Mutual funds help build long-term wealth by investing in stocks, bonds, money market instruments and other securities. This guide will help you understand eligible mutual fund investments and how they can improve your investment returns.

Concise Overview

- Mutual funds are a way to invest your money in a diversified portfolio

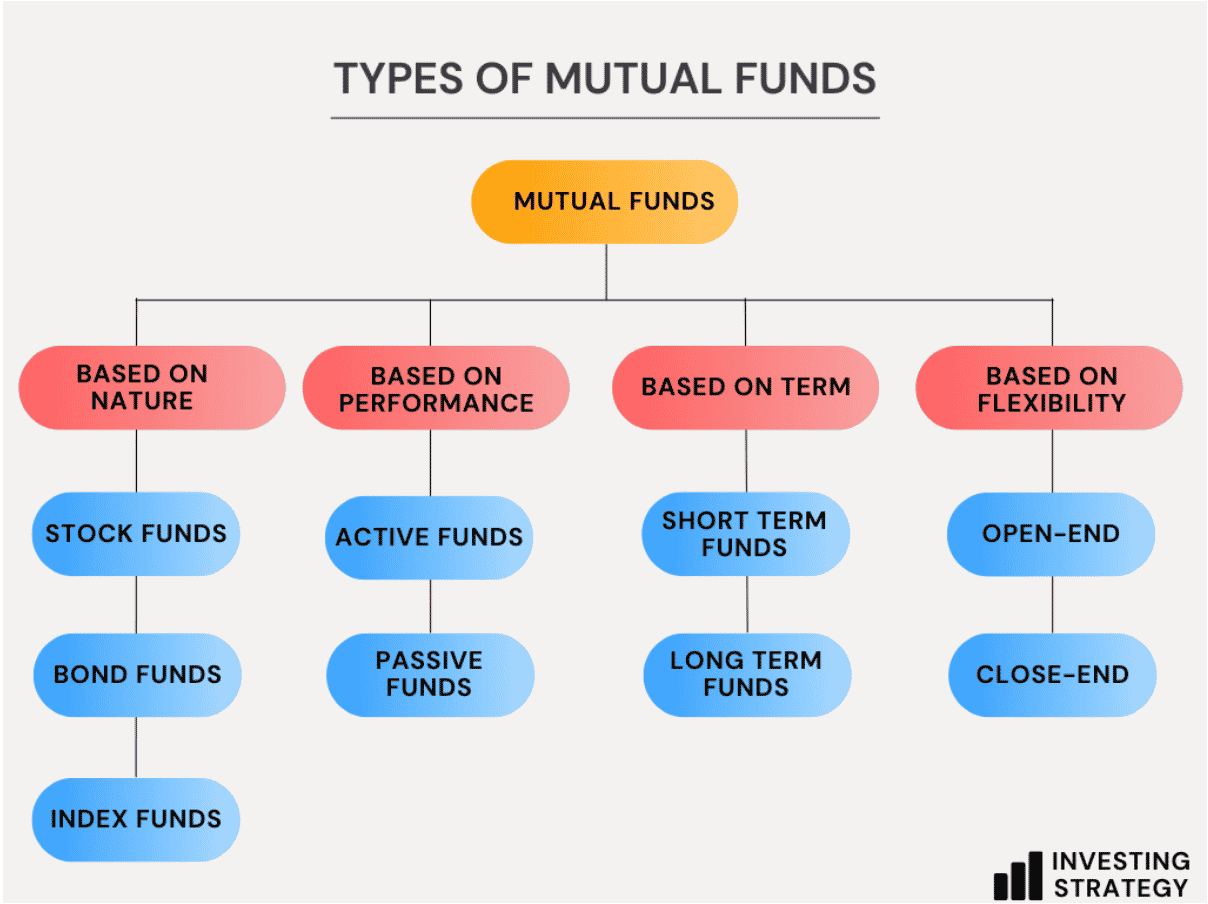

- Mutual funds can be based on nature, performance, term, and flexibility

- To invest in mutual funds, you’ll need to consider some factors

Introduction

Ask seasoned investors about economies of scale, and they’ll most likely talk about mutual funds. These funds allow you to spread your assets across different classes, increasing your chances of earning greater investment returns. Thus, they’re like investment cheat codes that serve as a way to give yourself an edge over the market.

With plummeting stocks and bonds, this is a great time to invest in mutual funds. These funds allow you to keep your money in stable assets rather than volatile stocks and cryptocurrencies. They’re also low cost, meaning you can invest in them with less risk and gain high returns.

But to invest in a mutual fund is to understand its fundamentals. Therefore, this article details everything you need to know about mutual funds, from how they look to how they work and how you should invest in them.

What Are Mutual Funds?

Mutual funds are a pool of money usually professionally managed by an investment company. That means the professional fund manager (or team of managers) is responsible for investing the money you’ve invested in the fund. It allows regular people to invest their money into something with a track record of success.

