Trident Royalties investors have enjoyed excellent returns over the past three years. But this could be just the start — and the stock has fallen to an attractive valuation for would-be investors.

Trident Royalties (LON: TRR) launched its FTSE AIM IPO in mid-2020 — just after the covid-19 pandemic mini-crash — following a successful placing raising gross proceeds of £16 million at 20p per share.

At the time, the company started trading with a market capitalisation of circa £20.7 million — but had almost trebled to a share price of 59p by the start of March 2023. That’s quite a performance when every other junior resource sector company was crashing around them — and try as it might, TRR has also been struck by the tightening monetary environment.

Shares have now corrected down to 37.4p, a fall of over 35% since the record high. But arguably, the company is fundamentally in a better position than it was earlier in the year — and its royalty-based investment strategy gives it a unique advantage over other popular AIM mining sector shares.

CEO Adam Davidson (who kindly answered some of my queries, below) argues that this movement is ‘more macro-driven vs. anything specific to our portfolio.’

And when asked on whether this performance can be repeated, he advises that ‘we’re trading at a significant discount which, inversely, gives me confidence that we can see good share price performance as our value re-rate to historic norms. There’s a lot of value on the table which, when coupled with new acquisitions, should only increase our NAV per share.’

Is this a fair view?

Let’s dive in.

Interim results

In H1 2023 (January-June), TRR saw royalty receipts increase by a sizeable 45% compared to the same half in 2022, and it expects further growth in 2024. It also sold several pre-production gold royalties for $15.6 million in the half, representing a 140% return on invested capital.

This royalty uplift is being attributed to the fact that many of Trident’s assets, having been acquired in the pre-production phase a year or two ago, ‘are only now starting to see cashflow – leading to the significant uplift in revenue.’ Encouragingly, the CEO expects ‘this trend to broadly continue as the portfolio continues to grow and mature.’

The company was also admitted to the OTC market in the US — accessing a pool of liquidity not available in the UK.

In the period, it saw solid progress across the portfolio including at the under-construction Thacker Pass Lithium Project, alongside the acquisition of the La Preciosa silver royalty in Mexico. And post-period, it saw two further royalty acquisitions over the Dandoko Gold Project in Western Mali, and a royalty over Anson’s flagship Paradox Lithium Project in Utah.

Davidson enthuses that the recent ‘transactions have enhanced the diversity of our portfolio and are set to contribute to our growing cash flow. It has been a solid start to the year and the Board, and I eagerly anticipate sharing further updates as the year progresses.’

The Trident difference

I’ve covered the junior resource sector for many years — interviews, broker notes, deep-dive analysis, conferences et al — and one of the key dangers with investing in single mining stocks is that they usually have one flagship asset that will either deliver exceptional returns OR lose money.

Horizonte Minerals’ share price crash over the past few days is a good example of what can happen when something goes wrong — though similar falls elsewhere are par for the course. It’s high risk, high reward, after all.

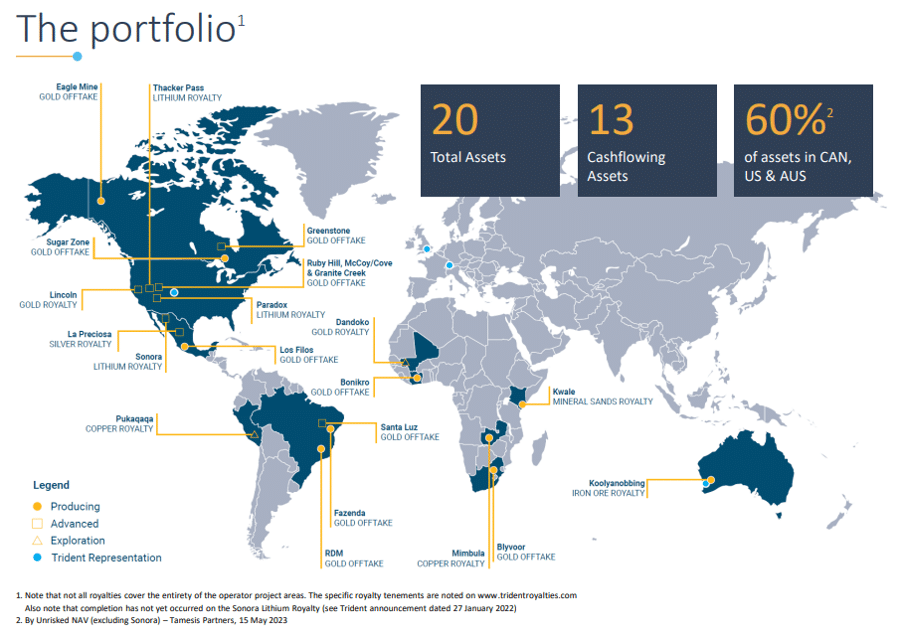

The beauty of Trident’s royalty model is that the company is invested in 20 assets, diversified by both metal and jurisdiction. Over the longer-term, it plans to be completely mineral-agnostic, with a portfolio covering critical minerals and precious metals — giving investors the chance to benefit from the commodity supercycle without having to take on the risk of investing in any one company.

