For some investors, investing in an individual stock or mutual fund can be confusing and technical. With a focus on Meta Platforms (Facebook), this article explains how to invest in stocks and mutual funds.

Concise Overview

- Meta Platforms is a high-profile publicly traded company with high stock growth

- The stock value recently fell, plunging the company into a temporary crisis

- As the company tries to mitigate the situation and rise again, this could be an ideal time to invest in its stocks

Introduction

If you had to mention three social media platforms off your head, at least one of them would belong to Meta Platforms — formerly known as Facebook. Initially created to connect Harvard students, Meta has grown to become one of the biggest businesses in the internet and social media industry. It has also added other businesses like Instagram, WhatsApp, and Oculus. It recently began to invest in the Metaverse as well.

In 2012, Meta became a publicly traded company selling stocks to interested investors. The stock price recently declined by over 60%, and many people would be interested in taking a position now that the stock is at a low. If you want to invest in Meta, the article is an excellent guide to help you get started.

What to Know Before Buying Meta’s Stock

Since it was known as Facebook, Meta has developed a high reputation. The company is a billion-dollar business with more users than any other social media platform. Whether you’re buying Meta’s stocks because it is a high-profile company or you love the company, there are a few things you need to know before investing in the company;

Price

Meta’s stock currently sits at $138.61 at the time of writing, falling from over $382 in August 2021. Many people will consider $138 a lump sum to invest for a single share of a company’s stock. However, stock traders might argue differently.

Stock traders do not evaluate a company’s stocks based on their pocket size. They determine if a share is overvalued by dividing the company’s profit per share by its stock price. This formula is known as the price-to-earnings (P/E) ratio.

According to Nasdaq, Meta’s price-to-earning ratio at the time of writing is 11.48, and CSIMarkets Q2 statistics show that the average P/E ratio of businesses in the internet and social media industry is 16.32. This value indicates that the stock is underperforming and might be overpriced despite costing an arm and a leg for average investors.

Volatility

Being a high-profile company, you would expect that Meta’s stock would constantly be on the rise. However, Meta belongs to a class of high-profile companies that suffer stock price swings because of market news. Sadly, these companies are always in the news, so the value of their stocks keeps fluctuating.

Sometimes, Meta’s stock is measured with Amazon, Apple, Netflix, and Google’s stock as a group known as FAANG stocks. Other investors prefer to replace Netflix with Microsoft to create a different group, FAAMG stocks. Like Meta, these companies are always in the news, and their stock price is highly volatile.

Investors use a specific metric known as Portfolio Beta to determine the volatility of a stock or group of stocks. The Beta score for S&P 500 is 1, and companies with a higher value are considered highly volatile. However, Meta’s Beta score at the beginning of October 2022 was 1.32.

If you plan a long-term investment in Meta, you won’t have to worry much about market volatility. However, short-term investors need to understand the market before they invest.

Dividend

Meta’s stock is fast growing, and the company always ends each quarter with an increase in revenue and profits. The constant profit is a strong reason for profit-seeking investors to invest in the organisation. However, the company does not pay dividends to its shareholders since it released its shares in 2012.

Profits from each quarter are reinvested into the company to achieve more advancement and intensify growth. By investing in Meta, you agree to long-term investment. Your consolation for not receiving dividends will be that your profit is compounding as the company invests in itself.

This means that Meta stocks are not recommended for people who need passive income and are ideal for those whose financial goals include a long-term investment plan. The stocks are suitable for young people and terrible for the older generation approaching or well above retirement age. However, there are speculations that the social media giant might start paying dividends to its investors soon, but that’s not a certainty.

Ownership

As you research Meta’s stock, you should know that there’s a possibility you already own some. Mutual funds and exchange-traded funds primarily invest in companies that follow the S&P 500 or top-performing companies in the stock market. With a $372.52 billion market cap, Facebook is currently the 12th largest company worldwide, making it a good business in the investment portfolio of mutual funds and ETFs.

Other than mutual funds and ETFs, if you have invested in the Vanguard 500 Index Fund (or Admiral Shares), 2% of the company’s portfolio is invested in Meta. Another 1.64% of The iShares Core S&P Total U.S. Stock Market is invested in Meta. These two examples prove that you could already have an investment in Meta through technology-inclined funds and ETFs. And these funds help you reduce the risk of exposure to high-volatile stocks like Meta.