You can invest in mutual funds by buying shares of the fund itself or by investing in a fund’s underlying assets. Some mutual funds are very focused, like those that invest solely in international stocks. Other funds focus on bonds, currencies, commodities, or other investments.

Besides, you can use mutual funds for retirement savings, college savings, lump-sum payments for life insurance policies, or other large payments. Their flexibility and tax efficiency allow you to invest in whatever asset class makes sense for your situation.

Types of Mutual Funds

Mutual funds can be so complicated if you don’t need where to begin. If you’re new to mutual fund investment, you may have difficulty deciding which type of fund is best for you. A good start is understanding that such funds can be based on nature, performance, term, and shares.

Based on Nature

Nature mutual funds offer investors an alternative way to build a portfolio of mutual funds based on different asset classes. The three most common ones are:

Stock Funds

These are investment vehicles that hold stocks. They’re typically managed by professional portfolio managers who buy and sell securities based on market conditions to maximise returns for investors. Many stock funds specialise in specific industries, geographic regions, or emerging markets. Others cut across global sectors.

Bond Funds

These funds invest in bonds, which are debt instruments that pay interest payments periodically. Most bond funds are managed by professional money managers who use different strategies to generate returns for investors. Bond funds can be used as a hedge against inflation as they tend to be more stable than stocks.

Index Funds

They’re a type of mutual fund that tracks a specific market index. In other words, an index fund is a mutual fund that tries to match the performance of the market as a whole and not just the performance of one company or industry. They model after the performance of a financial market index.

Based on Performance

The primary goal of mutual funds is to earn returns by diversifying your portfolio. Therefore, it’s necessary to understand if your funds are active or passive.

Active Funds

These are mutual funds where the manager actively chooses stocks to buy and sell. This can be done through market orders or limit orders, depending on the type of investment. The manager can also choose to hold a position in individual stocks called long or short positions.

Passive Funds

These investment types attempt to mirror the performance of an index. The most common types of passive funds are index funds and exchange-traded funds (ETFs). Index funds attempt to match the performance of an index, while ETFs attempt to track the return of an asset class.

Based on Term

You can classify mutual funds based on their terms. Some funds last for a short period, while others can go years before maturity. Below are the two categories:

Short Term Funds

Short-term mutual funds are investments with a minimum investment period of one year, and some short-term funds may have an even shorter term. These funds are designed to provide returns over periods more minor than the average holding period for traditional assets.

Long Term Funds

A long-term mutual fund typically holds securities for more than a year. Some long-term mutual funds are redeemed before their expiration dates, while others are held until their maturity dates. They’re usually owned by institutions, such as pension plans and state or local governments.

Based on Flexibility

If you’re thinking of flexibility, some mutual funds can help fulfil that. These funds are primarily two, and they’re:

Open-End

Open-ended mutual funds allow for investment in different funds. They aren’t limited to one or two options, like most other funds. A variety of different investments can be made in open-ended mutual funds, which can make them a popular choice for investors who want to diversify their portfolios.

Close-End

Close-ended mutual funds close once they have reached their investment goal. Such a mutual fund has a fixed number of units initially sold to investors until no more units are available.

How Mutual Funds Work

Mutual funds work by pooling your fund into an asset managed by a fund manager. From there, you get access to a wide range of investment functions that impact your returns. These functions include:

Dividend Payments (DP)

Dividend payments are the payments that a company makes to investors, usually paid out at the end of the year. Dividend payments can be made directly to investments, or they can be made to brokers (if a shareholder trades through one).

Capital Gains (CG)

Capital gains are often associated with stocks. Capital gains are the difference between the price you purchase security and its selling price on a larger scale. In other words, they’re the difference between what you paid for the security and what you sold it for to accrue gains.

Net Asset Value (NAV)

Net asset value measures a company’s liquid assets, including cash, stocks, and bonds. NAV is calculated by subtracting total liabilities from total assets. In a mutual fund, an investor can calculate their net asset value by subtracting the fund’s liabilities from its assets. The NAV is useful for comparing different funds.

Benefits and Risks of Mutual Funds

Investing in mutual funds comes with benefits and risks. One benefit is that they provide natural diversification. This is because it allows investors to invest in multiple securities and asset classes. Thus, there’s less chance that any stock or sector could tank the whole portfolio.

Another benefit is liquidity. Unlike stocks, which must be traded at a stock exchange, mutual funds can be bought and sold through any broker. This means the shareholders don’t have to deal with the long lines and trading hours of a stock exchange.

Additionally, mutual funds offer a low-cost investing option. Depending on the type of fund, costs can be as low as 0.25% annually – less than other investments and much less than what you’d pay for services such as financial advice or a stockbroker.

Lastly, access to professional management is one of the benefits of mutual funds. Professional management is essential for mutual funds. The reason is that professional managers make better decisions about the allocation of assets and the timing of buying and selling securities than individual investors.

However, while mutual funds have benefits, the risks can also be threatening. Some of the risks include losing money as part of the venture. The risk of losing money is why you shouldn’t invest more than you can afford to lose.

