Everything you need to know about investing in small cap lithium stocks. I concentrate on London-listed companies with deposits in Africa — here’s why.

Having spent significant amounts of time covering the African lithium stocks, I thought it might be time to bring the reasons why under one umbrella report. First though, a few important caveats:

- This is not financial advice. Do your own research and make your own decisions.

- This is high-risk, high-reward territory. You might lose some or all of your money.

- There are some important first steps to consider before investing in AIM shares, or in mining shares. Generically, these centre around developing financial resilience and diversification.

When I first started pushing my work on social media, it was in response to the emergence of AI. For context, I’ve been covering the stock market as a freelance analyst since April 2017 – and would have preferred to stay out of the ‘limelight.’

However, my view is that the kind of copywriting that I create for blue-chip clients will likely be replaced by ChatGPT, Bard, Ernie Bot etc. within the next few years. As I really enjoy my work, the answer is to get my name out there — such that investors attach my name to interesting pieces.

As I come close to 4,000 Twitter (X) followers, this has come with its own set of problems.

People who have known me for some time will know that I focus on generating the highest return possible in the shortest amount of time, using money set aside for risky investing. I enjoy the rollercoaster ride that comes with small cap investing because, psychologically, I am prepared to lose it. I do try to repeat this point as often as possible.

Every single AIM investor has at some point lost a significant amount of money in a single company. This could be because of a failed drilling campaign, weak clinical trial results, underreported financial issues – the list goes on and on.

Accordingly, despite any social media bravado, memes, jokes or otherwise, investors should go in with their eyes open: all these small cap mining companies are operating promising lithium projects, but within weak jurisdictions that can change their laws or regulations at any time.

And if you want 1,000%+ returns, you need to sweat for it. For context, the S&P 500 has delivered average annual returns of circa 11% since 1957 – anything above this is considered higher risk by the markets.

Let’s dive in.

The Lithium Five

If you are a UK-based investor looking to invest in small-cap London-listed lithium shares with a deposit in Africa, there are only five that really have any liquidity (read popularity) on the market:

- Premier African Minerals (LON: PREM)

- Kodal Minerals (LON: KOD)

- Atlantic Lithium (LON: ALL)

- Andrada Mining (LON: ATM)

- Marula Mining (AQSE: MARU)

Some of these are also listed elsewhere, but the key point is that if you want a NOMAD regulator (excluding MARU, though the AIM IPO is coming), and you also want exposure to the most popular mining element in Africa, these are the companies to invest in. To invest in these companies we would recommend the brokers IG or eToro.

| BROKER | PROS | FEATURES |

|---|---|---|

| + Founded in 1974 + First-class web trading platform + Superb educational tools + Great deposit and withdrawal options | Fees: Spread cost; Overnight financing costs; Inactivity fees Min. Deposit: $£250 Tradeable Symbols: 19537 |

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. |

||

| + Fast withdrawal + 0% commission on US stocks + Real Cryptos, Stocks + Copytrading + Social Trading + PayPal deposits possible + One Stop Shop | Fees: $5 withdrawal fee. Inactivity fee. Min. Deposit: $50 Pairs Offered: 47 Leverage: 1:30 Tradable Assets: 2000+ |

74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

||

Criteria: LSE, Africa, Lithium

There are some important reasons why I prefer to invest in the LSE-listed companies, rather than perhaps more popular offerings on the ASX or TSX.

Consider three ASX-listed lithium explorers in Africa: AVZ Minerals has lost its license for Manono and has been suspended for well over a year. Leo Lithium’s Goulamina has been hit by Malian regulatory changes, with shares falling by 50%, and Lepidico’s Namibian Karibib Project is burning through cash faster than a gap year student on a Thai beach.

The ASX companies exploring in Australia tend to do extremely well as the Tier-1 jurisdiction boasts excellent infrastructure, masses of qualified people, and a solid domestic investor base — but those investors continue to get burnt in African lithium — for a variety of reasons.

TSX/CVE companies have a different interpretation of the same problem. There are plenty of excellent opportunities in Canada, so investors in North America would rather stay out of African lithium — leaving companies like Li3 undervalued compared to if they were on AIM.

Then there’s the African aspect. Consider Atlantic Lithium’s Ewoyaa Project, which should eventually have a production capacity of 365ktpa. This is comparable to Mt Holland in Australia — and yet in terms of valuation, Ewoyaa is valued far lower.

Predominantly, this is because of the increased regulatory risk in Africa — which serves to allow juniors to discover some monster assets, and investors to buy shares with a view to generate exceptional returns.

And then we come to: why lithium?

This can only be a very basic overview, but for simplicity:

There’s not enough.

Do you want a recent example? China recently auctioned off exploration rights to two potential lithium sources with literally no evidence of lithium in the ground. The closing bids ended up 1,300x the opening bid, with over 8,000 bids by the end of the process.

Lithium is not like iron, or gold, or oil. There’s not enough to go around.

