Polarean Imaging shares constitute another FTSE AIM favourite waiting for a buyout after FDA approval of its novel MRI tech.

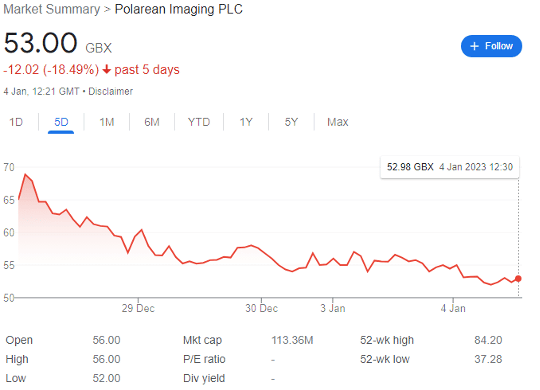

Polarean Imaging (LON: POLX) shares have been on my radar for some time, but the FTSE AIM company has now fallen by 18.5% to 53p over the past five days, providing what could be a reasonable entry point for long term position investors with the patience to wait for a potential buyout.

For context, while the company has fallen by 8% over the past year, and nearly 50% from its 104p record of October 2021, it remains up over 230% over the past five years. And it could have much further to go.

Polarean Imaging: science in brief

Polarean operates within the high-resolution medical imaging research space, developing equipment that improves existing MRI systems by allowing them to show more detailed pulmonary (lung) function by using hyperpolarised Xenon gas, an imaging agent used to visualise ventilation.

For context, there is significant unmet medical need in this field, with the annual economic burden of pulmonary disease estimated at over $150 billion in the US alone. More than 30 million Americans suffer from chronic lung disease already, and this number is only expected to grow with sedentary lifestyles.

Of course, diagnostic lung imaging has evolved hugely over the years. Rectilinear scanning came along in the 1960s, CT scans in the 1970s, and human MRI scans in 1977. However, even the most advanced current techniques cannot fully visualise the alveoli structures that make up the lungs, and like most medical procedures they also come with undesirable side-effects.

Polarean’s patented Xenon MRI (Magnetic Resonance Imaging) technology is fairly simple to break down into a handful of sentences, but investors may want to read up more on the investor site for a detailed explanation.

The company uses a polarisation device to transform Xenon into a hyperpolarised state using circularly polarised laser light. This leaves the gas’s atoms chemically unchanged but ensures that their nuclei are magnetically aligned. It’s then inhaled by a patient with suspected lung disease, replacing some of the air normally resident in their lungs.

The hyperpolarised gas essentially enhances MRI signals, making full lung function and any signs of breathing distress fully visible on an MRI scan. In addition to significantly speeding up the traditional MRI scan, it’s hugely helpful for clinicians to both make diagnoses and prescribe more accurate treatments.

In addition, POLX’s hyperpolarised Xenon MRI tech is far safer and less invasive than alternatives such as CT scans which involve the use of ionising radiation. This means its scans can be conducted multiple times on one individual to track a disease’s progression without needing to account for the negative side-effects.

In the future, uses will also likely be expanded to COPD, asthma, cancer, and cardiovascular imaging.

Recent developments

The most recent financial figures for Polarean come from its unaudited half-year results to 30 June 2022. At the time, it held a net cash position of $22.7 million, which POLX told investors would be sufficient to ‘finance the company into 2024.’ However, it expects to generate a net loss of $14.3 million in 2023, and it is not possible to rule out a share placement in the near future as cash burn accelerates.

On the other hand, the FTSE AIM share was selected as a featured company surrounding novel developments in interstitial lung disease at the 2022 ATS Respiratory Innovation Summit. Further, it boasts several big hitters as investors, including Amati Global, Chelverton Asset Management, and Canaccord. And CEO Richard Hullihen has more than 30 years of experience of success in the sector.

But what makes Polarean worth a long-term position is the release of news a week ago that the FDA had approved its Hyperpolarised Xenon for use in MRI scans — codenamed XENOVIEW — for the evaluation of lung ventilation for persons over twelve years old in the US.

The ‘significant market opportunity’ represents the first and only inhaled MRI hyperpolarised contrast agent in the US for novel visualisation of lung ventilation, without exposing patients to any ionizing radiation and its associated risks. And best of all, the dose is simply administered in a single 10-15 second breath hold MRI procedure.

Hullihen enthuses that the ‘FDA approval represents achievement of a major milestone for Polarean’s technology… a major step forward in modern respiratory imaging and we are proud to have pioneered this exciting new technology for clinical use.’

Polarean could now go one of two ways. Facing facts, the company does not have the capital to deliver its tech to the global market, and demand could rapidly grow as efficacy is proven in US clinical settings.

Of course, it could choose to licence out XENOVIEW. But a private equity buyout would be more likely; Peel Hunt recently warned the city that the European PE industry is sitting on a €270 billion war chest destined for acquisitions.

But I think a large pharma acquisition is just as probable, with many of the biggest blue-chips essentially squatting on piles of cash generated from the covid-19 pandemic era. This does still leave two risks: a possible placing, and the opportunity cost of leaving cash tied up in a company that may take some time to either develop its strategy or put itself up for sale.

However, at the current valuation, it’s a solid long-term 2023 portfolio buy for me.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Leave a comment