Besides, the price of the fund can change, which can make it worth less than the amount you originally paid for it. The price changes can result from the fluctuations of the fund performance from year to year. Some funds will outperform others, while others will underperform.

Another disadvantage is that the company that manages your mutual funds may go out of business. If not, it might change its policies and stop paying promised returns to investors who bought into its fund at a specific time. Therefore, a shareholder might not get what they want out of their investment.

How to Buy and Sell Mutual Funds

You can buy mutual funds from various places: a discount broker, a full-service broker, or directly from the mutual fund company itself.

You can also buy and sell mutual funds online. This is perhaps the most common way to trade mutual funds, and it’s also the simplest. By buying and selling shares through an online broker, a shareholder can trade funds flexibly. This means you can buy a fund at one price and expect the transaction to be done immediately and at the market price.

Aside from that, online trading helps you avoid commissions since these transactions occur directly between investors. However, some brokers may require minimum investments before allowing investors access to their services or charge fees based on traded volumes over time.

Regardless of how you trade, there are two ways to sell your shares in a mutual fund: as a whole or as part of a portfolio. When you sell your entire stake in a mutual fund, you’re selling an entire portfolio and not just one share. Selling individual stocks on their own will incur brokerage fees and tax consequences if sold at different times during the year.

Factors To Consider Before Investing In Mutual Funds

Investing in mutual funds is rewarding. But it’s easy to get lost in the details of your investments and forget about the picture. So, before you invest in mutual funds, here are some factors to consider:

Define Objective

Before you invest in mutual funds, you should first define your objective. One of the most common reasons for investing in mutual funds is to generate income. If this is your goal, look at funds focusing on dividend yields or those with a history of paying regular dividends. If growth is more important to you than income generation, try to find a fund whose objective includes capital appreciation or potential appreciation.

Weigh Risk Tolerance

Choosing a mutual fund is not as simple as selecting an investment option. There are many factors to consider before investing in this asset class. One such factor is risk appetite and tolerance.

Risk appetite refers to how much financial loss an investor can withstand while maintaining their emotional well-being during turbulent market conditions. Risk tolerance refers to how easily one can bear losses within an asset class. Generally, the higher your risk appetite and tolerance level, the more aggressive your investment will be and vice versa.

Consider Investment Horizon

It would be best if you considered your investment horizon. How long do you want to invest? Are you willing to commit for the long haul? How much risk are you willing and able to take? If the market goes down, can you afford that loss of principal?

If the answer is yes, it’s time to set up an investment strategy and determine how much money and time it’ll take to work out over the long term. It’d help if you also considered how much money is available for investing each month and how much of those earnings will go towards taxes after deductions.

Check Cost Structure

The cost structure of the mutual fund scheme is another factor to consider. This is the price that’s paid to invest in a mutual fund. The cost structure of a money market fund is different from that of a debt fund or an equity-oriented mutual fund.

Types of investment costs include transaction costs and exit loads levied by regulators and government bodies. Transaction costs include stamp duty and brokerage charges. Exit loads refer to additional fees charged by your mutual fund if you decide to redeem your units before maturity.

Consider Taxation

When you invest in a mutual fund, you’re considered to have invested by buying units of the scheme. Your mutual fund distributor or agent will tell you about the tax treatment applicable to the scheme. It’s therefore essential that before investing in any scheme, you understand what kind of taxes may apply to your investment returns.

Research Fund’s Performance

Before investing in a mutual fund, it’s essential to know how it’s performing. The most important thing is to ensure the fund grows at a rate that’ll help you reach your goals. If the fund isn’t growing, it may be time to look for a new investment.

Mutual Fund: What Else to Know

The complexity of mutual funds often stems from not understanding the fundamentals. Aside from knowing how to buy and sell and whether you should invest or not, below are crucial fundamental terms you should know:

Understanding Loads

Loads are fees investors pay to buy or sell their investments. Mutual funds charge these fees to cover the operational costs of running the fund, including marketing, administration, and other administrative costs. Loads can also be called ‘commissions’ and encourage you to invest your money with them.

Understanding Returns

Returns are the amount of money the fund has returned to you. They’re calculated yearly as an annual percentage rate. The returns you see on your mutual funds’ statements are calculated by dividing the total return of your fund’s investments over time by the value of those investments from the outset.

Understanding Breakpoints

Breakpoints are the levels of discount offered to an investor. They’re discounts and reduced sales charges for investors who make more significant investments. They’re usually offered to institutional investors as an incentive for large purchases.

Avoiding Fraud

To avoid investment fraud, you should read the prospectus for the fund and know the type of investment. Don’t trust any salesperson who wants to sell you something without disclosing all the details. It’s essential to know what type of investment is being offered before investing.

In Closing

Mutual funds offer different investments, including stocks, bonds, and indexes. These funds can be active or passive, open-end or close-end, and short-term or long-term. The fund manager will choose the right mix of these investments based on the fund’s goals and your preferences as an investor. Definitely, investing in mutual funds is a great way to diversify your portfolio and get the most profits for your own money.