The windfall tax was bad enough. Labour’s plan to stop all new investment is economic insanity on an unprecedented scale. My thoughts below.

In May 2022, as oil soared to multi-year highs on the back of Russia’s invasion of Ukraine, the then-Chancellor and current glorious leader Rishi Sunak introduced a new windfall tax on profits derived from income in the North Sea.

There’s some confusion on how this tax – dubbed the Energy Profits levy to great political laughter – works. It was introduced at a rate of 25%, and then increased to 35% in January 2023 by current Chancellor Jeremy Hunt, who simultaneously extended the deadline from March 2025 to March 2028. He also introduced a ‘temporary’ 45% levy on ‘extraordinary returns’ from low carbon electricity generators in the UK.

Overall, the government expects to generate £54 billion over six years, having completely forgotten the principle of the Laffer Curve.

The problem is that oil and gas firms like BP and Shell operating in the North Sea were already paying 30% corporation tax on profits, and a 10% supplementary rate on top — compared to 25% for all other companies with profits above £250,000.

Of course, these companies are able to offset capital expenditure like decommissioning North Sea oil platforms or factoring in losses against their corporation tax liabilities; such that both FTSE 100 oil majors received more back from the government than they paid between 2015 and 2020 (excluding Shell in 2017).

But the current situation is that the oil majors are facing a 75% tax on North Sea profits until 2028, primarily driven by public anger at energy bills rather than any objective policy analysis. And BP and Shell already ‘took one for the team,’ so to speak, after exiting their lucrative positions in Russian oil and gas.

Further, the UK accounts for less than 10% of BP’s global revenue. At Shell, it’s just 5%. And arguably, it’s unfair for the government which already taxes these companies more as standard, to impose a windfall tax on profits when the oil price rises, but refuse to support them when oil went negative when the pandemic struck.

Having already given up its Dutch identity, Shell is now also considering leaving London for the US, partially also because of new unreachable Dutch emissions targets.

But Harbour Energy has taken the most damage. The largest independent North Sea operator generates the vast majority of its revenue in the region. It’s fired hundreds of well-paid employees, halted multiple UK operations, and almost completely stopped exploratory work.

Former Shell CEO Ben van Beurden departed the FTSE 100 company at the end of last year, after seeing his 2022 pay rise by 50% to £10 million. Meanwhile, Harbour CEO Linda Cook notes that the 75% effective rate ‘all but wiped out our profit for the year…this has driven us to reduce our UK investment and staffing levels.’[5]

For balance, the FTSE 250 company has taken a $1.5 billion charge to cover expected future windfall tax payments, which it doesn’t have to pay quite yet. Free cashflow trebled to $2.1 billion and it spent $400 million on dividends and share buybacks. But shares have more than halved since the original tax was announced, and it’s now redirecting investment to Vietnam, Indonesia, and the Gulf of Mexico.

Harbour also got unlucky with its hedging — at just $78 per barrel, far below the $101 2022 average. It also didn’t benefit from the investment allowance designed to offset new production for consideration of its Tolmount gas project as it just missed the deadline.

But an expensive lesson learnt — stay away from investing in the UK.

Keir Starmer’s solution

The Labour leader — and likely next PM — has evaluated the situation carefully, and having apparently decided that given the country is swimming in cash like a gelded Scrooge McDuck, is stopping all new production altogether. An official statement will be made in Scotland next month.

No this isn’t April Fool’s or The Onion.

A Labour source has been quoted as saying:

‘We are against the granting of new licences for oil and gas in the North Sea. They will do nothing to cut bills as the Tories have acknowledged. They undermine our energy security and would drive a coach and horses through our climate targets. But Labour would continue to use existing oil and gas wells over the coming decades and manage them sustainably as we transform the UK into a clean energy superpower.’

Labour MP Jonathan Ashworth has intoned that while current production will be allowed to continue, thinks that ‘if you stop all new exploration, you are going to have to fill the gap from somewhere and it won’t all come from wind. We know that but the sums have been done.’ The Party thinks that investment in renewable energy will create 500,000 jobs from tidal, wind and nuclear.

I try to stay away from politics where possible, but it does seem that regardless of the financial links to Just Stop Oil, this strategy seems designed to find a way to lose the upcoming election, which previously seemed essentially unlosable.

If we’re being charitable, Boris Johnson won the last election with a thumping majority because many floating voters could not countenance Jeremy Corbyn’s policies. These same voters, who value pragmatism over ideology, will be turned off by this new messaging.

I would like to push back against the concept that taxing BP and Shell too much is a disaster for UK pensioners – the main funds own less than 0.2% of Shell and BP shares, with the average pension investing just £905 in Shell. After Lawson and Brown’s tinkering, fund managers have fled to the US for capital growth and bonds for safety — and regardless, UK taxes account for such a small proportion of revenue that it hardly matters to their financial performance.

