Here at Investing Strategy, we like to cover high-risk, high-reward shares in select sectors that provide the best opportunities in relatively short time frames.

One of these sectors is small-cap mining, with a focus on FTSE AIM, ASX, and TSX stocks. There is a reason for this: the London, Canadian, and Australian small cap markets have outsized junior resources offerings compared to other markets and offer a fair balance of risk and regulatory protection.

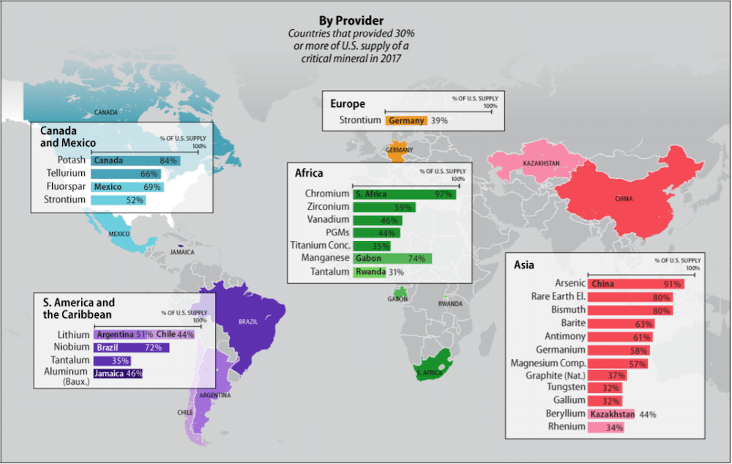

Beyond this, we have an investing thesis — which has been covered in great detail — that there are huge supply gaps, especially for the west, when it comes to critical minerals including lithium, copper, graphite, nickel, REEs et al. The basic argument is that anticipated future demand — as green energy and the rEVolution accelerate — for these minerals will vastly increase, while legacy supplies continue to degrade and the industry refuses to invest through what could be a recessionary period.

If you consider the economic data coming out of China, which controls most of the global production and processing (and also uses up much of these minerals domestically), it’s not looking good. There is little short-term incentive for capital expenditure at the likes of Glencore or Rio Tinto, especially at the junior resource level, as investors in the majors prefer the dividend income instead.

But over the longer-term, the juniors with quality deposits will be in the driving seat in future negotiations.

Our view is that this is inevitable — and a large part of the reason why we have covered a wide variety of small cap mining shares in the critical minerals space over the past couple of years. Beyond this, we are also relatively confident that the bottom is now in (or very close) for the junior resource space, which has suffered a fairly harsh 2023 thus far.

Mining stocks: how to get started in 10 easy steps

Before you start investing, there are some basics to get to grips with here. Once you’ve read the primer (and remember, this is not advice):

- Educate Yourself — before investing in any sector, including mining, it’s crucial to educate yourself about the industry, the commodities being mined (e.g., gold, lithium, copper, etc), the companies involved, market trends, and geopolitical factors that can affect mining operations and commodity prices. This is a learning process that never ends, but the best day to start is today.

- Research Mining Companies — research possible mining investments to understand their financial health, project development stage, management team experience, and overall business strategy. Look for companies with a strong management team and promising mining asset(s). My personal view is that you need to have faith in the CEO — and many are ‘characters’ to say the least. An important part of research is to source viewpoints from at least three sources; my interpretation of an RNS may be very different to another analyst’s, and the more perspectives you get the better.

- Commodity Analysis — analyse the commodities the mining company is involved in. Commodity prices can significantly impact the profitability of mining operations. Understand the supply-demand dynamics and factors influencing prices — lithium’s price will likely rise over time, while tin will probably be very volatile, and iron less so.

- Financial Analysis — examine the financial statements of mining companies. Look at key financial ratios such as its debt-to-equity ratio, cash flow, and profitability margins. A financially stable company is better positioned to weather market fluctuations. With small caps, it’s important to try to figure out how a company plans to bring an asset to production. There is no one right way to do this, but popular choices are share placings, alongside offtake or JV partners. Each has their own merits and downsides.

