Choosing a stockbroker is not an easy task. But when you select the right one, especially as a beginner, it can make all the difference to your investing success.

Concise Overview

- A stockbroker is a licensed individual who can help you navigate the stock market

- These individuals can work full-service or discount and can be robo-advisors

- There are steps to take in hiring the best broker for your investments

Introduction

Trading stocks is a serious business. It’s not just about your money and investments — it’s also about your time and energy. You have to keep track of the markets, trends, news stories and more if you want to succeed as an investor. And there are several ways to trade these days, and it can be hard to know where to start. To suppress the complexities, most investors hire stockbrokers.

Choosing a stockbroker isn’t as easy as it sounds, especially if you’re a beginner. There are many variables to consider, and if you’re not careful, you can end up with a broker who is more interested in making money than helping you. This post will guide you in choosing the perfect broker that meets your needs and trading style.

What is a Stockbroker?

A stockbroker is someone who buys and sells stocks for clients. They buy shares from sellers, sell those shares to buyers, and charge a commission for their services. Many stockbrokers are licensed by the Financial Industry Regulatory Authority (FINRA), which requires that they complete continuing education courses to maintain their licences.

Stockbrokers can work for a bank or brokerage firm, or they can be independent agents who work with multiple companies. Independent agents usually have more freedom than employees of banks or brokerage firms. But they might not boast the same level of experience and networking capacity.

Full-Service Brokers vs Discount Brokers

There are two types of stockbrokers: full-service and discount. Full-service brokers offer a wide range of services, including research and analysis of stocks, financial planning and advice, and access to individualised portfolio management. Discount brokers do not provide all of these services as they’re generally about carrying out buy and sell orders.

Full-service brokers are more expensive and require more time, but they often have better customer service and more resources than discount brokers. A full-service broker will help you set up your account and invest in stocks, bonds, and mutual funds. If you’re looking for a lot of guidance with your investment decisions, this may be the right option.

Discount brokers are cheaper. But you’ll need to do most of the work yourself, which means researching companies and making decisions about which ones to buy or sell on your own. However, if you know what you’re doing already, it might be worth saving some money by going with one of these types of brokers.

An Alternative: What Are Robo Advisors?

An alternative to full-service and discount brokers is robo-advisors. Robo-advisors are automated investment services that offer low-cost, diversified portfolios managed by computers and software. They allow investors to access professional advice at a fraction of the cost of traditional advisor services. They are increasingly popular with younger individuals.

There are benefits to using robo-advisors. First and foremost, they cost less than full-service brokers. If you have a small portfolio or make nearly trade, this can be a great option. Additionally, people not interested in trading may feel more comfortable with a robo-advisor because it takes some of the work out of investing.

Robo-advisors also offer services that full-service brokers don’t, such as automatic rebalancing and tax loss harvesting. These offerings make them ideal for those who want something simple yet effective.

However, there are some drawbacks. Robo advisors don’t provide personalised advice. Instead, they base their investment decisions on predefined algorithms. This may not be appropriate for every investor depending on their risk tolerance level or goals for retirement savings accounts like 401(k)s or IRAs (Individual Retirement Accounts).

Who Needs a Stockbroker?

