AstraZeneca, National Grid, and British American Tobacco are three FTSE 100 stocks boasting attractive defensive qualities for risk-averse investors.

As the UK economy lurches from crisis to crisis, many investors are taking a step back to recalibrate their portfolios, as they brace for the emerging recession to take a turn for the worse.

Soaring energy bills, sour European relations, the Ukraine War, and pandemic-induced economic fallout have all contributed to the current recessionary environment. The government’s reaction, including the Energy Price Guarantee and mini-budget, have only served to generate more havoc in the markets.

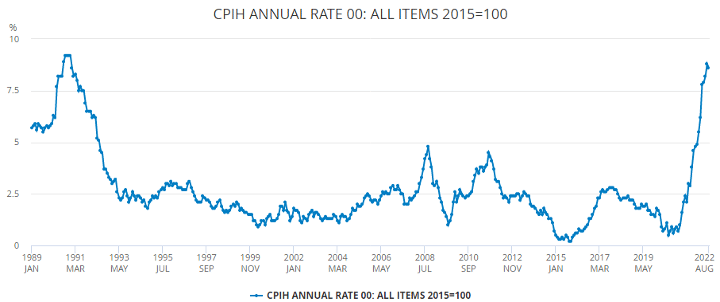

But one thing is clear. Despite rising interest rates, CPI inflation remains at 9.9%. This means any sterling left uninvested will steadily lose value.

This makes UK defensive shares exceptionally attractive for many.

Of course, beware overvaluations, as the eventual recovery will see institutional investment rapidly exit for growth. But this appears to be some time away.

Best UK defensive stocks

AstraZeneca (LON: AZN)

AstraZeneca shares are up by 105% over the past five years to 10,146p, demonstrating the resilience of healthcare stocks over time.

While unfortunate, healthcare tends to cope better in recessions as sickness continues regardless of the economy. And as the investment barrier to pharmacology is so high, the small handful of globally significant pharmaceutical companies can command a price premium for their products, a handy advantage in times of rising inflation.

AstraZeneca recently hit mainstream UK consciousness for its successful covid-19 vaccine, the first of its kind. This success has created further opportunity for growth, with revenues up 48% year-over-year to £22.1 billion in H1.

The FTSE 100 company is expanding rapidly, with continued spending on disease, oncology, and its $39 billion acquisition of rare diseases expert Alexion. Newly developed drug Enhertu could be particularly important, with some analysts hailing it a ‘multi-blockbuster’ that could help treat multiple types of cancer, delivering up to $6.6 billion of additional revenue.

Accordingly, full-year earnings are now expected to be in the low twenties, while EPS is predicted to remain in the mid to high twenties.

National Grid (LON: NG)

National Grid shares have always been an incredibly popular UK stock among defensive investors. At 990p, the company is up 8% over the past year, despite the wider market rout. And happily, it boasts a market-beating 5% dividend, which has not been cut since the 1990s. This could help investors shore up any portfolio weakness.

Like AstraZeneca, it is surrounded by what legendary investor Warren Buffett calls a ‘wide economic moat.’ It owns almost all of the UK’s gas and electricity network, as well as a large chunk of the market in the Eastern United States.

And like AstraZeneca, it’s been on a restructuring and acquisition spree, having bought out Western Power Distribution for £7.9 billion in 2021. Further, it now appears unlikely that National Grid will be hit with any windfall tax after it was ruled out by the new government.

And it’s investing tens of billions into the network, with £24 billion being spent on decarbonising alone, an investment that CEO John Pettigrew claims is the largest of its kind in the FTSE 100.

In full-year results, underlying operating profit increased by 11% on a pro forma basis to £4 billion, while EPS rose by 10% to 65.2p.

Of course, risks of power cuts and energy rationing remain.

British American Tobacco (LON: BATS)

Up 28% over the past year to 3,415p, British American Tobacco is an enticing defensive stock for investors lacking the ethical intolerance for tobacco investing. Like healthcare and energy, nicotine-addicted consumers view tobacco as a necessity rather than a luxury and will cut back elsewhere as a consequence, even if prices rise.

With its annual dividend in excess of 6%, management now expects cash flow conversion to hit 90% for full-year 2022. And it’s also returning £2 billion to shareholders throughout the year.

In half-year results, BATS saw revenue increase by a solid 5.7% year-over-year to £12.8 billion, predominantly due to increased sales of vaping and non-combustible products. For context, while traditional tobacco products like cigarettes only grew by 2.3%, ‘new categories’ saw sales rise by 45% to £1.3 billion in the half.

Of course, there are some risks. Legislation on vaping, and further restrictions on traditional tobacco products, are rising inexorably in key markets, especially the US.

But the near-term support seems high given the general lack of reliable cash generators in a time of high inflation.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.