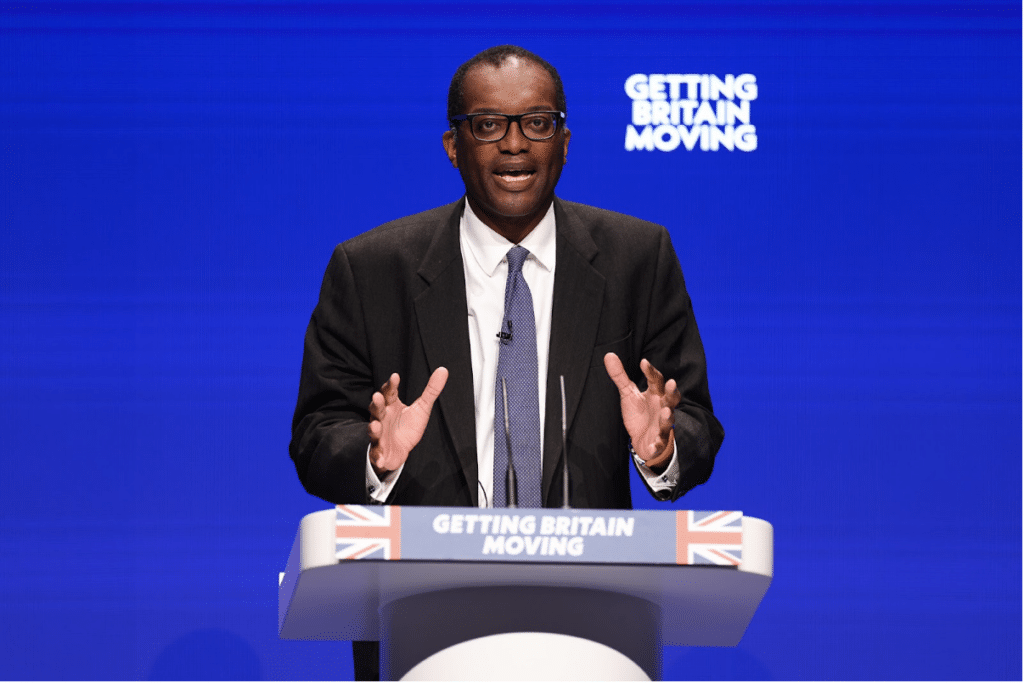

This post briefs you on the UK’s Spring Budget, announced on March 15, 2023, by Chancellor Jeremy Hunt. The UK is trying to grow the economy without scaring off financial markets. But what does it mean to you, your money, and your business?

Two big deals in this budget are capital allowances worth £27 billion over three years. And guess what? You can now put up to £60,000 or 100% of your UK earnings (whichever is less) into your yearly pension.

The budget’s all about getting folks back to work and keeping them there. No significant tax breaks for households, but some tweaks might give your wallet a tiny boost. Basic rate taxpayers will pay £500 more in tax in 2023-24, while higher rate taxpayers will pay £1,000 more.

To cut debt, the government’s sticking to super strict spending plans after the election. They’re upping spending and cutting taxes by about £20 billion a year, dropping to £10 billion by 2027-28. This means borrowing as a share of national income will be around 0.6% lower in the medium term.

But not everyone’s happy. Some say the budget doesn’t help the poorest households struggling with higher energy costs and stagnant incomes. Others say it doesn’t favour their business. Let’s find out what this is all about.

Six Things We Learned From the Spring Budget

We learned several lessons from the announcement of the Spring Budget. Many of these lessons are major highlights of the event, providing an overview. Here are six of them:

- Lower Energy Prices

Lower energy prices affected the growth and household incomes this year. Thanks to the situation in Ukraine, energy prices dropped, causing inflation to fall quickly. Although it gave us an “easier path” from the inflation crisis, it also led to faster wage increases, creating a loop between wages and prices.

- Fuel Duty Reduction

They’re cutting fuel duty by 1p per litre, which means we’ll pay less tax on fuel and enjoy lower prices at the pump. The government will lose some revenue, but they hope to make up for it with fiscal policies. Plus, it might encourage people to use public transport more and reduce carbon emissions.

- Personal Allowance Increase

Good news for many of us: the personal allowance is going up to £13,500. That means if you earn less than that, you won’t have to pay any income tax. About 30 million people in the UK will benefit from this change starting April 6, 2023.

- Reduction in Corporation Tax Rate

Corporation tax rate is dropping to 25%, which is still the lowest in the G7. But don’t worry; measures are in place to encourage businesses to invest, like a new full expensing regime for plant and machinery and an enhanced credit system for R&D-focused SMEs.

- New ‘Full Expensing’ Policy

The Super Deduction is ending, but a new ‘full expensing’ policy is here to motivate businesses to invest. It means companies can write off the investment cost right away, cutting their taxes by up to 25p for every pound they spend. The goal is to make this policy a permanent part of the UK’s corporate tax system.