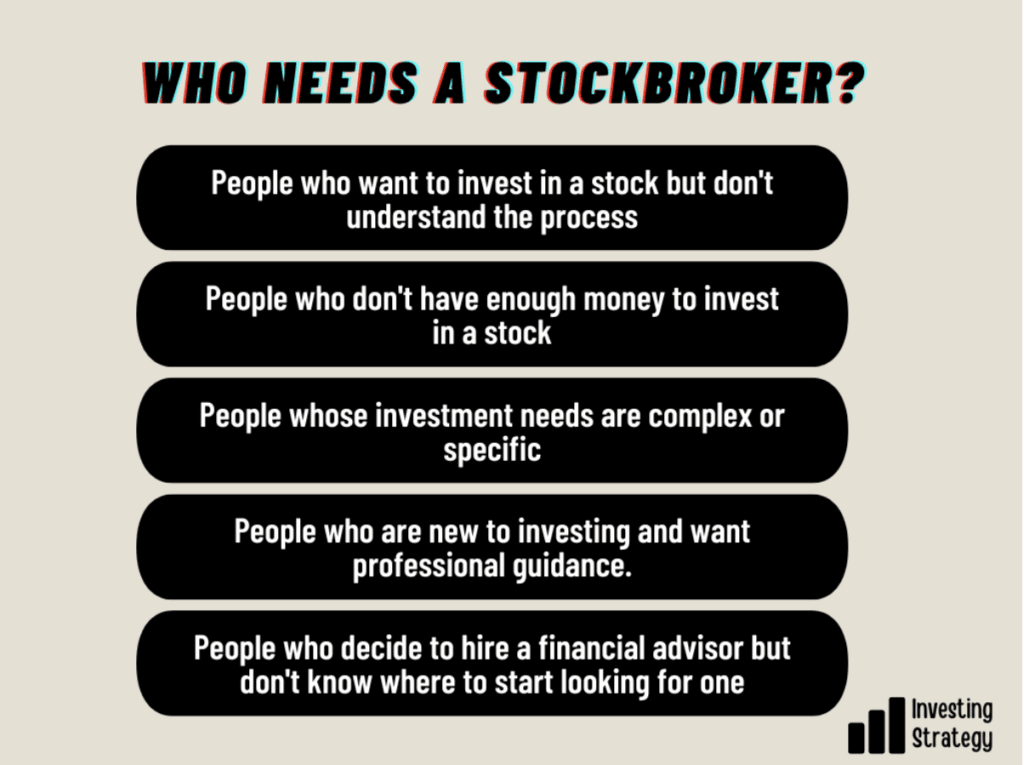

Not everyone needs a stockbroker. Stockbrokers are great for people who want to invest in the stock market and want someone to help them figure out what to do or who don’t have time to do it themselves. You’ll most likely need a stockbroker if:

- You want to invest in a stock but don’t understand the process. A stockbroker can help you decide which stocks to buy and sell based on your goals and risk tolerance.

- You don’t have enough money to invest in a stock. A broker can help you buy shares in increments as small as $1 to start investing without breaking the bank.

- Your investment needs are complex or specific. A broker is trained to work with people who have specific investment goals or want to make complicated trades like short selling or options trading.

- You’re new to investing and want professional guidance. A broker can help you get started by explaining the investment process, providing educational resources and answering any questions you may have.

- You decide to hire a financial advisor but don’t know where to start looking for one. Brokers can recommend trusted advisors who work with clients like yours every day.

- You want to expand your investment portfolio. A broker can help you diversify and ensure that you’re putting your money in the right place at the right time.

But if you’re not interested in investing in the stock market, there’s no reason why you should pay someone else to do it for you. You can learn how to read financial statements and understand their terminology. You can also start learning about how different companies are valued, what things affect their value, and how those factors relate to your personal investment goals.

How Do Stockbrokers Make Money?

Stockbrokers make money through commissions and fees. A commission is a payment for buying or selling a stock. The commission is typically based on the amount you invest in a stock. A fee is a payment to an investment professional for advice, information or services.

When you buy or sell a stock, the stockbroker charges you a commission or fee based on how much you spend on your trade. For instance, if you spend $20,000 on your trade, the commission could be 0.5% or $1,000 (which is half 1%). However, if you spend only $10 on your trade, the commission could be 0% because there’s nothing left to take away from your original purchase price.

Another way stockbrokers make money is through a percentage of your portfolio’s profits. This is known as ‘revenue sharing.’ It works like this: as your portfolio grows, so does the amount of money your broker makes. The more money you have invested with them, the more they earn off their services.

Finally, some brokers take advantage of their position by recommending investments that pay them higher commissions but may not be in your best interest or suitable for your situation. They might also recommend investments that aren’t necessary or appropriate for the type of investor they think you are (for example, someone who needs income from dividends rather than capital gains).

