Marijuana stocks are a hot commodity right now, and many people are looking for ways to invest in them. If you’re one of them, there are a few things that you need to know about how marijuana stocks work before you jump in.

Concise Overview

- Marijuana stocks are investments in companies directly or indirectly related to the cannabis industry

- While these stocks are relatively new investments, many risks are involved

- There are several types of investments associated with marijuana stocks

Introduction

Like the brewery industry, the marijuana industry is becoming more mainstream and accessible. A growing number of investors are trying to find ways to capitalise on the growth of this market. But it’s difficult to build a portfolio of cannabis stocks, especially given how many different investment vehicles are out there.

If you’re looking for a quick way to enter the cannabis industry, then buying marijuana stocks might be your best bet. But there are several things you need to consider before investing in these companies. Cannabis is a riskier investment than other stocks, and it’s important to understand that before you dive in.

This article is well-researched and concise. It will be useful to anyone who wants a clear overview and wishes to save time by getting all the information about this burgeoning industry in one place. Therefore, you’ll learn: what marijuana stocks are, how to invest in marijuana stocks, the classifications of marijuana stocks, why marijuana stocks are risky, factors to consider when investing in them, and if you should invest in them.

What Are Marijuana Stocks?

Marijuana stocks are a type of equity security or investments in companies directly or indirectly related to the cannabis industry. If you invest in a marijuana stock, you own part of the company and stand to benefit from its success or failure.

As with any investment, it’s important to do your research before committing money. There are many risks involved with investing in marijuana stock. You should know what types of investments exist in this sector so that you have a better idea of which one is right for you.

Classification of Marijuana Stocks

Marijuana stocks can be broadly classified into two main categories:

- Companies that are directly involved in the production and sale of marijuana products, such as cultivators, manufacturers, and retailers.

- Companies that provide services to the marijuana industry, such as consulting, logistics, and technology.

Within these categories, marijuana stocks can also be further classified based on factors such as the company’s size, geographic location, and product focus. For example, some marijuana stocks may focus on the production of medical marijuana, while others may focus on the production of recreational marijuana. Additionally, some marijuana stocks may be focused on the U.S. market, while others may have a global focus.

State of the Marijuana Industry

The marijuana industry has seen significant growth in recent years as more and more states legalise its use for medical and recreational purposes. According to a report by Grand View Research, the global legal marijuana market is expected to reach $102.2 billion by 2030, growing at a CAGR of 25.5% from 2022 to 2030.

In the United States, the marijuana industry has been primarily driven by the legalisation of medical marijuana in 37 states and the District of Columbia, as well as the legalisation of recreational marijuana in 21 states and Washington D.C. As more states continue to legalise marijuana and its use becomes more mainstream, the industry is expected to continue its rapid growth.

The growing popularity of marijuana-infused products, such as edibles, beverages, and topicals, is expected to drive further growth in the industry. Additionally, the increasing legalisation of marijuana for medical purposes, particularly for the treatment of chronic pain and other conditions, is expected to contribute to the industry’s growth.

Overall, the marijuana industry presents a significant opportunity for investors looking to capitalise on its growth potential.

Investing in Marijuana Stocks

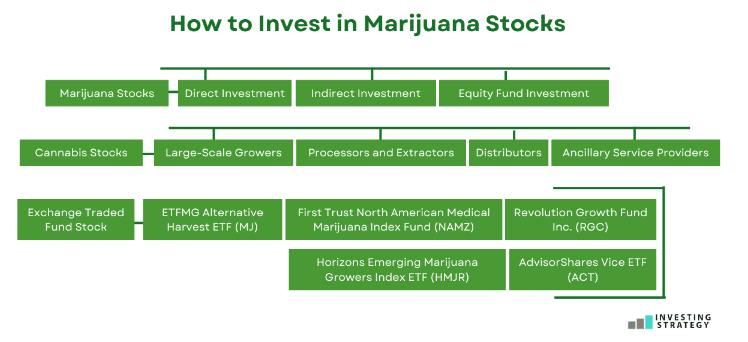

There are several ways to invest in marijuana stocks. This depends on the type of marijuana stocks you choose to buy. The types of marijuana stocks are classified into three investment vehicles such as: marijuana stocks, cannabis stocks, or exchange-traded funds (ETFs).

Marijuana Stocks

These are companies that produce and sell cannabis but aren’t directly involved in the business of growing marijuana. In this type of classification, there are:

- Direct Investment

Direct investment in the marijuana industry is considered by many to be the riskiest type of investment. In this case, you own a business selling or distributing marijuana products. You’re responsible for running the company and ensuring everything is up to code with state laws. This investment requires a high level of expertise in managing businesses and handling finances.

