Apple generated over $360 billion in sales in 2021, making it the biggest company in the world by market cap. Whether or not you use an Apple device, you can benefit from the company’s wealth by buying its stock, and this comprehensive guide will help you do that.

Concise Overview

- Apple is the world’s largest company by market capitalisation

- Its position in the global economy makes it a good investment option

- Before investing in Apple, you must learn the process to ensure you get a profitable investment

Introduction

On April 1, 1976, Steve Jobs, Steve Wozniak and Ronald Wayne, aged 25, 21 and 41, respectively, started the Apple Computer Company. The plan was to sell the Apple I computer, the first DIY all-in-one microcomputer. Wozniak designed and built the computer for himself. Jobs brought the idea to redesign, duplicate, and sell computers. And Wayne wrote their partnership agreement and Apple I manual.

After close to half a decade, the three co-founders no longer run the company. However, Apple has grown to become the world’s largest technology company based on revenue and, more importantly, the largest company in the world by market capitalisation. As a high-performing business, Apple shares have become a prize possession for many investors. Continue reading this article to see our comprehensive guide to investing in Apple.

Apple: An Overview

Apple Inc. (formerly Apple Computer Company) is a multinational corporation based in the United States. The company designs and sells consumer electronics, personal computers, and software.

After it was founded to sell Wozniak’s Apple I personal computer, the company developed its first product — the Apple II, one of the first highly successful mass-produced microcomputers. The company later developed the Macintosh, introducing several innovative features like an integrated mouse, graphical user interface (GUI), desktop publishing, and LocalTalk networking.

In 2022, Apple became the first public U.S. company valued at over $3 trillion. The company employs 154,000 full-time employees as of 2021, making it one of the largest companies in the world. It operates retail stores in many countries, and in 2020, it announced its plan to extend manufacturing into India, reducing over-dependency on China. Apple’s worldwide annual revenue totalled $365.8 billion for the 2021 fiscal year.

Apple became a publicly traded company in December 1980, trading at $22 per share. The stock has risen by over 900%, reaching an all-time high of $237.64 in 2019, and currently trades at $138.38.

While Apple’s stock has always been volatile over time, it is expected that this trend will continue in the future as well, which means that investors should carefully consider their investment goals before deciding whether or not to invest in Apple stocks right now.

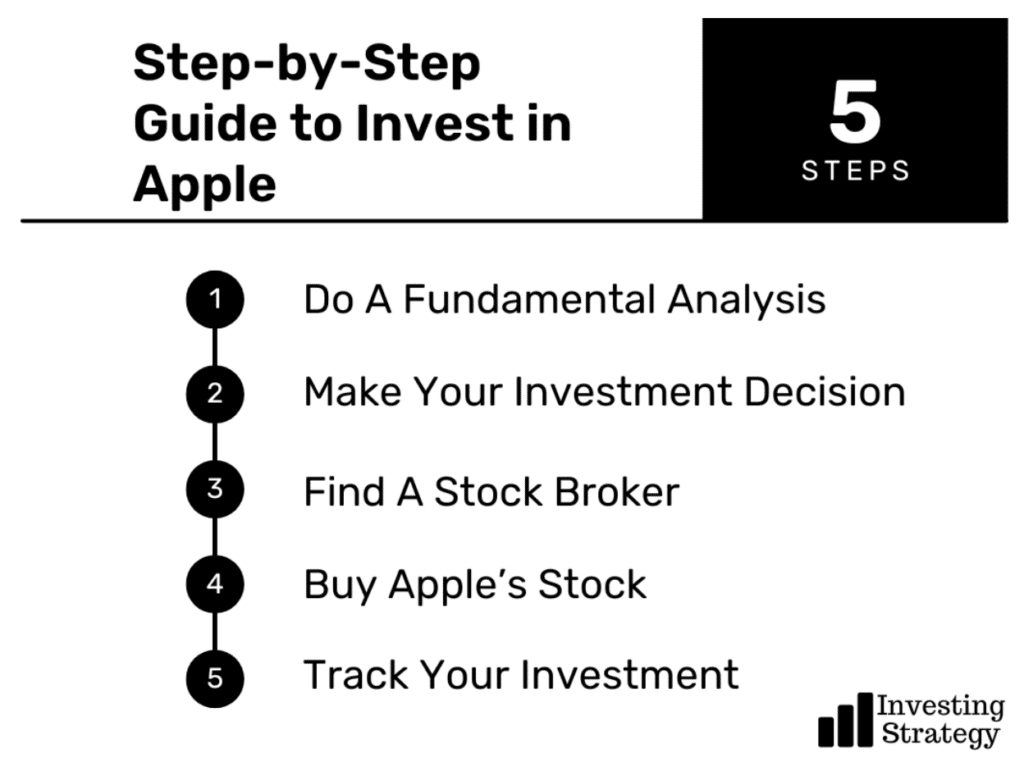

Step-By-Step Guide to Invest in Apple

Apple is a true innovator not just in software and hardware development but also marketing. While it is common knowledge that investing in Apple is a sound financial decision, investors must understand that it is procedural. Whether you are a professional or a new investor trying to navigate the stock market, here is a foolproof guide to investing in Apple stock:

