Blue-chip stocks are well-known and large companies with a long history. In theory, they have fewer risks. In practice, you need to know what you’re getting into before investing.

Concise Overview

- Blue-chip stocks are high-quality investments with a long history of paying dividends and growing their value over time

- Investing in blue-chip stocks is a great way to grow wealth and set yourself up for the future

- To invest, you need to research and understand the stocks you intend to buy

Blue chip stocks are one of the most popular investments among investors and corporations. They’re also referred to as large-cap companies, which means they have a market valuation of at least $10 billion. Besides, they’ve done well and are expected to keep doing well.

While blue chip stocks remain reliable long-term investments, this doesn’t mean there isn’t risk involved with owning them — especially if you’re looking to make short-term gains. Thus, you’ll need to understand what makes up blue chipping and how it can be used to your advantage as an investor.

For that, we’ve put together this guide to help you understand what it means to invest in blue chip stocks, why these companies are popular among investors, and how you can get started buying your shares today.

What Are Blue Chip Stocks?

Blue chip stocks are high-quality, well-established companies that have long been leaders in their respective industries. These are the kinds of businesses that investors turn to when they want to feel confident about stock stability and reliability now and in the future.

In investing, blue chip stocks are highly regarded because they have long histories as successful businesses and boast loyal customer bases. These companies often have a lot of resources at their disposal — such as brand recognition and proprietary technology. These make them attractive investments for investors looking for portfolio stability and security.

Origin of Blue Chip Stocks

In 1923, Oliver Gingold, an employee at Dow Jones, first used the term ‘blue chip’ to describe high-priced stocks. He observed that certain stocks were trading at $200 or more per share and thought they resembled poker chips. The phrase was then picked up by other investors, becoming a common term for blue-chip stocks.

The phrase ‘blue chip’ originally comes from poker, where the highest-value chips are made of blue clay. These chips were used in casinos because they were so valuable that they could not be counterfeited — just like the stocks they represented.

In the early 1900s, blue chip stocks were companies that had been around for a long time, with solid market positions and stable earnings. They were considered stable investments because their prices rarely fluctuated much, and they weren’t likely to go out of business any time soon.

Today, any company can be blue-chip as long as it fulfils specific considerations.

What Makes a Company Blue-Chip?

These days, blue chip stocks still represent large companies with shares worth buying over smaller companies or startups. The term also refers to companies with a high price-to-earnings ratio.

So, it might seem like a huge undertaking to figure out which companies are blue chips. But it’s pretty easy once you know what you’re looking for. And once you’ve got your list of blue chips in hand, all that’s left is checking in on them every once in a while to see if they’re still as good as ever.

Regardless, whether central or millennial, three distinguishing factors make a company blue-chip:

Reputation

Blue chip stocks are the big players in the market. They’re companies that have stood the test of time and proven their ability to grow and make money for their investors. Their reputation is one of the significant features. When you buy a blue chip stock, you know it’s been around for a while — and has survived leaner times to be where it is today.

Capitalisation

The capitalisation of a company refers to how much money it has raised from investors — and how much it has in total assets (like buildings or machinery). The larger this number is, the more likely the company will pay its debts and continue operating smoothly without needing more funding from investors or debtors (or shareholders). Blue-chip capitalisation is generally quite large and can withstand market fluctuations.

Establishment

The establishment of blue-chip stocks is based on its business model, management, and products or services. Blue-chip companies have been around for years. They have proven their business model in the market, and they continue to be successful. The companies are often great managers in their industries, and they tend to have large amounts of inventories and resources at their disposal.

Why Invest in Blue Chip Stocks?

There are several reasons to invest in blue-chip stocks, but here are five of the biggest:

Blue Chip Stocks are stable investments

Blue-chip stocks are generally considered very safe investments because they’re large, established companies with long histories and strong reputations. If you’re looking for a steady return on your investment over the long term, these are great choices.

They pay dividends

Dividends are a portion of a company’s profits paid to shareholders to reward them for investing in the company. Dividends can be paid as cash payments or in the form of stock. When you invest in blue-chip stocks, you typically receive dividends periodically. Many blue-chip stocks will pay dividends to shareholders every year, which can be a bonus if you’re looking for ways to increase your income.

They are not as volatile as other stocks

One of the reasons many investors choose to invest in blue-chip stocks is because they’re less volatile than other types of investments, such as penny stocks or speculative growth stocks. This means there’s less risk involved in buying these securities, and they’re more likely to provide a steady income stream over time.

