The possibility of a UK recession in 2024 has been a topic of discussion among economists and policymakers. While some experts predict a recession, others believe that the UK economy will continue to grow.

With differing opinions on the likelihood of a UK recession in 2024, it’s important to keep an eye on economic indicators and policy decisions that could impact the economy. We’ve carefully prepared this piece to find out the likelihood.

Quick Overview

- The likelihood of a UK recession in 2024 is uncertain, with predictions ranging from significant recessions to modest growth.

- Goldman Sachs and CEPR economists predict a significant recession, with a 2.5% contraction in GDP, while the CBI predicts a growth of 1.8%.

- High inflation and interest rates are contributing factors to the likelihood of a recession, with the Bank of England aiming to reach a 2% inflation target by 2025.

- The yield curve on government bonds, such as the 2-year and 10-year gilt bonds, indicates a possible recession with expected increases in interest rates.

- The unemployment rate is another factor influencing the likelihood of a recession, with predictions ranging from a rise to 5% by 2026 to a decrease to 4.1% in 2024.

Forecasts and Predictions for UK Recession Happening in 2024

The likelihood of a UK recession in 2024 is uncertain and varies depending on the source of the forecast.

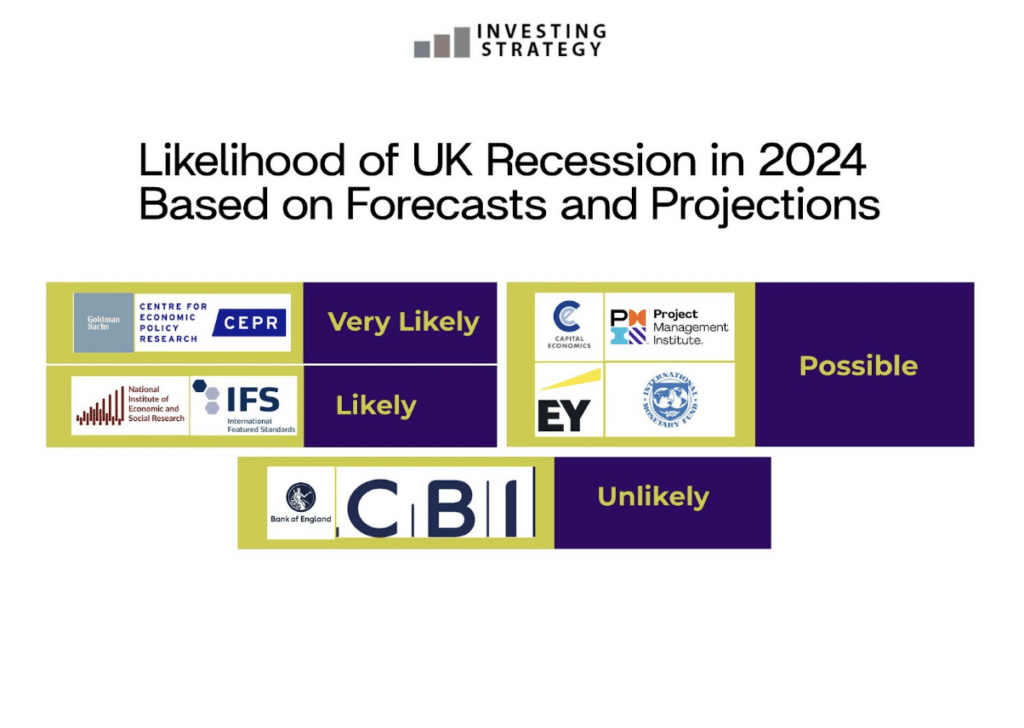

Some of the most pessimistic views come from Goldman Sachs and the Centre for Economic Policy Research (CEPR) economists, who both suggest a high likelihood of a recession. Goldman Sachs predicts a significant recession, with a 2.5% contraction in GDP. The CEPR survey of economists, conducted in 2023, found that 74% of respondents believed there was a significant risk of a recession in the next two years, which included 2024.

Other institutions predict a moderate or possible chance of a recession, with different degrees of severity and timing. The National Institute of Economic and Social Research (NIESR) assigns a 60% probability to a recession in the UK by the end of 2024, while the Institute for Fiscal Studies (IFS) warns of a “moderate” recession in the first half of 2024, with a 0.7% contraction in GDP. Both institutions highlight the potential impact of high interest rates and weak wage growth on the UK economy.

