Centi-millionaires are people who have a net worth of at least $100 million. They are the elite of the elite, the cream of the crop, the top 0.01% of the global population.

In 2023, their number and wealth increased dramatically, reaching new heights of prosperity and power. How did they do it? What are the sources and sectors of their wealth? Which countries and cities have the most centi-millionaires? And how do they manage and protect their fortunes in a turbulent world?

In this article, we will explore the rise of the centi-millionaires in 2023, using data from the latest Centimillionaire report by Henley & Partners.

Quick Overview

- Centi-millionaires are individuals with a net worth of at least $100 million

- Over the past two decades, the number of centi-millionaires has more than doubled

- The United States leads in the number of centi-millionaires, followed by China and India

- New York City, The Bay Area, and Los Angeles top the list of cities with the most centi-millionaires in 2023

- In the United States, the financial and professional services sector is the most common industry for centi-millionaires, followed by the tech industry and real estate

- Centi-millionaires employ various strategies to manage and grow their wealth, including global investments, philanthropy, and diversification into cryptocurrencies

Centimillionaire Benchmark is Better than the Billionaire Benchmark

The centi-millionaire benchmark is more realistic than the billionaire benchmark. According to the latest Wealth-X report, there are only 3,204 billionaires in the world as of 2023, accounting for 0.00004% of the global population. On the other hand, there are 295,450 centi-millionaires in the world, representing 0.0038% of the global population. This means that the centi-millionaire group is almost 100 times larger than the billionaire group, and thus more representative of the super-wealthy population.

Aside from being realistic, the centi-millionaire benchmark is also more relevant than the billionaire benchmark. This is especially true in emerging markets and smaller countries, where the number and wealth of centi-millionaires are growing faster than those of billionaires. For example, in China, there are 26,600 centi-millionaires as of 2023, an increase of 12% from 2022. In contrast, there are only 1,058 billionaires in China, a decrease of 3% from 2022. Similarly, in Nigeria, there are 724 centi-millionaires as of 2023, an increase of 15% from 2022. In comparison, there are only four billionaires in Nigeria, with no change from 2022.

Therefore, the centi-millionaire benchmark is better than the billionaire benchmark because it reflects more accurately and more widely the power and influence of the super-wealthy population. It also captures the dynamic changes and opportunities in different regions and sectors of the global economy.