- Indirect Investment

Indirect investment in the marijuana industry is a safer option. In this case, you’re not selling or distributing marijuana products but instead investing in businesses that do. You can invest in publicly traded companies that sell products like cannabis-infused beverages or edibles. Or you can get involved with private equity firms working toward legalising the recreational and medicinal use of marijuana.

- Equity Fund Investment

A third option is to invest in an equity fund that specialises in marijuana. An equity fund allows investors to pool their money together and purchase shares in various companies.

Financial experts set up these funds with years of experience in investing, and they can help you mitigate any risk involved with this type of investment. The portfolio managers then make investments on behalf of all investors in the fund, taking on a lot of the risk and ensuring that everyone gets a piece of a successful investment. If you’re looking for a more hands-off investment approach, this is arguably the best in the marijuana industry.

Cannabis Stocks

These companies grow marijuana and sell it directly to consumers. They are a bit riskier than the other options but offer the highest potential returns. The companies in this category are broken down further into the following:

- Large-Scale Growers

Large-scale growers are businesses that specialise in growing large amounts of cannabis. They often have strong backgrounds in agriculture and horticulture, which gives them an advantage over smaller companies. These businesses can also produce high volumes of marijuana at a low cost, which is important because the price per gram can vary depending on where it’s sold.

- Processors and Extractors

Processors and extractors are companies that specialise in converting marijuana into usable products. They often focus on extracting chemicals from cannabis plants to create oils, edibles, and other consumables used in medical applications. These businesses can also provide various services, such as testing and labelling, for other companies in the industry.

- Distributors

Distributors are companies that specialise in distributing products from manufacturers to retailers. They often work with many different businesses within their industry and can assist with logistics, shipping, and more. Distributors can also manage inventory for their clients, so they don’t have to worry about running out of stock.

- Ancillary Service Providers

Ancillary service providers are companies that provide additional services to their clients. These companies may specialise in areas like packaging, logistics, and more. They may also offer services like marketing, advertising, or product development. Ancillary service providers can help companies save time and money by taking care of these processes.

Exchange Traded Fund Stock

ETFs are listed on exchanges like other stocks and are purchased by retail investors through their brokerages or financial advisors. ETFs are investment funds that track specific sectors or indexes. They allow investors to gain exposure to a group of stocks without buying each stock.

Since the marijuana industry is still relatively new and volatile, it can be difficult for investors to determine which companies will perform best over time. However, there are some types of marijuana ETFs stocks which include:

- ETFMG Alternative Harvest ETF (MJ)

The ETFMG Alternative Harvest ETF (MJ) is one of the largest marijuana-focused funds on the market. It tracks companies that provide alternative solutions to the cannabis industry, such as those that manufacture smokeless tobacco products and vape pens. In addition, this fund is also designed to track the performance of this ETF, which includes companies such as Canopy Growth Corp (WEED) and Aurora Cannabis Inc. (ACB).

- First Trust North American Medical Marijuana Index Fund (NAMZ)

The First Trust North American Medical Marijuana Index Fund (NAMZ) is another marijuana ETF that offers broad exposure to the cannabis industry. This fund tracks companies involved in manufacturing and distributing marijuana-derived products, such as pharmaceuticals and beverages. It also includes some companies that are developing therapies for conditions like anxiety, depression, and insomnia. For example, this ETF includes Cronos Group Inc (CRON), which is a Canadian cultivator of medical cannabis with operations across four continents.

- Horizons Emerging Marijuana Growers Index ETF (HMJR)

This is another marijuana ETF that offers exposure to companies with ancillary businesses focused on the cannabis industry. In addition, this ETF provides broad exposure to companies involved in the cultivation of medical cannabis. This fund tracks a basket of North American-listed stocks classified as ‘marijuana growers,’ which includes established producers and companies with operations in countries where marijuana is legal for medical use. The fund tracks companies involved in biotechnology, pharmaceuticals, and agricultural sciences. It excludes companies involved in the cultivation of marijuana plants or their derivatives.

For example, this ETF includes CannTrust Holdings Inc (CNTTF), which is a licensed producer and distributor of medical cannabis, and Aphria Inc (APHA), a medical cannabis company – they both are based in Canada.

- AdvisorShares Vice ETF (ACT)

The AdvisorShares Vice ETF (ACT) provides investors with a way to gain exposure to the fast-growing cannabis industry while also taking advantage of potential opportunities in other areas that have been deemed ‘vice’ products. This fund invests in companies whose businesses focus on alcohol, tobacco, and gambling. In addition to cannabis, it includes investments in companies that produce and distribute energy drinks, recreational drugs like ecstasy, and even adult entertainment.

