The Byzantine UK personal tax system makes pension contributions far, far more efficient than many investors realise.

The disastrous UK mini-budget has all but been eradicated. New Chancellor Jeremy Hunt has made it clear that the unfunded tax cuts, including changes to the additional 45p rate, corporation, tax and the basic 20% income tax rate are gone.

It’s also reasonable to assume that the 1.25% National Insurance increase — dubbed the health and social care levy — will return soon, even if not right now.

Today’s PM Liz Truss had also previously planned to address the oddities within the tax system that constitutes an individual’s marginable rate. While her authority is now gone, this could have been a sensible plan.

Indeed, the notion that there are simply the basic, higher, and additional tax rates, is fantasy. Pension investing within a SIPP is significantly more tax efficient than most retail investors realise.

The taxation postulation

Consider a typical English university graduate, responsible for a plan 2 student loan, and who has a stay-at-home partner with two children. Their marginal rate is fiendishly difficult to calculate, and more importantly, the return on additional work at varying points negligible.

Note these figures are a rough calculation using rounded income bands. Individual circumstances vary, and these figures are only good for earnings within each band, rather than for earnings as a whole.

All earnings up to £12,500 are subject to both the universal credit taper rate at 55%, and withdrawal of council tax support at 25%, a marginal rate of 80%.

For earnings between £12,500 and £25,000, this person would face income tax of 20%, plus National Insurance contributions of 13.25%, followed by the 55% UC taper rate, for a marginal rate of 88.25%. In addition, they would lose access to multiple low-income benefits including Healthy Start vouchers, in addition to subsidised uniform and school trips derived from the Pupil Premium grant.

Of course, the UC taper applies on net income, so this isn’t completely accurate. And yes, it’s debatable whether Universal Credit taper functions as a tax or withdrawal of benefits, but the net result is the same for someone making the decision over whether it’s worth working more.

The next chunk, between £25,000 and £50,000, is the only band where this typical employee actually keeps more than 50% of their income. 20% income tax, 13.25% National Insurance, and 9% student loan contribution add up to a 42.45% marginal rate.

With the average English student now graduating with circa £50,000 in debt, which increases annually at a cumulative interest rate of 6.3%, few will ever pay off the full amount.

Further, a postgraduate would see an additional 6% tax on earnings over £20,000, though as the highest loan amount available is circa £12,000, this loan at least will be paid off by most.

Pension contributions: higher rate?

The so-called higher rate is where pension contributions start to get interesting.

Between £50,000 and £60,000 of earnings per annum, our typical earner sees their income tax band rise to 40%, though National Insurance contributions decrease to 3.25%. When factoring in the student loan, this leaves a marginal rate of 52.25%.

However, they also lose entitlement to child benefit, on a sliding scale between £50,000 and £60,000 of earnings. Child benefit for two children comes to £1,885 per annum, so an earner on £60,000 faces losing this income under an effective marginal rate of 71.1%.

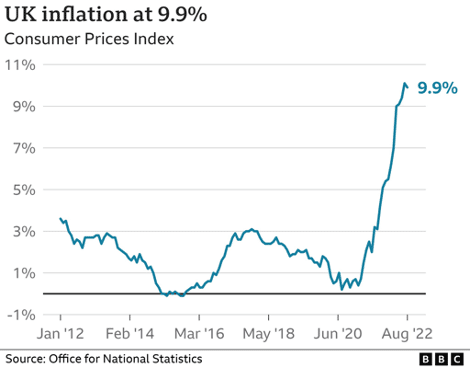

At this point, it’s worth noting that income tax bands are now frozen until FY2025-26, despite sky-high 9.9% CPI inflation. Many earners will be dragged into the higher bands over the next few years. And the UK now maintains a situation where two earners with children both making £40,000 per annum are massively better off than a sole earner on £80,000.

In addition, if this high earner was to exit the relationship, they would be expected to only contribute 16% of their gross weekly income to the non-earning partner, with benefits subsiding the children’s care.

Between £60,000 and £100,000, the marginal rate becomes simpler, in that an employee pays only 40% income tax, 3.35% NI, and their 9% student loan, for a 52.25% marginal rate.

But sadly, it then gets more complicated still. Between £100,000 and £125,000, earners hit what is dubbed the ‘60% tax trap.’ They lose £1 of their personal allowance for every £2 earnt over £100,000.

This means an earner is stung by a combination of 40% income tax, the 20% personal allowance tax trap, a 9% student loan, and 3.25% NI contribution for a marginal rate of 72.25%.

However, what few know is that earners on more than £100,000 also lose access to funded childcare. Though only relevant for a few years, this increases the rate even further. In many cases, breaking through the £100,000 barrier actually leaves them worse off.

Finally, between £125,000 and £150,000, tax reverts to the standard 52.25%, before increasing to 57.25% upon hitting the additional rate at £150,000+.

Why does this matter?

This typical employee can choose to sacrifice any earnings that takes them over any threshold into a private pension, commonly a Self-Invested Personal Pension (SIPP).

The key advantage is that employees qualify for tax and student loan relief on these contributions up to a £1 million+ limit.

As an example, an earner on £60,000pa would pay a 71.1% marginal rate on the £10,000 between £50,000 and £60,000 of income. Or to put it another way, they would see only £2,890 of this income if they take it as normal PAYE.

However, if they sacrifice this £10,000 into their pension, the government would use their taxes to top it up to £12,500. This means they are free to invest £12,500 for a £2,890 opportunity cost.

Of course, there’s also complicating factors surrounding tax treatment of investments at higher rates, as well as charitable contributions.

But the takeaway is this: for millions, tax is far higher than supposed, and pensions far more efficient than understood.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

You might also be interested in: Start a business or start investing? From a tax perspective, it’s an easy choice