Flagship Tulu Kapi in Ethiopia ticks all the right boxes. The value disconnect seems clear and in theory, won’t last long.

As a long-term investor in promising junior resource sector companies, I am always on the lookout for undervalued shares. And Kefi may now make the cut.

For context, exploratory gold shares have a much higher threshold for me to consider investing in than companies looking for lithium, copper, or graphite. There are two simple reasons for this:

- the critical minerals supply gap means that companies with promising assets are invariably on to a winner. Gold projects are different (even though Kefi also has copper on the books) — I don’t tend to invest unless there is an outstanding investment case.

- I would consider myself a critical minerals expert* but have much less knowledge about the gold market.

Gold companies I have covered in 2023 include Amaroq (up 40% y-t-d) and Hummingbird (up 63% y-t-d). I also think Greatland Gold now holds excellent value having fallen by circa 20% this year and am actively increasing my holding over time.

As a fan of diversification, I like to split investments across four or five opportunities within a single sector: in lithium, these are PREM, KOD, ATM, ALL, and MARU. In oncology, it’s AVCT, POLB, CIZ and HEMO. In new tech, I favour OPTI, TEK, ABDX, and ONDO. Investments are not split equally by any means, but it does make investing less stressful than going all in on one company.

And then we come to gold. ARMQ, GGP, and HUM need a compatriot — and KEFI is looking like a promising candidate.

Let’s dive in.

What a lovely share chart. That’s AIM alright.

Kefi shares were changing hands for 2.58p in September 2020, and had fallen to 0.53p by the end of August 2023. That’s not the kind of three-year performance anybody might want to see — but it is exactly what value investors are looking for.

While timing my exact entry will probably see me send a message to the technical analysts on my speed-dial, it’s not hard to see a bottom starting to form.

The Flagship

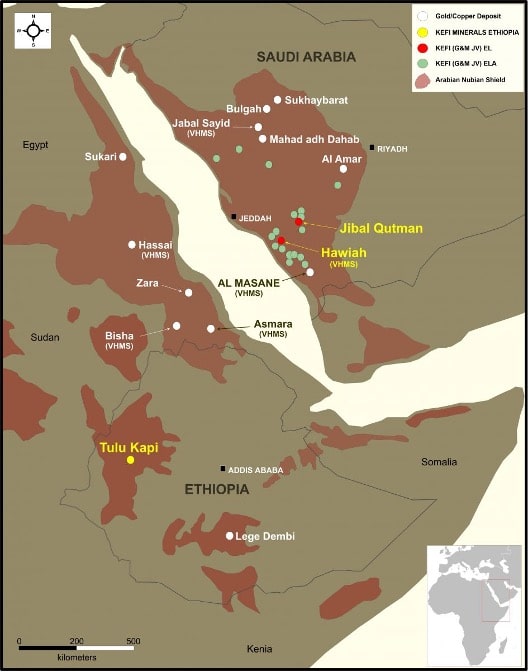

Kefi has interests in various assets, but the flagship is clearly Tulu Kapi in Western Ethiopia. The asset has a probable ore reserve of 1.05 million ounces and Mineral Resources of 1.72 million ounces.

The company arranged the Tulu Kapi Mining Agreement with the Ethiopian government in 2015, with terms including a 20-year mining licence, full permits for development and operations, and a 5% government free-carried interest.

As part of the Definitive Feasibility Study into the project, gold production will be an estimated 140,000 ounces per year, over seven years of open pit mining, while estimated AISC should be circa $950oz. While this is much lower than the industry average, I’d caution that these costs estimates are likely out of date given inflation.