Specifically, while 13 of these assets are already delivering cash flow, the company’s strategy is to buy royalties in early-stage assets where enough drilling has been completed to reduce the hazard without being enough to completely de-risk a project; in other words, targeting the highest potential reward value for the risk premium.

The other important consideration is that TRR is listed in London — where there is almost no other mining royalty companies. The only one worth considering is Ecora Resources, which has lost a third of its value in 2023 and has less diversified exposure. This makes Trident one of those background portfolio companies — used to hedge an otherwise risky portfolio, and if UK investors want easy access to this hedge, there’s not really another option.

In terms of analyst coverage — there’s plenty. A recent note from Stifel enthused that ‘the royalties over the La Preciosa project provide Trident with exposure to one of the largest undeveloped primary silver resources in Mexico,’ and further, that momentum is on its side given ensuing procurements, including the Dandoko gold project and the Paradox lithium project, which offer ‘potential for near-term revenue.’ Stifel maintains a buy rating and an 85p price target.

Meanwhile, Liberum also has a buy rating but with a lower 81p price target. And a third broker — Tamesis — has a buy rating with a 75p target.

All three analysts note that increasingly difficult equity and debt markets are creating an environment where Trident can push for some excellent royalty deals — with Liberum thinking TRR is in an ‘excellent position to sign more deals, with rising cost of finance making royalty financing increasingly attractive.’

In other words, getting a commercial loan on reasonable terms is becoming very expensive. For context, even the typical retail investor can get a 6.2% guaranteed return with NS&I — new corporate loans are coming in with punitive terms and rates of 10%+. Meanwhile, share placings at AIM’s low — the index is currently below 700 points and has fallen by nearly 50% since its 2021 high — are not a good idea either, as they deter investors through fear of dilution.

Indeed, the CEO admits that ‘we’re seeing many more opportunities to put royalties over high-quality projects which – if capital markets were less constrained – would be difficult to otherwise do, as the mining companies/sellers of royalties would be able to source lower-cost capital elsewhere.’

Another way of putting this: TRR would like to acquire more quality assets now at the height of the monetary cycle — and is actively seeking access to more funding to make this happen.

And for investors, royalties come with no capex exposure, no opex exposure, and no dilution risk. Further, they are almost always senior in the capital structure (in other words, if something goes wrong, royalty gets paid first).

In Davidson’s own words, this level of diversification is impossible with a small cap mining stock — noting that ‘at our market cap, we nevertheless have 20 assets of which 13 are cash flowing. For a mining company to have a similar profile, they would need to be a multi-billion market cap.’

Further, ‘our exposure is as a percentage of the operator’s revenue (rather than their profit), so we’re not exposed to their cost profile. If capex blows out, or operating costs increase due to inflation… we don’t see any impact to our revenue. This massively de-risks cashflow for investors.’

As an investor in several early-stage mining stocks, it’s worth noting that the comparative rewards of a royalty-based company are lower than those on offer with single asset companies, though the risk is also much lower. In addition, a royalty is only as good as an asset or operator — failure to get gold or lithium out of the ground still results in no royalty payment.

Fortunately, Trident’s portfolio looks solid.

Key portfolio considerations

There are essentially two important factors to consider:

1. The majority of Trident’s assets are focused in North America.

2. Despite ambitions to become more balanced, the portfolio is weighted towards lithium and gold.

When asked whether the focus on North America is a conscious decision, the CEO remarks that he wants ‘to retain the bulk of our geographic exposure to tier-1 jurisdictions such as the U.S., Canada, and Australia.’

Again, there is a clear focus on lower-risk opportunities which still deliver decent rewards for the risk level. And it’s worth noting that its listing on the OTC market in the US could well ‘start to have a more material impact as our U.S. projects move closer to cashflow.’

In terms of commodities, as long-term readers will know, I am a fan of both gold and lithium, so Trident’s current weighting is not a problem. Gold is attractive for its hedging power in times of inflationary stress — and lithium for its importance in the EV revolution. Central banks are not going to stop diluting fiat currency, and oil is going to eventually run out.

These metals are sound long term investments — and I’ve made the case for both many times over the years.

Davidson is also ‘bullish lithium,’ as it’s ‘in a rare position as it, effectively, has a legislated demand driver via government mandates/plans for de-carbonization and electrification. There seems to be a natural dislocation in the market as we can all see demand increasing, but supply will not turn on at the same time.’