If every new car in the world is going to be an Electric Vehicle by 2040, and the world is going to be powered by electricity-based renewable energy, then even if every single source of lithium we have right now started to be mined, it still wouldn’t suffice to meet anticipated demand.

And when demand exceeds supply, prices rise.

Here’s a fact: the International Energy Agency considers that EVs require six times as many minerals as conventional ICE cars. And the same body advised in 2021 that demand for lithium could grow as much as 30x by 2040.

GM, Volkswagen, BMW & Ford all plan for all their new car sales to be electric by 2030. In 2022, market leader Tesla delivered circa 1.3 million vehicles — but 85.4 million vehicles were manufactured in the year overall.

Tesla et al are already scrabbling for supply, but we haven’t really even got started yet. Kelley Blue Book data shows that sales of EVs rose by 45% in the US — and in China, sales leaped by 55%, in 2022.

And that’s just the EVs. Global Net Zero by 2050 needs far more lithium than just that powering cars. 90% of grid energy storage worldwide uses lithium-ion batteries.

Then there’s the supply chain crisis. I’m not sure if you’ve noticed, but the trade spats between the US and China are growing — spy balloons, iPhones, critical minerals, semiconductors, Ukraine…and it will only grow.

Now here’s the fun bit — China controls virtually all of the lithium processing and is building plants to process far more than it already is. It controls 76% of lithium battery cell production and also holds a market-leading position in lithium refining.

But the country imports most of the lithium it processes from the lithium triangle in South America, alongside select locations in Australia, and is only now really starting to get some out of its African investments.

This poses a problem, because if (for example), Australia stopped exporting to China in favour of the US or domestic processing, the Chinese battery economy would crumble. For context, Australia’s Resources Minister Madeleine King has already said tax breaks for lithium and other critical minerals projects are ‘on the table’ after Tesla’s Chairman urged the country to offer tax credits to producers.

