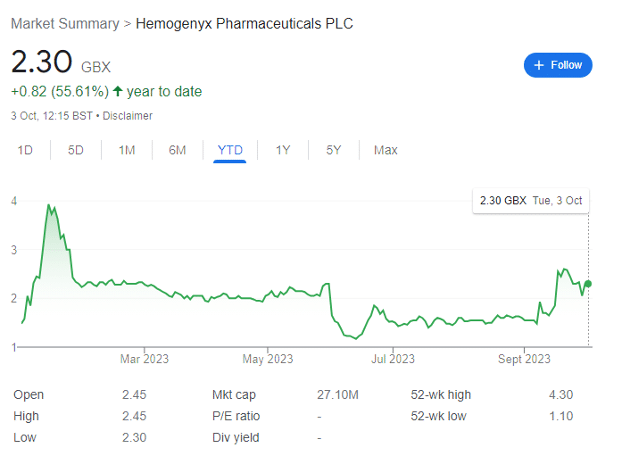

HEMO’s investment case is much strengthened since January, though the immediate cash issues remain a concern. my thoughts below.

Hemogenyx. It’s been a while since I covered this oncology portfolio stock — last running through the investment case in late January 2023. I’d encourage would-be investors who are new to the company to briefly scan through that original article to get a flavour of the company, and of CAR-T therapy.

At the time, the share was changing hands for around 2.5p after a placing at this level to raise cash needed to continue operations. I bought in shortly after that article was released, expecting complications with its treatments to be resolved fairly quickly.

However, FDA issues regarding its Investigational New Drug Application remain ongoing (if close to being resolved), and the share price fell to as low as 1.17p in mid-June. HEMO remains dragged down by negative market sentiment — and an imposed FDA clinical hold on its flagship CAR-T cancer treatment on 2 June, which became a full-blown review letter on 10 July.

The reason for the clinical hold relates to a splicing that occurs during the manufacturing process of the lentivirus that is used to produce its CAR-T cells. The Company has now identified the source of the splicing deficiency and has already developed a method to eliminate it. The lentivirus is being remanufactured, so in theory, the FDA should soon lift the hold.

Things are looking up — and after averaging down significantly over 2023 — it looks like rewards are finally in the pipeline.

FDA update and strategic investment

To start with, on 14 September, HEMO announced that the FDA had accepted its plan to address the US regulator’s concerns which formed the basis of the clinical hold.

CEO Vladislav Sandler enthused that ‘we are pleased that the FDA has agreed to our plan and preliminary test results to address their concerns regarding our HEMO-CAR-T IND application. We are now working hard to complete the schedule of work set out in the plan and to re-submit the IND as expeditiously as possible in order to move forward with clinical trials of HEMO-CAR-T.’

Then on 18 September, and likely because of this FDA news, the company saw a new strategic investment from Prevail Partners investment fund at a subscription price premium of 240%, to raise $830,000, allowing it to acquire circa 1% of the company’s new total issued share capital.

HWMO also signed an MSTA with contract research organisation (CRO) and Prevail Partners affiliate, Prevail InfoWorks, to:

‘provide clinical services and technologies for the Company’s upcoming Phase I study of its anti-FLT3 chimeric antigen receptor-redirected T cells in subjects with relapsed/refractory acute myeloid leukaemia.’

This contract, which will last 40 months, will include:

- clinical site coordination

- project management

- data management

- clinical monitoring

- safety management services

- InfoWorks’ integrated real-time data analytics platform, The Single Interface, for clinical support and real-time data analysis

The subscription funds are being used to pay for InfoWork’s initial work — so really, Prevail Partners is paying for the first part of the Phase I study in exchange for very little dilution. Arguably, it will continue to provide financing if trials go according to plan, at very good terms for this market.

Further, InfoWorks is an excellent partner to have on board — indeed Sandler notes that ‘we are very confident in Prevail InfoWorks’ ability to coordinate our Phase I clinical trial in relapsed/refractory AML. Their operational experience and expertise will enable a smooth execution of the study, while their specialization in real-time data integration and analytics will ensure fast, reliable data access to lower our clinical risk and potentially speed up our regulatory timeline.’

