The penny stock market can be exciting and profitable. But you’ll need to understand the risks to trade with the right strategy. This guide explores everything to know about penny stock investment.

Concise Overview

- Penny stocks are a type of security that is typically traded on the Over-the-Counter (OTC) market

- The penny stock market is a volatile, risky investment opportunity with a lot of room for growth

- Investing in penny stocks requires a thorough understanding of the entire process

Introduction to Penny Stocks

If you’ve ever wondered how to invest in penny stocks, you’re not alone. This type of trading has been around for decades and is popular with many traders. However, there are still some things to learn about it to be a successful trader.

To understand how to invest in penny stocks, it’s essential to understand what they are and what it means to invest in them. Penny stocks can be extremely risky investments because they frequently trade at prices below $5 per share or even less than one dollar per share. However, if you find the right company at the right time, you could make a considerable return on your investment.

If you’re interested in investing in penny stocks but don’t know where to start, this guide explains everything.

What Are Penny Stocks?

Penny stocks are low-priced, high-risk investments. They’re often traded through the over-the-counter (OTC) market, meaning most aren’t listed on a major exchange like the New York Stock Exchange or NASDAQ. These stocks usually have low volume and may be hard to find even when you know what you’re looking for.

Penny stocks can be risky because they’re often illiquid, which means they don’t trade very often, and their value is hard to determine. As such, people who buy penny stocks may lose money if they can’t sell them quickly enough — or at all — and may not be able to get out of their investments when they need to.

Who Should Invest in Penny Stocks?

Due to their nature, penny stocks aren’t for everyone. The following are investors who would benefit from penny stock investment:

Day Traders

If you’re a day trader, you’ll want to invest in penny stocks. If you’re unfamiliar with this, day trading involves buying and selling stocks within one trading session (usually between 9:30 am and 4 pm). The goal is to build up a profit before the end of each day by taking advantage of short-term price fluctuations. This may sound too risky for most people, but as long as you have some experience investing and know how to manage your risk, it can be an excellent way to make money off penny stocks.

Seasoned Investors

Seasoned investors are more likely to take a longer-term view on their investments. They understand that volatility is part of investing and can tolerate the ebbs and flows of the market. They usually have enough money invested through other means (like mutual funds) that they don’t need to depend on their investment portfolio for financial security or stability.

Short Sellers

Short sellers are people who believe the value of a company’s stock will go down. They, therefore, sell the stock at its current price and repurchase it later at a lower price, making money from the price difference. They find penny stocks attractive because there is often more volatility than with larger stocks. Usually, the higher the volatility, the higher the gains, and these investors know how to ride the profits within a short period before they turn negative.

