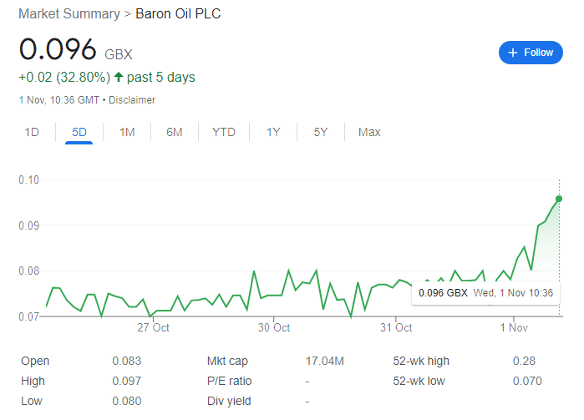

Baron Oil shares are rising sharply after months in the doldrums. Several catalysts are approaching concomitantly.

I’ve been covering Baron Oil for over a year and been invested for longer than that. The recent rise back to 0.10p reflects the excitement that another catalyst could be coming down the tracks — but this time, the rise might stick.

Let’s dive in.

Chuditch: the company-maker

I’m not going to go into technical details about Chuditch — this be found in the updated October 2023 corporate presentation, and also is several past pieces. Instead, this article is about setting out why November is a critical month for the company.

Before we start, my 10 year-old son told me this morning that Chuditch is another name for Australia’s largest endemic carnivore — the Western Quoll. Apparently like much of Australia’s wildlife, the animal is threatened by feral cats and foxes, and is protected in some areas by the Australian Wildlife Conservancy.

I think if Chuditch sells soon, it would be wholesome if investors would consider a donation sourced from the profits — so am leaving the link here for future reference.

September’s interim results highlighted that the company’s strategic priority remains preparing for the drilling and testing of an appraisal well at Chuditch. Of course, this strategy is strengthened by its six-month PSC extension from June 2023. The business now has a preferred appraisal drilling location, and significantly, this is 4.8km from the discovery well, demonstrating the potential size of the field.

The political dilemma

As long-term investors will know, the investment case for Chuditch hinges on whether the adjacent field, Greater Sunrise, gets developed. Of course, East Timor’s last operational field dried up this year, so it needs to get Greater Sunrise producing as soon as possible. And if Greater Sunrise gets developed, then all the infrastructure built to make this happen can also be used to develop Chuditch.

Greater Sunrise is the only major resource project it has left and without oil and gas revenue the country is coming close to bankruptcy. The state’s petroleum fund provides 85% of the government’s budget and will run out by 2030 as things stand.

However, there are two long-running problems: the first is technical difficulty in getting a pipeline from the fields either to East Timor or to Australia — but technological advancement and also reassessment of costs against the elevated price of oil and importance of supply in a geopolitically charged world, is changing.

And the decision on whether to pipe gas from the adjacent Greater Sunrise field to East Timor or to Australia is being made in November. To put pressure on Australia to agree that the gas will go to East Timor, East Timor just upgraded its bilateral relations with China in a formal joint statement covering military co-operation, and specifically the development of oil and gas.

Of course, it wants to get the gas and infrastructure built in East Timor, so is playing China and Australia off each other to make sure the infrastructure spending is made in the country. But the moment the Greater Sunrise decision is made in November, the clock will start ticking for the Chuditch sale — and my guess is that the decision has already been made.

Recent updates

On 28 September, BOIL tweeted out ‘Baron congratulates the new presidents of ANP and TIMOR GAP and looks forward to continued effective collaboration as we advance Chuditch gas together.’