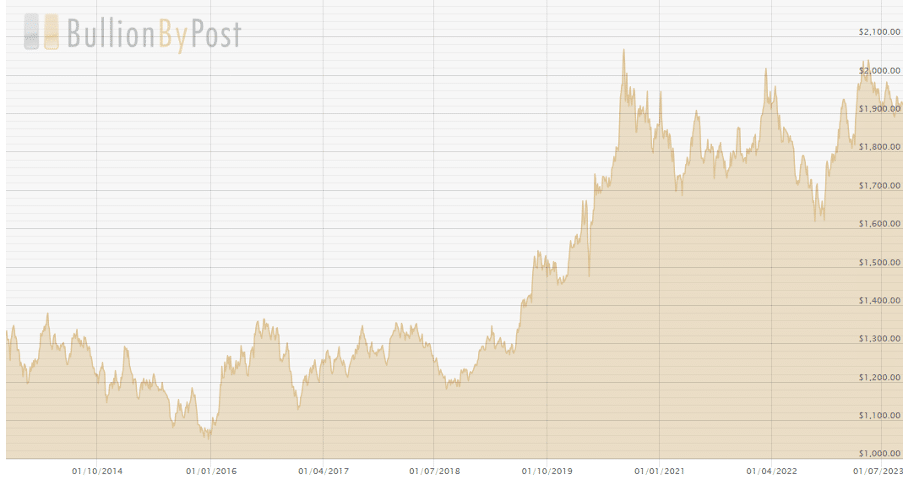

Happily, gold continues to trade near its record high, while central banks continue to stock up at record levels — so higher costs will likely be outweighed by rising profit margins.

Further, the DFS is completely JORC compliant and has been reviewed by several independent experts — and further exploration surrounding the project suggests that possible extensions are likely also profitable, extending possible LoM operations. Kefi’s exploration licences cover 200 square kilometres over and near the key deposit.

Kefi originally purchased a 75% interest in Tulu Kapi in December 2013 for £4.5 million — equating to just $10 per reserve ounce, and then acquired the remaining 25% in September 2014 for £750,000 and 50 million shares.

Bear in mind, previous operator Nyota had already created an initial DFS in December 2012 based on a 2.0Mtpa processing plant and capital expenditure totalling $290 million. And the asset is just 12km from the main road to Addis Ababa, and 40km from main electricity grid power lines.

Excitingly, on 5 September, the company announced that ‘the period between now and the end of 2023 is particularly important for KEFI and regular updates will be announced.’

Here’s the Clef notes:

- The project is moving forward steadily, with almost all the necessary prerequisites for construction in place.

- Focus is now on securing the final credit and board approvals for project financing.

- The project launch is scheduled for Q4 2023, and first production is expected by the end of 2025.

Capital Controls

Syndicate lenders are actively engaged with the National Bank of Ethiopia, the Ethiopian central bank, regarding capital controls.

A recent development includes the publication of a new NBE Directive on 14 August 2023, specifically related to foreign exchange controls.

This directive is now being integrated with project-specific details for the Tulu Kapi Gold Mines project. These changes within the directive are seen as favourable for the country and are being incorporated into KEFI’s plans. Intensive meetings were focused on addressing specific details and documentation requirements resulting from these changes in relation to the Tulu Kapi development — and the company has now affirmed these.

Further, formal approval of the updated Environmental and Social Impact Assessment has been received, facilitated by the Ethiopian Ministry of Mines, together with the requested updated completion schedules by the electricity and roads authorities for offsite infrastructure. This leaves only documentation and administrative matters to consider.

Accordingly, independent technical expert Behre Dolbear International has conducted an assessment and confirmed TKGM’s readiness for the development launch.

Drill Planning

- Plans have been made for grade-control drill planning in 2024 to support open-pit operational readiness programs.

- Additionally, there are plans for resource-extensional drilling in 2024-2025 as part of the underground mine feasibility study.

Funding Breakdown

Historical pre-development expenditure of approximately US$90 million was funded through equity sourced from stock markets in the UK, Australia, and Canada.

The $390 million development funding has been further detailed within Kefi’s finance syndicate as follows:

- A mining services contractor will provide $70 million in mining fleet equipment against the TKGM mining services agreement.