1. Do a Fundamental Analysis

Fundamental analysis of Apple’s stocks allows you to understand its financial and business health by looking at Apple’s income statement, balance sheet, cash flow statement, and other essential documents. These documents help you evaluate the company’s intrinsic value, compare it to the current stock price, and determine if it is a good investment. To perform fundamental analysis, do this:

Check the company’s financial ratios

Unless you are a supercomputer with the experience of an expert financial analyst, going through Apple’s financial documentation from 1976, when the company was established, till the present day would be an extremely daunting and time-consuming process. A better approach to get an overview of Apple’s financial statements would be to use the financial ratio analysis. There are many ratios that financial analysts and stock investors use, including:

- Earning Per Share (EPS): This is calculated by subtracting dividends from net income and dividing the answer by the average outstanding shares, i.e., Earnings Per Share = (Net income – Dividends) / (Outstanding Shares). Investors invest in a company with an increasing EPS for at least five years.

- Price to Earning (PE) Ratio: This is calculated by dividing the last closing price of the company’s stock by its most recent earnings per share. If the final value is relatively low compared to other companies within the same sector, investors can consider that as a green light.

- Debt to Equity: A company’s debt-to-equity ratio is an expression of how much debt a company has compared to its total equity. It is calculated by dividing the debt by the total shareholders’ equity. Companies with a debt-to-equity ratio of less than 1 are safe investments.

- Current Ratio: This is measured by dividing the company’s current assets by its liabilities. If the value of the ratio is less than one, the company has more long-term liabilities than assets. Hence, investors should always lean towards companies with a current ratio greater than one.

- Dividend Yield: The dividend yield is calculated by dividing the yearly dividend by the share price. The answer is multiplied by 100 and expressed as a percentage. While most companies pay dividends to investors, others, like Meta Platforms, reinvest their earnings for growth. Investors must ensure that the company’s dividend yield has been consistently increasing before investing their hard-earned money.

Investors can study other financial ratios to determine a company’s financial health status. Thankfully, you don’t need to do all these calculations yourself. The information is available online, and you can compare the results from multiple sources to reach your conclusion.

Investigate the company

After checking all the necessary financial ratios, you must research to understand what the company is doing. The financial ratios help you understand past performance, but your investigation will give you an insight into what the company is currently doing and its plans for the future. When evaluating a company, some of the necessary factors to consider include the following;

- Products and Services: What does the company currently offer the public? How do their products and services meet people’s urgent and future needs? For example, Apple offers over 20 products and services combined, yet over 49% of its revenue in the third quarter of 2022 came from iPhone sales. You must ensure the company has products that meet demand and raise revenue before purchasing its shares.

- Management: The people behind a company are an excellent way to determine if you should invest in the company or not. The first set of people to check is the founders and board of directors. For a company like Apple, its founders are successful inventors and businessmen, and although they no longer manage the company, they have laid a good foundation. You must also check the managerial abilities of people on Apple’s board to ensure they can grow the company’s market cap.

- Investors: Successful investors know that buying shares is not a gamble. You must go in head-on with a conviction that the company will succeed. If a company has its shares in the portfolio of top investors, it is a good sign for you. Apple’s top investors include its CEO, Tim Cook, former VPOTUS, Al Gore, Vanguard Group, BlackRock Inc., and Berkshire Hathaway.

- Vision and Mission: Stocks take time to mature. So before you invest in a company, you must ensure that they have specific plans to reach certain feats in a specified period. The best way to know Apple’s mission and vision are to check its website.

Check for red flags

As part of your fundamental analysis, you must check for red flags that can make investing in a company a wrong financial decision. The company’s debt is one of the biggest red flags for every investor. Other red flags include personal bias like investment goals, risk tolerance, and FOMO.

Competitors

By buying Apple’s shares, you are betting they will perform better than other companies in their industry. Hence, you need to confirm that they have worked in the pipes to achieve this, and you can use the following metric:

- Unique Selling Point: How does the company differ from other companies in the same industry? What unique solution does it offer customers that could make it a favourite?

- Customer Satisfaction: Impressing your customers is a sure way to get free marketing in today’s world. What are people saying about a company? Are people happy or disappointed about their experience with the company?

- Brand Value: This refers to how the public perceives the company, and it depends on factors like relationships with people, patents, customer loyalty, etc.