Some forecasts suggest a weak but not necessarily recessionary economic performance for the UK in 2024. Capital Economics points to the potential impact of rising interest rates on economic activity, but also predicts a modest GDP growth of 0.9% in 2024. PMI Data indicates a potential decline in the economy, with a composite output index below the 50 threshold that separates expansion from contraction in September 2023. EY predicts a sluggish GDP growth of 0.8% in 2024.

The International Monetary Fund (IMF) and the Bank of England present a more optimistic view, suggesting that a recession in 2024 is unlikely. The IMF expects the UK economy to grow by 0.6% in 2024, making it the weakest among the G7, while the Bank of England’s forecasts suggest a sluggish but not recessionary economy. These forecasts suggest that while the UK economy may face challenges, it may be able to avoid a full-blown recession.

Finally, the Confederation of British Industry (CBI) predicts a growth of 1.8% in 2024, indicating an unlikely chance of a recession. This is the most optimistic forecast, suggesting a relatively strong economic performance for the UK in 2024.

Inflation and Interest Rates Influencing the Likelihood of UK Recession in 2024

Inflation and interest rates are other economic variables that determine the likelihood of recession in a country. Whether there will be a recession in the UK in 2024 or not, predictions from different sources help us with some important guesses.

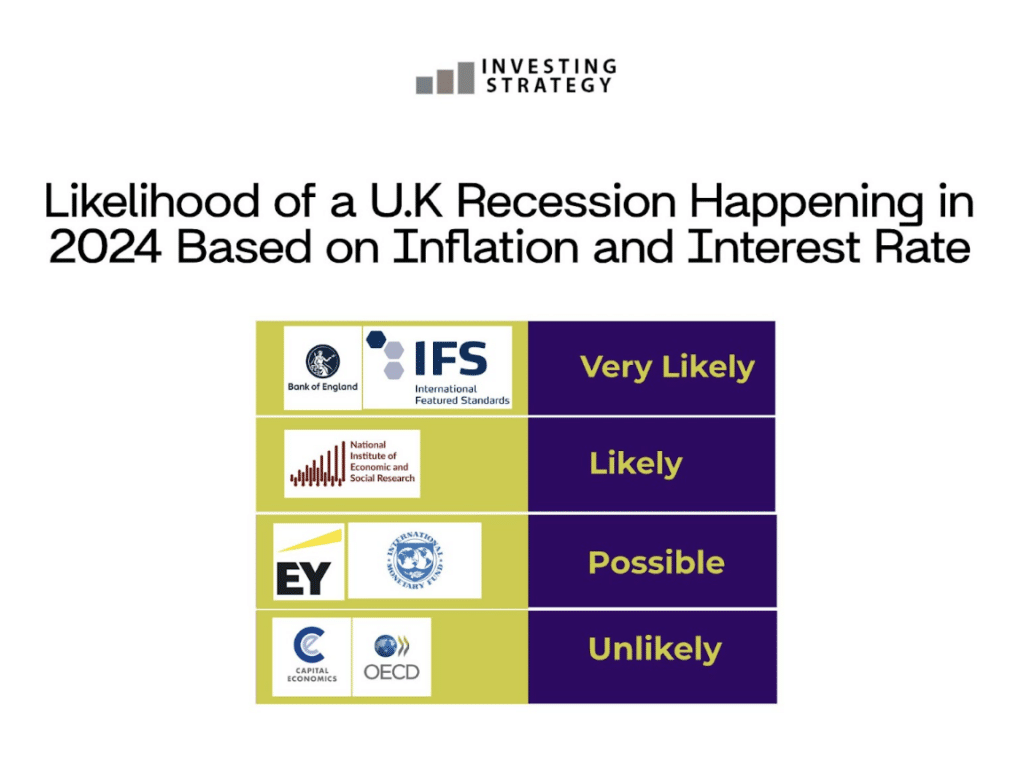

The Bank of England expects inflation rate to keep contracting into 2024, and reach a target of 2% by 2025. Also, in order to keep inflation low, they will continue to raise the interest which may exceed 5.25% by the end of 2024. Low inflation and high interest rate suggest high likelihood recession, as targeted by the Bank of England to reduce its inflated economy. The Institute for Fiscal Studies (IFS) did not specify, but believed there will be a high inflation and interest rates, indicating high public debts and impending recession.