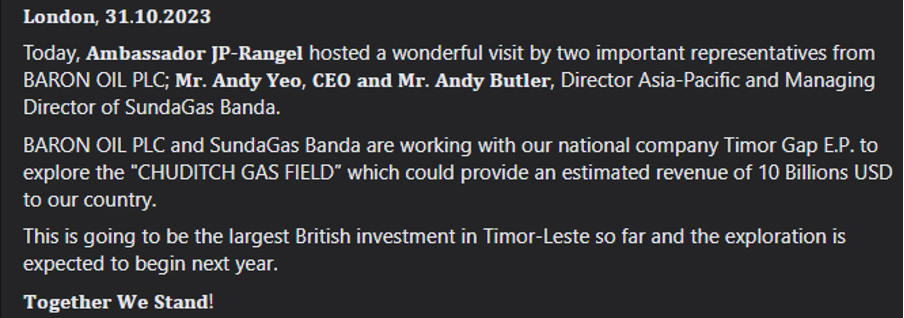

And then yesterday, it tweeted ‘a good meeting this morning with the Timor-Leste Ambassador to UK, and Baron Oil’s Andy Yeo and Andy Butler, to discuss the Chuditch Gas Field.’ This was accompanied with a couple of photos that looked like they had been taken with a potato — though fortunately, much sharper photos can be seen on East Timor’s London Embassy Facebook page.

Both Andy Yeo and Andy Butler were hosted by East Timor ambassador to the UK, João Paulo da Costa Rangel.

As an aside, Yeo is also non-executive Chairman at Oneiro, which is currently on the hunt for quality assets. I interviewed Rod Murray shortly after the IPO — and shares have doubled since the company launched.

The text of the post is below:

There are two things to take away from this:

East Timor thinks the field could deliver $10 billion of revenue to the ‘country.’ That’s significant on a number of levels — that’s $10 billion to the State, rather than in total, and perhaps only a fraction of the field’s value. And the phrasing suggests that the decision to send the oil and gas to East Timor has already been made.

The second factor is that this will be the ‘largest British investment’ in the country so far — while there is an element of an ambassador tooting his own trumpet, it’s also safe to say that the country is welcoming the outlay.

Now we can do a little photo analysis — Butler is wearing a scarf carrying East Timor’s colours:

- Black represents the centuries of colonial oppression.

- The yellow arrowhead represents ‘traces of colonialism in East Timor’s history’ and the struggle for independence.

- Red stands for the spilled blood of the population.

- And the white star symbolises hope for a better future.

You’ll notice that the white star looks visible close to Butler’s hand — but that the ambassador is wearing a red tie — which is unlikely to be a coincidence. You then have the national emblem of East Timor (Belak) above Butler’s head, signifying the country’s independence — as a variation was first used when the country declared independence in 1975.

Of course, I may be looking too deeply into this — but as a general rule, photo ops at embassies are very carefully choreographed. And the message the ambassador is sending is that the investment is welcome, but on East Timor’s terms.

Couple this with the wording, and I think the decision to process Greater Sunrise and Chuditch oil and gas in East Timor has already been made. When this is announced — hopefully later this month — then BOIL shares could rise rapidly as clearing this hurdle makes it far more likely that Woodside will develop Greater Sunrise — and then Chuditch’s value increases sharply.

Then it’s what happens next.

In interim results in late September, Non-Executive Chairman John Wakefield noted that ‘all of our efforts are currently focused on the Chuditch PSC drilling decision to be made late in 2023 for a Chuditch-1 appraisal well. We are making good progress and are in advanced discussions with a number of potential funding partners. We look forward to updating shareholders as soon as we are able.’

These ‘ongoing discussions’ — according to BOIL — ‘provide additional affirmation that the technical case is robust and there is alignment on the requirement for drilling an appraisal well on Chuditch, followed by additional exploration activities to delineate the total on block gas resources for this LNG scale project.’

On 11 October, the company announced some technical detail — it expects that ‘a Chuditch-2 appraisal well would be drilled in late 2024, using a jack-up drilling rig, and is expected to take around 21 days to drill, with a further 15 days assumed for logging and a drill stem test. The water depth at the proposed Chuditch-2 location is 60 metres and the well would be drilled to 3,020 metres below mean sea level.’

Of course, this remains ‘subject to drill financing.’ But under the assumption that Woodside makes a positive investment decision, drill partners will be lining up — and East Timor may even finance it themselves.

As ever, the asset remains on sale, so it could also be bought out at any time. I remain confident that the asset will be sold at a huge premium — and so it’s just a case of waiting it out.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Great article! Thanks mate

I was looking into Baron a few years ago but it has recently come across my eyes again. Could you expand on the ‘asset remains for sale’ section you wrote about?

Simple – Chuditch remains ‘for sale’ at any time. directors have been quite clear about this, and a deal could be struck soon after political decisions have been made.