Founded in 1984, Vodafone is a British telecommunications company present in multiple international markets. Vodafone delivers telecommunications services to retail customers, small and medium enterprises, as well as large corporations and multinational concerns.

According to its Network Strategy and Architecture director, Vodafone sees growth opportunities in developing innovative solutions to boost network throughput and decrease latency while cutting costs and encouraging competition.

From Vodafone’s perspective, the future is about API-rich network environments that allow users to create low-latency apps and software that will revolutionize online environments and create new sources of revenue.

As of March 2021, the company had more than 315 million mobile subscribers and over 28 million fixed broadband internet users.

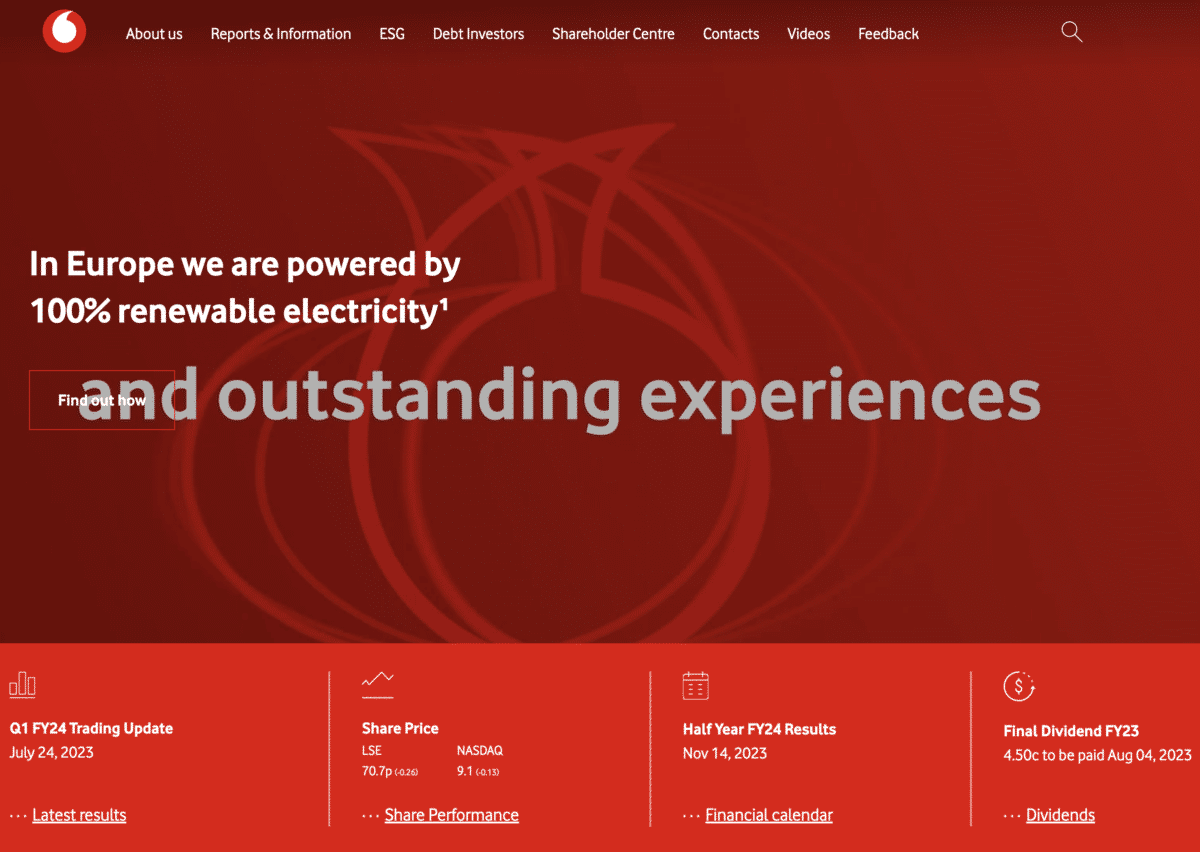

Vodafone stock is not one of the “traditional” winners of the business space. Before November 2021, Vodafone stockholders had nothing to be happy about. The value of their share in the company had taken a 40 percent hit over half a decade.

The spectacular drop in the Vodafone share price was not solely a product of the company’s performance. Many market dynamics, including investor sentiment, play a role in shaping the price of a stock.

In Vodafone’s case, dropping dividends and weak revenues both contributed to the poor performance of the stock.

Stocks that pay out dividends give their holders another option to generate returns, in addition to the possible share price appreciation. Vodafone’s paltry share price return gained a welcome boost from dividends. Since the dividends dropped as well, they became another force that dragged down the TSR and the value of Vodafone stock.

Through the latest Vodafone dividend payment, investors received $0.46 per share.

Is Vodafone Stock a Buy?

Vodafone’s stock may be a moderate buy. The company seeks to transform itself into a genuine technology organization by overhauling its internal systems and improving the quality of the services it provides. It also seeks to reduce costs, improve efficiency and increase productivity. How does it seek to accomplish these goals?

Vodafone’s leadership brass found the answer in the power of the cloud. By migrating its systems to the Oracle Cloud Infrastructure, the company will make the cloud a part of its infrastructure.

In addition to upgrading its services through the cloud, Vodafone will be able to deploy cloud-based applications to serve multiple markets.

The deal with Oracle has far-reaching implications. Vodafone’s data centers will feature the full suite of Oracle cloud services. The company is already accelerating the rollout of 5G services to its customers using Oracle’s cloud-based network policy management platform.

Equities Analysts Revise their Ratings of Vodafone Stock

Citigroup set a buy rating for Vodafone. Deutsche Bank lowered its target price on Vodafone stock, while JP Morgan Chase and Co. raised their price objective.

Several institutional entities have increased their Vodafone positions over the last few weeks. Kenfarb and Co., Tcwp LLC, and Elmwood Wealth Management Inc. all thought it worthwhile to pour additional investments into Vodafone.

In May 2021, Vodafone started a stock buyback program. The move suggests that the company has plenty of cash at hand.

Looking for more investment options? Invest in stocks in the UK here and find other popular stocks to buy here.