Growth Rate from 2003-2023

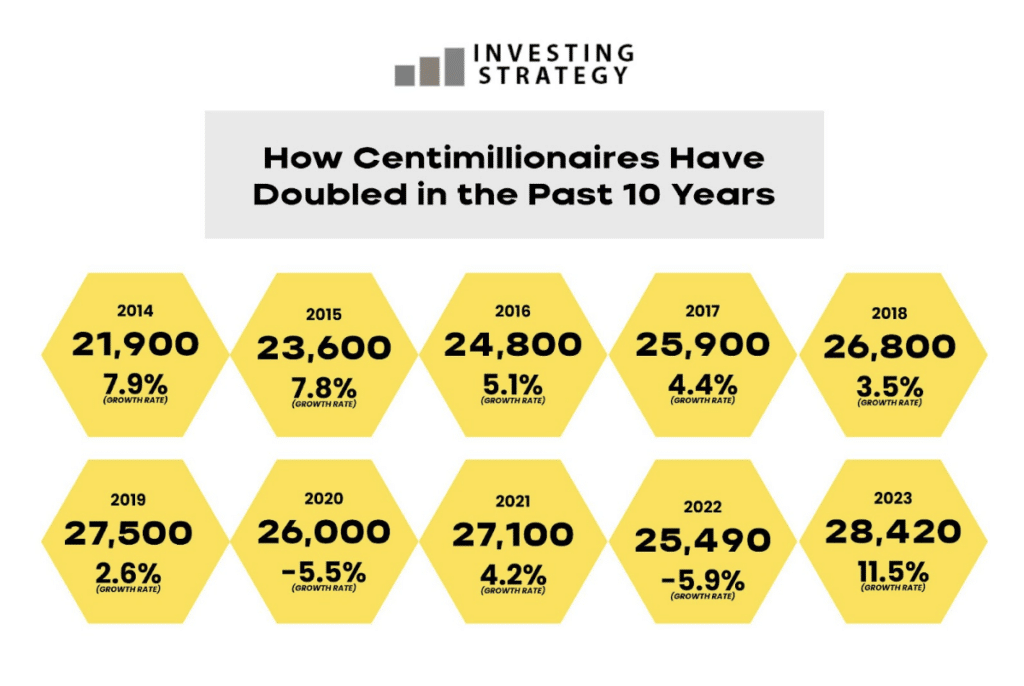

The number of individuals with a net worth of more than $100 million has more than doubled since 2003, reaching 28,420 in 2023. This represents a compound annual growth rate (CAGR) of 5.6% over the 20-year period. However, the growth rate has fluctuated significantly in the last decade, depending on various economic and social factors.

From 2014 to 2019, the number of centi-millionaires increased steadily, with an average annual growth rate of 5.2%. This was driven by strong economic performance in the U.S. and Asia, as well as favourable conditions for entrepreneurship and innovation. Many of the ultra-high net worth individuals (UHNWIs) created their wealth by running their own businesses or investing in startups.

However, the growth rate declined sharply in 2020 and 2022, dropping to -5.5% and -5.9% respectively. These were the years when the global economy was hit by major shocks, such as the Covid-19 pandemic and the mortgage crisis. The pandemic disrupted many industries and sectors, reducing the income and assets of many UHNWIs. The mortgage crisis increased the interest rates and lowered the property values, affecting the wealth of many centi-millionaires who had invested in real estate.

In contrast, the growth rate rebounded strongly in 2021 and 2023, reaching 4.2% and 11.5% respectively. These were the years when the global economy recovered from the shocks and resumed its growth trajectory. The recovery was aided by government stimulus packages, low interest rates, vaccine rollouts, and digital transformation. Many UHNWIs benefited from these measures and regained or increased their wealth.

