The UK energy bills freeze saw a deep sigh of relief sweep through UK households. But with Sterling sinking, it would be premature to pop the champagne.

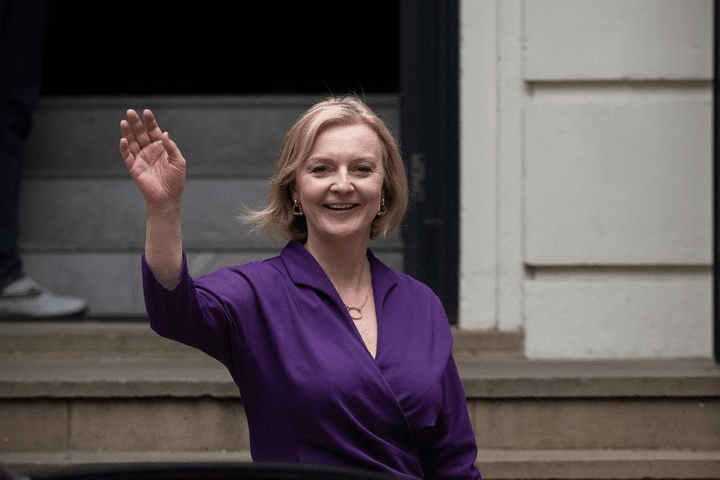

On 8 September, newly-appointed PM Liz Truss announced that the UK household’s average annual energy bill will be limited to £2,500 for the next two years.

Previously, this essential bill was planned to rise to £3,549 from October, and increase again by several thousand pounds from April 2023. As such, political intervention was inevitable, despite Truss’ distaste for ‘handouts.’

However, in the long run this noble attempt to save the economy may cause more problems than it solves.

Energy bills freeze: complicating factors

Controversially, funding for the bills freeze is coming from increased government borrowing, to be paid for by taxpayers.

Costing perhaps £200 billion over the next two years, the alternative was to apply increased windfall taxes to energy producers, such as BP, Shell, and Harbour Energy, and suppliers such as Centrica. Together, they are expected to generate £170 billion of excess profits over the next two years.

And while cheaper energy will bring headline CPI inflation far below Goldman Sach’s and Bank of England Chief Economist Huw Pill’s prediction of 22% next year, this intervention could be at the price of longer-term inflation lasting several years.

Sterling is already down significantly against the US Dollar this year, and a further move to parity is becoming more possible. Put simply, excessive money printing means the Sterling supply is rising. And with no upper limit to gas prices, the government’s risk is akin to a naked call option, in that there is theoretically no upper ceiling on its liability.

Concomitantly, US CPI inflation has increased by 10 basis points to 8.3%, sparking nerves that Federal Reserve Chair Jerome Powell could increase the federal funds rate by 125 basis points to send a message to the markets.

Of course, this will strengthen the Dollar further, piling on pressure for Bank of England Governor Andrew Bailey to respond in kind- creating a new affordability crisis, this time in terms of debt including mortgages, credit cards, and loans. And this will put Bailey in direct conflict with ‘Trussonomics,’ casting question marks over the Bank’s independence.

Further, the plan itself is fundamentally underdeveloped. While similar support has been promised for businesses, details may not be available until November.

In addition, the 20% of households still on fixed rates remain in the dark as to whether a proposed equivalent deduction — 17p/kWh for electricity and 4.2p/kWh for gas — will leave some with higher prices than the proposed cap, and others far under it, especially as many are fixed higher for one energy and lower for the other.

There are similar delivery issues with those on non-standard contracts, including a proposed discretionary fund that will be hellishly difficult to implement while safeguarding taxpayer funds.

The fundamental problem

But the key issue is that the emergency energy plan does not solve the immediate fundamental supply problem, despite some decent attempts to further develop energy independence. Russia supplied 40% of Europe’s gas in 2021, and Truss’ plan will not magic the gas required to replenish this amount.

Energy bills are still double what they were a year ago, despite additional funding such as the universal £400 grant. And reduced consumer spending remains likely, especially among traditionally middle-class households that are being hit by higher bills without additional support.

The EU is starting to realise the scale of the problem, and is planning to cut peak energy use by 5%.

But with Eurozone inflation raging, ECB rate rises are even more complex than those in the UK, as highly indebted EU economies like Italy simply will not be able to service their debt mountains if rates go too high. This means its ability to borrow out of the mess is even more sorely limited than in the UK.

Rationing or blackouts beckon.

However, there is one, bright, silvery lining amid the clouds of energy doom. Europe is desperately bringing more renewables online, in an attempt to boost supply to pre-Russian cut levels. Meanwhile, an eventual Iran nuclear deal could see further supply of oil and gas.

When peace comes, and it always eventually does, an eventual restoration of Russian exports to the west could create a supply glut adding rocket boosters to the economic bounce back.

But the recession before the recovery may be equally deep.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.