For their part, Prevail president Mary Schaheen enthuses that ‘Everyone at our fund is confident in the growth and success of Hemogenyx Pharmaceuticals as they develop CAR-T cells to target acute myeloid leukaemia.’

And in the company’s own words, ‘such investment, at a significant premium to the Company’s share price at the time, represents a vote of confidence by a specialist professional group with knowledge and experience of the pharmaceutical industry.’

Or in other words, they’re confident at the very least — to the tune of $830,000 — that the FDA issue will be resolved.

Financial position

HEMO announced half-year results to 30 June 2023 on 28 September.

In those six months, the company made a loss before tax of circa £4.3 million, including operating costs of £3.9 million — almost quadruple the £1.1 million loss of H1 2022.

The company attributed the increased costs with ‘the increasing volume of work and need to engage external service providers as the Company’s assets are taken towards the crucial clinical trial stage of their development,’ and described it (not unfairly) as an ‘inevitable corollary of developing the Company on a broader scale and moving forward its key projects.’

HEMO raised just over £4 million in January 2023 through share placings, and had just over £3 million in cash (and equivalents) on hand at 30 June 2023. This does put a question mark over the cash runway — if it lost £4.3 million in H1, this suggests a monthly cash burn of circa £720,000.

With £3 million at the end of June, this suggests it would need to raise more cash around the start of November — and would likely want to have a bit of a buffer. This suggests a placing is imminent (the $830,000 is for the MSTA contract), leaving the potential opportunity to buy shares at a small discount soon.

However, there are a few caveats to this prediction: first, Prevail will likely continue to finance clinical trials for the flagship into the future, massively reducing potential future capex.

Second, HEMO shares could increase sharply if the FDA grants the New Drug Application status before the placing comes — but I suspect severe volatility as the company may wait for this to happen, as the increased market cap would offer an opportunity to raise cash with much less dilution.

Third, further institutional investment (more likely after Prevail’s vote of confidence) could see the need for a placing negated, though this would need to happen very soon.

The bottom line

HEMO has made clear that ‘in the immediate future, we remain laser-focused on resubmitting our IND application for HEMO-CAR-T to the FDA as soon as we can, and on preparing for its move into clinical trials.’

There are other exciting assets in development, but the near-term future hinges on this one success — and investment funds like Prevail do not invest lightly.

For investors looking for the best value-for-money, that was in June. I frequently note that the best time to buy biotech shares is during the setbacks (after a placing or clinical trial hiccup for example).

Timing an entry point now is more a case of guesswork than analysis.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Nice summary Charles.

What enthuses me most of knowing that Hemogenyx Pharmaceuticals was the subject of a thorough, rigorous a due diligence process ahead of the investment by Prevail.

I wish the company the very best in the coming months as it approaches such a pivotal, monumental milestone in his development.

With the upcoming news and pending start of clinical trials, new investment should absolutely come at a premium. The share price right is not representative of the true value of Hemogenyx. If a company or individual wished to acquire a significant number of shares of the market, the price would very quickly be in the 5p to 10p range: hence why a premium issue of 4p+ seems reasonable.

Hi Steven,

In any other market I would agree with you enthusiastically (there’s a reason I’m invested). In this market, it’s a struggle to get anyone to invest even in significant technological medical advances – a placing at a small discount seems reasonable to me, especially as time is running out.

I see it as a long road ahead, further dilusion will drop so back right down i have been here over 3 and half years. In that time its had mainly down trend but realy hope we do end up in clinical trials then we can hope to get back up to 3p or so but all talk of 6 7 8 p is absolutely ridiculous so much to prove first

All I can say is that I do think further dilution is inevitable – but quality biotechs are usually undervalued on AIM and clinical success could see a buyout offer (which are usually at multiples of the SP)