- Assess Risks — mining stocks are subject to a variety of risks, including commodity price volatility, geopolitical instability, regulatory changes, environmental concerns, and operational challenges. Volatility is a given in the small-cap space, and it’s not uncommon to see daily 10% swings with large spreads at the close.

- Diversification — while we cannot give advice, putting all your capital into a single mining stock might not be the best idea. Diversify your portfolio across multiple mining companies and potentially across different commodities and geographies to spread risk.

- Long-Term Perspective — mining investments can be cyclical, subject to short-term volatility, and take years to get to profitability. Consider a long-term investment perspective to potentially benefit from the company’s long-term prospects and try to ignore the short-lived dips and spikes. If you can’t help but sell at 20% up or down, you will likely lose money over the long term.

- Stay Informed — easy for professionals who do this all day, but you need to keep up with industry news, market trends, and any developments related to the mining companies you’re invested in. While we subscribe to a long-term investing philosophy, a material change such as a CEO exit or poor drilling result can make it worth considering making an exit.

- Stay Unemotional — this is harder than it sounds. When you invest in a mining company’s journey, it can be hard to let go if it doesn’t end up well. Investing in early-stage companies does require conviction, but it’s also important to accept when you have made a mistake and get out with at least some of your capital.

- Choose a Brokerage Account: Open a brokerage account that allows you to buy and sell mining stocks. Ensure the brokerage platform provides the necessary research tools and resources for analysing mining companies — I’ve listed three popular choices below.

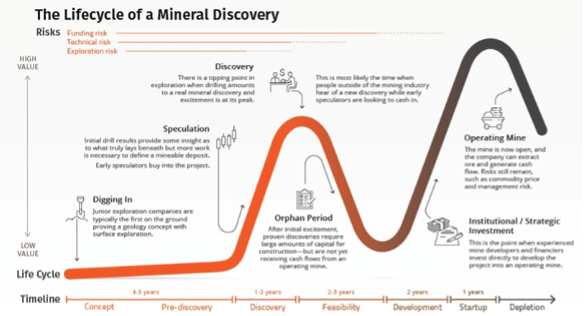

One of the most important factors to keep in mind is that most exploratory mining companies fail to turn a profit, ever. From concept, to scoping, to pre-discovery, to pre-feasibility, to feasibility studies, to development, through the orphan period, into operation — there’s a thousand things that can go wrong (and that’s in a Tier-1 jurisdiction).

You are trying to pick winners in a sea of losers; but if you get it right, then the rewards are far greater than in almost any other sector.

4 best platforms to consider

1. IG Index

IG Index is perhaps the very best platform for UK investors looking for a platform offering access to small-cap mining shares. The UK’s largest CFD trading provider offers access to a whopping 18,000 global instruments, alongside some of the best technical tools on the market — including guaranteed stop losses and access to sophisticated trading technology.

If IG does not offer trading on the share, then it’s probably unavailable to the typical retail investor. Everything from the AQSE minnows to the FTSE 100 titans is available. And the app is exceptionally user-friendly — though it makes sense to make use of the demo account to test out all of the functionality.

Further to this, IG offers some of the best blue chip analysis and educational content available anywhere in the investing world — though in the interest of fairness, Investing Strategy’s lead analyst also works with the platform to create this content.

The platform charges £8 per trade per month for most equities, but this drops to just £3 per trade when you trade 3+ times per month. Given the importance of accurate pricing, this can end up being cheaper than using a ‘free’ platform. And importantly, ISAs and SIPPs are both available.

IG

- Founded in 1974

- First-class web trading platform

- Superb educational tools

- Great deposit and withdrawal options

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

2. eToro

eToro is and remains one of the most favoured platforms in the UK, and with good reason. Its social media marketing strategy, tie up with X (formerly Twitter), and focus on copy trading have all helped it to become a preferred marketplace disruptor.

In particular, the copy trading aspect means that there is a strong social community to get additional perspectives on your favourite mining stocks from professionals you may not find elsewhere. And it’s all close to free. eToro boasts access to more than 3,000 instruments.

The app itself is well designed with a strong UX — features including push notifications, flexible search, and two-step authentication to keep your assets safe. And the platform itself is simply intuitive, making investing and trading both at home and on the move relatively simple.

