As 2023 moves closer, get ready to take your investing strategy to the next level. From the growing popularity of robo advisors and digital currencies, to the surge in green investments and the emergence of NFTs, there’s no shortage of exciting trends to watch out for.

Concise Overview

- Inflation rates and the effects of COVID-19 and the Russian-Ukraine war negatively impacted the global economy in 2022.

- Robo advisors, digital currencies, green investments, and NFTs are expected to be popular investing trends in 2023

- Investors should consider researching and carefully evaluating the potential risks and benefits of investing in these trends

Introduction

Indeed, 2022 was tumultuous. Inflation rates took a toll on the global economy. Many nations struggled to recover from the shock of the post-COVID-19 effects and the Russian-Ukraine war. Reserves were depleted, startups went bankrupt, and investments suffered.

2023 is around the corner, and many investors have started working on their financial goals. Some are thinking about how they can make the most out of their investments, while others are wondering about the best options.

Although it can be tricky to predict what investing trends will emerge, making educated guesses based on current trends is possible. Some trends that may be worth watching by investors in 2023 include the following.

Robo Advisors Will Become More Popular

Robo advisors are software programs that use algorithms to help clients invest their money in a way tailored to the client’s individual needs or risk tolerance. These advisors are designed to provide low-cost investment management services with little or no human intervention.

The value of assets managed by Robo Advisors is expected to experience significant growth, reaching $2.55 trillion in 2023. In 2017, there were 13.1 million users with assets managed by these programs. This number has seen a five-fold increase in 2022, representing a 54% year-on-year growth.

In 2023, the use of Robo Advisors will rise significantly as more people feel confident managing their investments. This trend will result from the benefits of self-directed investing, such as making quick and informed decisions, access to a wider range of investment options, and potentially lower fees.

The Continued Rise of Digital Currencies

Digital currencies, especially cryptocurrencies, are gaining a lot of attention as a potentially lucrative investment opportunity. While some investors have made impressive profits by investing in them, others have unfortunately suffered significant losses.

Despite the inherent risks, the popularity of cryptocurrencies as an investment vehicle shows no signs of slowing down. In fact, experts predict that even more investments will be made in 2023, with cryptocurrencies becoming an increasingly common mode of payment.

Though there has been a drastic fall in the price of cryptocurrencies, digital currencies are still gaining traction. A year ago, bitcoin was worth around $50,000. Now, it’s been moving between US$18,000 and US$20,000 for the past few months. This may concern investors, but it’s nothing to worry about.

The rise in digital currency will mean that more individuals and companies will invest in them. It also means they will be accepted as a form of payment, thus increasing their demand and value.

The Growth of Green Investments

Green investments are crucial to sustainability. The world is experiencing problems like climate change, pollution, and deforestation that need to be addressed immediately. So, the trend is increasingly evolving towards environmentally friendly investments.

In 2021, green and social bonds — designed to funnel investments into environmentally responsible projects — reached a global record of over $700 billion in issuances, almost double the 2019 total of $358 billion. The rise in environment-friendly technologies and solutions like electric cars or solar panels also drives the trend towards green bonds.

This trend is expected to continue in 2023 as people become more aware of their impact on the environment. Surges in the demand for green assets will lead to a surge in their prices. This means investing in green stocks may be more profitable than investing in regular stocks.

NFTs Investment

NFT is an investment combining the benefits of traditional and digital assets. The increasing demand for NFTs is due to their ability to bridge the gap between traditional investment instruments and blockchain technology. NFTs have shown a positive sign in the last year that they are the next big thing in the world of digital assets.

For example, From June to July 2022, daily NFT sales varied between 21,800 and 61,353. The highest number of direct sales was reached on June 3rd—on that day, 34,019 NFTs were sold at auction. Furthermore, the statistics show that daily NFT sales volume varies between $26 million and $43 million. Finally, the average price an NFT is sold ranges between $475 and $1,687, depending on daily activity worldwide.

NFTs have the potential to generate increased liquidity in the digital art market, as they allow for more transparent and secure buying and selling of digital assets. This will make it easier for artists and collectors to monetize their digital assets and for buyers to find and purchase unique digital assets.

Diversification of Investment Portfolio

Diversification will continue to be one of the biggest trends in 2023. This is because it allows investors to spread their risk and reduce the impact of market downturns on their portfolios. It also helps them to get better returns by taking advantage of the growth in different markets.

For instance, you allocate 50% of your asset to stock, 30% to bonds, and 20% to real estate. If the stock market has a downturn, but real estate is doing well, you can sell some of your stocks and invest in property instead. This will help you reduce the impact of any market turmoil on your portfolio and increase returns by taking advantage of different markets.