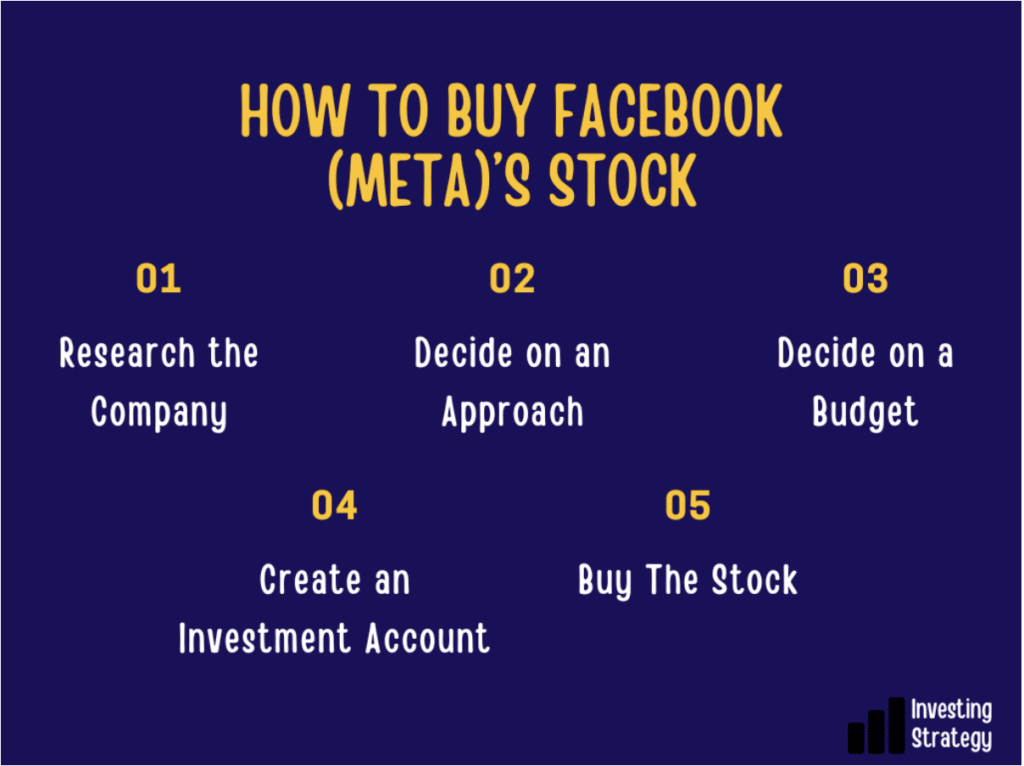

How to Buy Facebook (Meta)’s Stock

Stock buying is a financial decision that demands a careful approach. The stock market is not a quick money scheme you can rush into, and you need access to quality information before taking any step. If you want to purchase Meta’s stocks, here are the steps you need to follow.

- Research the Company

Successful investors do not buy stocks because they like the personality of the company’s owner or because they love the company’s products and services. Instead, they want to make profits from their investments. As a profit-inclined investor, learning about its financial status is the first step to knowing if a company is worth your money. This requires intensive research and is probably the most challenging thing you have to do before investing.

To ease your research process, you can check the company’s Form 10-K to find summarised information about its financial activities. The Form 10-K is an annual report containing audited financial statements that all publicly traded companies must submit to the SEC.

Studying a company’s Form 10-K can show you:

- Its earnings and source(s) of income.

- Its assets and liabilities.

- Its percentage profit in specific periods.

- Its performance among competitors

- Potential risks

- The management team and their reward scheme, etc.

Checking Form 10-K is a step in the right direction. However, there’s more that needs to be done when researching a business’s finance. You also want to know the company’s plans to stay relevant in a competitive industry. The social media industry is unarguably a tough one.

Meta Platforms owns Facebook, WhatsApp, and Instagram — three of the top five biggest social media platforms, and it is safe to say the company has a tight grip on the social market. However, other customer-centric organisations like Amazon, Netflix, and Disney+ still compete with Meta to gain customer attention. So how is Meta planning to stay on top of these competitors, and how feasible are these plans?

Researching a company means you look at its past to see where they’re coming from. Evaluate their present to measure relative growth. And analyse their plans for the future to see how they align with your financial goals.

- Decide on an Approach

There are several ways to own a Meta stock, and you can choose to explore any of these options depending on specific circumstances. While some people are unbothered about the volatility of Meta’s stocks, others would instead invest in mutual funds to reduce their risk exposure. Some of the possible approaches to investing in Meta’s stocks include;

- Personal Investment: If you prefer to invest in individual stocks, you’ll need to do a lot of research and analysis about Meta. If you are scared of numbers, cannot analyse, or don’t have the time to do comprehensive research, you will need to consider other options.

- Portfolio Managers: Investment experts make a living by helping people invest money and manage a portfolio. These experts work with your financial goals and build an investment portfolio that contains stocks from Meta and other profitable companies. You can purchase such services from brokerage organisations or hire an investment manager to handle your portfolio. This method of accumulating stock is less invasive and reduces your risk of losing money.

- Index Funds: You can also invest in index funds that have Meta in their portfolio. Organisations that manage these funds track indexes like S&P 500 or Nasdaq to determine stocks that will accrue substantial profit after a long period. Stock indexes like S&P 500 have constantly produced annual returns as high as 10%, and tracking the companies that make up these indexes is a logical approach.