Top 10 Countries with the Most Centi-Millionaires in 2023

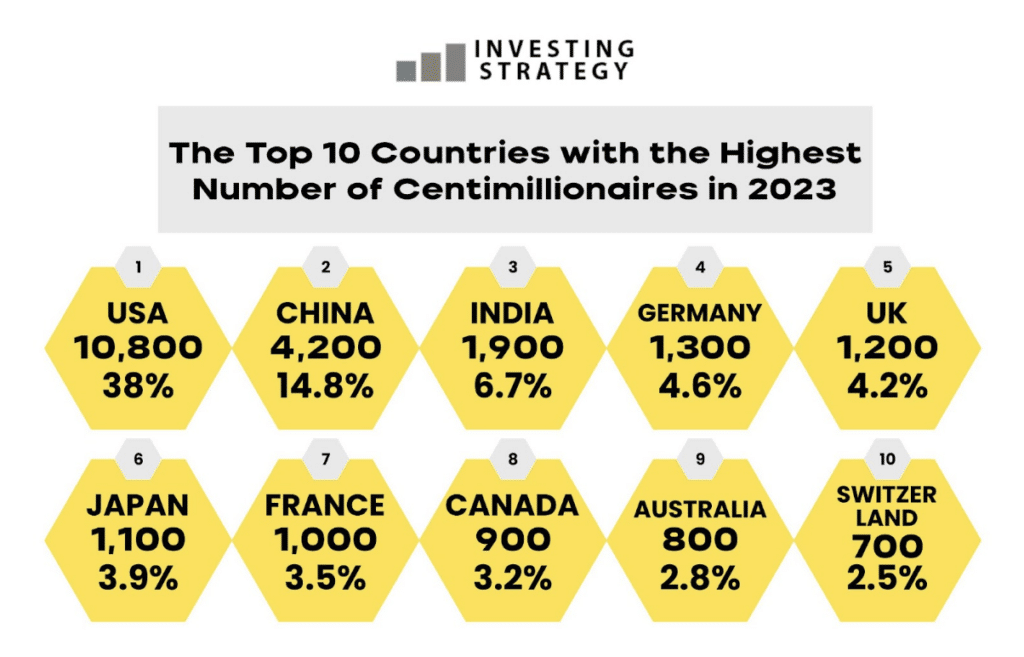

The United States is the clear leader in the top 10 countries with the most centi-millionaires in 2023. It boasts 10,800 centi-millionaires, which is more than double the number of the second-ranked country, China. The US centi-millionaires represent 38% of the global total, which is 25,490. Most of them are either self-made entrepreneurs who founded multinational companies or heirs and heiresses of large fortunes.

China follows with 4,200 centi-millionaires, which is 14.8% of the world’s total. China has seen a rapid growth of its super-rich population in recent years, thanks to its booming economy and emerging industries. India ranks third with 1,900 centi-millionaires, which is 6.7% of the global total. India also has a large and diverse economy, with many successful business leaders and innovators.

Germany and the UK are the fourth and fifth countries in the list, with 1,300 and 1,200 centi-millionaires respectively. They account for 4.6% and 4.2% of the world’s total. These two European countries have long histories of wealth creation and accumulation, with many of their centi-millionaires coming from established families or businesses.

Japan is the sixth country with 1,100 centi-millionaires, which is 3.9% of the world’s total. Japan is known for its advanced technology and manufacturing sectors, which have produced many wealthy entrepreneurs and executives. France is the seventh country with 1,000 centi-millionaires, which is 3.5% of the world’s total. France has a strong cultural and artistic influence, as well as a diversified economy.

Canada, Australia, and Switzerland are the last three countries in the top 10, with 900, 800, and 700 centi-millionaires respectively. They account for 3.2%, 2.8%, and 2.5% of the world’s total. These countries have high standards of living and stable political systems, which attract and retain many wealthy individuals.

Overall, the table shows that the distribution of centi-millionaires is uneven across the world, with some countries having much more than others. It also shows that there are different sources and paths to achieving such wealth, such as entrepreneurship, inheritance, investment, or leadership.