- Revolution Growth Fund Inc. (RGC)

The Revolution Growth Fund Inc. (RGC) is a venture capital fund specialising in startups. The fund holds shares of companies in the consumer, enterprise software, and online content industries. It has also invested in several well-known companies. This fund gives investors access to some of the most promising companies in their early stages before they go public at a lower cost than if they had invested directly into these startups.

Why Is Marijuana Stock Risky?

Marijuana stocks are risky investments because of the following reasons:

- Price Volatility

The price of marijuana stocks is highly volatile. This means that the value can change by a large amount over a short period, which makes it difficult for investors to predict how much their investments will be worth in the future. This also makes it difficult to sell your shares if you need to raise money quickly.

- Early Stage in the Industry

The marijuana industry is still in its early stages, so companies haven’t proven whether they can be profitable. Investors are taking a risk by investing in these companies because it’s possible that their products will be less popular than they are and that there may be cheaper competitors on the market.

- Legal Risks

Marijuana stocks are risky investments because of the legal risks associated with investing in this industry. The federal government considers marijuana illegal, so it may take action against businesses that sell cannabis products. The federal government could also decide to crack down on states that have legalised recreational marijuana. This could make it more difficult for these companies to operate and significantly reduce their revenue.

- Lack of Regulation

The marijuana industry is still in its infancy, so there aren’t any regulations for companies or support. For example, because banks are regulated at the federal level, most banks are hesitant to work with marijuana companies. This makes it difficult for marijuana companies to access the financial services they need to operate, and it also makes it difficult for investors to buy and sell marijuana stocks. As a result, investors have very little protection, so it’s important to do your research before investing in any marijuana stocks.

- Lack of Recurring Revenue

The marijuana industry is a volatile one because it doesn’t have any recurring revenue streams. This means that companies don’t have a consistent source of income each year, and they must rely on the sale of cannabis products to make money. Besides, the marijuana industry is highly competitive, with many companies vying for market share. This can result in intense price competition and low-profit margins, making it difficult for companies to generate sustainable revenue streams.

- Susceptible to Scam and Fraud

Marijuana stocks are susceptible to scam scams and fraud because the marijuana industry is still relatively new and unregulated. This lack of regulation makes it easier for unscrupulous individuals to take advantage of investors by making false claims about the success or potential of marijuana-related companies. Additionally, the lack of standardisation in the industry can make it difficult for investors to accurately assess the value and potential of these stocks. Thus, investors need to be careful about the companies they choose to invest in because plenty of shady businesses out there want nothing more than your money.

Factors to Consider When Investing in Marijuana Stocks

In the marijuana industry, there are several factors that you should consider. Investors should consider the following factors when investing in marijuana stocks:

- The Company’s Management Team

Investors need to make sure that they do their due diligence on the management team of a marijuana company before investing. They should look at their resumes, check if they have any experience with the cannabis industry, and see what kind of reputation they have in the industry.

- The Company’s Financial Position

The financial position of the company is also important to consider. Investors should make sure that the company has enough cash on hand and that it doesn’t have any debt. They should also look at the balance sheet to see how much inventory and equipment the company has acquired and whether or not it has been paid for yet.

- The Company’s Product and Strategy

Investors should also look at the company’s product portfolio and strategy. They need to ensure that they invest in a company with a strong product line and a solid growth plan. They should also look at how the company plans to use its current products and services to expand into new markets. This will help ensure that the investment is likely to pay off.

- Business Model

What type of business model does the company have? Is it an e-commerce site that sells cannabis products directly to consumers, or is it a company that manufactures and distributes its product line? The investors need to look at the business model and see what revenue stream it will generate. They should also ensure that the company has a growth plan to repay its investment.

- Industry Competition

Does the company have the ability to compete in this industry? Investors need to look at the competition and see how the company will be able to stand out from its competitors. They also need to ensure that there is a market for the product being sold, as well as a demand for it. How big is the industry itself? Are there any other companies doing what yours does, or is it unique in some way? This can help you understand how hard it will be to compete with them.

- Understand How Cannabis Market Work

How does the cannabis market work? This is a question that every investor should be able to answer. Understanding how the industry functions and how you can use this information to your advantage is essential. Understanding what consumers want, what suppliers have available for sale, and where it all comes together will help you make better decisions about your business’s future.

Should I Invest in Marijuana Stock?

The marijuana industry is growing at an incredible rate. As more states legalise cannabis, the market has expanded and provided new opportunities for companies that specialise in producing marijuana products. The industry is expected to grow as more states legalise medical marijuana and recreational use becomes more common. If you’re looking for a way to invest in this growing industry, consider buying shares in one of these companies instead. It’s also risky, so you must consider how much you want to invest and if you’re willing to risk losing money.

This article has been prepared for information purposes only. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.