The sentiment towards the stock market and stocks themselves is not at its peak currently. The banking crisis has caused most indicators that measure the willingness to take risks on the stock market to hit rock bottom.

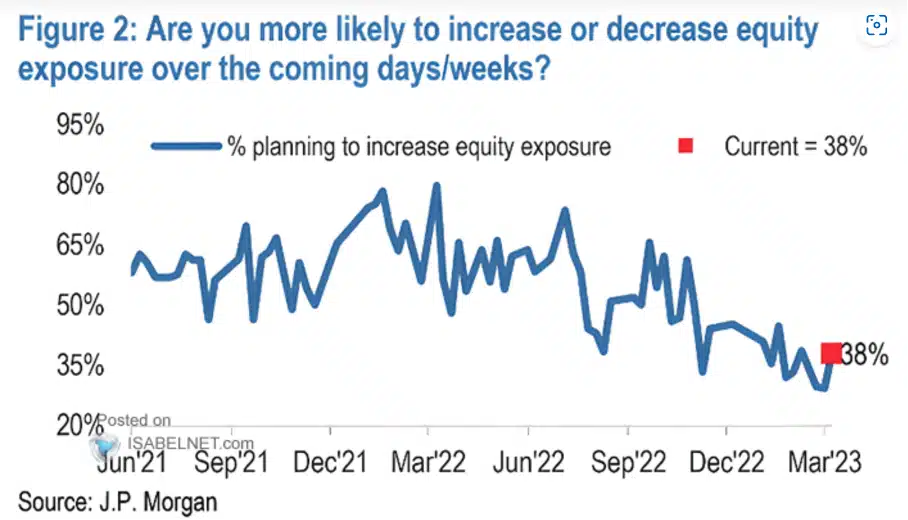

Investment bank J.P. Morgan’s poll among its clients is no exception. The question asked was how likely the customer is to increase or decrease their stock exposure in the coming days or weeks.

Only 38% intend to buy more stocks

Last year, about 65% of respondents at different measurement times intended to invest in more stocks. This is despite inflation, interest rate hikes, and Russia’s invasion of Ukraine. Now that figure is down to 38%.

A worse climate now than in 2022

Investors obviously judge the current stock market climate to be more unfavorable than last year’s.

The only positive thing is that it is a slight increase compared to the previous measurement, which landed at 35%, which was itself the worst since the summer of 2021.

Good contrarian indicator

This does not necessarily signal a weak stock market in the future. Large asset managers are usually quite slow to change their large portfolios. They are rarely the first ones out, but rather tend to follow the trend, albeit a little behind. In fact, they are almost a good contrarian indicator.

Weak sentiment for stocks may be good

This was the case just over a year ago in January 2022. Then the sentiment was high after a strong year for the stock market. At that time, 80% of respondents intended to invest more money in stocks.

This was despite the already noticeable rise in inflation. If sentiment is weak, it doesn’t take much positive news to improve it.