Top 10 Cities with the Most Centi-Millionaires in 2023

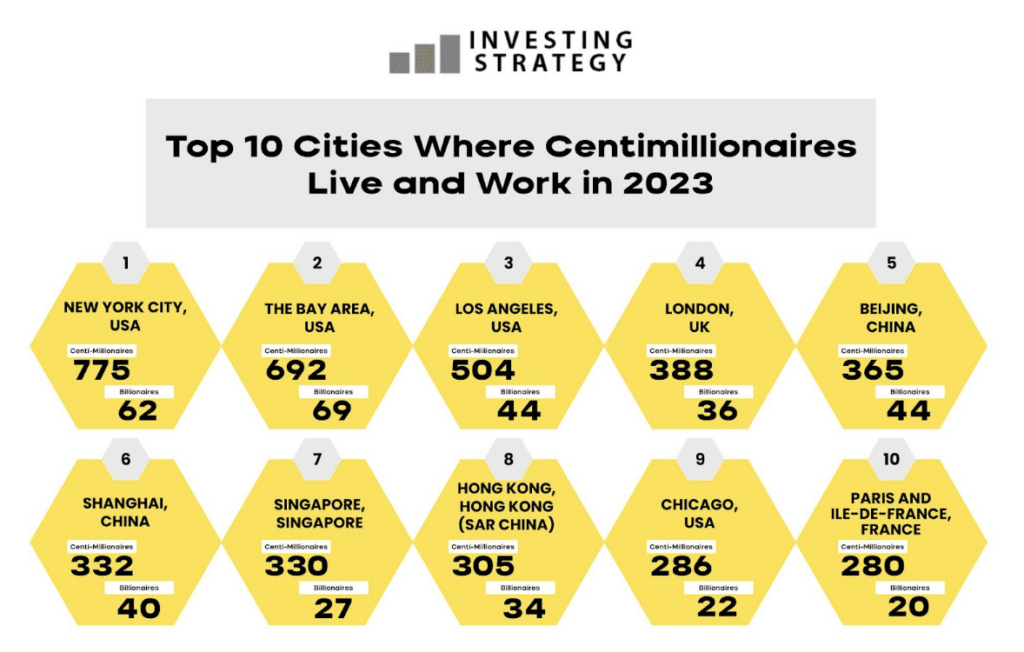

The United States dominates the list with four cities: New York City, The Bay Area, Los Angeles, and Chicago. New York City tops the ranking with 775 centi-millionaires, followed by The Bay Area with 692. Both cities also have a high number of billionaires, with 69 in The Bay Area and 62 in New York City. Los Angeles ranks third with 504 centi-millionaires and 44 billionaires, while Chicago ranks ninth with 286 centi-millionaires and 22 billionaires.

China is the second most represented country with three cities: Beijing, Shanghai, and Hong Kong. Beijing ranks fifth with 365 centi-millionaires and 44 billionaires, slightly ahead of Shanghai, which ranks sixth with 332 centi-millionaires and 40 billionaires. Hong Kong ranks eighth with 305 centi-millionaires and 34 billionaires.

The remaining three cities are London, Singapore, and Paris. London ranks fourth with 388 centi-millionaires and 36 billionaires, making it the only city in Europe to make the top 10. Singapore ranks seventh with 330 centi-millionaires and 27 billionaires, surpassing Hong Kong as the leading city in Asia for UHNWIs. Paris ranks tenth with 280 centi-millionaires and 20 billionaires, being the only city in France to make the list.

The visual reveals some interesting insights about the distribution of wealth across different regions and cities. The United States has the largest share of UHNWIs in the world, accounting for about a quarter of the global total. China is catching up fast, with its UHNWI population growing by more than 10% annually. Europe is lagging behind, with only one city in the top 10 and a slower growth rate of UHNWIs. Asia is a diverse region, with Singapore and Hong Kong competing for the status of financial hubs, while Beijing and Shanghai represent the economic powerhouses of mainland China.

The visual also shows that there is not a strong correlation between the number of centi-millionaires and billionaires in each city. For example, The Bay Area has more billionaires than New York City, despite having fewer centi-millionaires. Similarly, Singapore has more billionaires than Hong Kong, despite having fewer centi-millionaires. This suggests that there are different factors that influence the accumulation of wealth at different levels, such as entrepreneurship, innovation, taxation, regulation, philanthropy, and inheritance.