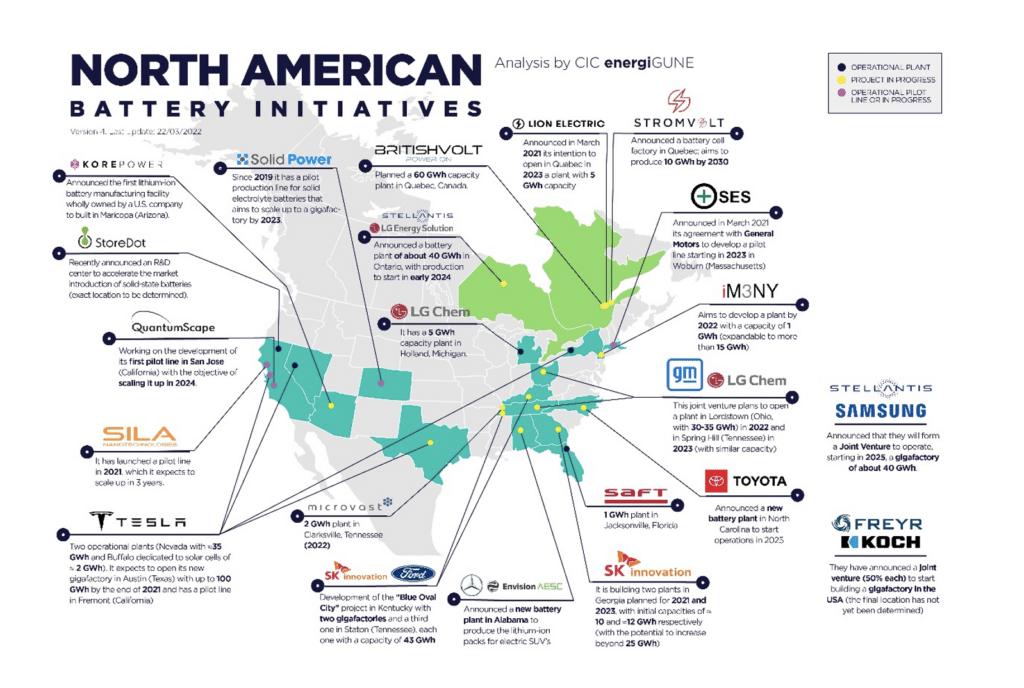

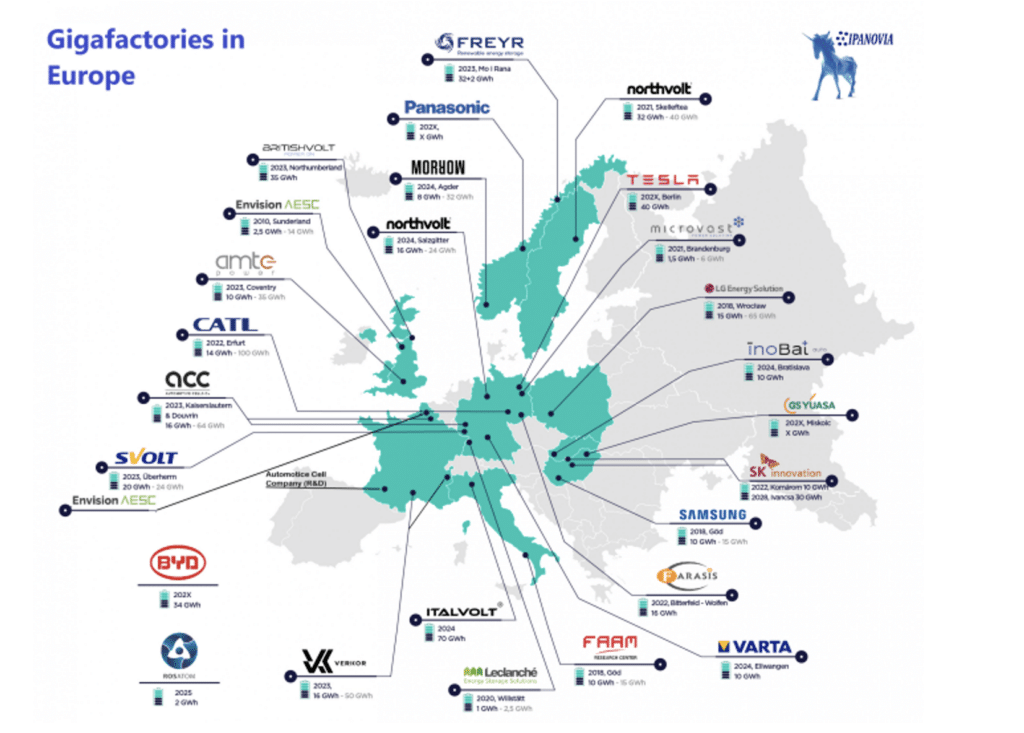

However, there’s nowhere near enough processing capacity elsewhere to match China, which has been ahead of the game for some time. The West is trying hard to catch up (see below), but it will be years before this processing is all online — and even then, it’s nowhere near enough.

The US Inflation Reduction Act now provides tax incentives of up to $7,500 for the purchase of new EVs built in the US, Canada, or Mexico through 2032 (there’s a reason why Mexico has overtaken China as the US’s largest trading partner).

In the US, Biden:

- plans to have half of all new cars be electric by 2030

- started a $3.1 billion plan to boost domestic battery production

- is building 500,000 EV chargers

- invoked emergency Presidential powers under the 1950 Defense Production Act, ‘to reduce our reliance on China and other countries for the minerals and materials that will power our clean energy future’

Moreover, half of the $7,500 tax credit requires 40% of metals in an EV battery to come from either North America or a US free trading partner, increasing to 80% by 2027. For context, Albemarle has the only major operating lithium mine in the country. This creates huge financial incentives for AUS producers to send lithium to the States instead of China. Europe and India are planning similar incentives.

Further, the other half of the tax credit relies on 50% of battery components being made in North America, rising to 100% by 2029.

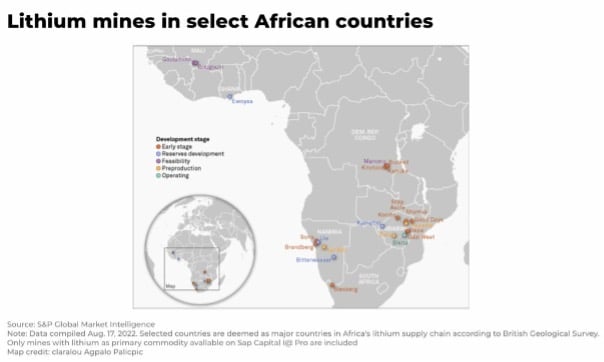

And the problem China has is that its demand for critical minerals, including lithium, is already far higher than its domestic production capacity. Africa and Canada are essentially the only untapped reserves — the lithium triangle and Australia have been mined for years, but African sources have barely got started. Meanwhile, Canadian sources will be used in North America; look at how Canada forced three Chinese companies to divest stakes in lithium companies last year.

Indeed, carmakers are getting so worried that they are all signing up to direct supply contracts with third parties, or even getting involved in investing in mines themselves. For example, Ford has deals with SQM, Albemarle and Canmax — to not only develop processing plants together, but also to get direct offtake agreements.

For context, lithium from PREM’s Zulu Project could well be taken by Canmax to the joint Ford/CATL processing factories in China OR in the USA (remember that Canmax and CATL operate are arguably the same company wearing different hats).

But the key thing is that all these contracts rely on each other. Ford sells EVs, and takes some of that revenue and gives it to Canmax, which gives some of that revenue to PREM. But with any breakdown along the supply chain, nobody will be making anything.

Of course, Ford’s not the only one at it — Tesla has a three-year deal with Ganfeng, Volkswagen is planning a ‘full ecosystem of suppliers,’ and Renault has signed agreements with a handful of suppliers. The list is practically endless.