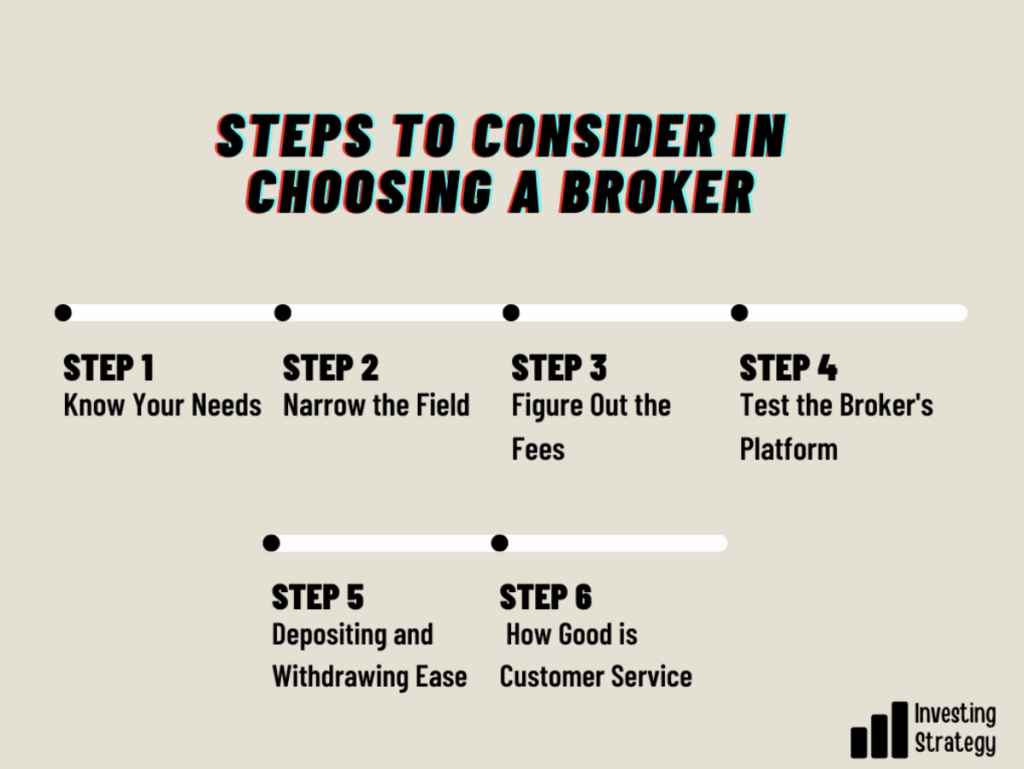

Steps to Consider in Choosing a Broker

If you’re new to investing, it can be tricky to choose a stockbroker. Luckily, this list can help. Here are steps to take when selecting your first broker:

Step 1: Know Your Needs

The first step in selecting a broker is to know what you need the broker for. Do you want to make an investment or trade (or both)? Do you plan on investing in stocks, bonds and mutual funds? Are you looking for online brokerage services, or do you want to go down-to-earth and talk with someone at your local branch? Answering these questions can inform your decision.

Besides, you need to know your risk tolerance. This will help determine how much money you should invest. If there’s any chance that market volatility could cause panic attacks and sleepless nights, choosing low-risk options is probably wise. Also, keep in mind that different brokers offer different levels of service. Some might specialise more in individual investors, while others are better suited toward large institutions like pension funds.

Step 2: Narrow the Field

The next step is to narrow down your options by deciding what kind of trader you want to be: active or passive. Active traders are individuals who make their own investment decisions, while passive traders let a professional handle all the details for them.

If you’re an active trader, research each broker thoroughly. Look at their educational background, certifications, and experience level before deciding which one is right for you. Passive traders may have less work involved in choosing their brokerage firm. However, they must look into each broker’s background and reputation before signing up.