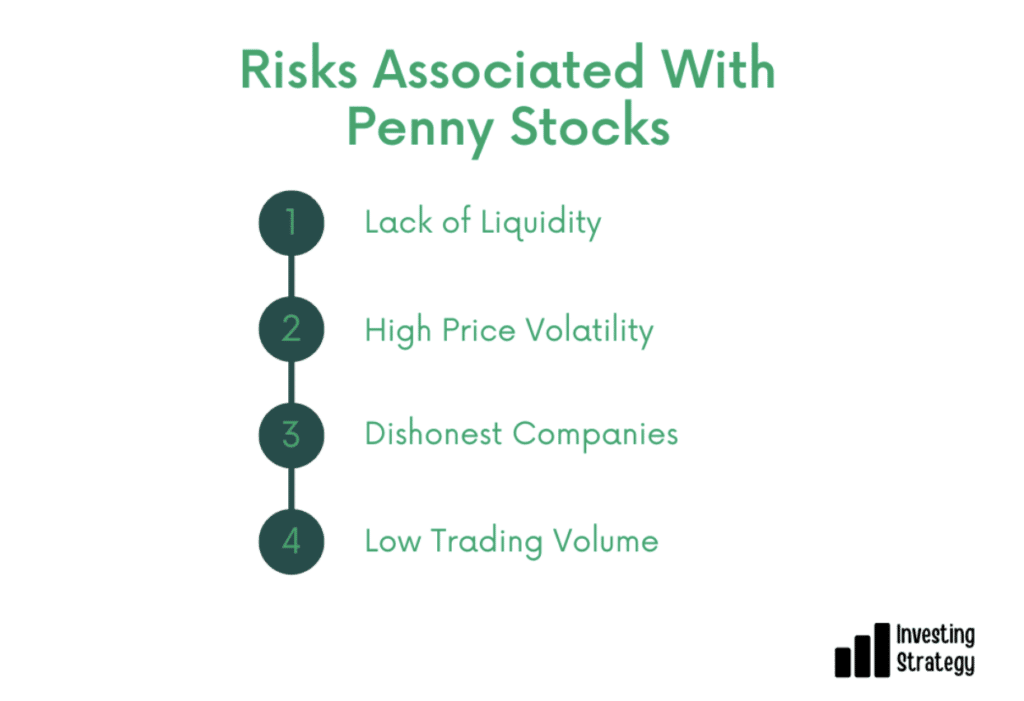

Risks Associated With Penny Stocks

Risks mean many things to different people. To investors, they’re a necessary evil. So, before you invest in any penny stocks at all, here are some risks to know:

Lack of Liquidity

Liquidity measures how easy it is to buy or sell an asset. The more liquid an asset is, the easier it is to buy and sell. In some cases, the lack of liquidity can cause investors to lose their investment entirely because they cannot find a buyer for their shares. Penny stocks are often illiquid because they’re traded on the OTCBB or Pink Sheets exchanges — exchanges that don’t require minimum standards for disclosing information or trading volume.

High Price Volatility

Penny stocks are volatile, and the underlying companies can be even more so. This can make it difficult to determine an accurate value for the stock. In addition, penny stocks are often thinly traded, meaning there are few buyers and sellers at any given time. This makes it difficult to understand how much a particular share is worth.

Dishonest Companies

Not all penny stocks are scams or fraudulent companies. However, there are many dishonest companies out there that use penny stocks as their vehicle for deceitful practices. These can be very dangerous for investors who do not fully understand what they’re getting into when they buy these types of stocks.

Low Trading Volume

The volume of trading in penny stocks is low compared to other types of securities, which makes it difficult for investors to sell their shares quickly when they want to exit their positions. This is not a problem for investors looking to hold their positions long-term, but it can be a significant problem for traders who need to sell quickly due to other financial obligations. The low trading volume in penny stocks makes them harder to sell than other securities.

What Are Penny Stock Scams?

Penny stocks scams are companies that have no value but promise high returns. They’re often sold to small investors who don’t know better. Their fraudulent strategies often include claims about how much money you’ll make if you invest in their company. Here are common scams to look out for:

Pump and Dump Scam

This scheme involves a person or group acquiring large amounts of cheap stock and then promoting it as a ‘hot’ tip or ‘can’t miss’ investment. Once the stock price has risen, the perpetrators sell their holdings, causing the stock price to plummet and leaving investors with worthless penny shares.

Chop Stocks Scam

A chop stocks scam is similar to a pump and dump scam in that it involves artificially inflating the price of a stock through false information about its value. However, instead of selling off their shares at this inflated price, the perpetrators sell them at regular market rates. Then they wait for the price to drop before re-purchasing them at an even cheaper value.

Insider Trading

This happens when someone who works for a company buys or sells shares based on information about the company that others don’t have access to. This usually happens because they’re privy to confidential information about upcoming events or developments within the company itself.

How To Buy Penny Stocks

You can’t buy penny stocks without following some procedures. Whether you’re buying through the intuition of someone you know or a blog you read, below are some steps to take:

Do Your Research

Before you invest in any penny stocks, you must do thorough research on the company and its products or services — and make sure that those products or services are helpful. You should also look at the company’s financial records (including profit margins) and talk with other investors who have already purchased shares of this particular company before committing any money of your own.

Choose a Broker

Many brokers focus on penny stocks, so you’ll have several choices. A good place to start is with your bank or credit union. They may offer discounted rates on trades, saving you money in the long run. You can also find brokers online. However, you should find a broker you can trust. If the company is legit and the products are genuine, it should be easy to find a broker who will offer them to you.

Start Trading

The trading process aggregates several processes. It includes opening a live trading account and funding it. It also involves making some analyses on position size, trade placements, and the entire buying and selling decisions.