They boast opportunities

As a result of their size and stability, blue chips tend to have more flexible business models than other types of companies do. This means they can adapt to new trends in their industry much more quickly than smaller firms. So if you’re looking for exposure to a particular sector like healthcare or technology, it may be possible through one or more blue chips.

They are easy to buy and sell

You can easily purchase shares online through a brokerage, so you don’t need to meet with an investment advisor or stock broker in person. All you have to do is log on to your brokerage account and place an order for the shares you want to buy. You can also sell your shares online through the same brokerage account.

Downsides to Blue Chip Stocks

Blue-chip stocks are the best of the best, but they aren’t for everyone. Here are four downsides to investing in blue-chip stocks if you’re starting.

They are expensive

Blue-chip stocks have a high price tag. This means they’ll take longer to grow and recover from a recession than other stocks. If you’re looking to make a quick buck, blue chips aren’t for you.

They are safe but not exciting

Blue chips don’t offer much risk or reward. They’re safe investments that won’t give you a lot of returns on your initial investment. If you want more excitement from your investments, blue chips may not be for you.

They don’t offer enough diversity

Diversification helps spread out your risk across multiple investments. That way, if one goes wrong, the others can pick up some slack and help soften the blow on your portfolio’s value overall. Blue chips don’t offer enough diversity to give them this benefit. Instead, they all do the same thing.

They can hit turbulence

While most blue chips will ride out the ups and downs of the market, there are some exceptions. For example, oil companies tend to take a big hit when oil prices fall. If you want to invest in oil companies, ensure you know what risks they carry before making an investment decision.

How to Buy Blue Chip Stocks

If you’re looking to buy blue-chip stocks, there are a few things you need to know.

Before investing in any company, understand what it does and how it makes money. This will help you understand if the business is sustainable in the long term or if it’s just riding on past success. If you can’t answer these questions about a potential investment opportunity, it may not be worth your money.

Another thing to look at is its risks. One of the reasons blue chip stocks are considered safer investments than other types of stocks is because they usually pay dividends. This means that part of your money will be paid back each year as part of their earnings report (assuming those earnings are positive).

However, this doesn’t mean these companies won’t experience problems or go out of business. In fact, the biggest stock market crash in modern history happened when large companies experienced sudden and unexpected losses. For example, Enron was one of the most successful companies in America during the late 1990s. It collapsed amid a massive accounting fraud scandal.

So, if you’re considering investing in blue chip stocks or other types of investments, ensure you understand the risks involved with each investment opportunity. Also, endeavour to research as much as possible to understand the fundamentals and patterns, movements, and structures.

Where to Buy Blue Chip Stocks

There are several ways to buy blue-chip stocks. You can buy them through an online brokerage or financial advisor, or you can purchase them directly from the company itself. You can buy them through a mutual fund or an exchange-traded fund (ETF).

If you choose to use an online brokerage, you’ll need to open a brokerage account and link it to your bank account. You’ll then be able to buy shares of different companies using this account.

Brokerage accounts generally charge fees and commissions on transactions made through them. Still, they often offer lower costs than other investment accounts because they’re simpler to use and manage than other options like mutual funds or ETFs.

If you work with investment advisors instead of going through a broker directly, they’ll help you choose which stocks are best for your portfolio based on your goals and risk tolerance level. The advisors will then be responsible for buying those stocks on their accounts and charging you a fee for the service.