- 401(k): Another approach will be to invest in your employer’s 401(k). This method is typical among people new to investing and teaches many lessons about the benefits of delayed gratification and compounding interest.

- Decide on a Budget

Financial management is crucial when it comes to stock investment. You can’t hurriedly decide to invest your spare money in stocks.

First, you need to understand that stocks ideally take at least three to five years before you begin to realise profits. So any money you decide to invest in stocks cannot be something you’ll need anytime soon. Emergency funds, tuition fees, vacation savings, or other short-term cash are not ideal for stock purchasing because the reward is not short-term.

Holding your stocks for as long as five years is vital because certain factors can cause the value of stocks to drop in the short term. However, organisations have their ways of navigating situations and coming back stronger.

For instance, COVID-19 adversely affected international trade in 2020, but the market was able to bounce back in 2021. If you had sold your stock to avoid a 2020 loss, you would have missed the opportunity to gain profit in 2021.

Buying stock is the only means of investing your funds and is not compulsory for everyone. Even if you have spare funds, you must consider certain factors before buying Meta’s stocks.

- Age: The older you grow, the less interested you become in medium and high-risk investments. Hence, buying stocks is preferable for younger investors. Fixed deposits and other low-risk investments are recommended for older adults.

- Stock Percentage in Your Portfolio: If you have funds to spare for at least five years and are okay with buying stocks at your age, the next thing to consider is the percentage of your investment that should be in stocks. As an investor with a diversified portfolio, you understand the advantage of keeping your eggs in different baskets. The Rule of 110 is a generally accepted way of calculating the percentage of your investment that should be in stocks. This Rule subtracts your age from 110; the result is the percentage that should be invested in stocks.

- Meta’s Percentage in Your Stocks: Now that you know the percentage of your portfolio that should contain stocks, it is left for you to decide how many of Meta’s stocks you want in your collection. Remember that Meta is a volatile stock, so you should choose a reduced investment to prevent the risk of harming your portfolio. In essence, the money you decide to invest in stocks has more to do with you and your financial condition than Meta’s stock price per share.

- Dollar Cost Averaging or Lump Sum Investment: You can consistently invest money into Meta’s stock over a certain period. This strategy is known as dollar cost averaging (DCA). DCA minimises your risks and reduces your average price per share.

- Create an Investment Account

You need a brokerage account to invest in Meta stocks. Opening one takes only a few minutes; however, it takes more time to find the right one to open. Investors must consider several factors when choosing a broker.

First, the broker has to meet your investment needs. Do you want to DCA into the market or invest a lump sum? Do you want to pick Meta’s stock or invest in a mutual fund? Some brokers even allow you to do both. Other factors to consider before choosing an investment broker include:

- Broker’s Fees: Brokers have varying fees that they charge investors who trade with them. Comparing the individual fees of different brokers will help you decide the best choice for you.

- Trading Platform: Your desired platform should be easy to use and navigate. You want something that’s beginner-friendly and provides safety for investors.

- Available Stocks: As much as you want to buy Meta stock, you should find a company that provides a wide range of options if you want to buy other stocks.

- Account Type: Your account choice depends on your reason for investing and how soon you want to gain access to your investment. A standard brokerage account is ideal if you want more control and easy investment access. However, Individual Retirement Accounts (IRAs) are more suitable for people who want to save for retirement. There are also several varieties of IRAs if you are saving towards retirement. The goal is to find an account type that matches your financial goal and a broker that allows investors to open this kind of account.

- Account Features: Brokers offer different features to investors. These features include educational tools, expert research, industry news, and other features to help them make better investment decisions and maximise profits. Some brokers have excellent customer service and physical offices to welcome investors and resolve queries.

- Buy The Stock

Once you have settled for a specific broker, opening an account takes a few minutes, but the broker might need a more extended period to verify the account. Once your account is verified, proceed to fund it with your budget. You can now proceed to set your order and buy the stock.

You can choose between a market or limit order. Market orders allow you to buy stocks at the market’s current price. However, limit orders trigger a purchase when the market price reaches a specific limit.

Should I Buy Meta’s Stock?

Meta’s current performance in the stock market is not so outstanding. The company recently fell from the top ten to become the 12th largest company in the world by market cap. Mark Zuckerberg, Meta’s CEO, also announced that the company is facing a terrible downturn and will have to take measures to prevent further loss.

Considering this situation, you need to review your decision to buy Meta stock or how much stock you want. In his announcement, Mark also stated that these measures will last till the end of 2023.

The company’s investment in the Metaverse is another financial decision that might not be profitable in a few years. There is no certainty of whether or how soon Meta’s stocks will rise back, so you must evaluate your financial goals before buying Meta’s stock.

Remember, your investment decision has little to do with the company and more with you and your financial situation.

This article has been prepared for information purposes only. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.