial intelligence (AI) and the chatbot GPT-4 has led investors to bet on tech stocks like never before.

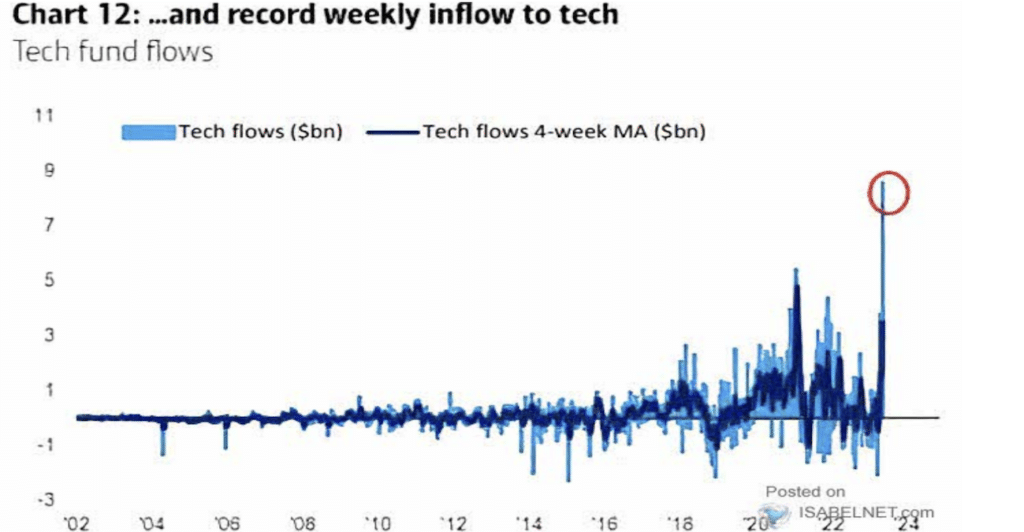

Largest capital inflow ever

Last week saw the highest inflow ever into tech funds, according to statistics from investment bank BofA. Globally, approximately 10 billion SEK flowed in.

That’s about 50 percent more than the previous record from 2021. It’s not surprising, therefore, that prices are rising in the sector.

P/S 40

Companies related to AI have performed the best. And valuations don’t seem to bother investors.

Nvidia, which is a leading provider of AI chips, now has a P/E ratio of about 60, and each revenue dollar is valued at nearly 40 (P/S).

It takes a long investment horizon for investors to justify that valuation.

Not as expensive anymore

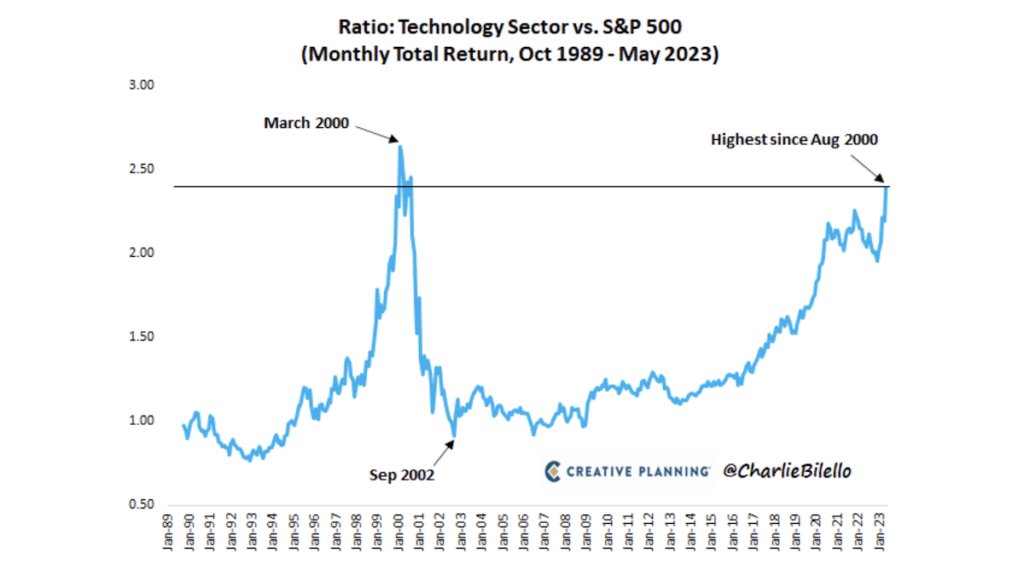

Looking at history, the current rise in stock prices resembles the situation over 20 years ago (see chart below), at least in terms of price performance.

However, valuations, with a few exceptions, are not as challenging then as they are now. Adjusted for cash, for example, tech giant Alphabet trades at under 20 times earnings for this year. That is not high for a growth company with near-monopoly on search functionality.

This article has been prepared for information purposes only. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.