Enphase Energy, First Solar, and SolarEdge Technologies could be three of the best solar energy stocks to watch as the UK and US seek further energy independence.

2022 is the year to think about investing in some of the best solar stocks. Demand for renewable energy is skyrocketing. The surge of post-pandemic demand combined with two-way sanctions imposed on Russian oil and gas have seen the commodities soar to multi-year highs.

Brent Crude hit a high of $140/barrel earlier this year, while natural gas prices soared as much as 11 times higher than pre-pandemic levels, despite falling back in recent weeks.

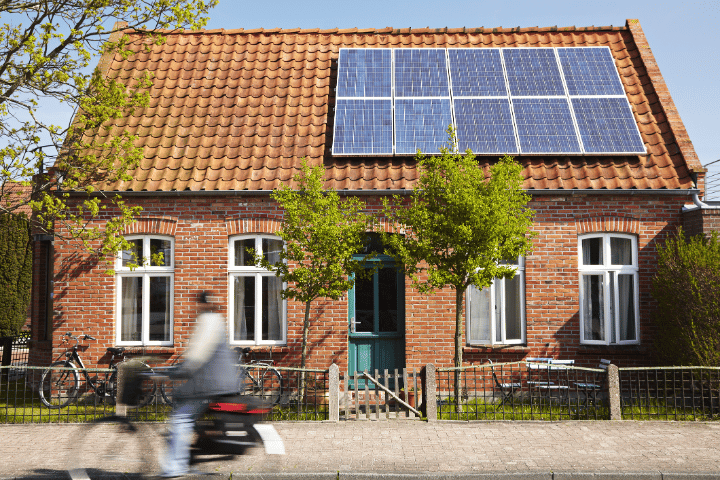

With 40% of Europe’s gas coming from Russia in 2021, and the taps firmly closed for now, homeowners and businesses are seeing the investment case for solar strengthen, as the time to pay off the initial capital outlay has reduced from decades to as little as six years according to Eco Experts. And self-reliance also means that blackouts and rationing can be avoided.

UK PM Liz Truss has set out to further develop UK energy independence, after being forced to deliver a potential £200 billion package to save the UK economy from sky-high energy prices. Renewable energy and energy independence are both now at the top of the political agenda.

And with new chancellor Kwasi Kwarteng previously a fierce proponent of solar, wind, and nuclear, his mini-budget a week from now could well see incentives that send solar stocks soaring.

State-side solar stocks could rocket even further, with the recently passed Inflation Reduction Act creating $370 billion in subsidies and credits which could see as much as $1.2 trillion of private investment into the renewables sector according to Wood Mackenzie.

Blackrock’s US head of thematic and active equity ETFs Jay Jacobs argues that ‘EV’s and clean energy we think are going to be the two main winners based on where the dollars are being allocated.’

And these three solar stocks could be prime beneficiaries. Of course, no investment is without risk.

3 best solar energy stocks

Enphase Energy (NASDAQ: ENPH)

At $312, Enphase Energy shares have become hot commodities for solar stock traders. The US-based company is up 99% over the past year, and an incredible 22,000% over the past five.

Enphase is a developer and installer of cutting-edge solar technology, and also sells energy monitoring software and batteries for domestic and business use.

Key to its investment case is its weatherproof microinverters, which help to increase solar energy production, and its Enphase IQ batteries, which allow residential homes to have access to power through blackouts.

In California, the most populous US state, officials are warning that there could be blackouts over the next three summers due to supply shortages in the wake of the pandemic, climate change, and the Ukraine war.

Microinverter shipments rose by 18% to 3.35 million in Q2, helping total revenue rise by 20% year-over-year to a record $520.2 million. Moreover, the solar company expects this to increase to between $590 million and $630 million in Q3.

First Solar (NASDAQ: FSLR)

At $132, First Solar shares have doubled since mid-July as the company expects to benefit hugely from the Inflation Reduction Act.

This is because unlike many of the nest solar energy companies, First Solar has not outsourced production to China, which could soon see import bans due to long-running Sino-US regulatory issues and the potential use of slave labour. Instead, its factories are either in South-East Asia or the US, where President Biden plans for strong domestic manufacturing support.

The company works across the entire supply chain, building solar panels and photovoltaic power plants, offering construction and maintenance services, and also recycling solar equipment. Its competitive edge comes from its ultra-thin semiconductor technology, which allows for better energy efficiency.

The company is investing $1.2 billion in scaling production of American-made solar products, with plans to build a new factory in the country.

Further, Q2 results were a marked improvement on the results of Q1, with net sales up to $621 million, an increase from $254 million in the prior quarter. This left the solar stock with an operating income of $145 million against a prior loss of $58 million.

CEO Mark Widmar enthused ‘We now have a record backlog of over 44 GWs, extending the horizon for future expected deliveries to 2026.’

SolarEdge Technologies (NASDAQ: SEDG)

SolarEdge Technologies shares are up over 1,000% over the past five years, mostly due to the company’s patented intelligent inverter solution which maximises power generation at the individual photovoltaic module level while lowering the cost of energy produced by the system.

The company also provides optimisation services, maintenance, and monitoring solutions for its systems.

In Q2 results, the solar stock saw revenues rise by 11% quarter-over-quarter and 53% year-over-year to a record $727.8 million. Meanwhile, GAAP gross margin fell to 25.1%, down from 27.3% in the prior quarter and down from 32.5% in the same quarter last year.

And encouragingly, Q3 revenues are predicted to be within the range of $810 million to $840 million.

CEO Zvi Lando thinks that ‘the growing demand for energy in general and clean energy in particular continued to drive top line growth this quarter…we continue to support our customers while building the infrastructure for sustainable growth.’

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.