- Make Your Investment Decision

After your fundamental analysis, you should have a strong opinion about whether a company’s share is worth buying or not. Now the focus has shifted from whether or not the company will be profitable to whether or not it is worth investing in. Factors that can help you cement your decision to invest in Apple include:

- Investment Risk: There are two kinds of investors; aggressive investors (risk tolerant) and conservative ones (risk averse). Apple’s stock is volatile, making it a high-risk investment; hence, it favours aggressive investors. Conservative investors can invest in equity securities like mutual funds or exchange-traded funds (ETFs) to reduce the risk involved.

- Portfolio Diversification: High-risk assets like Apple stocks and cryptocurrencies should have a lower percentage of your investment portfolio. Diversification does not mean that you should invest in every asset class. Instead, it would help if you considered investing in profitable asset classes like stocks, bonds, and real estate.

- Financial Condition: Before investing in Apple, you must evaluate your financial situation — debts, assets, expenses, savings, etc. This analysis will help you know how much you can spare on investment.

- Investment Returns: Stocks take a long time before generating profit. Hence, you must be willing to wait. Your wait period will largely depend on your age. Generation X and Baby Boomers should avoid high-risk investments like Apple’s and invest in safer assets like bonds and cash equivalents.

- Investment Approach: Your investment approach refers to how you plan to enter the market. You could invest in bits to test the waters or put all your money in at once. If you invest in bits, the best strategy is dollar-cost averaging.

- Find A Stock Broker

You cannot purchase Apple’s stock directly from the company, but you can partner with a brokerage firm. With so many different options, choosing which stock broker to use is vital. Look for a broker that fits your needs and offers you the required service without breaking the bank. Here are a few factors to consider:

- Credibility: Research your potential stock brokers to see how long they have been in the stock market and how well they have performed. Technology has made it easy to find reviews from people who have worked with that broker. Read these reviews to see how well they have served customers before.

- Experience: If you’re starting, it might be best to work with someone who has been in the industry for some time and knows how best to help new investors. If you are investing for retirement, your children’s tuition, or anything else, ensure you find a broker that understands you and your investment goals.

- Minimum Balance: All stock brokers have a minimum balance that investors must have to invest with them. This amount is not universal and varies between brokers. As an investor, you need to find a broker with a minimum balance that you can comfortably afford without breaking the bank or disrupting your monthly budget.

- Availability: A good stockbroker should be available for their clients at all times. They should be able to answer your questions and provide guidance. Another availability factor is the ease of access to your money. How soon can you withdraw available funds to your bank? How soon does it take the broker to process transactions?

- Expertise: An expert broker will not only help you navigate complicated investments, but they will also explain how these investments can help you reach your financial goals. A good stockbroker can help you access various financial instruments and investment opportunities.

After choosing a broker, you can go ahead to open and fund your brokerage account. Opening an account takes only a few minutes, although it might take longer to verify the account. Fund the account with the money you want to buy the stocks.

- Buy Apple’s Stock

Finally, you can become one of Apple’s shareholders. With proper investment knowledge, a good broker, and the right amount of money in your account, you can proceed to buy the stocks. Before you take action to invest, you must remember that the stock price fluctuates, and it is preferable to find a reasonable price before entering the market. There are two options for investors:

- Market Order: Placing a market order means buying the stocks for their current price at the time of buying. As a volatile asset, the price might be slightly different when processed, but the difference will be insignificant.

- Limit Order: Placing a limit order means waiting till the price reaches a certain point before buying the stocks. If you expect the stock price to fall below its current value, you can set a limit order with your stock broker so that the trade is executed when the price reaches your expected threshold.

- Track Your Investment

Apple is a great investment option, but tracking your investment is essential to ensure it’s performing well. There are various ways to track Apple’s performance. Some of them include the following:

- Brokerage Statement: You can view your brokerage statement online or offline, depending on what kind of account you have. You may need to go to the website of the broker who holds your account and log in to see these statements.

- Financial Website: Another way to track your investment is through a financial website like Yahoo or Google Finance. These sites will give you an idea of how much money you have made or lost over time by showing graphs of how Apple’s stock has performed compared with other stocks, bonds, and other assets.

Should I Buy Apple’s Stock?

The past is often said to be the best predictor of the future. Looking at Apple’s track record of being the first company to hit a new trillion-dollar revenue mark, there might be some optimism that Apple could climb back beyond $3 trillion and hit $4 trillion.

But optimism isn’t enough reason for an intelligent investor to buy the shares of a company. Research how Apple’s current administration utilises the company’s resources, its marketing strategy for the current product, and future innovation plans.

If a company is making money, growing, and innovating, then that company is probably a good investment. Although Apple has soared to previously unseen heights in the tech world, it still has room to grow even higher. Choose your investment approach, find the best time to enter the market, and manage risk.