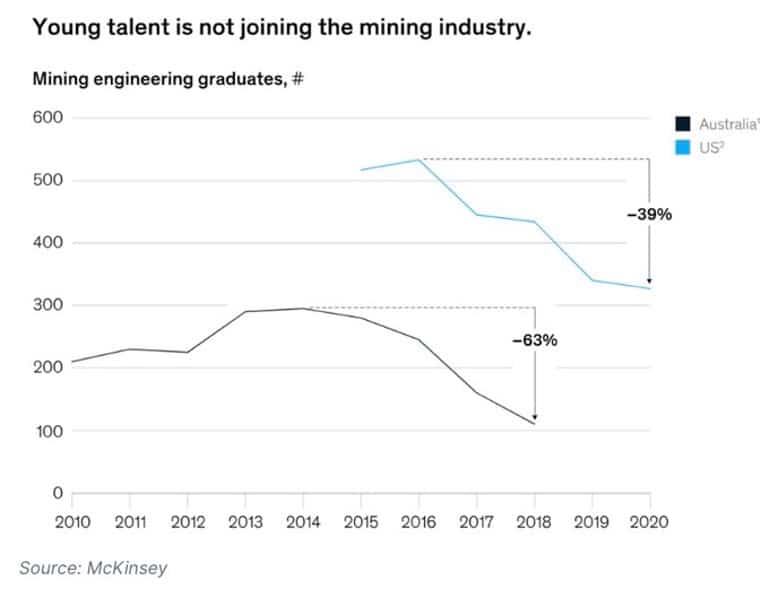

Then there’s the mining employment crisis. McKinsey notes that there has been a 39% decline in young talent joining the industry in the US, rising to 63% in the US (compared to the mid-2010s).

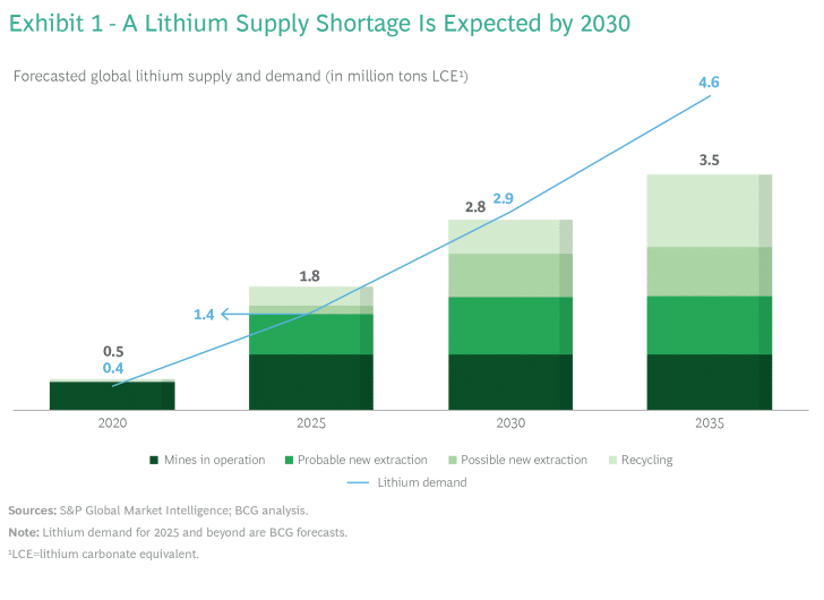

Right now, there is enough lithium capacity for anticipated demand until circa 2025 (interestingly coinciding with when Pilbara et al are planning to move to their own processing). This rises to 2030 if you assume that enough lithium recycling operations come online.

But even if you assume that every single new lithium mining project that the industry regards as economically and technically feasible goes into operation, McKinsey research shows that lithium supply by 2030 will STILL fall 4% short of demand by 2030 (circa 100,000 metric tons of lithium carbonate). By 2035, this supply gap is projected to rise to 1.1 million tons, or 24% less than demand.

For context, in 2021, the shortage gap — the difference between copper mined and demand — came to just 2% of production, enough to push up copper prices by 25%.

And no — despite the media frenzy, the old volcano at the McDermitt caldera in the US may not be the market-changing discovery analysts think. It might be geographically close to the 13.7 million-ton Thacker Pass but researchers are basing their 120 million ton estimates (and 2026 mining start date) on lab work only.

Not one single drill has broken the surface — and as geologists know well, theory and practice are ugly twins. There’s also almost certainly going to be a contaminants issue — and then there’s the environmental and Native American issues to consider.

Understanding lithium investing

You cannot directly invest in lithium, or the underlying commodity. Lithium is very different to other commodities. Like uranium, it is extremely reactive and usually has to be stored in an inert substance, often oil. It’s extremely expensive to mine, store, and transport.

