Netflix is one of the most recognizable names in the digital era of television. It has arguably revolutionized how we watch TV, bringing shows, movies, documentaries, and the like to millions of paying viewers worldwide. In 2010, the market capitalization of the media company was $3 billion. Now, it is $110 billion.

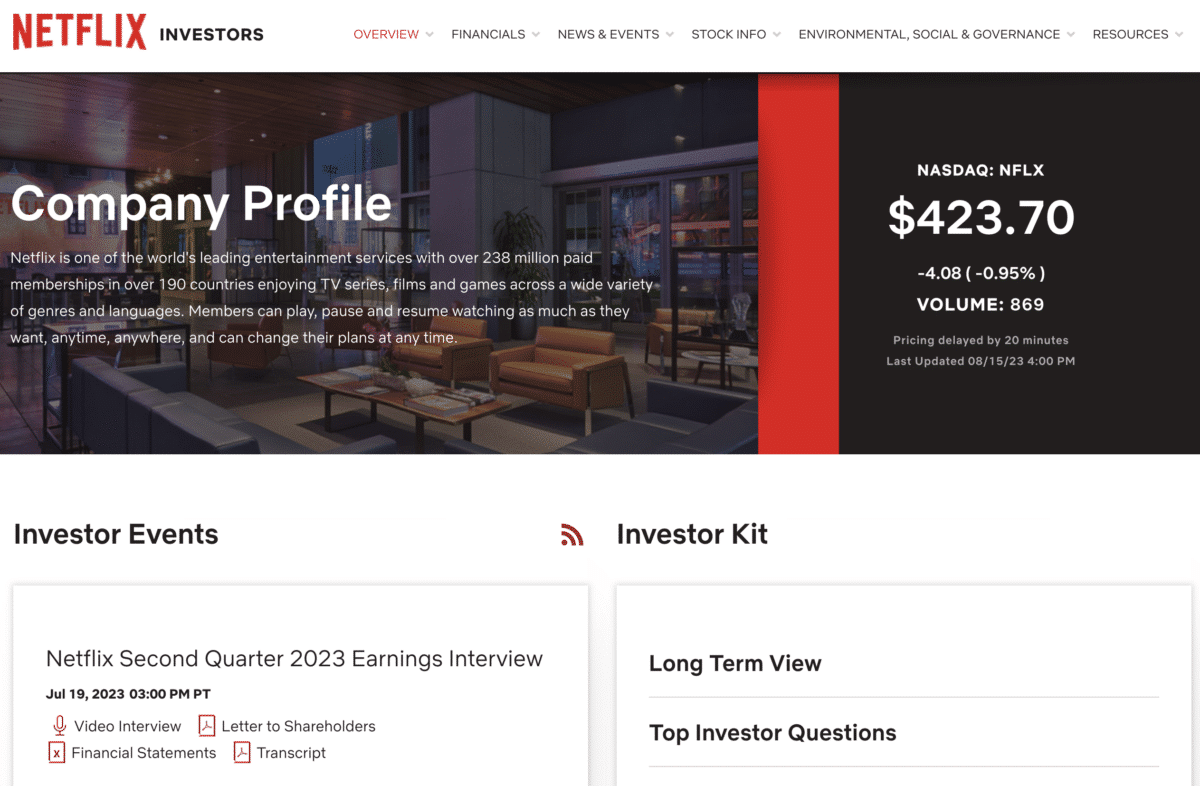

The skyrocketing stock price has probably made many investors rich over the last decade. Should you buy Netflix (NFLX) stock? Is it still a buy? How and where can you buy Netflix stock? Before answering those questions, you should ensure that you know how Netflix derives its revenues.

How Netflix Makes its Money

Incorporated in 1997, Netflix’s original business model was DVD rental by mail. It has retained this segment of its business to this day, though, nowadays, people know it as one of the biggest and most successful streaming services in the world. In 2022, the company had over 200 million paying subscribers. In a nutshell: that is how it makes its money.

Netflix buys, licenses, and produces content it then sells according to a subscription-based model. Netflix subscribers gain access to a large selection of movies, TV shows, and documentaries they can watch without advertising.

Lately, the company has been trying to shift its focus to producing its own content. The result is more Netflix-branded shows. Some users appreciate this shift while others don’t.

The DVD rental service the company still operates has seen declining revenues recently. That business model is arguably obsolete and will probably not have a role in Netflix’s future.

What’s currently keeping the DVD rental service alive is that it offers titles that are unavailable through streaming. Netflix features two DVD subscription plans. One costs $11.99 per month and allows for a single DVD to be out at a time, with an unlimited number of rentals per month. The other plan costs $14.99 per month and allows for two DVDs to be out.

The domestic DVD subscription service only accounts for 1% of Netflix’s revenues. The international streaming segment is responsible for 56% of revenues, and the domestic streaming service makes up the remaining 43%.

Netflix’s Competitors

Competition has grown stiff in the streaming space over the last few years. Netflix now competes for subscribers with services like:

- Amazon Prime

- Disney+

- Hulu

- Apple TV +

- HBO Max

- Paramount

How to Buy Netflix Stock

If you have made up your mind to buy Netflix stock, your first step is to find a broker. Research your broker well. Many online shams are masquerading as legitimate brokerages.

Try to find a broker with low fees, commissions, and lenient investment minimums.

Open an account. Research the account type that suits your needs. There are taxable accounts, retirement accounts, 529 plans that allow you to save for college, etc.

Retirement accounts work well for long-term investments, but they charge you punitive fees and taxes if you decide to make a withdrawal before the age of 59 and a half.

Taxable accounts offer no tax benefits, but they are better suited for short-term investments.

Place on order for the number of Netflix shares you want to buy, and create an exit plan in case your investment turns sour.

Read more about stock trading apps or how to buy stocks and shares in the UK.

The Peculiarities of Netflix Stock

Netflix’s individual share price is reasonable and may be attractive for beginner traders. Some brokers allow fractional share trading. But with a low-enough share price, even investors of more meager financial means can afford to buy whole shares.

Netflix’s share price has been highly volatile. Over the last 12 months, it has dropped by about 50%. As a potential investor, you should be aware that even the company thinks its price will continue to be volatile.