The global economic environment is becoming increasingly uncertain, with several potential risks and uncertainties on the horizon. Diversification can mitigate the impact of financial shocks on a portfolio, as it can help to reduce the concentration of risk in any one asset or sector.

The Return of Bonds

It’s been a long time since the bond was an unattractive investment. In fact, 2022 marked one of the worst investment years for investors and bondholders. A report from ETF Stream emphasised on the increased inflation being the sole reason for the sharp decline in bond prices.

In fact, it was reported by ETF Stream that Bloomberg’s global bond indices, which track the value of bonds from around the world, were all down at least 10% this year. Some dropped to nearly 20%. But it’s not all doom and gloom for the asset class.

Bond returns are seen as a safe bet for investors in 2023. Bond prices are expected to rise next year as the Fed economy continues its recovery. One solid argument that makes bonds an attractive investment for next year is that the inflation rate will likely decrease over time.

It’s a fact that low inflation means positive for bond investors. This is because the value of fixed-income investments like bonds is typically marred by higher inflation. According to Euromonitor International, the inflation rate is projected to fall to 6.2% in 2023, down from 9% the previous year.

The Continued Rise of Insurtech

Insurance technology is a term often used in the financial services sector. It’s a broad category that includes many solutions and services, such as data analytics and artificial intelligence (AI). With the rise of insurtech comes many benefits, including increased customer satisfaction, reduced costs, and improved efficiency across all insurance operations.

As more and more people become aware of the risks of insurance, this is why the insurtech market is expected to grow significantly. According to an article published by the Reinsurance News, In the second quarter of 2022, investment in the insurtech space increased by 8.3% from opening-quarter levels to $2.41 billion. This shows that investment in the insurtech space is on the rise, which indicates that more and more companies are looking to solve problems in insurance.

In fact, it’s evident that more investors will be on the radar for insurtech startups driven by great ideas and the need to solve real-world problems in insurance.

More Investment in Healthcare

The healthcare sector is often seen as an attractive investment opportunity due to some factors, including the ageing population and the increasing prevalence of chronic diseases. As the population ages, there is generally an increased demand for healthcare products and services, which can create opportunities for companies in the sector. The rising prevalence of chronic diseases such as diabetes, heart disease, and cancer drives demand for healthcare products and services.

There are many different ways that investors can access the healthcare sector, including through individual stocks, mutual funds, and exchange-traded funds (ETFs) that focus on healthcare companies. This is expected to be a success in 2023, as more and more people will need improved healthcare. In addition, investments in healthcare devices like blood sugar monitors, sphygmomanometers, and heart monitors can be one way to access the healthcare sector.

These devices are used to diagnose and treat various medical conditions. The demand for these devices is often driven by factors such as the aging population and the increasing prevalence of chronic diseases.

Continued Rising Inflation

The Federal Reserve’s inflation has been rising in recent months and is expected to continue increasing. The expected annual rate is 2%, but it’s grown above 9% in 2022. This trend will continue into 2023. This is a big problem for investors because inflation increases the cost of living and reduces the value of assets.

It also means that people will have less money in real terms, making it harder to buy things like housing, food, and healthcare. The increase in inflation will also cause interest rates to rise. This means that the cost of borrowing money will go up, which is bad news, generally, for investors. Investors will have to look for assets that are less likely to lose their value, such as considering investing in gold and other precious metals.