In this, he and I are of the same mind.

One more point — the CEO is aware that the portfolio is slightly lopsided and wants to recalibrate using base metal royalties including copper — another metal I have a lot of time for.

For context, lithium project royalties at Thacker Pass, Paradox, and Sonora account for 43% of the company’s net asset value, while gold royalties account for a further 37%.

I’m not going to into detail on every project (the corporate presentation has the details) but it is worth running a selection of assets:

Thacker Pass Lithium Royalty — largest reserve in North America, 1.05% gross revenue royalty. In construction, with first production set for H2 2026. 40-year LOM, General Motors investing $650 million into the mine, and at full production will be worth $30 million per annum to Trident. Davidson notes that this ‘key asset has been massively de-risked… with the permit being upheld on appeal in July, and construction having commenced.’

To be clear — Thacker is the ‘flagship asset,’ and rumours of potentially $1 billion in government funding for operator Lithium Americas could see a significant increase on Trident’s balance sheet. The CEO only notes that Lithium Americas has ‘been very clear that they expect the government to fund a large portion of construction, given that it’s a very strategic asset.’

Given the desire of the US to wean itself off Chinese critical minerals dependency, funding of this size would not come as a surprise. In a similar vein, Golden Metal Resources’ Pilot Mountain (I‘ve covered elsewhere) could also see government funding.

Paradox Lithium Royalty — very advanced stage project, with a 2.5% net smelter return royalty. Will pay $11 million per annum to Trident for first 10 years of operation, DFS completed in H2 2022 with a final investment decision due by the end of 2023.

Eagle Gold Offtake — Trident has rights to 25% of gold production up to 1,111,500oz delivered (1MT remaining). Produced 150koz in 2022, targeting 200koz pa over next eight years and 2.1Moz of total production to 2034.

La Preciosa — 1.25% net smelter royalty and $8.75 million milestone payment due 12 months after first silver production. First production due in Q4 2023, mineral resource of 120Moz of silver and 224Koz of gold, operator plans silver production to ramp up to 3.5Moz in 2028.

Remember, Trident has a market cap of circa £115 million, so arguably these four assets combined, alone have the potential to be worth more than the current market cap over the next few years.

Financial position

At 8 September 2023, the company had a cash balance of $29 million, and debt of $40 million. This debt includes a fully drawn facility with Macquarie which the CEO views as a ‘sustainable debt position.’ However, he also wants ‘to get a revolving facility with one of the commercial banks as many of our larger peers have done. This would allow for a lower cost of capital, while also providing flexibility to draw on the facility to make royalty acquisitions.’

Again, now is the time to be buying assets — and the management team know it.

Detailed finances can be found through various RNSs, but the bottom line is that the business is sustainably financed. Royalty growth at 45% and rising is what investors want to see.

As a caveat, there are also circa 13.2 million management options, and 14.8 million warrants outstanding with a 51p exercise price. These are not currently relevant with the share price under 40p but are worth considering should TRR move towards the analyst targets.

The bottom line

The common thread through this piece is that Trident Royalties functions as lower risk access to the junior resource sector for investors not keen on the volatility that comes with individual assets or stocks.

Further, Trident is unique because it offers exposure to the early stages of production. To understand the implications, larger royalty companies typically trade on 12-15x revenue, and Trident trades on a similar level based on 2022 revenue and 2023 to date.

But because most of its net asset value is in the development phase (with a clear pathway to production), there’s the potential to benefit from ‘significant uplift in revenue/cashflow’ but without the risk that comes with investing in equities.

At this price point, Trident Royalties shares are a solid buy.

Full Q&A with CEO Adam Davidson

1. Trident Royalties shares have put in an impressive performance since its admission to AIM, though have been falling by about a third since March. What’s going on?

The recent softness in share price appears to be more macro-driven vs. anything specific to our portfolio. In fact, as mentioned, our key asset (Thacker Pass lithium project) has been massively de-risked over this same period – with the permit being upheld on appeal in July, and construction having commenced.

2. Can you repeat the share price performance of the past three years? Do you think the company is trading at good value right now?

We’re trading at a significant discount which, inversely, gives me confidence that we can see good share price performance as our value re-rate to historic norms. There’s a lot of value on the table which, when coupled with new acquisitions, should only increase our NAV per share. Key events such as first production at Preciosa silver, Thacker Pass lithium, Dandoko gold, Paradox lithium, etc. should see a crystallization of value in those particular assets within the portfolio.

3. Recent interim results saw royalty receipts increase by 45% in H1 2023 compared to H1 2022. What was the key catalyst behind this rise?