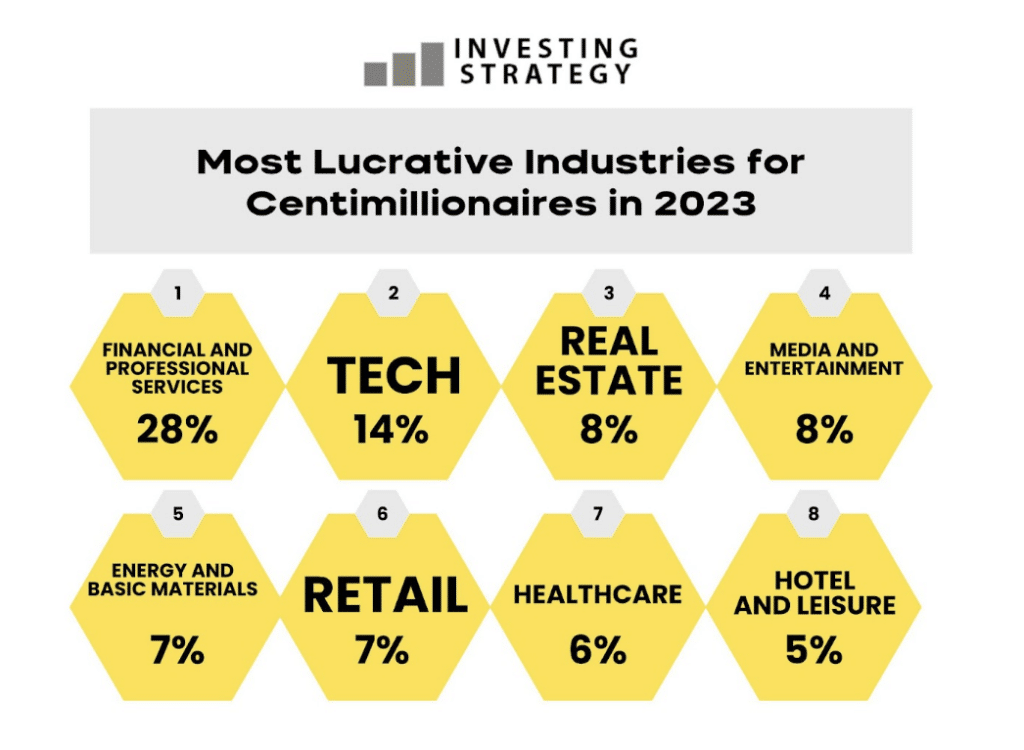

The Most Common Industries for Centi- Millionaires in 2023

This section analyses the United States’ industries where most centi-millionaires make most of their fortunes.

Most of the super rich are found in the financial and professional services sector. Professions relating to this sector include bankers, lawyers, accountants, consultants, etc., and statistically, they represent 28% for these ultra-high net worth individuals.

The tech industry ranks second for most of the professions the wealthy are into, representing 14%. Entrepreneurs, innovators, engineers, developers in technologies like e-commerce, AI, biotech, fintech, etc., are categorically some of the professions considered for the tech sector.

Eight percent of the individuals with over $100m are into real-estate businesses. While there are 10,800 centi-millionaires in the U.S., this means 864 individuals in the united are into the business of real-estates. Categorically, developers, investors, brokers, owners of income-generating or appreciating properties, are considered as a realtor.

The media entertainment industry is a lucrative business in the United States with eight per cent of the 100-millionaires embracing the business. Celebrities, producers, directors, writers, influencers in various media and entertainment forms, are the professions considered for this industry.

The energy and basic materials sector represents seven per cent of the ultra-high net worth individuals. The 100 millionaire club in this consideration include executives, entrepreneurs in companies producing/trading energy sources or basic materials.

The retail industry comprising of founders, owners, managers of retail businesses like e-commerce platforms, supermarkets, fashion brands, etc., represents seven per cent of the 100 millionaire club.

The healthcare sector, like the medical professionals, executives, entrepreneurs in healthcare services or companies, represent 6% of the centi-millionaires in the United States. Lastly, owners/operators of hotels, entrepreneurs, investors in leisure activities like sports, wellness, gaming, etc., represents five per cent of the hotel and leisure sector where these super wealthy invest.