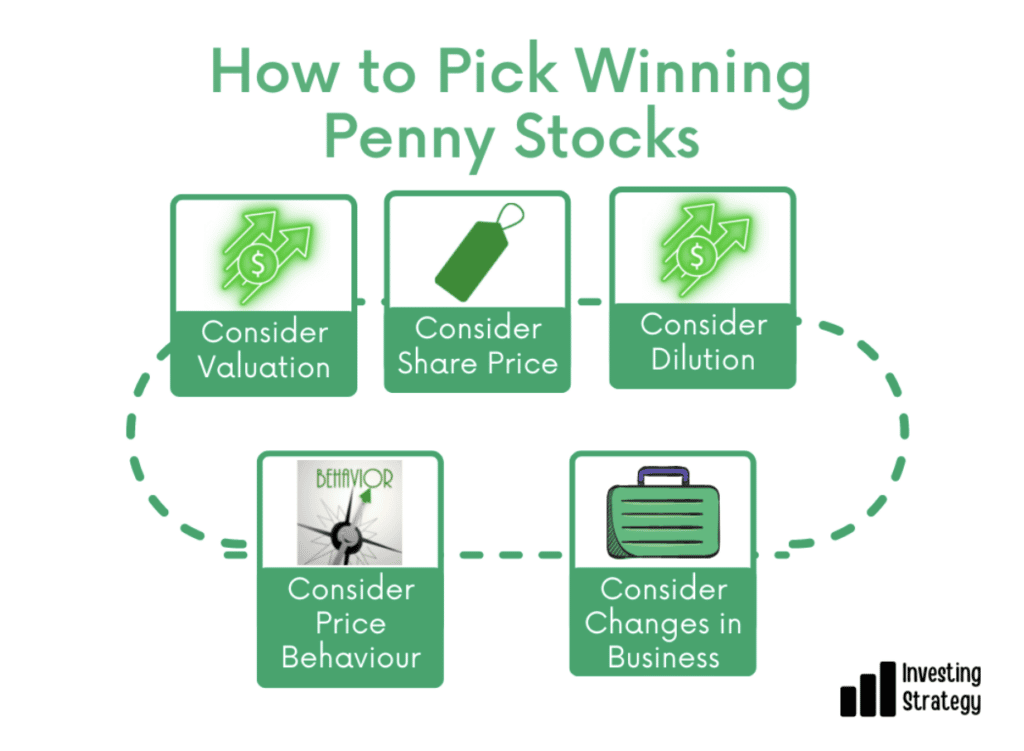

How to Pick Winning Penny Stocks

Picking winning penny stocks can be a tricky business. It’s hard to find a stock that is both undervalued and has growth potential. Many people rely on technical analysis, but there are also other ways you can approach the process.

Consider Valuation

One of the most important things to consider when choosing a penny stock is its valuation. A company’s valuation refers to its total market capitalisation (the value of all shares), divided by the number of outstanding shares. This figure will tell you how much each share is worth and give you an idea of how much each investor has put into the company — and whether or not it’s worth investing.

When companies have low valuations, their stock may be cheap enough that even if they don’t perform well, there might still be some profit left over for investors who buy in at the right time. However, because these companies tend to be riskier than those with higher valuations, it’s essential not only to look at a stock’s price but also its earnings per share (EPS).

Consider Share Price

A company’s share price is an essential measure of its success, and penny stocks are no exception. A low share price can indicate that the market has high confidence in the company’s future performance, or it may mean that investors are wary of investing in a company with a fragile business model.

When you buy shares, you’re investing in the company’s future. You’re essentially betting on the company’s success — and if it succeeds, your investment will pay off handsomely. You should always look at what other investors are doing before making an investment decision. If many people are buying shares in a particular company, it’s probably a good idea for you to do the same.

Consider Dilution

Dilution refers to the fact that new shares are being created and sold by the company. This makes it harder for existing shareholders to maintain their percentage of ownership in the company. For example, if a company has 1 million shares outstanding and they issue another million new shares, they now have 2 million shares outstanding. As a result, the percentage of ownership you hold in the company has decreased by 50%.

This is something you want to avoid when picking penny stocks because if you invest in one that’s issuing a lot of new shares, it might not be able to make enough money to keep paying dividends on those shares, so your investment will suffer as a result.

Consider Price Behaviour

Price behaviour refers to how a stock’s price moves over time based on its volatility. This can be seen through the stock’s Bollinger Bands, which show the range of price fluctuations over time and whether they’re widening or narrowing. In general, penny stocks that exhibit an upward trend (meaning they’re consistently increasing in value) tend to be more stable and less risky than those that show downward trends (meaning their prices are falling).

Consider Changes in Business

It’s not enough to know that a company is doing well — you need to know why they’re doing well and what might change in the future. If a company sells more products than it did last year, then its revenue will likely increase as well. That increase in revenue means their stock price should also rise. If there are no significant changes in the industry or the company, it’s probably a good idea to invest your money there because you can be confident your investment will grow over time.