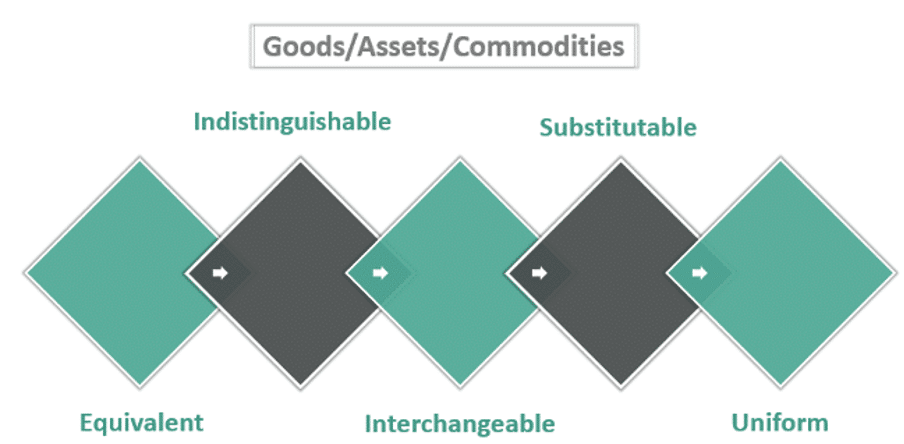

In addition to this issue, lithium from different sources is non-fungible. Fungibility essentially means that all of a certain item are mutually interchangeable; one pound sterling can be swapped for another, or one Bitcoin can be swapped for another — they are both fungible.

Gold and copper are also fungible — you can mine gold in an Australian mine, pan for gold in a river in the US, or dig a nugget out of a field in Africa, and the gold will be chemically close to identical.

By contrast, different sources of lithium are non-fungible, leading many analysts to characterise the silvery-alkali metal as a ‘speciality chemical’ rather than a commodity.

Lithium comes from three primary sources (excluding recycling):

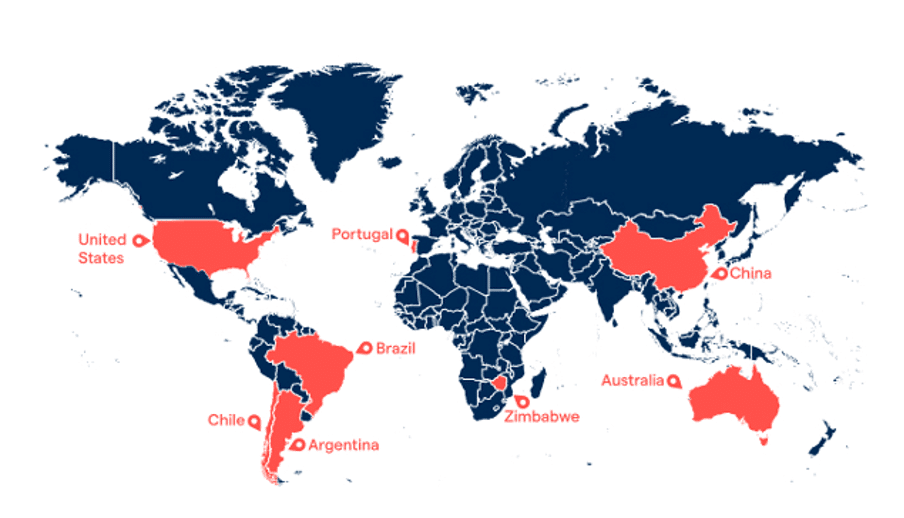

- Lithium-rich brine — a concentrated saltwater solution, found where ancient seas have evaporated over millions of years leaving behind concentrated lithium salts. The most significant deposits are found in the South American lithium triangle, covering Argentina, Chile, Brazil, and Bolivia.

- Lithium-bearing pegmatite — an igneous hard rock formation (spodumene is the usual lithium-bearing mineral found in pegmatites). Significant deposits are found in Australia, DROC, and Zimbabwe.

- Lithium clay deposits — which hold lithium minerals such as jadarite and hectorite. This is less popular, but a notable deposit is the Jadar deposit in Serbia.

As you can see, not only are there three different types of deposits, but there are also different types of lithium-bearing minerals, from which you extract different types of lithium.

Lithium hydroxide vs lithium carbonate

The two key types of lithium sold at the market are:

- lithium carbonate

- lithium hydroxide

Lithium hydroxide is the ‘premium’ product that the market wants. While lithium is used in dozens of products from antidepressants to heat resistant glass, the vast majority is used and will be used within batteries for EVs.

The market wants lithium hydroxide because, for complex chemical reasons, it’s far better for battery manufacturing than lithium carbonate.

Lithium extracted from spodumene, and other hard rock sources, can usually be turned into either carbonate or hydroxide, while lithium extracted from brine must first be turned into carbonate before being converted into hydroxide.

This is the reason why China wants lithium from Australia and Africa — domestic Chinese brine-sourced lithium from Sichuan is costly to process into battery-quality products. Spodumene lithium requires one round of processing, so is much cheaper.

It’s worth noting that there are huge technological strides being made in an attempt to bridge this gap, but the fundamental chemistry means that at present, hard rock producers’ costs are less than half that of brines — and deliver a product that is cheaper to manufacture into batteries.

This explains the power that Australia has in the lithium market — while it has less lithium than in the South American triangle, virtually all of Australia’s lithium is derived from spodumene — and China remains relatively happy to buy at premium prices.

Understanding SC6 production

Spodumene concentrate 6 (or SC6), is a high-purity lithium ore with circa 6% lithium content, produced as a raw material. SC6 quality can be as low as 5.5%, but not lower.

