Shell, Harbour Energy, and Tullow Oil could be three of the best UK oil stocks to watch in 2023, as rising commodity prices meet with the rising tide of global recession.

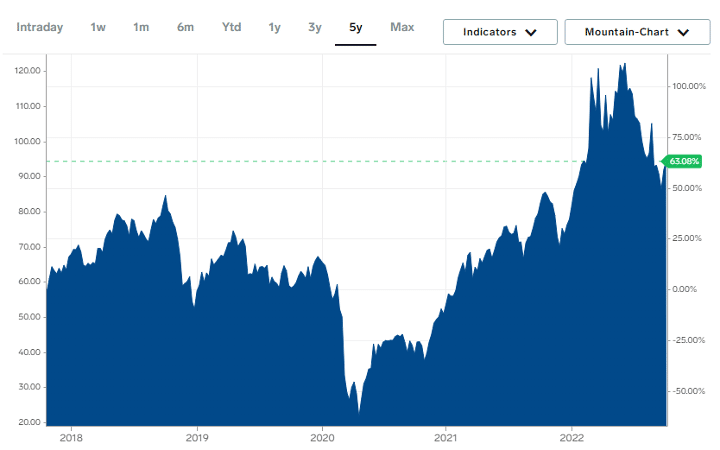

Oil has been the investing winner of 2022, and it’s not hard to see why. After a disastrous pandemic, where benchmark Brent Crude went negative for the first time ever, and a two year-long oversupply amid weakened demand, prices have shifted rapidly.

Surging global demand caused by the reopening world economy was already sending oil rocketing in January. Compounded by Russia’s invasion of Ukraine, Brent soared to over $140 per barrel earlier this year, before dropping back to $92 today.

However, this is still far above the $70 average of 2021.

With worries of a global recession on the horizon, demand destruction fears recently saw the OPEC+ cartel decide to cut production by 2 million barrels per day. But with prices likely to remain elevated for some months to come, some of the best UK oil stocks could soon become excellent opportunities, even if energy prices start to dip.

Of course, some may soon be hit by the shifting political sands. New Chancellor Jeremy Hunt has insisted he is ‘not against the principle of taxing profits that are genuine windfalls,’ despite warning that the ‘very cyclical’ industry has periods of ‘feast and famine.’

The current windfall tax, which imposes an additional 10% levy on top of the 40% tax rate on UK-derived oil and gas profits, had a clause baked in offering a 91% rebate on further North Sea investment.

Future windfall taxes may not be so generous. And Shell CEO Ben van Beurden appears certain more windfall taxes are inevitable.

However, temporarily increased taxes alongside falling energy prices could create decent entry opportunities for the best UK oil stocks.

3 best UK oil shares

Shell (LON: SHEL)

Shell shares are up 35% year-to-date to 2,293p, as the FTSE 100 oil major benefits from rising wholesale prices of oil and gas. With long-time CEO van Beurden set to step down at the end of 2022, the company is set to enter a transition phase in 2023. It’s warned that despite posting record-breaking profits this year, Q3 is under pressure as refining margins have dropped and it deals with ‘significantly’ weaker earnings from natural gas trading as prices fall from record highs.

Indicative refining margins have dropped to $15 a barrel compared to $28 a barrel in Q2, while indicative margins for chemicals have dropped to negative $27 per tonne versus a positive $86 earlier this year amid a slump in demand for plastics.

This fall in refining margins could negatively impact adjusted earnings before EBITDA to the tune of between $1 billion and $1.4 billion in Q3.

However, the potential resulting share price dip could represent an excellent buying opportunity as energy prices continue to stay elevated compared to historical levels.

Harbour Energy (LON: HBR)

Harbour Energy shares are up 9% year-to-date to 400p. The largest independent oil and gas operator in the North Sea has no international operations, and is therefore hit much harder by both the current windfall tax and those likely to be imposed in the near future.

The FTSE 250 company rose to a year high of 530p as recently as April, before the UK’s windfall tax announcement took the wind out of its sails. CEO Linda Cook has pointed out that the current levy remains ‘seriously flawed’ as it disproportionately impacts the company compared to its competitors, while also acting as a deterrent for domestic UK investment.

However, Harbour is likely to benefit from sped-up licence approvals for North Sea exploration, already having $1.2 billion in capex booked over the next 12 months. And in half-year results, the company saw revenue rise by 78% to $2.67 billion, while pre-tax profits increased to $1.49 billion, up from $120 million in the year-ago half.

Further, it’s cut its net debt position by more than half to under $1 billion, and plans to be debt free in the new year.

Tullow Oil (LON: TLW)

Tullow Oil shares represent a contrarian oil stock pick for investors with a healthy risk appetite. Down 20% year-to-date to 38p, the independent operator with assets in Africa and South America has been forced to abandon a merger with Capricorn Energy, as major investors of the latter failed to back the deal.

But CEO Rahul Dir argues that ‘the turnaround of Tullow has gained momentum in the first half of 2022, with solid production from our West African portfolio driving stronger financial performance.’

However, he had argued that ‘the proposed merger has the potential for material value creation by implementing a combined business plan which accelerates investment in key projects and delivers very significant synergies.’

In half-year results, Tullow saw revenue of $846 million with a realised oil price of $87 per barrel after hedging, with profit after tax of $264 million and underlying operating cash flow of $165 million.

Encouragingly in this tightening monetary environment, net debt has fallen to $2.3 billion, while gearing has been reduced to only 1.9x net debt.

If Tullow has overcorrected as a result of the failed merger, a share price rise could be in order next year.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Leave a comment