A placing seems in the immediate offing, but there could be a solid opportunity thereafter. Aptamer is not worth less than £20 million.

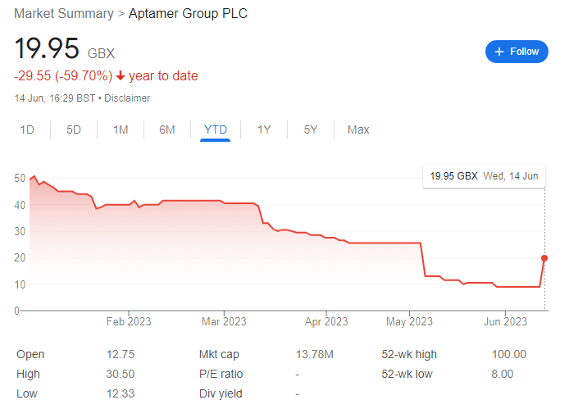

Aptamer shares are down by almost 60% year-to-date, with one trading update on 5 May halving the share price alone. The share was trading for 9p at the start of the week but has since shot up after releasing the first positive RNS in some time.

For context, I covered the Aptamer IPO together with its risks in December 2021 — this stock was always a high risk trade.

This positivity may not last.

Aptamer shares: trading update

Let’s take a closer look at that trading update, which covers most of the financial year to 30 June 2023. In unaudited terms, revenue for the 10 months to 30 April 2023 was circa £1.4 million, lower than expected as ‘the existing pipeline of new business has taken longer than expected to convert, especially licensing and royalty-based contracts, against a backdrop of continuing market headwinds.’

Worse still, the company noted that it ‘expects full year revenues to be materially below FY2022.’ While the sales pipeline remains ‘healthy,’ the problem is that the ‘majority, if converted, will fall into the next financial year.’

For context, FY22 revenue covering the 12 months to 30 June 2022 saw revenue increase by 152% to £4 million, and left the company with a cash balance of £6.7 million. It had raised £10.8 million on its AIM listing but posted an adjusted EBITDA loss of £1.7 million.

Revenue has therefore halved, while the cash balance as of 30 April 2023 was £700,000. While it notes that ‘the Group is making cost savings in order to extend the cash runway,’ Aptamer has advised that it will need to raise capital. It’s exploring both dilutive and non-dilutive options, but in a high interest rate environment when biotechs are collapsing like a house of cards, the former seems more likely.

It’s worth noting that Aptamer moved into new premises three times its former size elsewhere at York Science Park last year.

Then on 10 May, founder and CEO Arron Tolley announced he was leaving after 15 years, but only after some garden leave. It’s the equivalent of Alastair Smith leaving Avacta. Chair Ian Gilham — who you may know from Genedrive and is also well known for his Chairmanship of Horizon Discovery until it was sold to Perkin Elmer for £296 million — is currently Executive Chair.

Tolley’s exit was poorly received, but the company is in capable interim hands. And in human terms, it’s worth noting that there may be good personal reasons for his exit. Outside investors simply don’t know.

Today’s update

At 7am on 14 June 2023, Aptamer told investors that it would be partnering with Neuro-Bio to develop an Alzheimer’s disease diagnostic test, simultaneously announcing success in the development of Optimer binders to enable a lateral flow test for the early diagnosis of Alzheimer’s disease.

Aptamer has developed a panel of Optimer binders to a novel Alzheimer’s disease biomarker which have been patented by Neuro-Bio. There is a strong possibility for a rapid lateral flow test of Alzheimer’s via nasal sampling, and even ‘the potential to diagnose the disease as early as 10-20 years before symptoms emerge.’

The biomarker itself was discovered by Neuro-Bio’s founder and CEO Baroness Susan Greenfield, and while early intervention could help stave off the worst of the disease, the company is also working to develop a complementary therapy that could stabilise disease progression in diagnosed patients, ideally at the pre-symptomatic stage.

Interim Aptamer CEO Rob Quinn notes that with ‘no current tests available for early-stage diagnosis, the advancement of new biomarkers and diagnostics in this field offers hope to the millions of patients and their loved ones worldwide.’ Meanwhile, Greenfield considers the tech a ‘potentially game-changing technology to combat one of the biggest unmet medical needs of our time.’

So far, so good.

However, four hours and 16 minutes later, the company released an RNS stating that the resultant share price movement — which saw Aptamer stock shoot up to as much as 30p — other than the new announcement, was not because of ‘any material commercial or operational reason.’

It again reminded investors that it is actively seeking funding options, and that it is running out of cash.

The bottom line

The interesting thing is that Aptamer — the company and the tech — are arguably very oversold. Aptamer is providing its solution to 15 of the top 20 pharma companies in the world. Investors are worried because the company has made it plain that a placing is likely — indeed this is probably the reason why it updated the market at midday.

But another way of looking at the company is that even after the rise, it’s still’ valued at less than £20 million — a fraction of its IPO value, even though it’s likely worth more intrinsically. Not because of the revenue, but the potential of its technology and the millions already invested.

An Alzheimer’s test which could provide early diagnosis decades in advance? That’s worth a lot more that £20 million. And the company has simply been hit by a tightening monetary policy which few ever expected.

As a long-term investor, I’m staying away until the placing is over with, or until short-term funding gets sorted out. But thereafter, it becomes an opportunity on the dip. Of course, there’s also the small outside chance of institutional investment from Neuro-Bio. Greenfield was the scientist who formally opened Aptamer’s new site in November 2022, and the new deal makes this a possibility.

But investing on pure speculation rarely ends well.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.