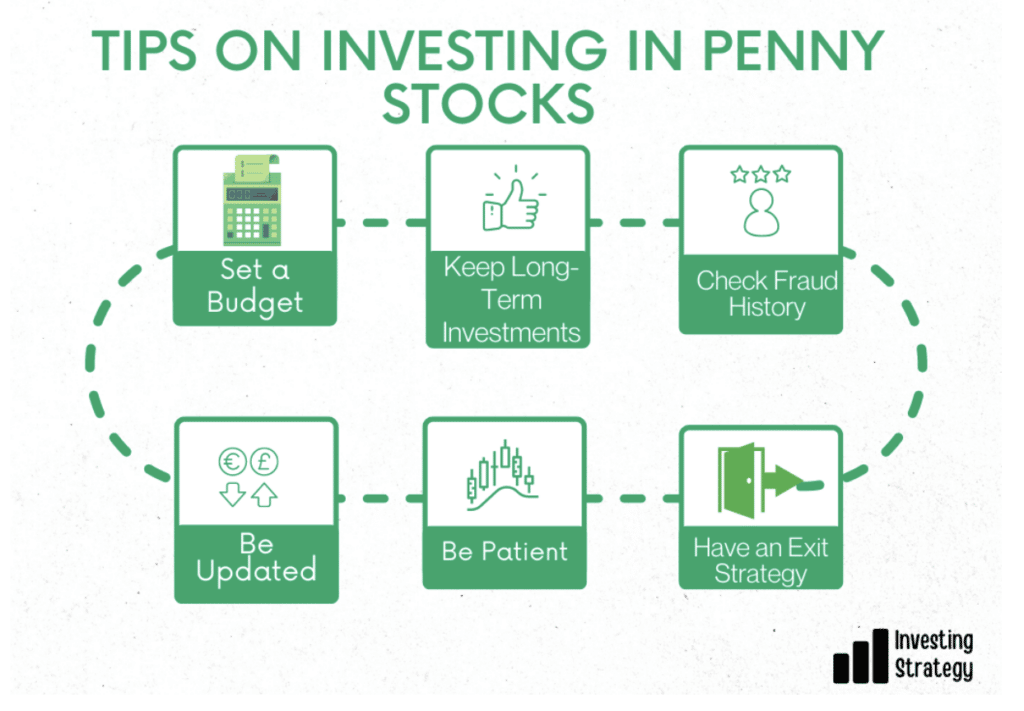

Tips on Investing in Penny Stocks

If you’re considering investing in penny stocks, here are some tips to help ensure that your investment is successful:

Set a Budget

Set a budget for how much you are willing to invest in penny stocks. You must have the funds available to lose this money, so if you don’t have the cash on hand, don’t invest. Investing in penny stocks can be risky, but if done correctly with a diversified portfolio of multiple companies and industries, it can be very lucrative.

Keep Long-Term Investments

When investing in penny stocks, it’s easy to get swept up in the excitement of making a quick buck. However, don’t neglect your other long-term investments. Remember that you should never put all your eggs in one basket and don’t put all your money in one investment or stock. You should diversify.

Check Fraud History

Penny stocks can be especially susceptible to scams because they’re less regulated than larger stocks and the companies behind them may not be well known by the public. Fraudulent companies are more likely to lose money or even go bankrupt. You can research online to know whether or not the company has been involved in any financial scandals.

Be Updated

Keeping up-to-date on the financials and business of the companies you’ve invested in will help you avoid surprises. You should also try to stay in contact with the companies that interest you, either by calling them or visiting their headquarters. This will give you an inside look at how things are going, which can help you make informed decisions about when it’s time to sell your stock or buy more shares.

Be Patient

In the world of penny stocks, patience is key. It’s important to remember that even if a stock looks like it’s going to take off soon, there’s no guarantee that your investment will be worth more than what you paid for it. The best thing to do when investing in penny stocks is to do your research and ensure that what you’re buying has potential before committing any money.

Have an Exit Strategy

You need to have an exit strategy. You should know when you want to sell, take profits or cut losses. Also, you must know when to take a break from trading. The market can be very stressful, and sometimes it is good to step away from the markets for a while until things settle down again.

Penny Stock Investment: What Else to Know?

When considering investing in penny stocks, it’s crucial to understand the risks involved. Although penny stocks can provide investors with an opportunity to make huge gains, they also come with significant drawbacks that can hurt your portfolio. You should always research before investing in any company or stock to know what you’re getting into before putting your money on the line.