The remaining $320 million is divided into debt-risk capital and equity-risk capital:

- Debt-Risk Capital: circa 60% of the project finance ($190 million) will be injected at the TKGM level by co-lenders.

Equity-Risk Capital: $130 million will be injected as follows:

- $40 million will be allocated as share capital to local partners in subsidiary companies.

- $90 million will come from major international corporations in the form of Equity Risk Notes.

- Some ERNs are non-convertible and will be repayable in cash only out of future revenue.

- Others are potentially convertible into KEFI shares, beginning from the end of the third year after funds drawdown, at the higher of the price at funds drawdown and the then market prices based on VWAP.

- Kefi has the option to request repayment in cash, which is considered feasible due to the estimated healthy surplus cash generation from the Project, assuming a gold price of $1,850/ounce. Remember, gold remains close to a record high and this may not continue.

Where next?

Once the project’s financing is closed, as noted above, the company plans to launch development of open pit operations at Tulu Kapi for first production by the end of 2025 — with a PFS on potential underground mining operations to be completed in 2024, followed by a DFS in 2025.

Saudi Arabian Plans

Away from the flagship, Kefi also has operations in Saudi Arabia — which is desperately trying to move away from oil dependency.

There are two key projects to be aware of:

Jibal Qutman

- Kefi is aiming to conduct a Definitive Feasibility Study on this project.

- It completed a 13,000-metre drilling program designed to update the current Mineral Resource Estimate (MRE). The drilling mainly targeted shallow open pits to improve the classification of Mineral Resources, to come closer to declaring Ore Reserves.

- Detailed mine planning has already commenced for open pit mining.

- In addition to drilling, Kefi completed metallurgical testwork on the Oxide Ore. Furthermore, Phase 1 of the Fresh Ore Testwork Program is already underway.

- Kefi is also conducting additional metallurgical testwork with the goal of enhancing gold recoveries from sulphide ores.

- After completing the Mineral Resource upgrade drilling, the company intensified exploration efforts to discover nearby resources. It initiated the process by sampling dumps from extensive artisanal workings, which suggested the presence of gold-bearing structures that require further investigation.

- Trenching and diamond drilling are also underway to explore prospects in close proximity to the planned open pits.

- The company presented their findings and progress on the Jibal Qutman Gold Project the Society of Economic Geologists’ ‘Resourcing the Green Transition’ conference in London on 29 August 2023.

Hawiah

- Kefi is also focusing on its Definitive Feasibility Study at Hawiah.

- It’s conducting extensive drilling across the project area, including Crossroads, Crossroads Extension, Camp Lode, and Central Zone. This drilling campaign aims to upgrade the Hawiah Mineral Resource Estimate.

- Drilling results have been positive, with the deepest drill hole in Crossroads Extension uncovering a 7.5-meter-wide mineralisation at a depth of 750 meters below the surface. This represents a significant extension from previous drilling.

- Ongoing metallurgical test work has been confirming the flotation recoveries used in the Hawiah Pre-Feasibility Study. Additionally, it has provided data to evaluate alternative processing routes such as SX/EW or the Albion Process, which could further enhance recoveries.

- At the Al Godeyer Exploration License, Kefi has been conducting infill drilling to expand the maiden Al Godeyer Mineral Resource Estimate, with the goal of increasing the resources to 2 million tonnes.

- Exploration activities have also commenced at the Abu Salal Exploration License, located 50km south of Hawiah. Initial trenching at this greenfield site has exposed a 2-kilometer-long, discontinuous gossanous ridge, revealing the main VMS horizon.

The bottom line

Kefi shares are depressed by weak market sentiment, but the fundamentals are strong and significant ongoing drilling continues to de-risk the investment case. At some point the shares will become exceptional value — they may already be there given the promised news flow between now and the end of the year.

Perhaps the company — Kefi is Greek for ‘joy’ — may start to live up to its name.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.