Netflix’s share price crash combined with obvious Microsoft synergies could make their recent advertising partnership a test run for greater things.

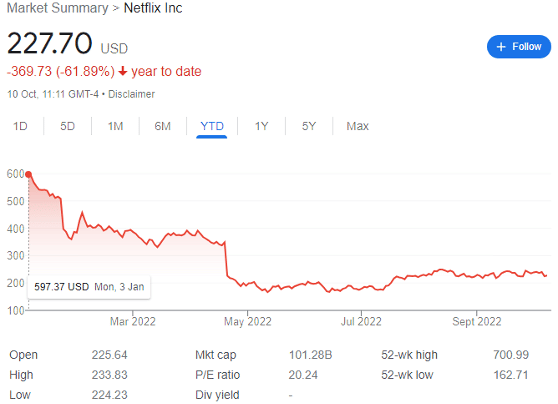

It is unlikely to have escaped many investors that Netflix is having a bad year, even compared with the wider Nasdaq Composite crash. The US tech-heavy index has fallen by 33% year-to-date to 10,652 points, while Netflix is down by 62% to $225.

This means the streaming trailblazer is now worth less than $100 billion, down from a record $314 billion just a year ago. Of course, for many companies, this still leaves a buyout impossible.

But despite losing a third of its value this year, Microsoft remains a $1.75 trillion behemoth. And it plays by different rules.

Netflix shares: the buyout thesis

The thesis is relatively simple: from multiple perspectives, it just makes sense.

There are few companies in the same league as Microsoft, but three are Alphabet, Amazon, and Apple. All operate their own streaming service, and this remains an area that Microsoft can still break into for growth.

But new streaming services fail more often than not. Quibi, CNN+, and a horde of others have bitten the dust after multi-billion-dollar investments. The surviving dozen or so are fighting for diminishing consumer discretionary income, and with variable results.

Marmite reviews of Amazon’s Rings of Power and The Wheel of Time adaptations are testament that throwing money at wildly popular trademarks isn’t enough. Productions need heritage, and Netflix originals have that in spades.

For example, Stranger Things season four has generated 1.3 billion viewing hours alone.

Further, Netflix is starting to dip its toes into the gaming market, despite only 1% of current subscribers having an interest.

But Microsoft, which runs the Xbox and PC ‘Game Pass,’ often called the ‘Netflix of Gaming,’ is pursuing a $68.7 billion acquisition of Activision Blizzard, the enormously successful owner of the Call of Duty franchise.

It’s not hard to see how a bundled subscription could fare, given Netflix’s loyal 220 million-strong subscriber base.

In addition, Netflix runs on Amazon Web Services, and a deal could allow it to take a premium client from a major cloud computing competitor and move them onto Azure.

Would Netflix be open to an offer?

Kantar research shows the average US household pays for 3.7 streaming subscriptions. However, as Netflix found out earlier this year, streaming growth is stalling and customer discretionary income collapsing.

This could become a growing problem. Amazon’s offering also comes with Prime benefits like fast shipping or music. Apple’s is incorporated into its polished brand machine. And Alphabet’s Youtube is still growing rapidly, with premium subscriptions for music and ad-less videos on the rise.

Netflix is looking vulnerable as a streaming-only option, especially as production costs rise with inflation and debt costs inflate with interest rate rises.

What it needs is money, as evidenced by its deeply unpopular subscription sharing crackdown, and plans to open up to advertising against its intrinsic nature. Fortunately, money is something Microsoft has in spades. And spending heavy on Netflix’s dip could well reap rewards during the recovery.

Netflix’s original amortized spend grew at an annual growth rate of 68.2% between 2014 and 2020, but it’s expected to slow to about 14% between 2021 and 2025. S&P Global Market Intelligence notes that it will ‘temper its content spending growth.’

And while it’s allocated $17 billion in annual cash spend for its entire worldwide programming budget in 2022, this may not be sustainable without a serious cash injection.

Then there’s the growth proposition to consider. In Q2, revenue grew by 9% year-over-year to $7.97 billion, but most of this growth has come from price rises and cracking down on sharing subscriptions, not subscriber growth.

In fact, its April Q1 results share price crash originated from losing subscribers for the first time ever. A tie-up with Microsoft would immediately reverse this worrying trend. And when a company can no longer organically grow, selling to a larger competitor is often the best way to generate value for shareholders as the sale usually comes with a circa 30% premium.

In its upcoming ad-supported version, Netflix has even selected Microsoft as its ‘global advertising technology and sales partner.’

COO Greg Peters enthuses that ‘Microsoft has the proven ability to support all our advertising needs as we together build a new ad-supported offering…we have much to work through. But our long-term goal is clear: More choice for consumers and a premium, better-than-linear TV brand experience for advertisers.’

Could the two be testing the waters?

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Leave a comment