In The Style cannot continue as a going concern for long. Is a buyer waiting in the wings, or could ITS soon be facing down administration?

In The Style (LON: ITS) shares are a long-term investor’s worst nightmare. ITS launched its FTSE AIM IPO in March 2021, raising £49 million in an oversubscribed placing valuing the online retailer at £105 million.

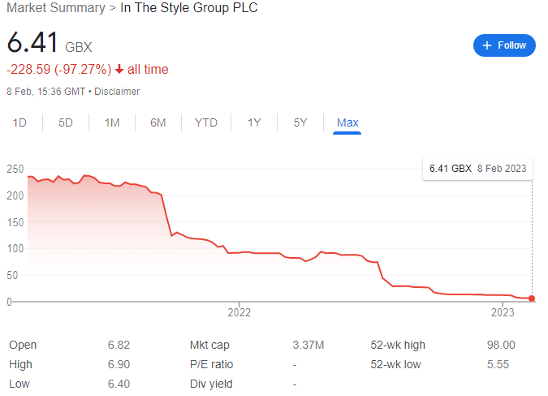

Fast-forward to February 2023, and ITS shares have dropped by 97% yielding a market cap of just £3.37 million. As a downtrodden penny stock, this does attract my interest as a recovery play, and many traders are buying shares hopeful that NEXT, or some other suitor will save the day with a buyout of the brand at a reasonable premium.

For perspective, consolidation of brand names in the fashion industry is not an uncommon strategy.

Boohoo picked up the Debenhams brand not so long ago, while Arcadia’s collapse saw brands such as Topshop, Burtons, and Dorothy Perkins carved up by the vultures. Meanwhile, Fraser Group seems to be snapping up another brand every couple of months. However, these brand names were only snapped up after the parent fell into administration.

This leaves two questions for would-be investors: is ITS worth more than its current market cap, and is it attractive to larger companies looking to consolidate their position? The company models itself as a ‘disruptive digital womenswear fashion brand with an innovative influencer collaboration model.’

I’m not certain this is unique enough to be worth saving.

ITS shares: a look at the numbers

Fortunately, there are some recent financial figures for investors to consider, with a winter quarterly trading update released on 20 January. The company noted that while November saw an ‘encouraging performance,’ December was ‘challenging,’ blaming macro factors including high levels of reductions, the cost-of-living crisis, and delivery disruption.

Accordingly, revenue declined by 22% year-over-year, while ‘gross margin was lower than expectations.’ Interestingly, the company held £3.2 million of stock at the end of December, an almost identical number to its market cap. But the company also has £3.2 million of cash, with an additional £0.4 million of liquidity undrawn from an invoice discounting facility.

ITS expects full-year revenue ‘in the region of £46 million,’ but anticipates an adjusted EDITBA loss of between £4.25 million and £4.75 million for the year. Understandably, it currently has a core focus on ‘cash management and liquidity.’

At the time, the company noted that a strategic review ‘may or may not result in a sale of the Company or some or all of the Group’s business or assets’ and advised that ‘a further update will be made in due course.’ For context, Interim CEO Adam Frisby remains ‘absolutely confident in the fundamental strengths of the In The Style brand as well as our differentiated model.’

Buyout potential

Even as a high-risk investor, ITS does not fit my risk profile as a long-term play. The company is losing money, and it does not currently have, nor will it be likely to have in the future, access to financing suitable to perform a turnaround on its own.

Instead, ITS shares are good for a good old-fashioned short-term trade. At the end of December, the company owned a combined £6.4 million of assets in stock and cash; and it is predicting it will lose circa £4.5 million over 12 months or 375,000 per month. Therefore, it’s safe to assume that the FTSE AIM company has roughly £6 million in combined assets and cash at present.

Then there’s the brand name — worth £46 million per year in a recessionary environment where retail is suffering amid a significant cost-of-living crisis.

Given this £46 million figure, it’s very possible that a brand like NEXT could well choose to buy the company now, at a reasonable premium to the share price, with the idea that it would be better placed to convert that revenue into profit using its own economies of scale.

Moreover, the brand is sold in multiple outlets, both online and in-store, including not only NEXT, but also Very and ASOS. And ITS would be easily affordable for any of these companies — but the question remains: would any want to rescue the company, or would it be easier to simply bid for the brand name when it falls into administration?

If the UK was in a boom phase, I’d consider it likely that these potential buyers would simply wait for ITS to collapse. But with every customer pound key for thriving through the recession, my cautious view is that a sale will be agreed in the near future.

But I wouldn’t throw the kitchen sink at it.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.