The twin titans of the gold mining industry, Newmont Corporation and Barrick Gold, could see significant upside as the world tips into recession.

UK CPI inflation in August was at a heady 9.9%. And despite a slight drop on July’s 10.1%, it shows no sign of slowing down. The Bank of England has predicted that the UK will enter recession in Q4, which will continue to year-end 2023 at the minimum.

In addition, PM Truss and Chancellor Kwarteng have promised £150 billion in energy bills support, and are launching a mini-budget that could see similar spending to reduce taxes in hopes of spurring growth.

Meanwhile, the US Federal Reserve’s decision to increase the Federal Funds rate by 75 basis points yesterday is piling on the pressure for the Bank of England to mirror its Transatlantic counterpart, as Sterling sinks to a fresh low against the US Dollar.

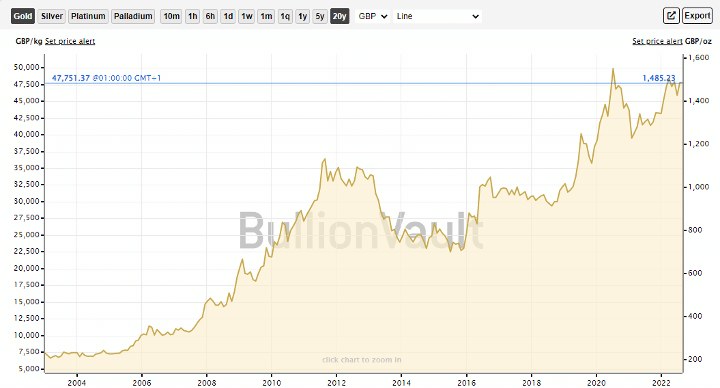

Gold price history

In a high inflationary environment, gold is often seen as an essential component of a balanced defensive portfolio, preserving purchasing power and acting as a hedge against high economic stress and stock market corrections.

Of course, the asset pays no interest. But this is not particularly relevant in a time of falling markets. For example, during the 2008 financial crisis, the S&P 500, widely touted as the benchmark for the US economy, fell by 37% while gold rose by 24%.

However, while many prefer to invest in physical gold, or perhaps a gold ETF for liquidity, some of the best gold stocks outperform direct investment. And with a global recession coming, these gold stocks could once again be set to outperform.

Further, while gold is dipping slightly alongside international rate hikes, at £1,485/oz, the precious metal remains at elevated levels and only slightly off its record £1,552/oz of July 2020.

2 best gold stocks to watch in 2022

Newmont Corporation (NYSE: NEM)

Newmont is a US-based company which claims pole position as the largest gold miner in the world. Managing projects across the globe, it is the only gold stock constituent of the S&P 500.

In addition to gold, it also mines silver, copper, zinc, and lead, and is investing $500 million on renewable energy projects through 2025 to reduce its carbon emissions by 30% by 2030.

While Newmont shares rose to a record $85 in April 2022 as Russian gold became exiled from the international markets, they have since fallen to $42 apiece, marking a return to pre-pandemic levels of value.

In Q2 results, the company produced 1.5 million ounces of gold, up from 1.45 million in the same quarter last year. Moreover, the NYSE-listed stock increased its full-year outlook to 6.2 million ounces.

Meanwhile, sales remained roughly steady at just over $3 billion, allowing it to promise investors that its $12 billion share repurchase program would be used ‘opportunistically in 2022, with $475 million remaining.’

However, costs applicable to sales jumped by 23% year-over-year to $932 as the company struggled with increased labour and commodity costs. But with a 5% forward dividend yield, it’s still edging out physical gold as an investment.

Canaccord Genuity analysts argue that Newmont offers a ‘steady gold production profile,’ and have placed a price target of $60 on the gold stock. And UBS analyst Cleve Rueckert has a price target of $78, arguing it has a ‘compelling’ valuation alongside a ‘very attractive’ dividend yield sustained by its $4.3 billion cash pile.

Barrick Gold (NYSE: GOLD)

Barrick Gold is also one of the largest gold-producing companies in the world. The NYSE-listed stock has been struggling alongside Newmont through 2022, having fallen by 18% year-to-date to $15 a share, far below its record $30 a share in September 2020.

Market weakness for gold could be rising, as the hawkish Federal Reserve continues to make the US dollar more attractive. Yields on 10-year US treasury bonds are above 3.5%, and Barrick’s costs are rising for the same reasons as Newmont’s.

However, the upcoming recession could reverse this sentiment. With the world entering an economic downturn and the Ukraine war likely to escalate after Russia’s partial mobilisation in response to Ukrainian pushbacks, gold could become more appealing as a protective asset.

And in Q2 results, the company beat the average analyst consensus estimate by 9.1%, with adjusted EPS of $0.24 in the quarter. And the company is trading at around 11x consensus 2022 earnings, down from 24x in 2020 at the height of the pandemic.

Further, Barrick is now strongly positioned. Having deleveraged from debt, its debt to equity is at just 0.21, and it holds a $600 million net cash position.

Though it has underperformed historically, this could create a buying opportunity for patient investors. Production is planned to ramp up through 2025 with rising gold demand. And Q2 operating cash flow was already at an impressive $924 million.

It’s also scaling up copper production, until now a secondary concern. Although copper only accounts for 10% of all sales, Q2 saw production rise by 25% year-over-year to 120 million pounds (lbs), and this could contribute to higher profits as demand takes off with the EV revolution.

And as copper occurs naturally in gold mines, this is extra revenue for little additional investment.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.