Stock trading is completely free (with caveats covered here), and it’s very quick and simple to open your account. On the downside, there is limited educational material — which isn’t ideal for beginners, and non-core fees can mount up. For example, while trading is commission-free, there are fees for withdrawals, inactivity, and currency conversions.

However the $5 withdrawal fee covers any amount, so it discourages depositing and withdrawing small amounts, which can be good from a psychological perspective.

3. Plus500

If you want to trade mining stocks rather than invest (not our style, but up to you), then Plus500 is a popular choice. Plus500 has a decent CFD offering, allowing you to speculate on the price movements of shares without owning the underlying asset.

As I have covered in the past, most people lose money trading CFDs, there are no tax advantages, and it is often newer traders losing money to more experienced traders on the other side of the trade. On the other hand, trading on leverage can be seriously profitable for the lucky few.

Trading on Plus500 is commission-free, the app is easy to download and navigate, and it has decent alerts and search functions. Trading tools on offer are fairly advanced, and it even has a smartwatch app if you feel like looking like a finance bro.

On the other hand, there are inactivity fees — and some investors find they need to upgrade once their knowledge base expands.

Plus500

- Advanced risk management tools

- 24/7 online support.

- 30+ languages.

- All devices.

- 0 commissions.

82% of retail investor accounts lose money when trading CFDs with this provider.

4. AvaTrade

AvaTrade is immensely popular globally for its forex trading offering, with 55 major currency pairs, a huge range of CFDs, and excellent educational content. But it’s good for stock trading too — it has a great selection of trading platforms, it’s easy to open your account, and the copy trading on AvaSocial is just as good as at eToro.

Avatrade could be the best platform for buying blue chip mining stocks, such as Rio Tinto or Antofagasta. While there are high inactivity fees, slightly higher costs than elsewhere, and a limited range of assets to trade, its worldwide presence makes it a popular choice for investors looking for a globally recognised brand.

AvaTrade

- Fast order execution

- Tight spreads

- Zero commissions

- Big variety of deposit methods

- Risk-management for beginners “AvaProtect”

- Negative Balance Protection

76% of retail investor accounts lose money when trading CFDs with this provider.

Choosing an investment app for you

There are several important questions to consider when it comes to choosing an investment app — whether for mining stocks or otherwise:

Is there a Demo Account?

Practising on a demo account allows you to try out a platform, check it offers all your favourite shares, and see whether the UX design works for you. What works for one investor won’t work for another, and there are literally hundreds of differences between each.

Can you open an ISA/SIPP? The tax advantages of ISAs and SIPPs are simply outrageous, and you can invest £60kpa into your SIPP from your gross income, and £20kpa into your ISA from your net income. If you prefer to invest rather than trade, this is a key decision factor.

How experienced are you?

Your investment experience will determine what platforms work best for you. If you plan to trade often, know all the basics, want all the latest tools, and are happy with your risk attitude, then you will need a different platform compared to an investor just starting out.

Do you understand the fees?

High fees can eat away at your gains, but even the so-called ‘free’ apps charge in one way or another. It’s important to consider the entire cost of opening an account, opening a position, closing it out, FX fees, withdrawal costs, overnight charges, and even inactivity fees. That’s just the start.

Do you need customer support?

In the days of instant apps, you might find you don’t think you need decent phone-based customer support — that is, until you do. A 24/7 hotline usually only comes with a premium platform, and you must usually be prepared to sacrifice some customer service if you go down the commission-free route.

How safe is my app of choice?

There are three key factors UK investors should look for: FCA authorisation, FSCS compensation scheme compatibility, and two-factor authentication. These three things are critical — and if not, a suitable alternative.

The bottom line

Investing and trading in early-stage mining stocks is high-risk, high-reward activity. Learning how to invest takes time, and picking the right investing app or platform for you can be a case of trial and error. It can make sense to open Demo Accounts with multiple providers (starting with the three above), and then progressing into live accounts when you feel confident.

Similarly, it can make sense to invest in blue chip miners such as Rio Tinto, BHP, or Glencore, while engaging in small cap research. This can help you avoid losing money simply due to a lack of research or market understanding — before you take the plunge with your first high-risk investment.