- Lifetime Allowance Changes

There are changes to the Lifetime Allowance too, which could affect your retirement plans. It’s essential to know how much you can build up in pension benefits without losing tax benefits and how exceeding this limit could impact your income due to a lifetime allowance tax charge. Just keep an eye on those pension rules.

What the Spring Budget Means for You and Your Money

Want to know how the Spring Budget 2023 affects you and your wallet? Here’s a breakdown of some key points:

Energy Bills

So, good news – the government’s got your back with energy bills. They’re delaying that £500 price hike that was coming in April, so your bills will stay around £2,500. Also, from July 1, prepayment energy meter bills will be slashed by £45, which is great for over four million households who need it most.

Childcare Costs

The budget has got some deals for parents. They’re expanding free childcare, increasing funding for nurseries, and making it easier for you to find wraparound care. Over the next couple of years, more free hours will be available for younger kids, and by September 2025, working parents of under-fives will get 30 hours of free childcare.

Pension Allowances

No more Lifetime Allowance (LTA) for pensions! This means there’s no cap on enjoying full tax benefits on your pension. This change helps experienced workers, like NHS doctors, to stay in work longer without being hit by pension taxation.

Fuel Duty Freezing

The fuel duty freeze is still on. It’s staying at 52.95p per litre until March 2024. You’re dodging a 12p per litre price increase, and last year’s 5p duty cut will stick around too. This budget didn’t have a lot of motoring policies, but it’s still helping you save at the pump.

Cigarettes and Alcohol

Smokers, your cigs will cost more – a 20-pack will be over £14 now. And for everyone else, there might be some changes in alcohol prices too. The government’s raising tobacco prices by 2% above the Retail Price Index (RPI) and hand-rolling tobacco by 6% above RPI.

What the Spring Budget Means for You and Your Business

Let’s break down the Spring Budget for you and your business in a more casual, concise way:

Business Rates

The planned reductions in liability are gone, which means if you’re in retail, hospitality, or aviation, you’ll see some immediate benefits. The government’s also revaluing business properties from April 2023 and capping bill increases with a £1.6bn scheme. The FSB wants to scrap rates for small firms and extend small business rates relief past March 31, 2023.

Corporation Tax

No changes here – the main rate is still rising to 25% from April 1, 2023. That’s the lowest rate among G7 countries. The small profits rate stays at 19% starting April 1, 2024. Also, companies can now deduct investment spending from profits with a “full capital expensing” policy expected to become permanent.

Investment Allowance

The £1,000,000 limit for the Annual Investment Allowance will be permanent from April 1, 2023. Plus, there will be £27 billion in capital allowances over three years, with 100% enhanced allowances for decarbonisation investments.

National Insurance

The threshold for paying National Insurance is going up! From July 2022, you won’t pay NI contributions until you earn £12,570 a year, saving millions of workers over £330.

Capital Gains

TTR, OTR, and MGETR relief rates will stay at 45% and 50% until March 31, 2025. After that, they’ll drop to 30% and 35%. The capital gains assessment period might change too.

VAT and Dividend Tax

The tax system’s getting simpler, with some administrative changes to help small businesses. Business rates for small retailers and pubs will be cut by 50% for two years from April 2023. The dividend threshold will go down to £1,000 next year and then to £500 from April 2024, meaning you’ll pay more tax if you get dividends above those amounts.

Criticisms of the Spring Budget 2023

Experts are unhappy with the UK’s Spring Budget 2023, mainly because it didn’t really tackle the issues with public services. Even with Jeremy Hunt talking for an hour, he barely mentioned them. That’s pretty bad, considering public sector strikes were happening, and the poor state of public services was well-known.

Another issue was the lack of wiggle room in the budget. The economy’s been slow, so there wasn’t much to work with for spending or cutting taxes. Because of this, we didn’t see many goodies in the budget. Some peeps, like Conservative MPs, right-leaning press, and motoring groups, wanted to keep the fuel duty freeze or even cut it further.

A further criticism is the budget not addressing the cost-of-living crisis affecting the UK economy. The recent surge in inflation, driven by spectacular increases in energy prices, has caused sharp falls in household living standards. Some experts have argued that ongoing cost of living difficulties should have been addressed more effectively in the budget.

Rounding Off: You, the Budget, and Your Business

The UK’s Spring Budget 2023 aims to support economic growth, reduce the cost of living, and provide relief for businesses and individuals. Key highlights include capital allowances, increased pension allowances, lower energy prices, reduced fuel duty, increased personal allowance, and changes to corporation tax.

While the budget offers some benefits, such as delaying the energy price hike, expanding free childcare, and removing the Lifetime Allowance for pensions, it has also been criticised for not adequately supporting the poorest households and favouring certain businesses. Overall, the Spring Budget sets the stage for a new economic phase with lower inflation and higher growth, but its impact on individual living standards remains uncertain.