Despite prophecies and high short-term volatility, the stock market has shown surprisingly stability over time.

Last week, the well-respected American investor Stanley Druckenmiller was quoted in the media regarding his views on the global economy in general and the stock market in particular. When asked about the future of the stock market, he gave a bleak prophecy, stating that prices would remain unchanged for a decade.

Asset bubble

Druckenmiller saw the current period as the most uncertain in the stock market during his 45-year career. Valuations are high, and he assessed that a significant asset bubble had formed along with unhealthy high interest rates. Druckenmiller may very well be correct, but if we look at history, it won’t be as bad. For example, we can look back at the past 25 years, which have been a tumultuous period in stock market history.

Crisis after crisis

It started with a 30% stock market crash in 1997, followed by a burst tech bubble at the turn of the millennium, with three consecutive years of falling stock prices. This was followed by a financial crisis where the stock market nearly halved in value. Then came the European debt crisis, negative interest rates, war in Europe, the highest inflation in 50 years, and the fastest interest rate hike ever, just to name a few events.

On par with the average of the past 200 years

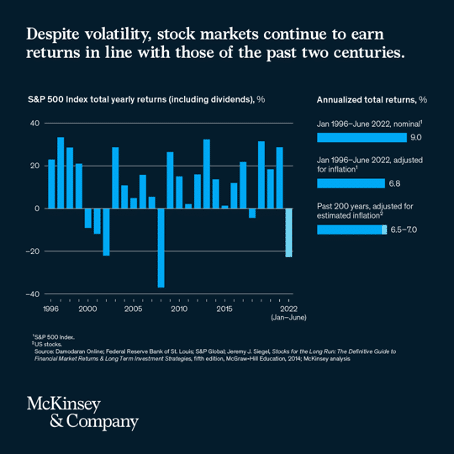

Despite all of this, the stock market has continued as usual. Consulting firm McKinsey has analyzed the past 25 years and noted that it has been a volatile journey in the stock market. Nevertheless, the average annual return on the S&P 500 index has been 9%, and 6.8% when adjusted for inflation. This aligns with the average return of the past 200 years (see chart below).

The stock market remains stable over time.

The conclusion of McKinsey’s analysis is that as an investor, one should not be swayed by short-term price movements but rather take a long-term perspective. The stock market is stable over time, and investing in the stock market over the long run is profitable.