It generally takes about 7.5 tonnes of SC6 to create one tonne of lithium hydroxide. Hydroxide sells for circa 10-11x more than SC6, so there is a healthy profit margin for large-scale processors. SC6 is commercially valuable because it is currently scarce, and the higher purity means a processor can create more lithium hydroxide more economically.

The takeaway is that if you are looking for the best battery-grade lithium, it’s SC6 from a hard rock mine. Lower grades, such as SC4, are not worthless — but higher processing costs to get the correct hydroxide quality cut into margins, and the end result is often simply not as good.

Of course, this is only half of the equation.

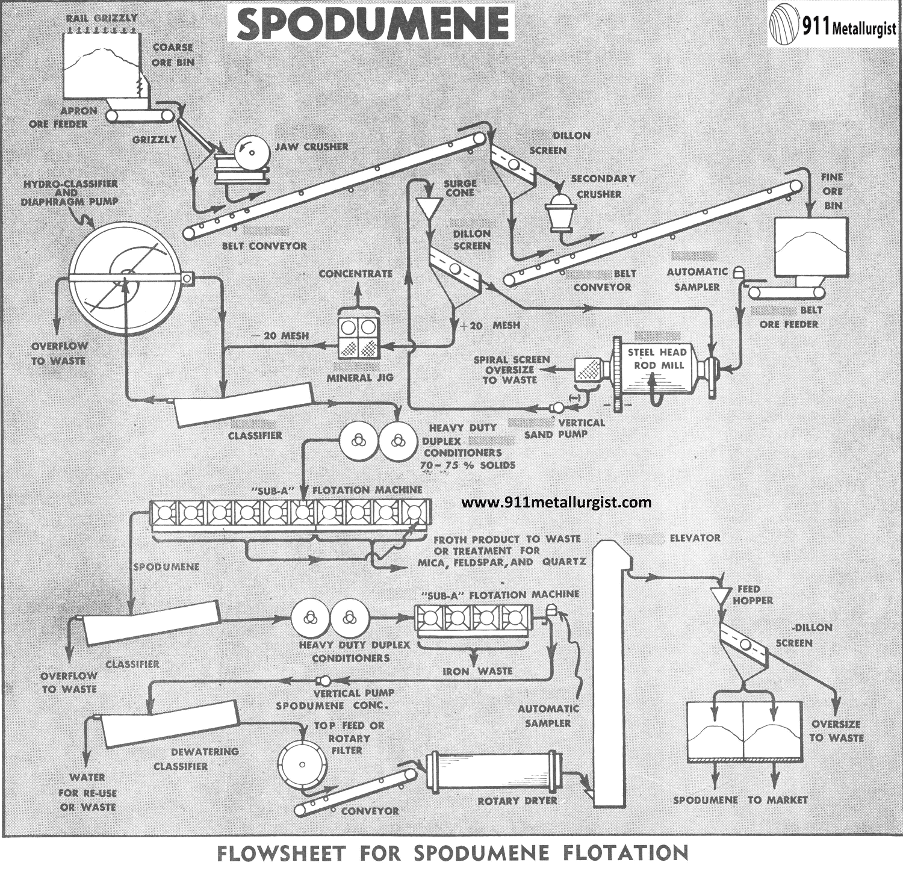

Here’s how it works — remember this is a relatively basic overview as overly technical language is unlikely to be of much use to readers. If you happen to be a mining engineer, I’m sure there’s a lot of detail missing.

There are two main grades of spodumene concentrate:

Chemical, used for batteries — <0.8% Fe2O3, SC5.0-SC6.0

Technical, used for glass/ceramics — 0.15% to 0.5% Fe2O3, >SC6.5

Fe2O3 is the symbol for iron oxide, while Li2O represents lithium oxide.

Obviously, African miners care about the chemical grading as they are selling to battery manufacturers, meaning that the iron content is just as important as the lithium. Let’s take two deposits:

The first is Li2O at 1.0%, Fe2O3 at 1.5%, and a recovery rate of 75%. If you want SC6, you will need 8 tonnes of ore because 8 x 1.0% = 8.0%, but only 6.0% given the 75% recovery. The problem is that you would also have to deal with 12% of Fe2O3.

The second is Li2O at 1.0%, Fe2O3 at 0.5%, and a recovery rate of 75%. If you want SC6, you will still need 8 tonnes of ore, but you only have 4% Fe2O3.

Converters will accept ore with higher iron content, but the iron produces clinkers when the spodumene is roasted when being converted to lithium hydroxide — and the more clinkers there are, the more expensive they are to remove.

It’s a similar story with mica and other contaminants — you can use magnetic or spiral separation to get some of the contaminants out before shipping, but at some point, too much iron in the deposit makes it economically unviable.

A good example of when the iron content will be too high to be worthwhile is if you plan to extract lithium from a volcanic deposit (see above). I would wager that the new super discovery will have too much iron. It’s simple geology.