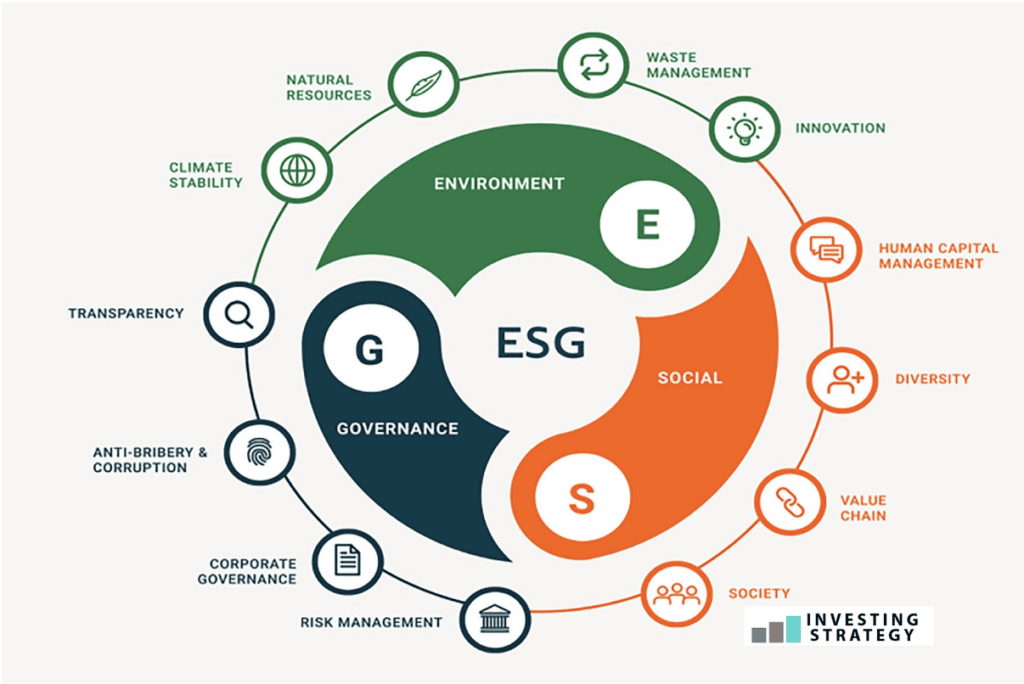

Sustainability Environmental, Social, and Governance (ESG) Investing

Sustainability and ESG investing are becoming increasingly popular as investors recognize the importance of considering their investments’ environmental, social, and governance impacts. This trend is driven by various factors, including growing concerns about climate change, increasing awareness of business practices’ social and environmental impacts, and the growing recognition that solid governance practices can be a critical factor in a company’s long-term success.

In addition to being motivated by ethical concerns, investors also recognize that companies prioritising sustainability and ESG factors may be better positioned to weather economic and regulatory changes, and have more robust long-term financial performance. As a result, investors are increasingly incorporating sustainability and ESG considerations into their investment decision-making process and are looking for investment opportunities that align with their values and goals.

Investors Will Stick to Passive Investing

Passive investing, or the use of passive funds that track the performance of a particular market index, has gained popularity in recent years due to a number of factors. One reason is the desire of investors to reduce the costs associated with their investments and make their portfolios more easily accessible. Another reason is the increasing use of passive strategies by financial advisors seeking to diversify their clients’ portfolios.

This trend is particularly evident among millennials, who have grown up with the internet and are accustomed to having instant access to information. They may not want to wait for an “expert” to try to time the market or pick individual stocks, and instead prefer the simplicity of buying into a broad range of stocks or bonds without any specific investment strategy or expertise.

In addition to the cost savings, passive investing also offers the convenience of saving time. As more people come to realise that active management does not always produce the desired results and that passive investing can be a viable alternative, we may see even greater adoption of passive strategies in the future.

The Importance of Investing Trends

Staying informed about investing trends allows investors to make informed decisions about where to allocate their resources, which can increase the chances of success. The importance of tracking investing trends includes:

- Make Better Decisions

Investing trends can help you make better decisions about your portfolio. By knowing what’s hot and what’s not, you can find investments that are likely to do well in the future. For example, if you’re considering investing in a company that makes heart monitors, knowing that there is an increasing demand for these devices could be important information when making your decision.

- Diversify Your Portfolio

Investing trends will help you diversify your portfolio by spreading your risks among different asset classes and sectors. For example, suppose you are worried about investing in a particular industry that might be volatile because of economic factors. In that case, you could invest in companies in other industries that will help balance your portfolio.

- Keep Your Competition at Bay

Learning about investing trends can also help you keep your competition at bay. For example, if you know a competitor has invested heavily in this sector and has yet to make money, it only makes sense to invest there if there is something special about the market.

- Find New Investment Opportunities

By tracking the investing trends and understanding them, you can find new investment opportunities for yourself. For example, if there is an increase in demand for green energy and you know that a company is making money from it, it might be worthwhile to invest in that company.

- Review Your Investment Goal

Investing trends help you to review your investment goal and to ensure that you are on the right path. If your goal is to make a lot of money in a short amount of time, then an investment trend makes you see the light in investments that focus on short-term gains rather than the one that focuses on long-term profits.

Investing in 2023: What Else?

Investing trends are good for investors who want to make money through investments. They help you to identify opportunities that are popular and in demand. This way, you can invest in a particular trend and make money from it. However, investing trends should be one of many sources of information when making financial decisions. You should review other aspects of the investment opportunity before making any decision.

This article has been prepared for information purposes only. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.