Step 3: Figure Out the Fees

In this step, you’ll want to consider the broker’s fee structure. Fees should be clear and transparent. The structure should be easy to understand and consistent across the board. It should also be reasonable in comparison with other options out there. Finally, it should be competitive—i.e., they’re not charging more than their competitors for similar services.

To begin with, ask what the commission is for each trade. This can range from $0 (no commission) to thousands of dollars per trade, depending on your account size and the type of investment vehicle you’re buying or selling (e.g., stocks vs mutual funds). Some brokers charge as little as $5 per transaction, while others charge as much as $25. That’s quite a difference.

Step 4: Test the Broker’s Platform

Then, test the broker’s platform. You can do this by logging into your account and seeing how it operates. Look at its website, mobile app and desktop app. Does it have all the features you need? If not, you’ll need to find a different broker that does offer them.

The biggest thing you should look for in a platform is its ease of use. If there are too many buttons or drop-down menus, it may confuse beginners who haven’t used online trading before or even someone unfamiliar with computers. You want an interface that allows users to execute trades quickly so they’re not wasting time figuring out how everything works when they could be spending their time investing instead.

Step 5: Depositing and Withdrawing Ease

When you’re ready to deposit or withdraw funds, how easy will it be? Will there be a minimum deposit amount? Will you have to mail in checks or do something more involved? Is there a fee for depositing or withdrawing cash from your account?

Many brokers offer different ways to transfer your funds, including electronic transfers, cheque writing, or cashier’s checks. Look at the available options, and ensure you can access what you prefer when dealing with your broker. An online broker may not give you the same flexibility as a traditional broker; this should be considered before signing up with someone.

Step 6: How Good is Customer Service

A good broker will have a lot of resources available to you, including 24/7 phone support and an online portal that lets you check your account and make trades. An excellent broker will also offer services like a dedicated account manager who can walk you through the process of trading stocks, options, or other investments.

When choosing a broker, look at how responsive they are and what kind of communication they have with their clients. Look at reviews from former customers to see if there are any complaints about customer service—either positive or negative. Also, try to get an idea of what kind of experience other people had working with this particular broker.

UK Best Online stockbrokers for Beginners

The stock market offers tons of opportunities to make money. However, you’ll need the right broker to enjoy the benefits. If you’re a beginner investor who wants to dip your toes into the world of trading stocks, below are brokers that are great for you:

- eToro

eToro is a UK-based stockbroker that offers beginners and experienced investors the ability to trade a wide variety of assets, including stocks, commodities, exchange-traded funds (ETFs) and cryptocurrencies. eToro has been designed to be simple and easy to use. The company has also recently launched an online app which allows clients to access their accounts on mobile devices.

- IG Investments

IG Investments is an online broker that provides investors access to the global markets. The company offers a wide range of trading opportunities, allowing clients to invest in stocks, bonds, currencies and commodities. It offers competitive pricing on its range of CFDs and stocks and provides advanced charting tools and research content such as market news.

- Interactive Brokers

Interactive Brokers is a broker with a wide variety of trading options. They have everything from stocks and ETFs to futures, options and more. And they offer lower rates than most other online brokers. Their platform is user-friendly and offers excellent research tools as well as some of the best customer support in the industry.

- Freetrade

Freetrade is a broker aimed at beginners and those new to investing who want to learn more about the stock market. The brokerage offers a wide range of educational resources, including an online course, video tutorials and webinars. This makes it easy to get started on your investment journey with Freetrade.

- DEGIRO

DEGIRO offers trades as low as $1 per trade, making them one of the cheapest brokers on our list. They also offer access to over 5,000 stocks and ETFs worldwide, giving you plenty of opportunities to diversify your portfolio. The company has been around since 2008 and is known for its simple but effective investment platform

The Bottom Line

In summary, choosing a stockbroker can be a daunting task. The key is to be realistic in your expectation of what you need and have the right broker for your level of risk tolerance and experience. If you are new to trading, you should find someone who can help guide you through the process before jumping in with both feet. You will want someone experienced enough to understand how markets move and how their clients feel about investing but also patient enough to not rush into trading decisions.