Of course, before you can start talking about contaminants, you need to also grasp the concepts of traditional Dense Media Separation and flotation techniques.

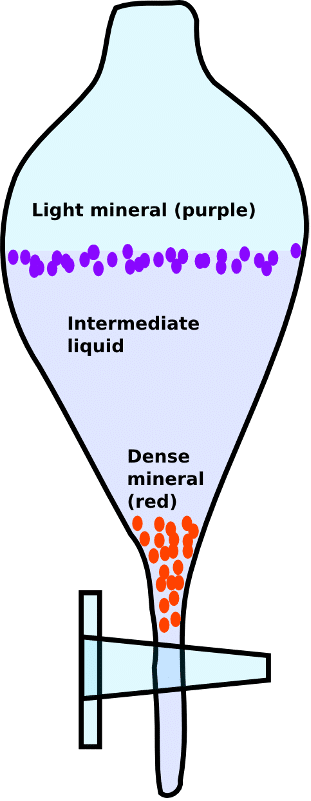

Dense Media Separation is actually very easy to understand — it works by separating out minerals based on their density (heaviness). For example, spodumene has a density of 3.11g/cm3, while quartz is 2.64g/cm3, iron oxide is 5.24g/cm3 etc.

Initially, the ore is crushed to free spodumene from other waste materials and then placed into a DMS cyclone with a heavy liquid separation liquid (the idea being that a material whose specific gravity is less than the liquid’s will float and a material with a greater specific gravity will sink).

The liquid usually has a density of 2.9g/cm3, such that as the cyclone spins, the heavier materials sink through it and lighter materials rise through it. Incidentally, this is why larger spodumene crystals are better, because they can be separated from waste with less crushing, which is cheaper. Smaller crystals need to be crushed within a ball mill and sent through to floatation.

Problems start when spodumene can’t be liberated from waste, because the density of the combined material means the spodumene you want will float out into the waste pile.

Four products are generally created using just DMS:

1. High grade spodumene concentrate

2. Waste product (quartz, feldspar, and various rubbish)

3. Intermediate product containing spodumene and waste

4. Small ore particles that can’t be processed using DMS

Dealing with the third and fourth types of product means hugely elevating extraction and profitability — you do this using floatation.

How does this work? The intermediate product and also the finer particles (3+4) are ground into fine material using a ball mill, increasing the surface area of the particles to make separation easier for the next steps. This ground ore is mixed with water and chemicals — including frothers, to create a stable froth on the surface of the flotation cell, and collectors which selectively bind to spodumene particles.

This slurry is then sent into flotation cells — either mechanical cells which force collector-coated spodumene to bind to air bubbles, or column cells where the air bubbles capture spodumene as they rise through the slurry to the surface. This creates a froth layer on top, which contains all the valuable material, which is then skimmed off, collected, and dewatered through filtration or centrifugation.

Hopefully, you then have your delicious SC6.

Of course, ore sorting can take this all a step further. I’ve gone into this in detail elsewhere, but typically you can add XRT (or NIR, colour etc) sorters from Original Equipment Manufacturers like Tomra or Steinert — or have them professionally integrated by engineers such as STARK or Consulmet.

XRT sorting works based on the principle that different materials absorb X-rays to varying degrees. For example, lithium-bearing ores absorb X-rays differently from waste materials. XRT sorting equipment distinguishes between valuable and worthless material, like how a doctor can distinguish bone through soft tissue on an X-ray scan.

Waste rock liberation through XRT sorting targets the higher density of waste rock, which sees waste removed from the material, improving the ore grade being fed into subsequent units. You can take this one step further through UV laser sorting, where the sorters can directly ‘see’ the spodumene. It requires the spodumene to be well liberated but usually achieves larger mass reductions and lower losses.

The process exploits the intrinsic chemical properties of spodumene (the unique UV fluorescence of its crystal lattice impurities), which is a clear difference from waste rock. UV lasers and sensors are used to scan ore particles, creating raw images of processed material.

The tech then merges the raw images to classify the ability of an ore particle to fluoresce within a pre-set range. On site, an ore particle that can fluoresce shows up green from multiple angles, while other materials will appear grey — and it’s a combination of these different technologies that can get the highest grade out of a deposit.

Can lithium be replaced?

While there are efforts being made to create mass-market hydrogen-powered cars, these will likely take many years to come online. It is true that some EVs still use nickel, as lithium shortages and the expense of manufacture make the metal much cheaper to use.

However, neither nickel nor any other element is likely to replace lithium. If you assume that the EV revolution is unstoppable — and not everyone agrees with this — then only lithium will work. Even though nickel batteries last for more charging cycles and can be recycled profitably, the chemical reality is essentially impossible to change.

For context, the UN Department of Economic and Social Affairs shows demand for electric vehicles Li-ion batteries increased from just 19 GWh in 2010 to 285 GWh by 2019. And demand is set to soar further to 2,000 GWh by 2030, representing 8% of the global energy supply.

Lithium is the least dense metal and by far the most effective for conducting electricity. Lithium-ion batteries charge much faster, and their maximum charging capacity is less affected after each charge.