We’ve only been listed for a little over three years, so many of our assets acquired in the first year or two are only now starting to see cashflow – leading to the significant uplift in revenue. We expect this trend to broadly continue as the portfolio continues to grow and mature.

4. Is Thacker Pass the flagship? When do you expect royalty streams to start coming through – and can you comment on the potential $1 billion of US government funding for the project?

Thacker is the flagship asset for Trident, with first revenue expected by H2-2026.

It’s hard to comment on the $1b in potential government funding (we don’t have any info outside of what is in the public domain), but the operator (Lithium Americas) has been very clear that they expect the government to fund a large portion of construction, given that it’s a very strategic asset (the U.S. doesn’t produce much domestic lithium, so is largely beholden to China).

5. What’s the advantage behind a royalty-based business plan?

There are several:

- We can build a diversified portfolio, which is difficult for a mining company to do. For example, at our market cap, we nevertheless have 20 assets of which 13 are cash flowing. For a mining company to have a similar profile, they would need to be a multi-billion market cap. Similarly, we have exposure to lithium, copper, gold, silver, iron ore, and mineral sands… whereas a mining company would struggle to have such broad exposure outside of the mega cap diversified miners.

- The royalties themselves carry a huge advantage, as our exposure to the underlying assets is at the top-line of the P&L. Namely, our exposure is as a percentage of the operator’s revenue (rather than their profit), so we’re not exposed to their cost profile. If capex blows out, or operating costs increase due to inflation… we don’t see any impact to our revenue. This massively de-risks cashflow for investors, providing the commodities exposure that they want, but without the equity risk inherent in the mining sector.

6. What are the positives/negatives of the higher rate environment? For example, do the challenging equity and debt markets give Trident an advantage when negotiating royalty deals?

That’s correct, we’re seeing many more opportunities to put royalties over high-quality projects which – if capital markets were less constrained – would be difficult to otherwise do, as the mining companies / sellers of royalties would be able to source lower-cost capital elsewhere.

7. While you have a global presence, the majority of your assets are in North America. Is this a conscious choice?

We want to retain the bulk of our geographic exposure to tier-1 jurisdictions such as the U.S., Canada, and Australia.

8. How has admission to the OTC market in the US gone? Are you seeing greater liquidity?

It’s been building slowly, but we suspect that it will start to have a more material impact as our U.S. projects move closer to cashflow.

9. You recently added Anson royalty streams to your portfolio. What was the commercial reasoning behind this?

This asset provides us with good lithium exposure in the US, over a late-stage project which recently completed its DFS and is finalizing the final study before moving into a construction decision / financing. We were able to structure the deal with 85% of the purchase consideration linked to production milestones of the underlying project, which massively de-risks the royalty for us while still locking-in our exposure.

10. Trident claims to be mineral-agnostic, though arguably investors are most excited about the lithium projects. Do you think this is a justified view?

I believe so, we’re bullish lithium (particularly Trident’s lithium exposure, being a U.S. based, globally significant project being built with General Motors as joint-funder). Lithium more broadly is in a rare position as it, effectively, has a legislated demand driver via government mandates / plans for de-carbonization and electrification. There seems to be a natural dislocation in the market as we can all see demand increasing, but supply will not turn on at the same time (this is mining after all!), so we may enjoy several years of exceptional revenue while prices remain elevated due to a sharp increase in demand while supply lags behind.

11. What’s the Trident approach? Why buy shares in Trident when larger more established royalty firms are available?

Royalty companies typically trade on cash flow multiples (e.g., 12-15x revenue). While we’ve been trading at similar level based on our 2022 revenue (and 2023 to-date), the bulk of our net asset value is actually in development stage assets. The important point is that most of these development stage assets have a very clear pathway to production (Thacker being an obvious example, given it’s in construction), so the value story is very clear – with so many assets advancing toward production, we can expect to see the anticipated significant uplift in revenue/cashflow which will ultimately be reflected in the share price.

12. What’s the value creation track record like compared to industry standards?

Since inception, I believe Trident is the best performing royalty company.

13. Would you say that your profitability is reliant to some extent on continued government support for the energy transition?

Not necessarily, the government push for electrification helps, but I believe this shift will continue regardless.

14. Can you provide a brief overview of the debt position and management options? Is the debt position sustainable?

We have a facility, which is fully drawn, with Macquarie bank. We view it as a sustainable debt position. Ultimately, we want to get a revolving facility with one of the commercial banks as many of our larger peers have done. This would allow for a lower cost of capital, while also providing flexibility to draw on the facility to make royalty acquisitions.

15. Do you have any specific targets in mind to add to the Trident portfolio in the near future?

We would like to add more base metals, particularly copper.

ENDS

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.