The National Institute of Economic and Social Research (NIESR) predicted a slower inflation rate at 3.9% by the end of 2024, and also expects a 5.5% interest rate by the same time-line. With this, they were able to arrive at a probable 60% of recession occurring in the UK. EY predicts a possible recession, expecting inflation to shrink to 3.4% in 2024, and 1.7% in 2025. The Club also thinks interest will decline, denoting a possible but yet proven recession.

With the IMF, there’s a possible outcome of recession in 2024. The IMF believes in the likelihood of high inflation and interest rate in 2024, but according to its World Economic Outlook report, the inflation rate will be 5.2% in 2024, lower compared to its last two years. By 2024, the IMF believes the rate of interest will be within the range of 5.25% and 5.5%, a sign of a possible recession. With these predictions, there’s a growing feeling that the UK may be the slowest among the G7 nations.

Capital Economics thinks that interest rates will be trimmed further, and will give investors a superior borrowing confidence. However, they expect that interest rate won’t be cut down until the second half of 2024, and also do not expect recession in the UK as they believe in rising inflation in the market. The Organization for Economic Co-operation and Development (OECD) also predicts a 2.9% inflation rate by 2024, and there’s also a growing feeling of unlikely recession in the UK in 2024.

UK Recession in 2024 Based on Yield Curve

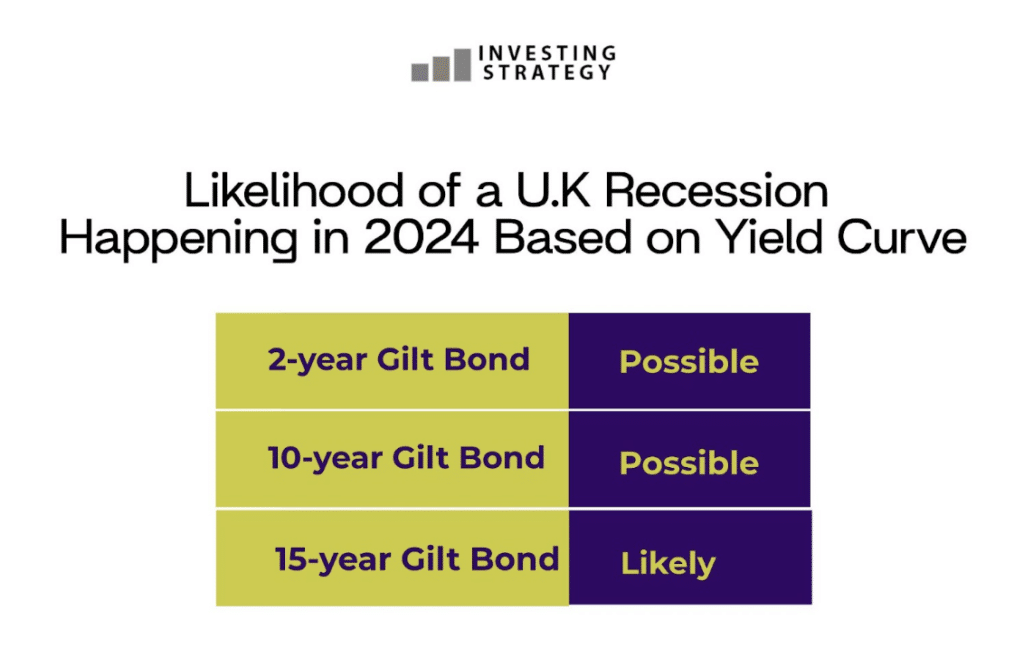

There’s a non-proportional relationship between recession and the government yield bonds. In the UK, analysts – Trading Economics especially – stated what the yield curve on bonds would be in 2024. In lieu of this, we can use these predictions to decide what impact it will have on the economic activities of the UK.

Presently, in October 2023, the yield on the 2-year gilt bond of the UK stands at 4.88%, and it’s expected to reach 5.00% by the end of the quarter. Trading Economics predicted an outcome of 5.59% within the next 12 months, say December 2024, which is an increase from 2023. Logically, the government increases interest rates on bonds to curb excesses, and with an expected increase of 2 year gilt bond, there’s possibility of recession setting in in the UK in 2024.

The UK 10-year gilt bond is expected to close at 4.51% by the end of Q4 2023. Trading Economics global analysts expected the yield on the bond to climb to 4.99% by the end of the fourth quarter in 2024. The other bond, 15 year government bond, is expected to heighten to 5.866% by March 2024, 6.014% by June, and end the year 2024 with a whopping 7.24%.