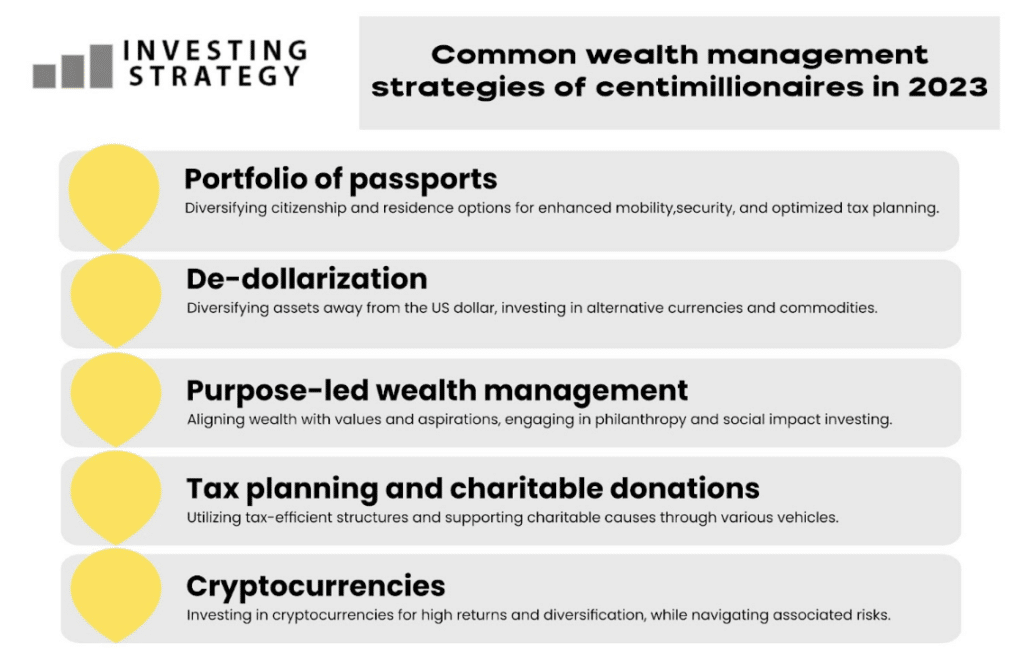

How Centimillionaires Manage and Grow Their Wealth in 2023

As shown in the infographic, people with more than $100 million use different ways to manage and grow their money in 2023. Some of these ways are:

- Getting many passports and homes in different countries: To travel easily, be safe, and pay less taxes by using different rules.

- Investing in other things besides the U.S. dollar: Protects them from losing money if the dollar goes down and lets them benefit from other markets.

- Using their money for good causes: Matches their values and goals, and also makes them look good and invest in things that will last.

- Planning their taxes and giving to charity: Saves them money and helps them do good at the same time.

- Buying cryptocurrencies: Gives them a chance to make more money and try new things, but also has some risks and challenges.

Growth Prediction for the Next 10 years

| Years | Forecast Rates (%) |

| 2024 | 22 |

| 2025 | 50 |

| 2026 | 17 |

| 2027 | 12 |

| 2028 | 60 |

| 2029 | 63 |

| 2030 | 55 |

| 2031 | 24 |

| 2032 | 6 |

| 2033 | 45 |

Unlike in the last decade, the next decade for the 100 millionaire club is forecasted to grow exponentially. While other years are predicted to grow above 12% in the next decade, only in 2032 the growth for the super rich is forecasted to be lower, drastically reaching 6%. Moreover, growth will perform at its best in 2029, as the rate is predicted to reach 29% in 2029.

Even when the result shows a ridiculously low growth rate in 2032 for the next decade evaluation, once can hold on to the fact that there won’t be any year where the previous year’s total would outnumber the subsequent number of the super wealthy. Instead, they would only be a steady growth, which similarly represents growth at a slower pace.

Conclusion

The rise of centi-millionaires, individuals with at least $100 million in assets, is a significant trend. Over the past two decades, their numbers have more than doubled, driven by factors like changing money values and low-interest rates. While there were setbacks in 2020 and 2023, the super-wealthy rebounded in 2023.

The U.S. leads the pack, followed by China and India as members hailed from diverse backgrounds and industries, all emphasising diversification. Lastly, prediction for the next decade suggests steady and consistent growth for ultra-rich net-worth individuals

FAQs

A centi-millionaire is an individual with a minimum of $100 million in investable assets, while a billionaire has a net worth of at least $1 billion. Centi-millionaires are more numerous and considered a more accurate reflection of the super-wealthy population.

The number of centi-millionaires has more than doubled since 2003, with a 29% growth rate over the last decade. Various factors, such as changes in the value of money, low-interest rates, and government assistance, have contributed to this increase.

The decline in 2020 and 2022 can be attributed to the global disruption caused by the COVID-19 pandemic and higher mortgage rates in 2022, leading to decreased asset prices.

The United States tops the list with 9,730 centi-millionaires, followed by China with 4,200, India with 2,100, Germany with 1,200, and the UK with 1,000. These countries have significant populations of super-wealthy individuals.

Centi-millionaires value diversification and explore various opportunities to ensure their wealth continues to grow. They don’t solely rely on income from their primary industries.