Nickel has almost half as much energy density, so altogether this means much more is needed to power an EV. It also gets hot quickly so can only operate with a cooling system — another weight problem.

So whatever technical advances come along in the battery arena, the fundamental chemistry is not going to change. Instead, companies may choose to use nickel for some applications, and sodium-ion or hydrogen for others. But these simply cannot replace lithium as the best mineral for EVs.

Will there be a lithium spot price eventually?

As more producers come online and traders clamour for a way to lose money quickly, it’s essentially inevitable.

For context, oil is now thought of as fungible and therefore it is very easy to trade oil in myriad different ways. However, in practice, different types of oil vary hugely in chemical makeup, grading, sulfur, viscosity, lightness, sweetness, refinement needs, and usability.

Consumers can blend different grades to achieve a desired standard mixture, and benchmark prices have created an integrated pricing structure in the international markets that means most view one barrel of oil as good as any other.

As lithium gains in popularity, it’s not hard to see an enterprising individual looking to set up a spot ETF that somehow tracks lithium similar to Yellow Cake’s tracking of uranium. Further forward, money always finds a way.

The African mining story

One of the key ongoing themes in African mining is that countries want to get more out of deals made with both Western and Chinese companies looking to exploit precious metals and critical minerals. Consider:

- Zimbabwe’s raw lithium export ban

- Zambia’s lawsuit against Anglo-American

- Niger’s uranium pricing plans

- Mali’s mining taxation/regulation changes

- DROC’s higher licensing requirements

All of these have only become issues over the past year or so, but this will continue to be a theme as China and the West compete for lithium deals with African producers.

Of course, there is a fine balance as states which get too greedy regarding profit share or state equity in mining projects will see investment leave for another country. Africa is a massive continent — competition works in more than one way.

High-risk, high reward

I have covered the African five — PREM, KOD, ALL, ATM & MARU — in detail over the past year(s) through various outlets, including here at Investing Strategy.

But I try not to compare them too much as all five are operating in different countries, and are in completely different stages, with different geologies and risk factors.

Consider for example:

PREM is on the verge of production. Under the assumption that the company delivers the first product of SC6 to the assigned timeline, it will rocket. Failure will see investor confidence crash. The company has prioritised production over a DFS — a quick route to production, but with elevated risk. For example, financing remains constrained until revenues start flowing in.

KOD is on the verge of signing its Hainan deal. This has been ongoing for nearly the entirety of 2023, but a signature could well see Kodal rise to 1p as funding to production is then all but guaranteed. However, in the unlikely event that the deal is pulled, it would be a disaster. Meanwhile, it’s drilling fast.

ALL has Piedmont on board, and also MIIF funding from Ghana. But it lacks some licenses and hasn’t even announced details to get production started. However, there is a MRE and DFS which is being continually improved by drilling work.

ATM has started operations at its lithium pilot plant, and while Spodumene Hill is extremely promising, most of its revenue is still tied to the tin market, which has historically been extremely volatile. MARU remains at a relatively early stage, even if operations are accelerating rapidly.

But there is a key point here: this is not like comparing EV manufacturers such as Tesla or Ford. Every Tesla sold is a car that Ford could have sold, so they are in direct competition. This is different with lithium producers, including those with African deposits.

There isn’t enough high-quality lithium, so there is space in the market for every single one to generate huge profits, despite the risks right now. It does sometimes seem that there is competition between the stocks for investor funds, but the reality is that you can either invest in a mix or simply pick your favourite and wait for profits.

These deposits will be mined because market titans are desperate for supply.

My personal view is that it’s best to invest in all five to varying degrees – it makes a good night’s sleep much easier. Going all in on any one company is not a sound strategy; despite the promising potential returns, we’ve all been burnt before. While these companies may sometimes trade as pairs, the fundamental investment cases are separate. To trade these specific companies you could use these brokers:

| BROKER | PROS | FEATURES |

|---|---|---|

| + Founded in 1974 + First-class web trading platform + Superb educational tools + Great deposit and withdrawal options | Fees: Spread cost; Overnight financing costs; Inactivity fees Min. Deposit: $£250 Tradeable Symbols: 19537 |

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. |

||

| + Fast withdrawal + 0% commission on US stocks + Real Cryptos, Stocks + Copytrading + Social Trading + PayPal deposits possible + One Stop Shop | Fees: $5 withdrawal fee. Inactivity fee. Min. Deposit: $50 Pairs Offered: 47 Leverage: 1:30 Tradable Assets: 2000+ |

74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

||

Finally, it’s important to remember these companies remain high risk. All of this is only opinion – and very much NOT advice.

But global demand for lithium is only going to rise — and as supply will eventually catch up, this is a genuine once-in-a-lifetime opportunity. There are about a dozen quality blue-chip lithium stocks to buy for those looking for less risk, but for investors wanting to make astonishing returns within a few years, this chance won’t come again.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Excellent article, as is the AVCT research, thank you!

Thank you Malcolm. We will let Charles know.