The UK 10-year gilt bond shows a possible recession with a minimal increase. On the other hand, the 15-year government bond shows a likelihood that recession abounds due to the magnitude of the differences.

Labour Market & Unemployment Rate Influencing the Likelihood of UK Recession in 2024

The likelihood of recession depends on many factors, including the unemployment rate. In the UK, the unemployment rates have been predicted by different analysts to indicate whether recession is looming.

The Bank of England, in their monetary policy report, released that unemployment rate will continue to grow in 2024. They believe unemployment will likely rise to 5% in the UK by 2026. The Institute of Fiscal Studies (IFS) assumed a 5.5-6.0% unemployment rate at the end of 2024. They also believe the unemployment rate will climb from 4.3% in 2023 to 5.8% in 2024.

The National Institute of Economic and Social Research (NIESR) had another view. To them, the UK is heading to the fifth consecutive year of losing its economic growth, and predicted a 4.7% increase in unemployment rate, peaking at 5.1% in 2024. So, there’s a likelihood that the UK experiences recession in 2024 due to the loss of economic growth.

The Confederation of British Industry (CBI) prediction is almost similar to the NIESR forecast. Interestingly, they proposed a 5.0% increase in the unemployment rate by late 2023 and early 2024. It’s also predicted that going further into 2024, the unemployment will deplete to 4.5%, denoting a possible recessionary economy in the country. Statista predicted that the UK unemployment rate will be down by 0.1 million, it may not totally eliminate recession.

The Organization for Economic Co-operation and Development predicted a 4.1% unemployment rate in 2024, a decrease of 0.2% from 2023. Recession is unlikely in the UK in 2024 as the OECD did not predict a recession in the near future. With EY suggesting unemployment rate to rise to 3.8% entering April 2024, there’s a possible downturn of the economy by next year.

Economic Outlook: Factors to Avoid a UK Recession in 2024

Some analysts have forecasted that the UK is likely to face a recession in 2024, while others do not see a recession forthcoming. However, no nation can avoid a recession forever; instead, they can mitigate its impact.

To enhance productivity, the UK government needs to implement ambitious reforms. Before the 2008 global financial crisis, the UK was a robust performer within the Group of Seven nations. However, this momentum waned during the mid-2010s.

As of 2022, real business investment in the UK remains slightly below 2016 levels, contrasting with the 14 percent increase seen in other G7 economies. Specifically, addressing the relatively elevated levels of labor inactivity among individuals over the age of 50 in the UK has the potential to yield a significant boost in economic growth within a relatively brief timeframe.

Strengthening purchasing power is another important factor to curb a recession in the UK setting. One way to do this is by reducing inflation through tight monetary policy. Increasing wages can also help by cutting taxes and raising minimum wages. Additionally, energy prices can take a larger part; reducing them will lower citizens’ cost of living and stimulate economic growth.

So, Will the UK Get Hit by a Recession in 2024?

The likelihood of the UK experiencing a recession in 2024 is uncertain, as reported in this piece. However, the possibility of a recession happening is high when weighed across various indicators such as inflation, interest rate, yield curve, and the labour and unemployment rates outlook.

Looking at historical data and other analysts’ predictions, most of the projections look more likely than not. Indicators like unemployment, inflation, interest rate, and yields are forecasted to be on the rise, which could lead to a recession. However, it’s important to note that few other analysts conclude that the UK may not experience a recession.

FAQs

The likelihood of a UK recession in 2024 is uncertain and varies depending on the source of the forecast. Some institutions predict a high likelihood of recession, while others are more optimistic.

Organisations such as Goldman Sachs and CEPR Economists predict a significant recession in 2024. NIESR and IFS also suggest a moderate to likely chance of recession, while the Bank of England and CBI believe a recession is unlikely.

Factors used to assess the likelihood of a recession in the UK include GDP growth, unemployment rate, inflation, interest rates, the yield curve on government bonds, and labour market conditions.

The UK government can implement ambitious reforms to enhance productivity and stimulate economic growth. Strengthening purchasing power by addressing inflation, raising wages, cutting taxes, and reducing living costs are also potential strategies to curb a recession.

High inflation and high-interest rates can increase the likelihood of a recession, as they can lead to reduced consumer spending and business investment. The Bank of England and IFS predict rising inflation and interest rates, which may contribute to recessionary pressures.