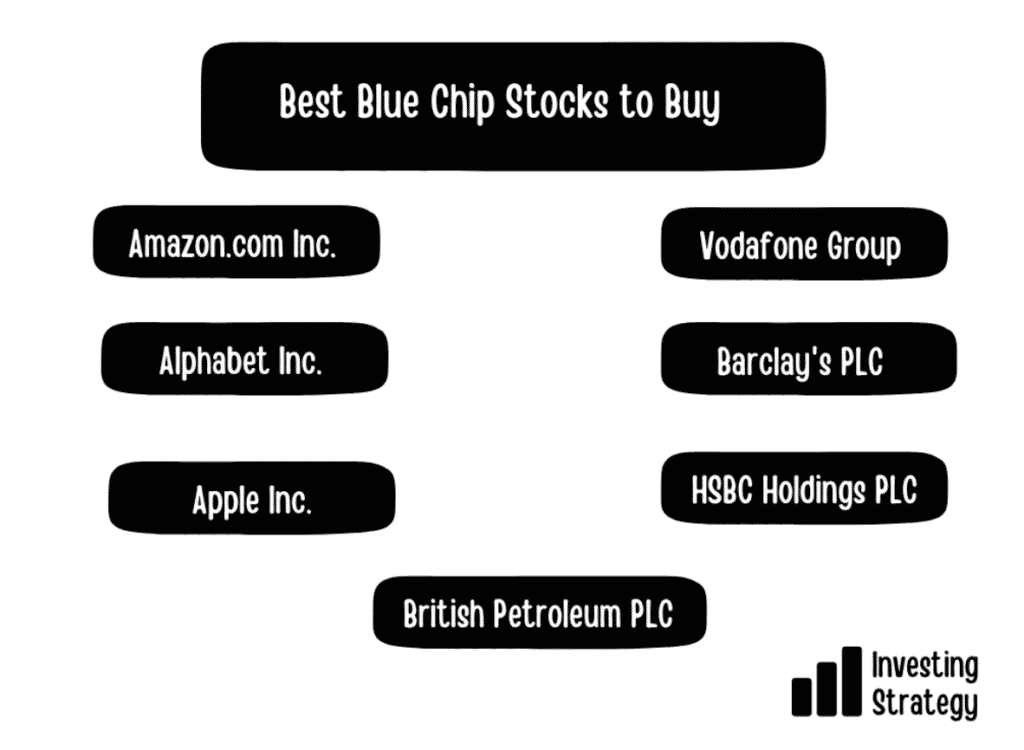

Best Blue Chip Stocks to Buy

If you’re looking for blue-chip stocks to buy, here are some of the best.

- Amazon.com Inc. (NASDAQ: AMZN)

Amazon is an outstanding blue-chip stock to invest in. The company has been around for over two decades and has a well-established brand with a diverse portfolio of products and services. They’re constantly innovating and are at the forefront of technology.

- Alphabet Inc. (NASDAQ: GOOGL)

Alphabet is another good blue chip stock to invest in. They’ve been around for 20 years and produce unique products like Google Maps, Gmail and YouTube. They also have an extensive portfolio of other companies that provide healthcare, travel, and several others.

- Apple Inc. (NASDAQ: AAPL)

Apple is another popular option when investing in blue chip stocks. They’ve been around for over 40 years and have developed some of the most innovative products, including the iPhone, iPad and MacBook Air which have created new markets for consumers worldwide.

- British Petroleum PLC (LON: BP)

British Petroleum (BP) is one of the oldest oil companies, founded in 1909 by William Knox D’Arcy. He purchased an oil concession from a British government official in Persia (now known as Iran).

- Vodafone Group (NASDAQ: VOD)

Vodafone is a telecommunications company that offers wireless and fixed line communications services. The company also provides broadband internet access, cable TV and other services. It operates in more than 30 countries worldwide.

- HSBC Holdings PLC (NYSE: HSBC)

HSBC is a global bank that provides financial products and services to individuals, small businesses, and corporate clients across 70 countries. Its businesses include retail banking, commercial banking, global banking and markets, and investment banking. Its headquarters are in London.

- Barclay’s PLC (NYSE: BCS)

Barclay’s is a global financial institution that offers investment banking, personal wealth management, credit cards and mortgages, among other products, through its worldwide network of over 900 branches in 36 countries. Its headquarters are in London.

- Alibaba Group Holding Ltd (NYSE: BABA)

Alibaba is an e-commerce company based in Hangzhou, China, that provides technology platforms to small businesses and merchants to sell their goods online to customers worldwide. The company operates AliPay Wallet Services, which provides payment processing on websites owned by merchants using AliPay’s payment system while facilitating money transfers between users’ accounts.

Blue Chip Investment: What Else to Know?

Blue chip stocks can be a great way to kick-start your investing career. They’re incredibly stable and highly profitable, so they’ll help you build that solid foundation to grow your portfolio over time.

But while blue chip stocks are easy to buy and sell, they’re not foolproof. You need to research before investing in them and ensure you understand their risks and rewards.

The good news is that plenty of resources are available to help investors like yourself figure out what’s what. We hope this guide has given you a good idea of how blue chip stocks work and how they fit into the larger context of investing.