But the idea that net zero by 2050, which is ambitious but achievable, can be achieved by simply switching off new production and crossing our fingers, is patently cretinous. The UK is already a world leader in wind power – in 2020, 43% of our electricity came from wind, solar, bioenergy, and hydroelectric sources.

But building the kind of renewable infrastructure required to replace new oil and gas production in the timeframe Labour are thinking of is ludicrous. What will inevitably happen when the country runs out of energy is that we will have to rely on less than savoury regimes for oil and gas (think Saudi Arabia and Russia), paying premium prices for a commodity which we have freely available within our own shores.

Now don’t get me wrong — I am fully in favour of the energy transition. Regardless of your climate opinions, hydrocarbons are running out. We should both leave some oil and gas for future generations, and plan for a future where they’re gone.

But stopping billions of pounds of investment and losing masses of tax revenue to virtue signal the UK’s green credentials is pointless. Coal accounts for more than half of China’s energy needs. Local governments in the country approved more new coal power in Q1 2023 than the entirety of 2021. Economic growth at any cost is its number one priority.

While it’s easy to criticise this approach, when China entered the WTO in 2001 the average annual wage was $1,127 according to the National Bureau of Statistics. In 2021, this had risen to $16,153. There are still tens of millions of Chinese people living in abject poverty — and they couldn’t give a stuff about climate change.

Meanwhile, the UK CPI inflation remains at 8.7%, and I suspect this will stay high for much longer than many analysts think. I also believe, and have argued for some time, that the Bank of England terminal rate will get to 8% in time. Getting inflation down below 3% is going to take some very bitter medicine.

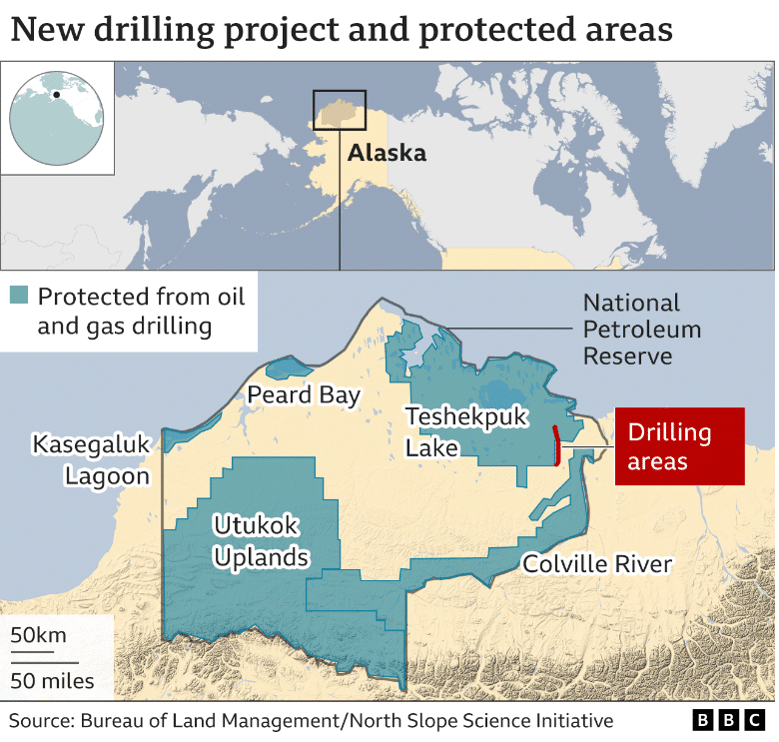

I also think it’s worth noting that in the US, President Biden has approved the Alaskan Willow Project to exploit 600 million barrels of oil, and approved masses of fracking. Norway recently signed off on 47 new oil and gas licences in Q1. Given both countries’ massive investment into green infrastructure, it’s hard to argue that either aren’t committed to energy transition. They just accept that outsourcing oil needs is expensive, more ecologically damaging, and politically naive.

Reform

The question is this: how do you reform North Sea oil and gas development to benefit the UK, the environment, and the companies taking the risk operating there?

My personal preference is this:

50% of all NEW North Sea oil and gas production should be auto hedged by the UK government. The government pays $50 per barrel for this half of production, regardless of whether oil goes to $150 or $0 per barrel. For context, BP CEO Bernard Looney called the company a ‘cash machine’ when oil was around $73/barrel, and the company breaks even at $40/barrel.

This hedged production enters the UK and helps to drive down inflation and provide cheap energy. The remaining 50% can be sold on the open market as usual.

The government repeals the windfall tax and returns the tax rate to 40%. It implements a tax credit scheme for green infrastructure investment that allows oil companies to reduce their tax rate accordingly, but also fills in the accounting holes that currently allow them to do this for ordinary business costs.

The key thing is that there needs to be certainty — a cross-party consensus saying that neither will change the terms for a period of ten years. At the moment, investing on the North Sea is becoming increasingly unattractive as politicians view it either as a sacrilegious cow to be alternately cared for, over-milked, or slaughtered.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.